Calculate the breakeven points and comment on the overall Canadian expansion plan.

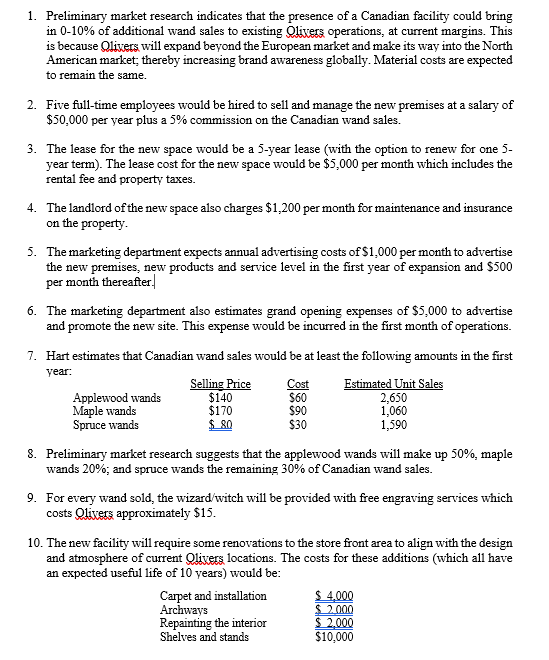

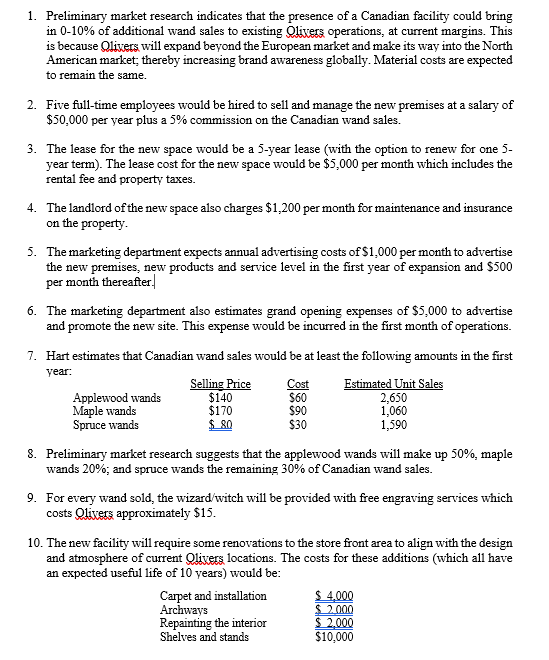

1. Preliminary market research indicates that the presence of a Canadian facility could bring in 0-10\% of additional wand sales to existing Qlivers operations, at current margins. This is because Qlivers will expand beyond the European market and make its way into the North American market, thereby increasing brand awareness globally. Material costs are expected to remain the same. 2. Five full-time employees would be hired to sell and manage the new premises at a salary of $50,000 per year plus a 5% commission on the Canadian wand sales. 3. The lease for the new space would be a 5 -year lease (with the option to renew for one 5 year term). The lease cost for the new space would be $5,000 per month which includes the rental fee and property taxes. 4. The landlord of the new space also charges $1,200 per month for maintenance and insurance on the property. 5. The marketing department expects annual advertising costs of $1,000 per month to advertise the new premises, new products and service level in the first year of expansion and $500 per month thereafter. 6. The marketing department also estimates grand opening expenses of $5,000 to advertise and promote the new site. This expense would be incurred in the first month of operations. 7. Hart estimates that Canadian wand sales would be at least the following amounts in the first year: 8. Preliminary market research suggests that the applewood wands will make up 50%, maple wands 20%; and spruce wands the remaining 30% of Canadian wand sales. 9. For every wand sold, the wizard/witch will be provided with free engraving services which costs Olivers approximately $15. 10. The new facility will require some renovations to the store front area to align with the design and atmosphere of current Qlivers locations. The costs for these additions (which all have an expected useful life of 10 years) would be: 1. Preliminary market research indicates that the presence of a Canadian facility could bring in 0-10\% of additional wand sales to existing Qlivers operations, at current margins. This is because Qlivers will expand beyond the European market and make its way into the North American market, thereby increasing brand awareness globally. Material costs are expected to remain the same. 2. Five full-time employees would be hired to sell and manage the new premises at a salary of $50,000 per year plus a 5% commission on the Canadian wand sales. 3. The lease for the new space would be a 5 -year lease (with the option to renew for one 5 year term). The lease cost for the new space would be $5,000 per month which includes the rental fee and property taxes. 4. The landlord of the new space also charges $1,200 per month for maintenance and insurance on the property. 5. The marketing department expects annual advertising costs of $1,000 per month to advertise the new premises, new products and service level in the first year of expansion and $500 per month thereafter. 6. The marketing department also estimates grand opening expenses of $5,000 to advertise and promote the new site. This expense would be incurred in the first month of operations. 7. Hart estimates that Canadian wand sales would be at least the following amounts in the first year: 8. Preliminary market research suggests that the applewood wands will make up 50%, maple wands 20%; and spruce wands the remaining 30% of Canadian wand sales. 9. For every wand sold, the wizard/witch will be provided with free engraving services which costs Olivers approximately $15. 10. The new facility will require some renovations to the store front area to align with the design and atmosphere of current Qlivers locations. The costs for these additions (which all have an expected useful life of 10 years) would be