Answered step by step

Verified Expert Solution

Question

1 Approved Answer

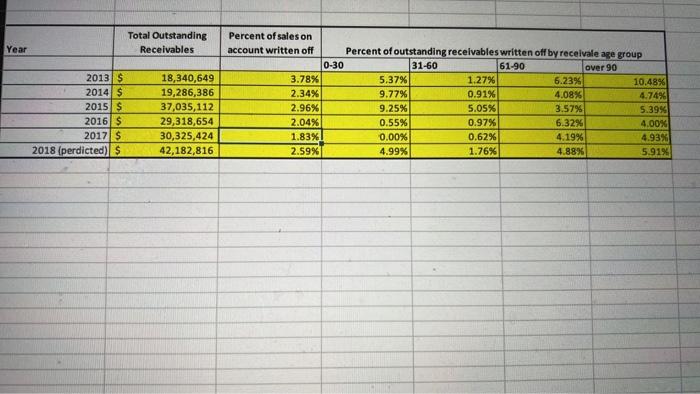

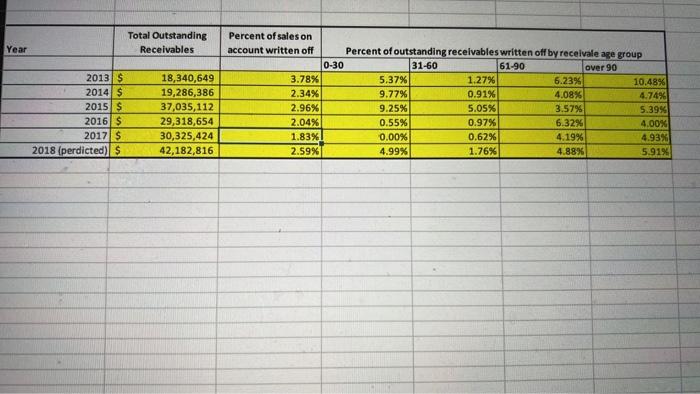

Calculate the bad debt expense. Assume balance of Allowance for uncollectible is zero c. Your recommendations and the reasoning behind them should you use percent

Calculate the bad debt expense. Assume balance of Allowance for uncollectible is zero

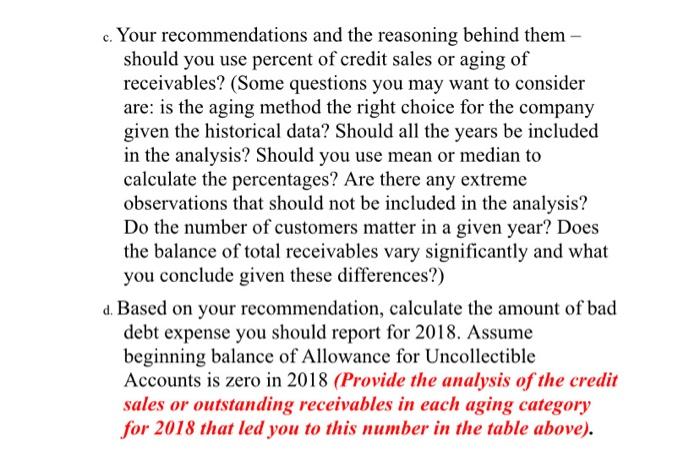

c. Your recommendations and the reasoning behind them should you use percent of credit sales or aging of receivables? (Some questions you may want to consider are: is the aging method the right choice for the company given the historical data? Should all the years be included in the analysis? Should you use mean or median to calculate the percentages? Are there any extreme observations that should not be included in the analysis? Do the number of customers matter in a given year? Does the balance of total receivables vary significantly and what you conclude given these differences?) d. Based on your recommendation, calculate the amount of bad debt expense you should report for 2018. Assume beginning balance of Allowance for Uncollectible Accounts is zero in 2018 (Provide the analysis of the credit sales or outstanding receivables in each aging category for 2018 that led you to this number in the table above)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started