Answered step by step

Verified Expert Solution

Question

1 Approved Answer

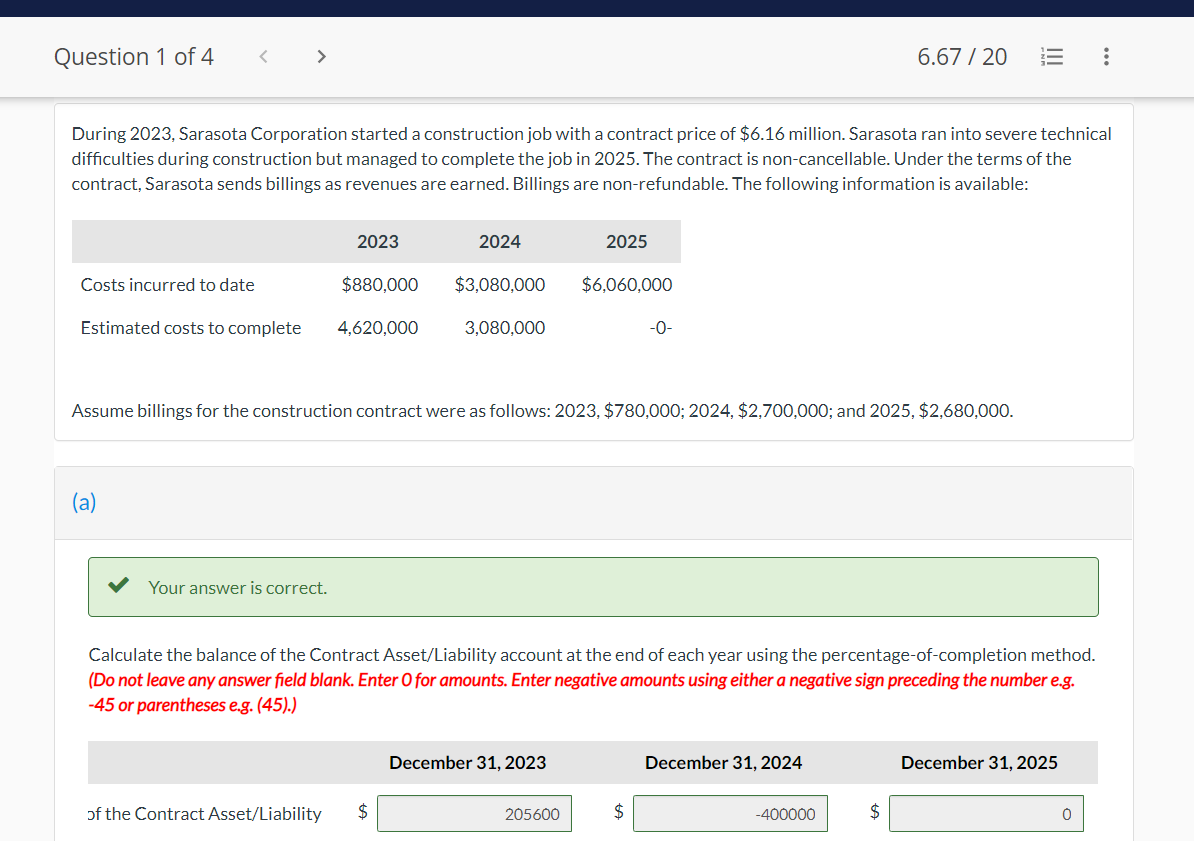

Calculate the balance of the contract asset/liability account on December 31, 2023, 2024, and 2025 using the zero-profit method During 2023 , Sarasota Corporation started

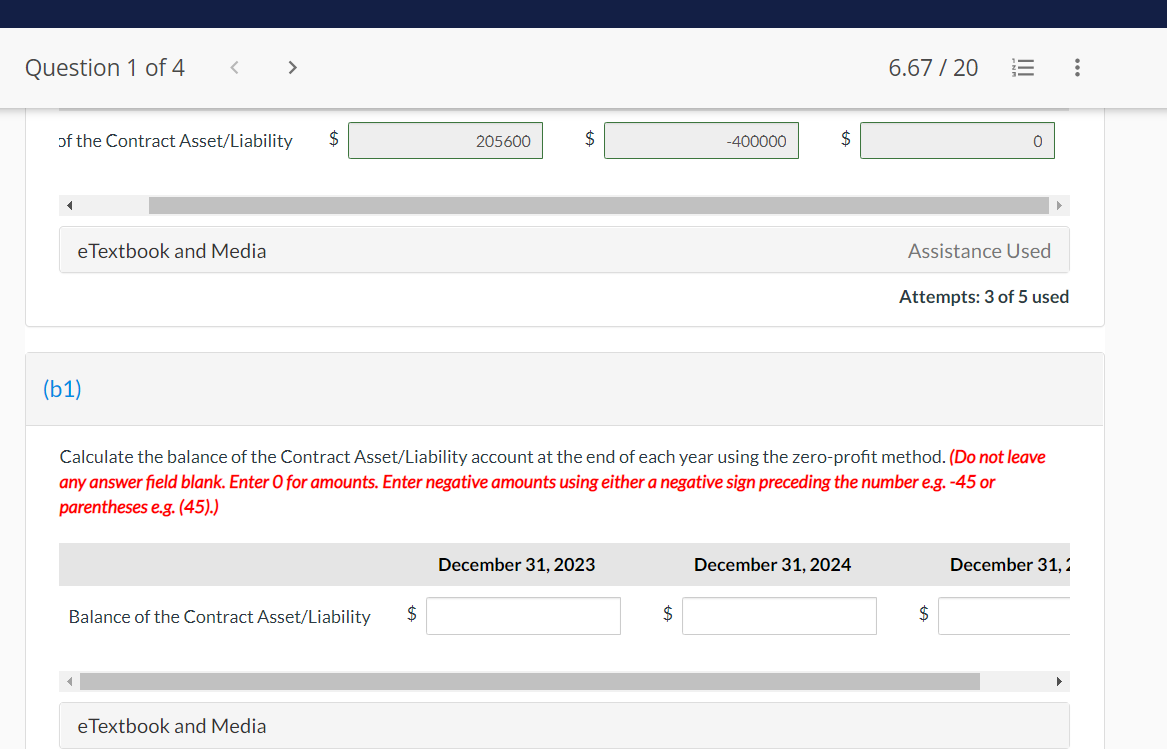

Calculate the balance of the contract asset/liability account on December 31, 2023, 2024, and 2025 using the zero-profit method

During 2023 , Sarasota Corporation started a construction job with a contract price of $6.16 million. Sarasota ran into severe technical difficulties during construction but managed to complete the job in 2025. The contract is non-cancellable. Under the terms of the contract, Sarasota sends billings as revenues are earned. Billings are non-refundable. The following information is available: Assume billings for the construction contract were as follows: 2023,$780,000;2024,$2,700,000; and 2025, $2,680,000. (a) Your answer is correct. Calculate the balance of the Contract Asset/Liability account at the end of each year using the percentage-of-completion method. (Do not leave any answer field blank. Enter O for amounts. Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45).) Calculate the balance of the Contract Asset/Liability account at the end of each year using the zero-profit method. (Do not leave any answer field blank. Enter 0 for amounts. Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45).)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started