Answered step by step

Verified Expert Solution

Question

1 Approved Answer

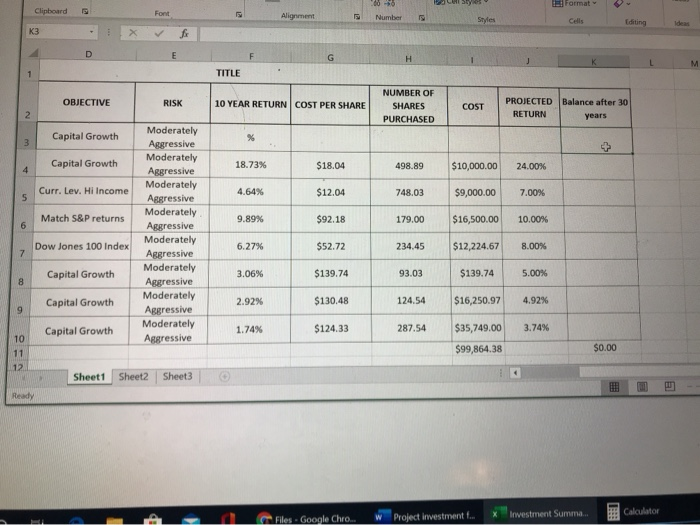

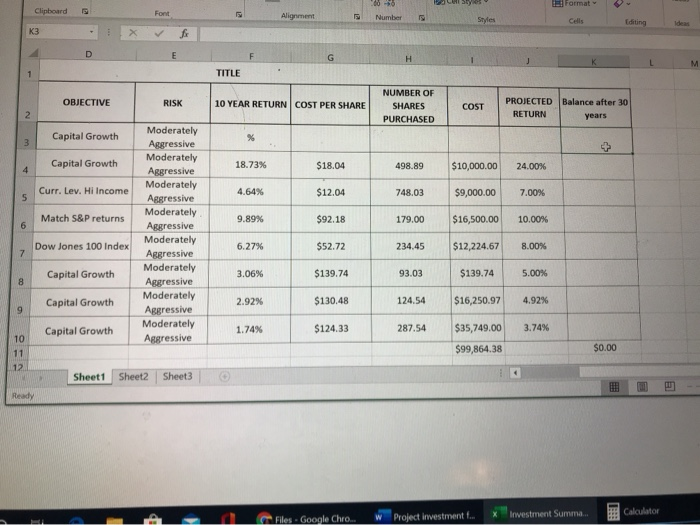

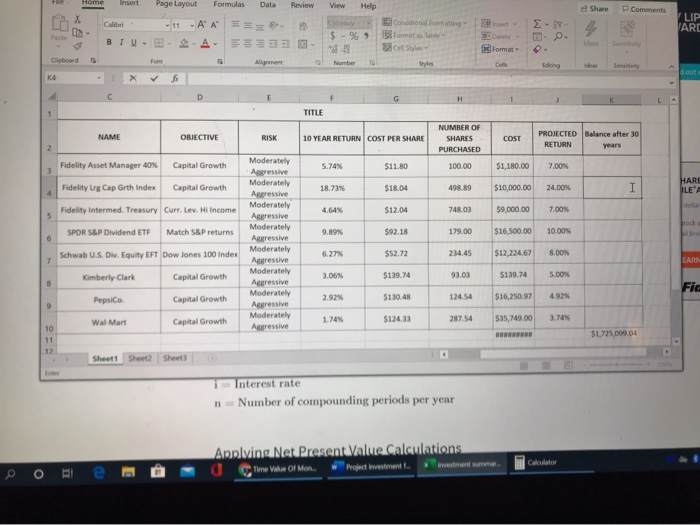

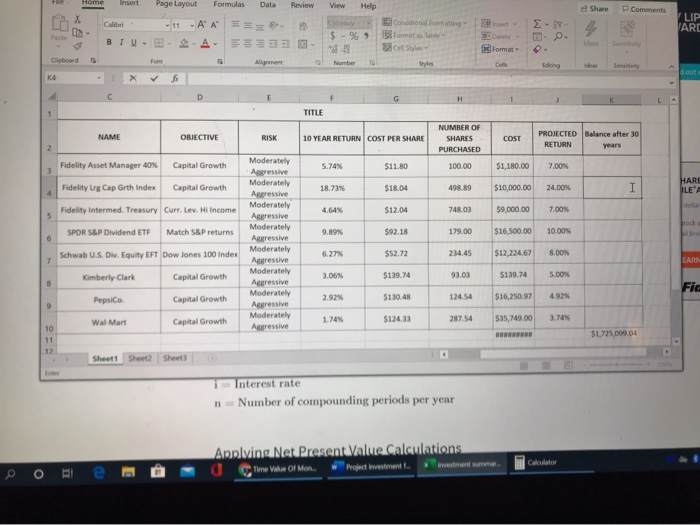

calculate the balance after 30 years the return is is annualized. what is the balance of each return after 30 years? Format Clipboard 9 Font

calculate the balance after 30 years

the return is is annualized. what is the balance of each return after 30 years?

Format Clipboard 9 Font Alignment 100 -6 Number Styles Cells Editing Ideas K3 f D E G M 1 TITLE OBJECTIVE RISK 10 YEAR RETURN COST PER SHARE NUMBER OF SHARES PURCHASED COST PROJECTED Balance after 30 RETURN years 2. Capital Growth 3 Capital Growth 18.73% 4 $18.04 498.89 $10,000.00 24.00% Curr. Lev. Hi Income 4.64% $12.04 748.03 5 $9,000.00 7.00% Match S&P returns 9.89% $92.18 179.00 $16,500.00 10.00% 6 Moderately Aggressive Moderately Aggressive Moderately Aggressive Moderately Aggressive Moderately Aggressive Moderately Aggressive Moderately Aggressive Moderately Aggressive 6.27% $52.72 234.45 $12,224.67 8.00% 7 Dow Jones 100 Index Capital Growth 3.06% $139.74 93.03 $139.74 5.00% 8 Capital Growth 2.92% $130.48 124.54 $16,250.97 4.92% 9 1.74% Capital Growth $124.33 287.54 3.74% $35,749.00 $99,864.38 10 11 12 $0.00 Sheet1 Sheet2 Sheet3 HE HU Ready Investment Summa... Calculator Files - Google Chro.. Project investment Home Insert Page Layout Formulas Data Review View Help Share Comments X LIP Calibri 29 net 2 - 2 - 11 AA SEE A- ARC $ % conditional Formatting Formatas table constyles BTW Sen Format Clipboard Font Alignment Number Edining Sony K4 dout X D 1 TITLE NAME OBJECTIVE RISK 10 YEAR RETURN COST PER SHARE NUMBER OF SHARES PURCHASED COST PROJECTED Balance after 30 RETURN years 2 Fidelity Asset Manager 40% Capital Growth 5.74% 3 $11.80 100.00 $1,180.00 7.00% Fidelity Lrg Cap Grth Index Capital Growth 18.73% $18.04 498.89 $10,000.00 24.00% HARE ILEA Fidelity Intermed. Treasury Curr. Lev. Hi Income dollar $12.04 748.03 $9,000.00 7.00N 5 krock SPOR S&P Dividend ETF Match S&P returns 9.89% $92.18 179.00 $16,500.00 10.00N 6 Moderately Aggressive Moderately Aggressive Moderately Aggressive Moderately Aggressive Moderately Aggressive Moderately Aggressive Moderately Aggressive Moderately Aggressive Schwab U.S. Div. Equity EFT Dow Jones 100 Index 6.27% $52.72 234.45 $12,224.67 8.00% 7 EARN Kimberly-Clark Capital Growth 3.06% $139.74 93.00 $139.74 5.COM B Fic PepsiCo Capital Growth 2.92 $130.48 124.54 $16,250.97 9 Capital Growth Wal-Mart 1.70 $124.33 287.54 $35,749.00 3.74 $1,725,099.00 10 11 12 Sheet1 Sheet2 Interest rate Number of compounding periods per year n Annlving Net Present Value Calaulations Calculator The Vow of Mon. Project investment BI O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started