Answered step by step

Verified Expert Solution

Question

1 Approved Answer

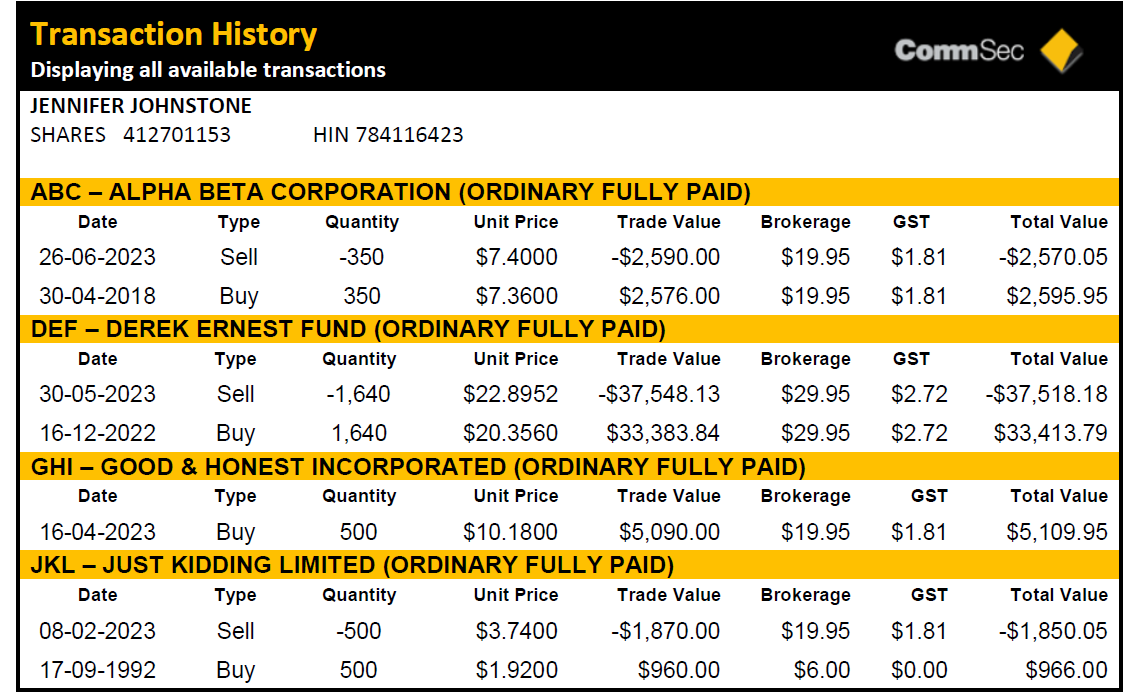

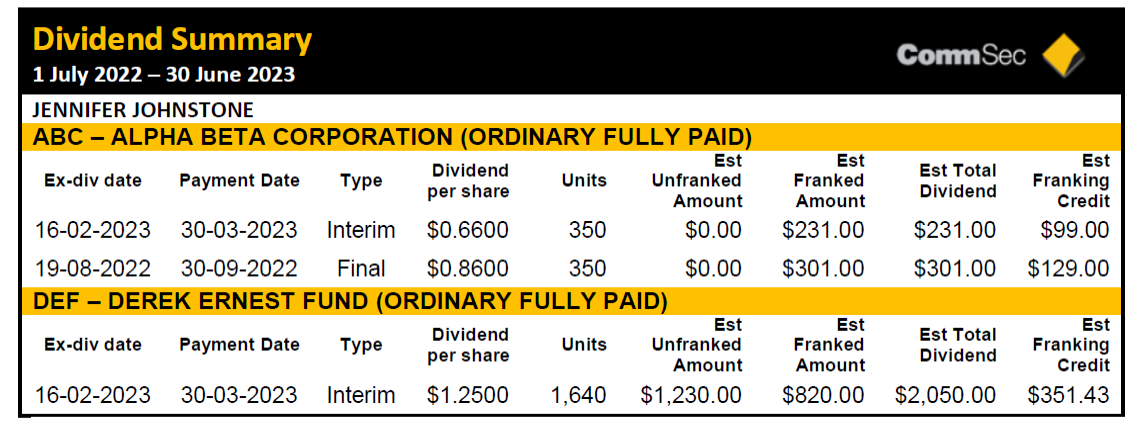

calculate the Capital Gain in the case below? Which method is good and how to fill in the Item 18 in Tax Return? Transaction History

calculate the Capital Gain in the case below? Which method is good and how to fill in the Item 18 in Tax Return?

Transaction History Displaying all available transactions JENNIFER JOHNSTONE SHARES 412701153 HIN 784116423 ABC - ALPHA BETA CORPORATION (ORDINARY FULLY PAID) Date 26-06-2023 30-04-2018 CommSec Quantity Unit Price Trade Value Sell -350 $7.4000 -$2,590.00 Brokerage $19.95 $1.81 GST Total Value -$2,570.05 Buy 350 $7.3600 $2,576.00 $19.95 $1.81 $2,595.95 DEF DEREK ERNEST FUND (ORDINARY FULLY PAID) Date 30-05-2023 16-12-2022 Quantity Sell Buy -1,640 1,640 Unit Price $22.8952 $20.3560 Trade Value -$37,548.13 $33,383.84 Brokerage $29.95 $2.72 GST Total Value -$37,518.18 $29.95 $2.72 $33,413.79 GHI GOOD & HONEST INCORPORATED (ORDINARY FULLY PAID) Date 16-04-2023 Buy Quantity 500 Unit Price $10.1800 Trade Value $5,090.00 JKL - JUST KIDDING LIMITED (ORDINARY FULLY PAID) Date Quantity Unit Price 08-02-2023 Sell -500 $3.7400 17-09-1992 Buy 500 $1.9200 Brokerage $19.95 GST Total Value $1.81 $5,109.95 Trade Value -$1,870.00 Brokerage $19.95 $1.81 GST Total Value -$1,850.05 $960.00 $6.00 $0.00 $966.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started