Answered step by step

Verified Expert Solution

Question

1 Approved Answer

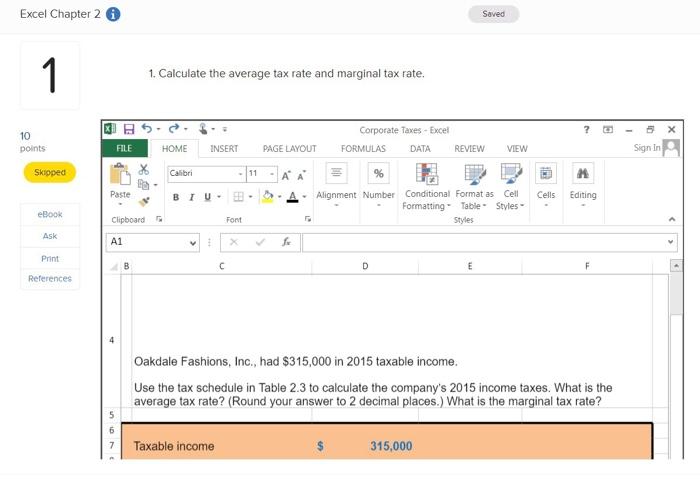

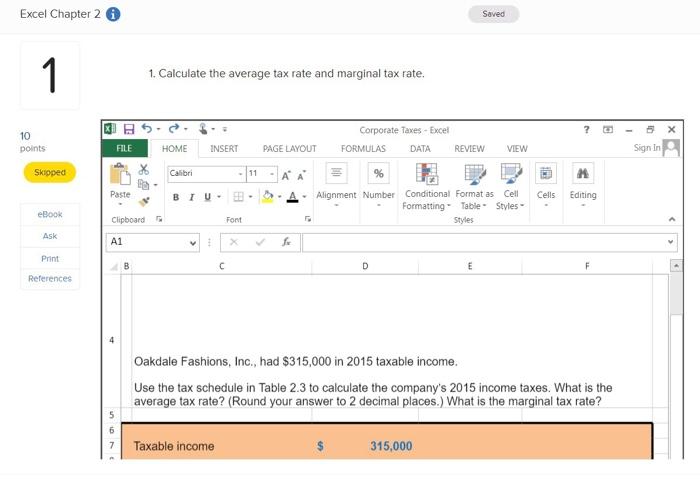

Calculate the Average tax rate and the Marginal tax rate. Excel Chapter 2 i 1 10 points Skipped eBook Ask Print References FILE Paste Clipboard

Calculate the Average tax rate and the Marginal tax rate.

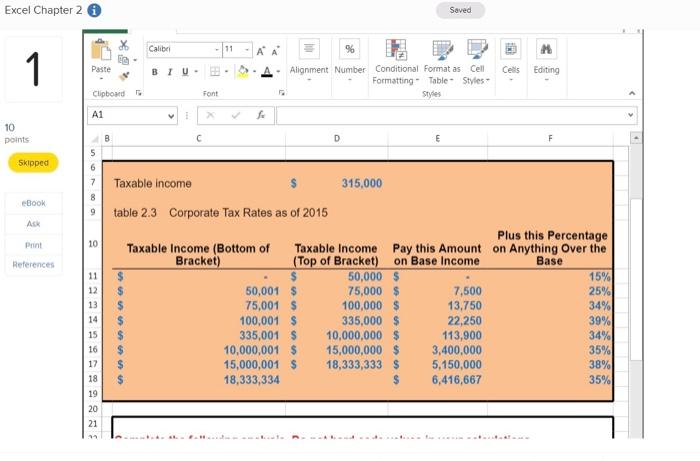

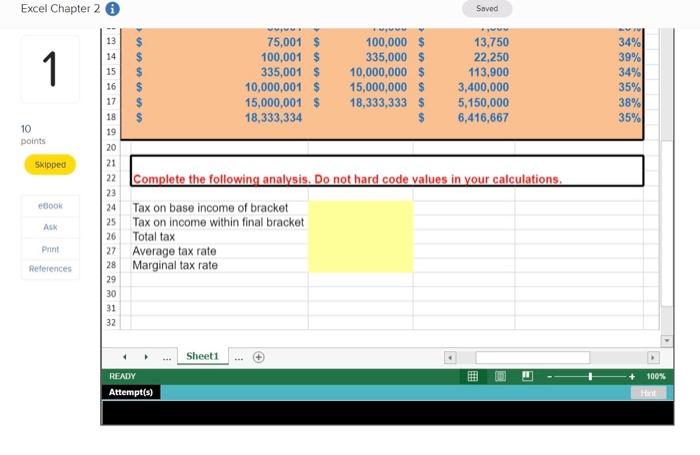

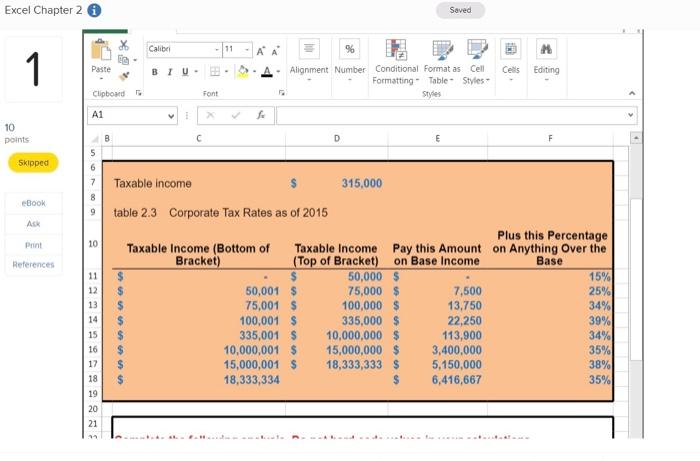

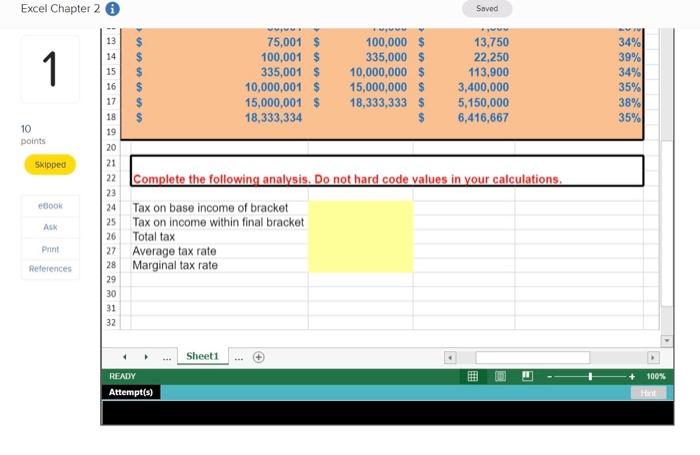

Excel Chapter 2 i 1 10 points Skipped eBook Ask Print References FILE Paste Clipboard A1 107. 1. Calculate the average tax rate and marginal tax rate. BS Corporate Taxes - Excel HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW A % Alignment Number Conditional Format as Cell Cells Editing Formatting Table Styles- Fu Styles fr B D E F Oakdale Fashions, Inc., had $315,000 in 2015 taxable income. Use the tax schedule in Table 2.3 to calculate the company's 2015 income taxes. What is the average tax rate? (Round your answer to 2 decimal places.) What is the marginal tax rate? Taxable income 315,000 Calibri BIU- # Font x 11 Saved A- 8 Sign In X ( Excel Chapter 2 1 10 points Skipped eBook Ask Print References Paste Clipboard A1 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 B Calibri BIU- 1 $ Font x 11 C Saved Alignment Number Conditional Format as Cell Formatting Table Styles- Styles G D E Pay this Amount on Base Income 7,500 13,750 22,250 113,900 3,400,000 5,150,000 6,416,667 fe Taxable income table 2.3 Corporate Tax Rates as of 2015 Taxable Income (Bottom of Bracket) A A 315,000 Taxable Income (Top of Bracket) 50,001 $ 75,001 S 100,001 S 335,001 $ 10,000,001 $ 15,000,001 $ 18,333,334 50,000 $ 75,000 $ 100,000 $ 335,000 $ 10,000,000 $ 15,000,000 $ 18,333,333 $ $ Cells Editing F Plus this Percentage on Anything Over the Base 15% 25% 34% 39% 34% 35% 38% 35% Excel Chapter 2 www. wwwww *www 13. 100,000 $ 13,750 22,250 1 14 15 16 75,001 $ 100,001 $ 335,001 $ 10,000,001 $ 335,000 $ 10,000,000 $ 113,900 15,000,000 $ 3,400,000 17 5,150,000 15,000,001 $ 18,333,333 $ 18,333,334 18 $ 6,416,667 19 20 21 22 Complete the following analysis. Do not hard code values in your calculations. 23 24 Tax on base income of bracket 25 Tax on income within final bracket 26 Total tax 27 Average tax rate 28 Marginal tax rate 29 30 31 32 Sheet1 READY Attempt(s) 10 points Skipped eBook Ask Print References Sssssss Saved E 34% 39% 34% 35% 38% 35% M 100% Hint

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started