Answered step by step

Verified Expert Solution

Question

1 Approved Answer

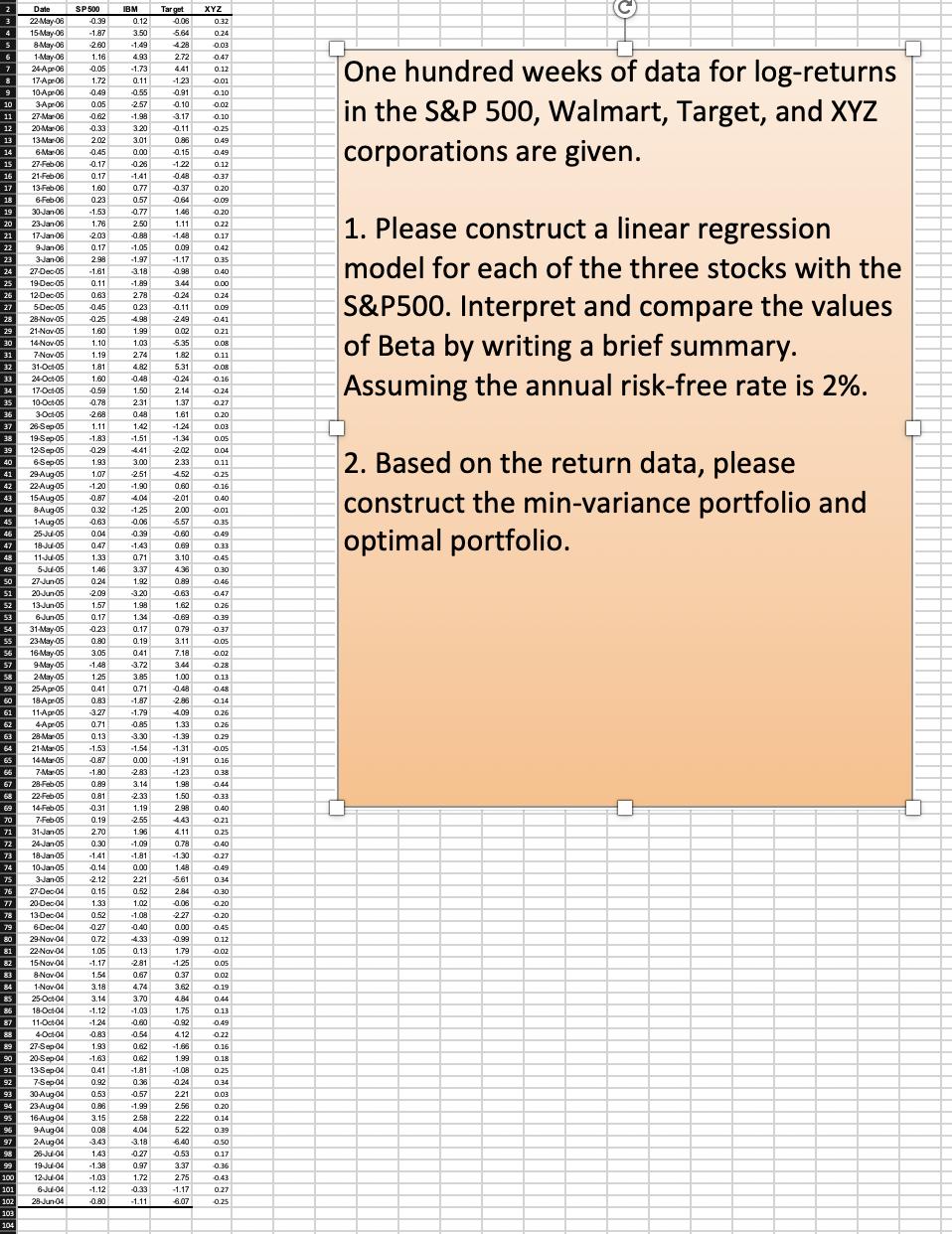

Date SP500 IBM Target XYZ 22-May-06 -0.39 0.12 -0.06 0.32 15-May-06 -1.87 3.50 -5.64 0.24 5 8-May-06 -2.60 -1.49 428 -0.03 6 1-May-06 1.16

Date SP500 IBM Target XYZ 22-May-06 -0.39 0.12 -0.06 0.32 15-May-06 -1.87 3.50 -5.64 0.24 5 8-May-06 -2.60 -1.49 428 -0.03 6 1-May-06 1.16 4.93 2.72 -0.47 7 24-Apr06 -0.05 -1.73 4.41 0.12 17-Apr-06 1.72 0.11 -1.23 -0.01 10-Apr-06 -0.49 -0.55 -0.91 -0.10 10 3-Apr-06 0.05 -2.57 -0.10 -0.02 11 27-Mar-06 -0.62 -1.98 -3.17 -0.10 12 20-Mar-06 -0.33 3.20 -0.11 -0.25 13 13-Mar-06 2.02 3.01 0.86 0.49 14 6-Mar-06 -0.45 0.00 -0.15 -0.49 15 27-Feb-06 -0.17 -0.26 -1.22 0.12 16 21-Feb-06 0.17 -1.41 -0.48 0.37 17 13-Feb-06 1.601 0.77 -0.37 0.20 18 6-Feb-06 0.23 0.57 -0.64 -0.09 19 30-Jan-06 -1.53 -0.77 1.46 -0.20 20 23-Jan-06 1.76 2.50 1.11 0.22 21 17-Jan-06 -2.03 -0.88 -1.48 0.17 22 9-Jan-06 0.17 -1.05 0.09 0.42 23 3-Jan-06 2.98 -1.97 -1.17 0.35 24 27-Dec-05 -1.61 3.18 -0.98 0.40 25 19-Dec-05 0.11 -1.89 3.44 0.00 26 12-Dec-05 0.63 2.78 -0.24 0.24 27 5-Dec-05 -0.45 0.23 -0.11 0.09 28 28-Nov-05 -0.25 -4.98 -2.49 -0.41 29 21-Nov-05 1.60 1.99 0.02 0.21 30 14-Nov-05 1.10 1.03 -5.35 0.08 31 7-Nov-05 1.19 2.74 1.82 0.11 32 31-Oct-05 1.81 4.82 5.31 -0.08 33 24-Oct-05 1.60 -0.48 -0.24 -0.16 34 17-Oct-05 -0.59 1.50 2.14 -0.24 35 10-Oct-05 -0.78 2.31 1.37 -0.27 36 3-Oct-05 -2.68 0.48 1.61 0.20 37 26-Sep-05 1.11 1.42 -1.24 0.03 19-Sep-05 -1.83 -1.51 -1.34 0.05 39 12-Sep-05 -0.29 4.41 -2.02 0.04 40 6-Sep-05 1.931 3.00 2.33 0.11 41 29-Aug-05 1.07 -2.51 4.52 0.25 42 22-Aug-05 -1.20 -1.90 0.60 -0.16 43 15-Aug-05 -0.87 -4.04 -2.01 0.40 44 8-Aug-05 0.32 -1.25 2.00 -0.01 45 1-Aug-05 -0.63 -0.06 -5.57 -0.35 46 25-Jul-05 0.04 -0.39 -0.60 -0.49 47 18-Jul-05 0.47 -1.43 0.69 0.33 48 11-Ju-05 1.33 0.71 3.10 -0.45 49 5-Jul-05 1.46 3.37 4.36 0.30 50 27-Jun-05 0.24 1.92 0.89 -0.46 51 20-Jun-05 -2.09 3.20 -0.63 -0.47 52 13-Jun-05 1.57 1.98 1.62 0.26 53 6-Jun-05 0.17 1.34 -0.69 -0.39 54 31-May-05 -0.23 0.17 0.79 0.37 55 23-May-05 0.80 0.19 3.11 -0.05 56 16-May-05 3.05 0.41 7.18 -0.02 57 9-May-05 -1.48 -3.72 3.44 -0.28 58 2-May-05 1.25 3.85 1.00 0.13 59 25-Apr 05 0.41 0.71 -0.48 0.48 60 18-Apr05 0.83 -1.87 -2.86 -0.14 61 11-Apr05 3.27 -1.79 4.09 0.26 62 4-Apr-05 0.71 -0.85 1.33 0.26 63 28-Ma-05 0.13 -3.30 -1.39 0.29 64 21-Ma-05 -1.53 -1.54 -1.31 -0.05 65 14-Mar-05 -0.87 0.00 -1.91 0.16 66 7-Ma-05 -1.80 -2.83 -1.23 0.38 67 28-Feb-05 0.89 3.14 1.98 0.44 68 22-Feb-05 0.81 -2.33 1.50 -0.33 69 14-Feb-05 -0.31 1.19 2.98 0.40 70 7-Feb-05 0.19 -2.55 4.43 -0.21 71 31-Jan-05 2.70 1.96 4.11 0.25 72 24-Jan-05 0.30 -1.09 0.78 -0.40 73 18-Jan-05 -1.41 -1.81 -1.30 -0.27 74 10-Jan-05 -0.14 0.00 1.48 -0.49 75 3-Jan-05 -2.12 2.21 -5.61 0.34 76 27-Dec-04 0.15 0.52 2.84 -0.30 77 20-Dec-04 1.33 1.02 -0.06 -0.20 78 13-Dec-04 0.52 -1.08 -2.27 -0.20 79 6-Dec-04 -0.27 -0.40 0.00 -0.45 80 29-Nov-04 0.72 -4.33 -0.99 0.12 81 22-Nov-04 1.05 0.13 1.79 -0.02 82 15-Nov-04 -1.17 -2.81 -1.25 0.05 83 8-Nov-04 1.54 0.67 0.37 0.02 84 1-Nov-04 3.18 4.74 3.62 -0.19 85 25-Oct-04 3.14 3.70 4.84 0.44 86 18-Oct-04 -1.12 -1.03 1.75 0.13 87 11-Oct-04 -1.24 -0.60 -0.92 -0.49 4-Oct-04 -0.83 -0.54 4.12 -0.22 89 27-Sep-04 1.93 0.62 -1.66 0.16 90 20-Sep-04 -1.63 0.62 1.99 0.18 91 13-Sep-04 0.41 -1.81 -1.08 0.25 92 7-Sep-04 0.92 0.36 -0.24 0.34 93 30-Aug-04 0.53 -0.57 2.21 0.03 94 23-Aug-04 0.86 -1.99 2.56 0.20 95 16-Aug-04 3.15 2.58 2.22 0.14 96 9-Aug-04 0.08 4.04 5.22 0.39 97 2-Aug-04 3.43 3.18 -6.40 -0.50 98 26-Jul-04 1.43 -0.27 -0.53 0.17 99 19-Jul-04 -1.38 0.97 3.37 -0.36 100 12-Jul-04 -1.03 1.72 2.75 -0.43 101 6-Jul-04 -1.12 -0.33 -1.17 0.27 102 28-Jun-04 -0.80 -1.11 -6.07 -0.25 103 104 One hundred weeks of data for log-returns in the S&P 500, Walmart, Target, and XYZ corporations are given. 1. Please construct a linear regression model for each of the three stocks with the S&P500. Interpret and compare the values of Beta by writing a brief summary. Assuming the annual risk-free rate is 2%. 2. Based on the return data, please construct the min-variance portfolio and optimal portfolio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started