Question

required to conduct a funding exercise on Project Y with the following information. ? We are considering a Mezz Loan Facility for Project Y, with

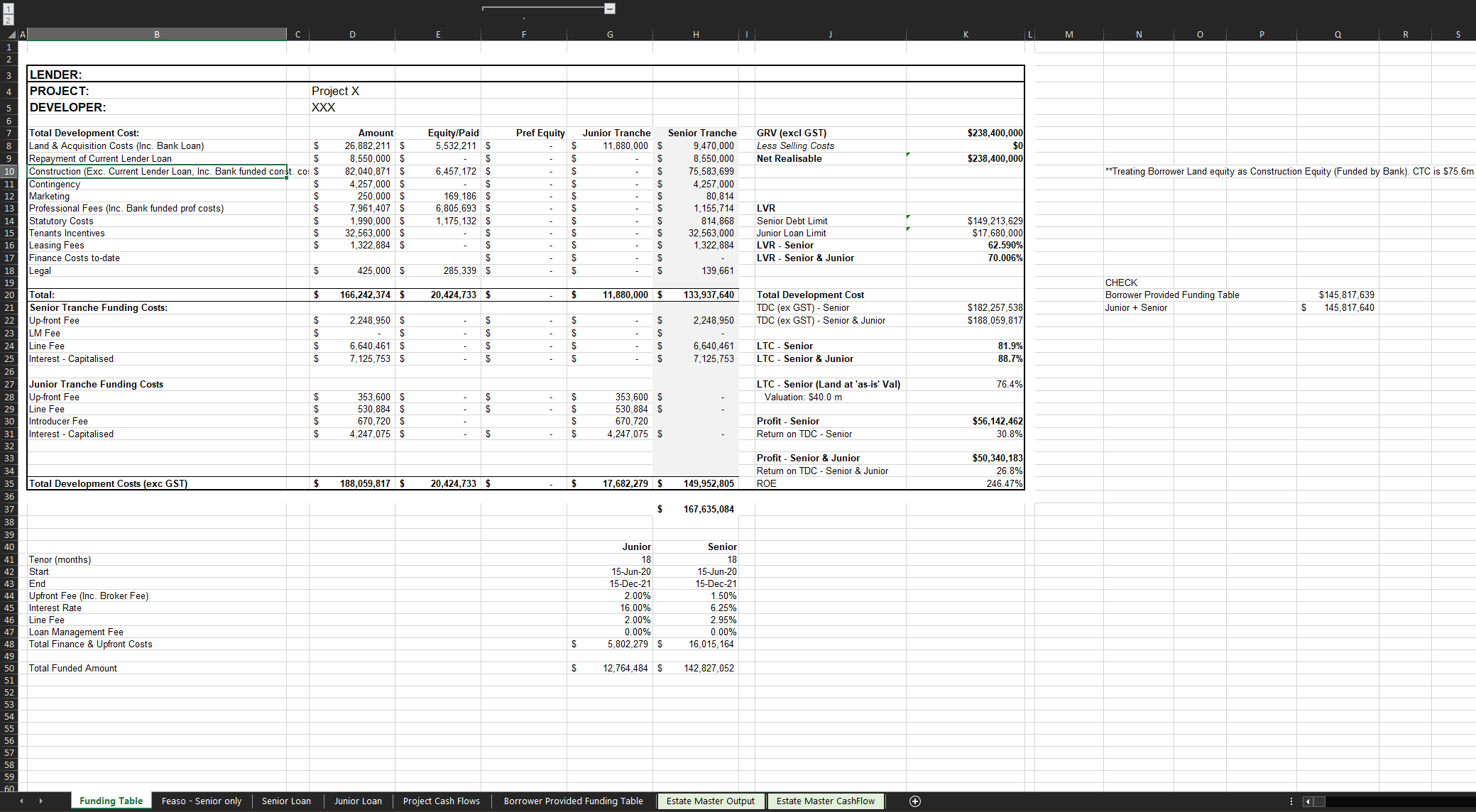

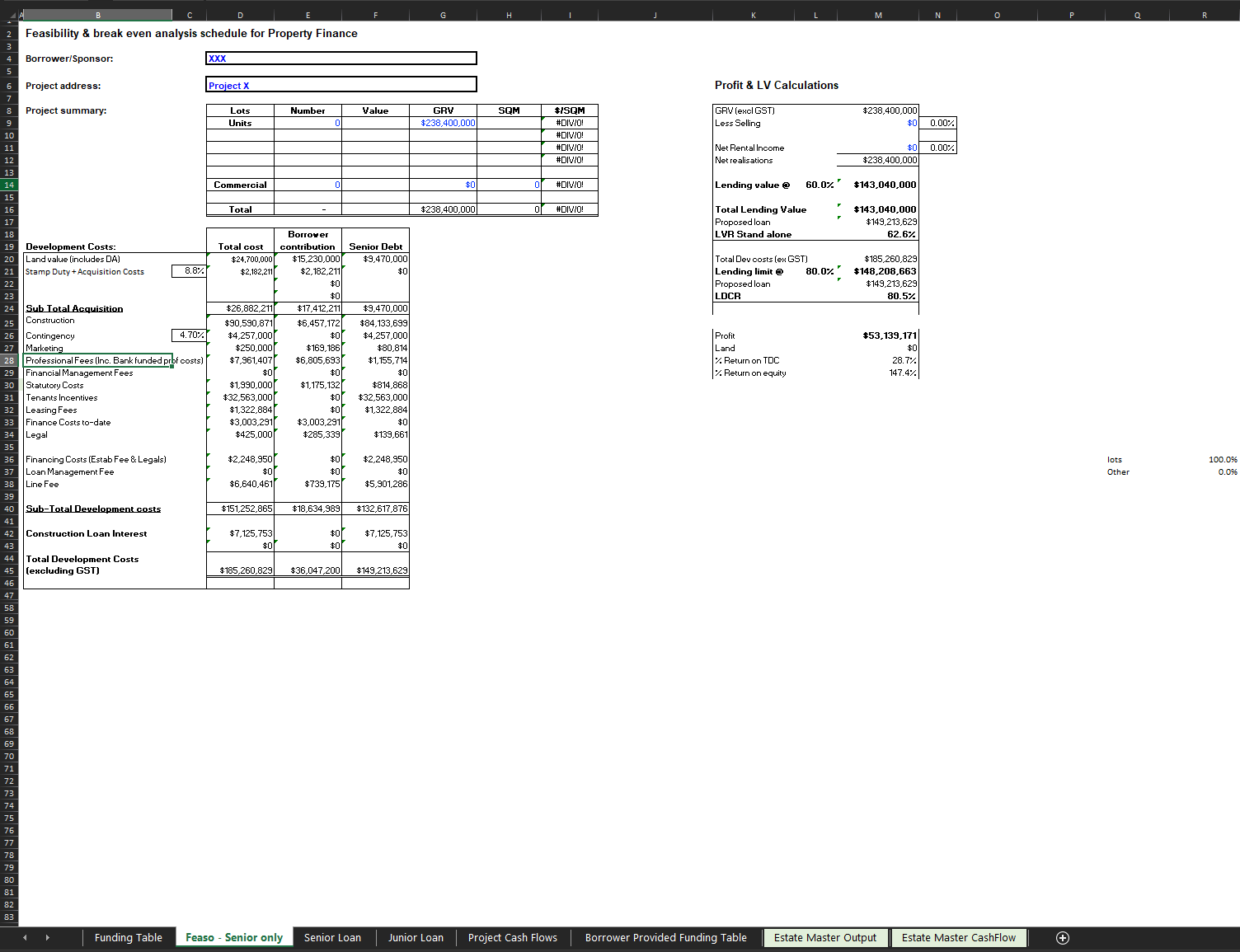

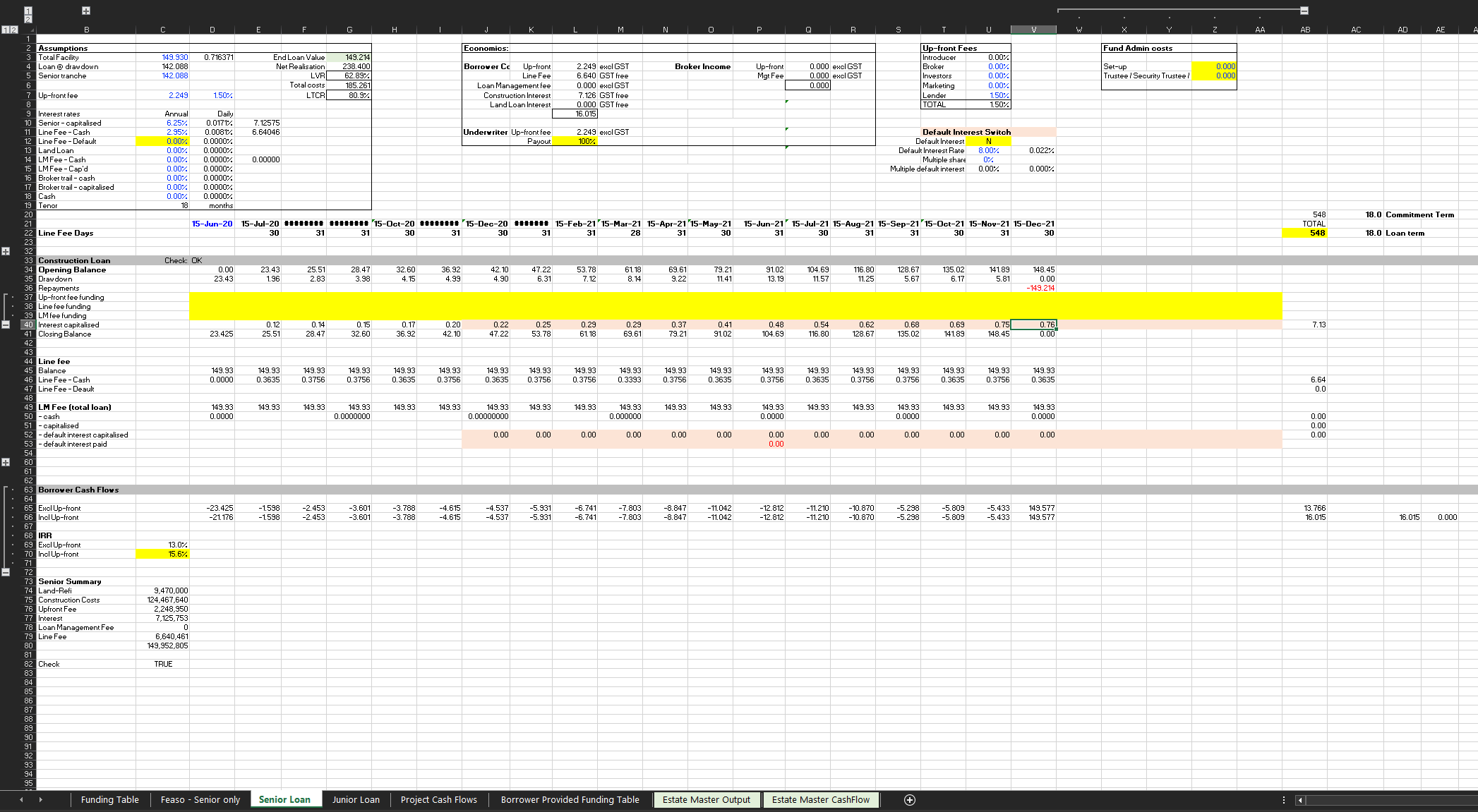

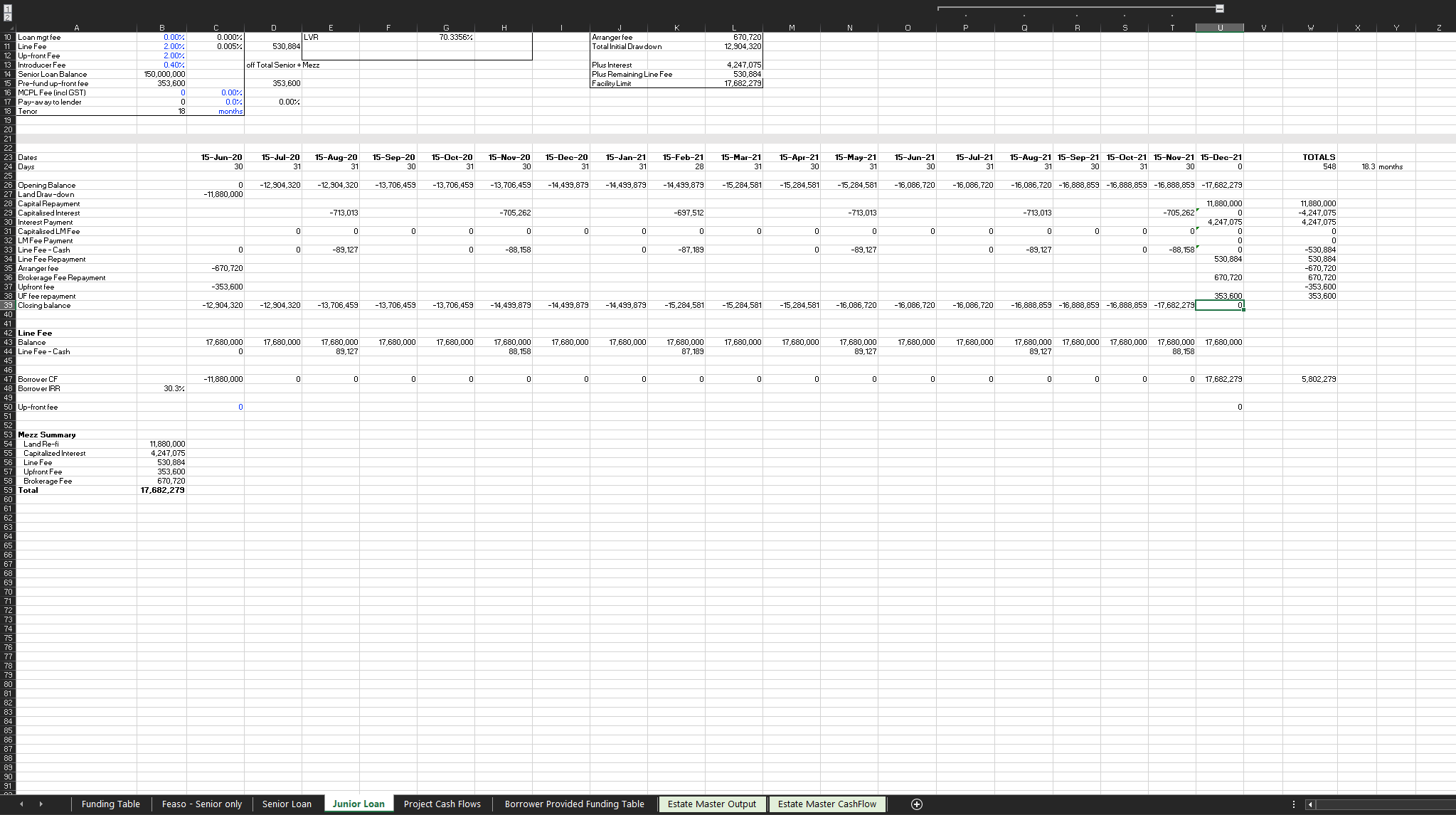

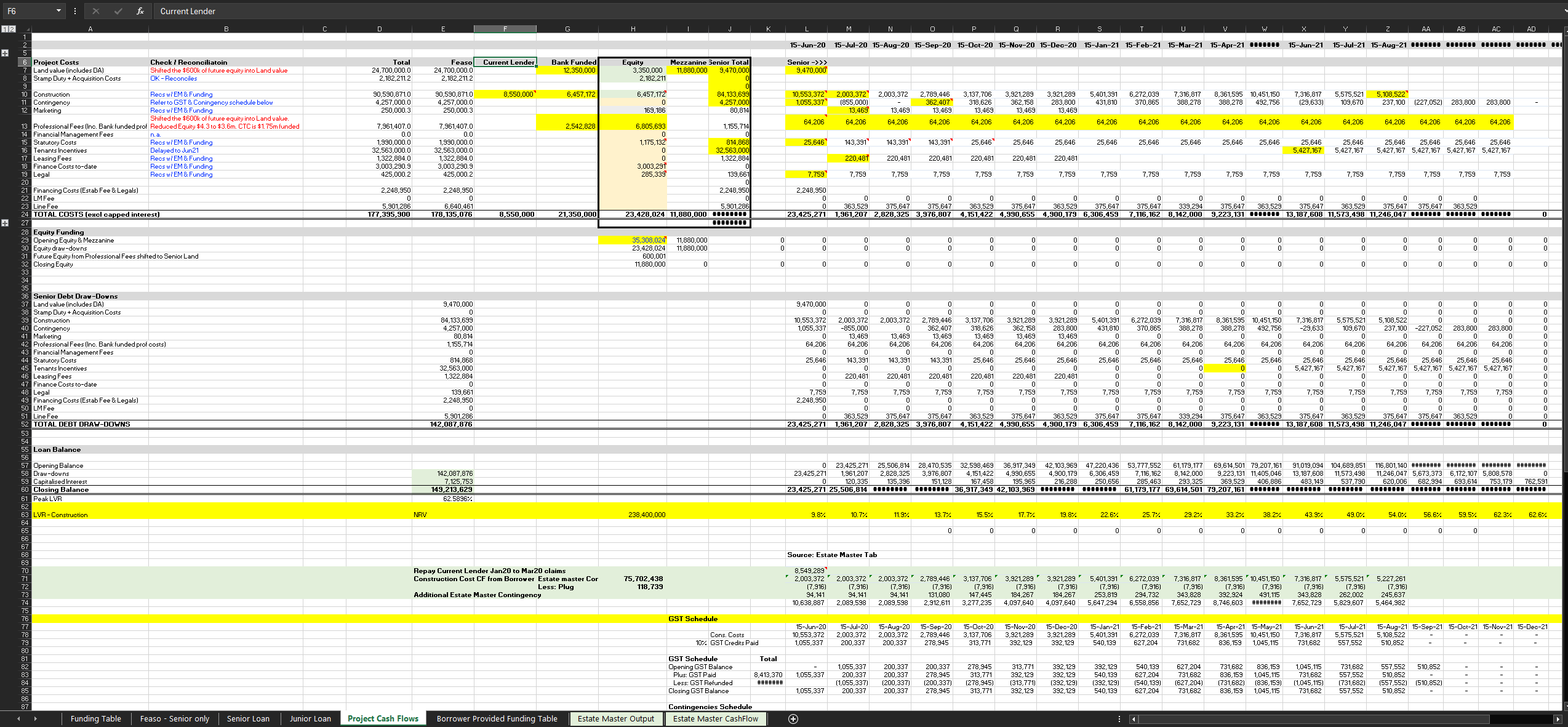

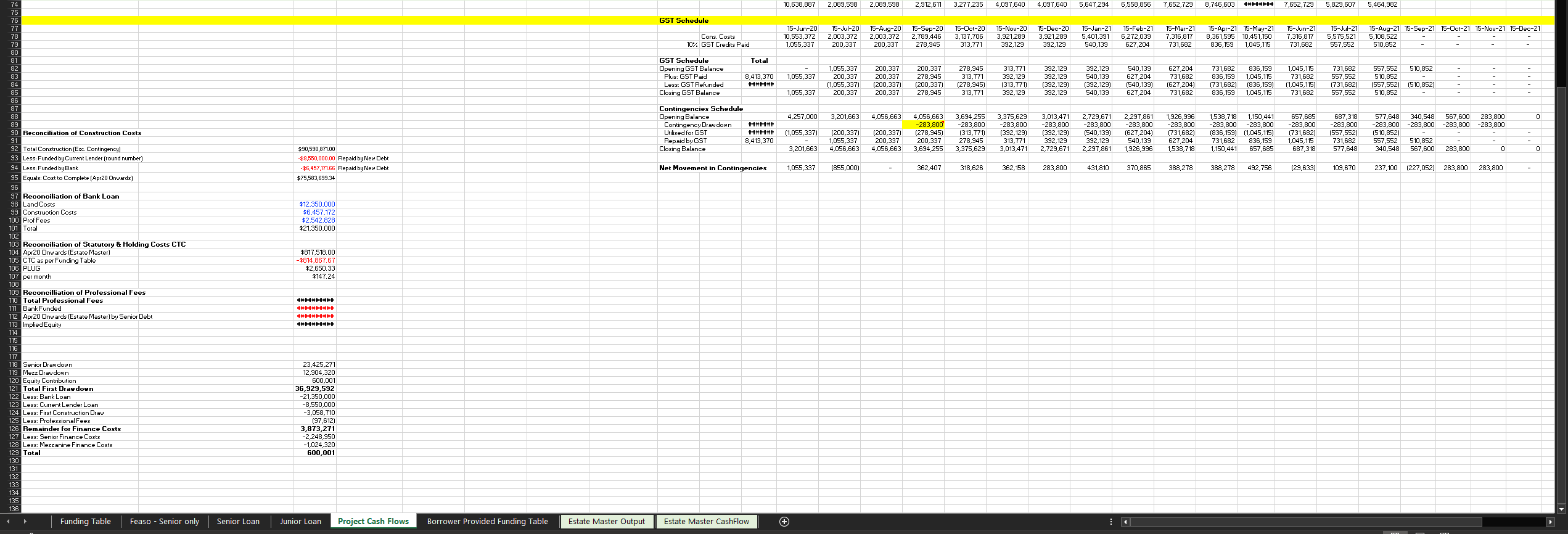

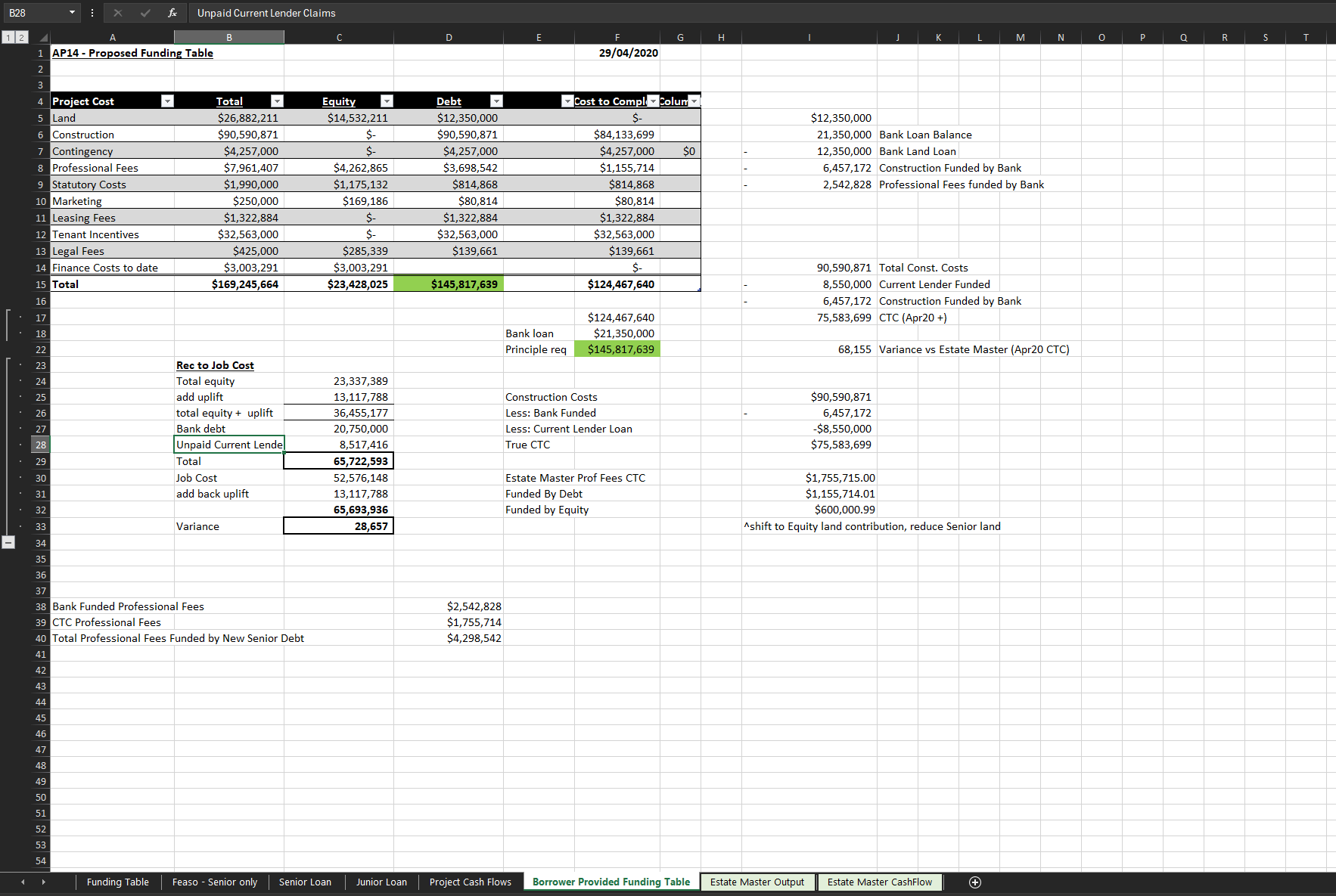

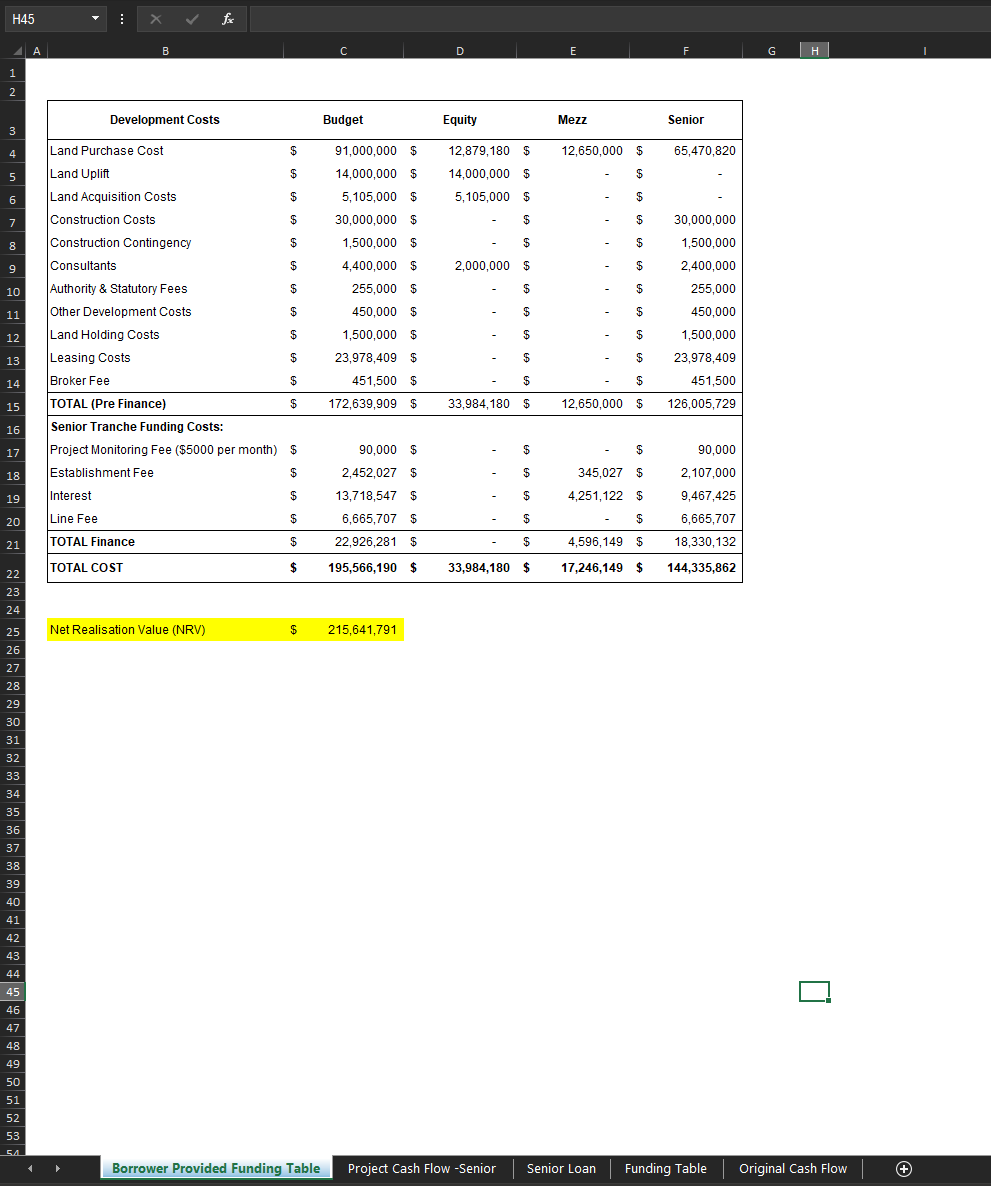

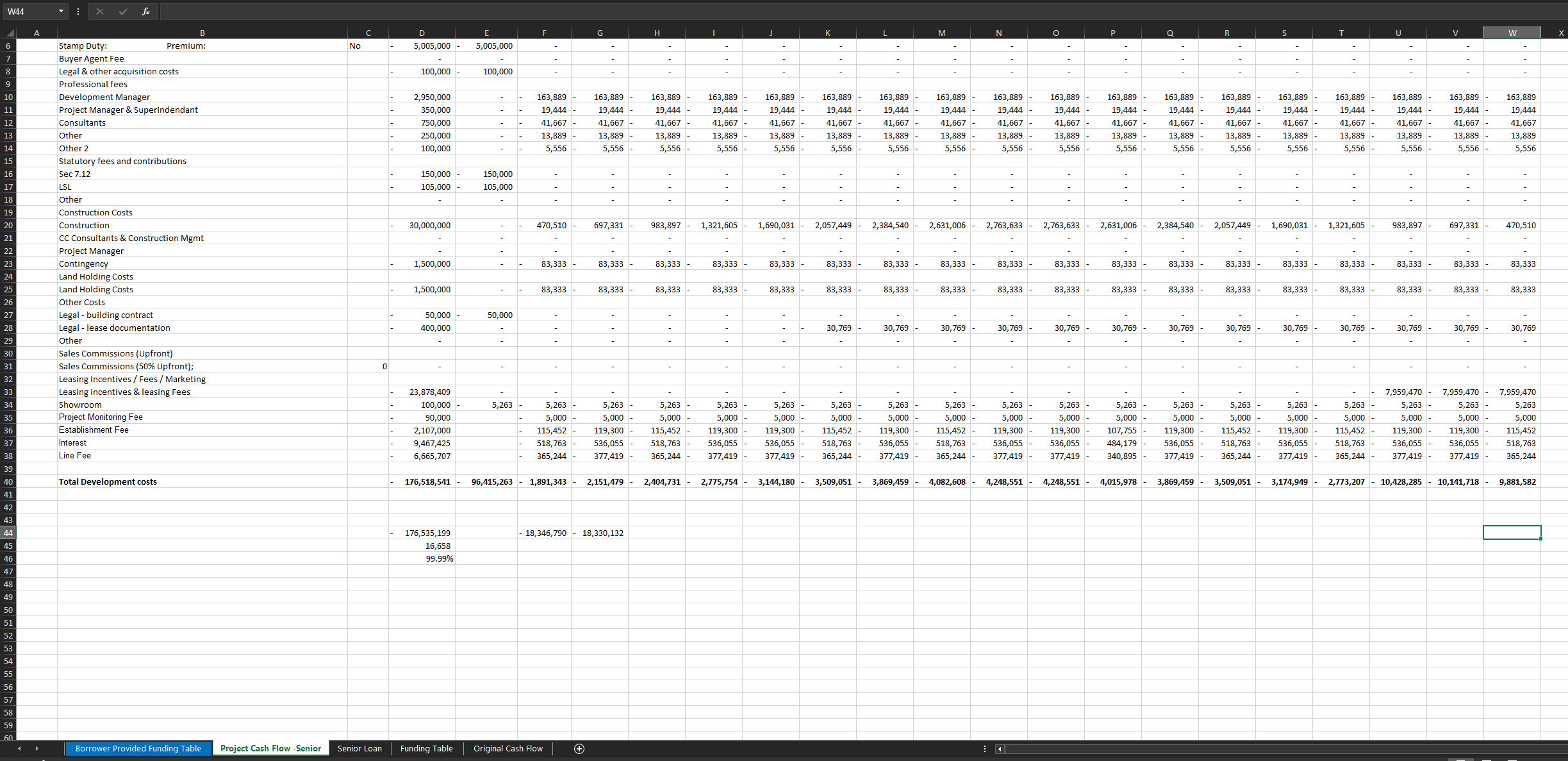

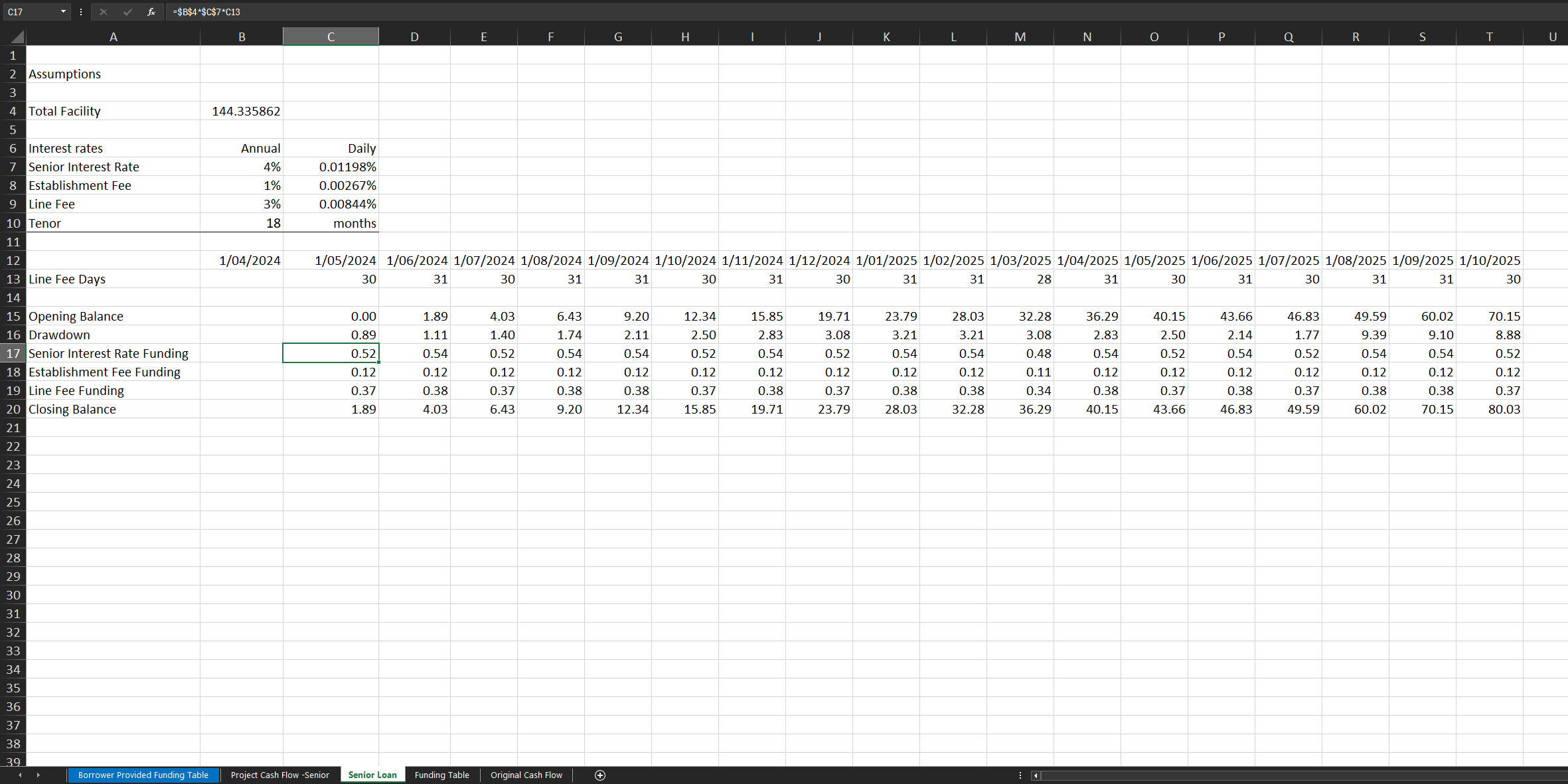

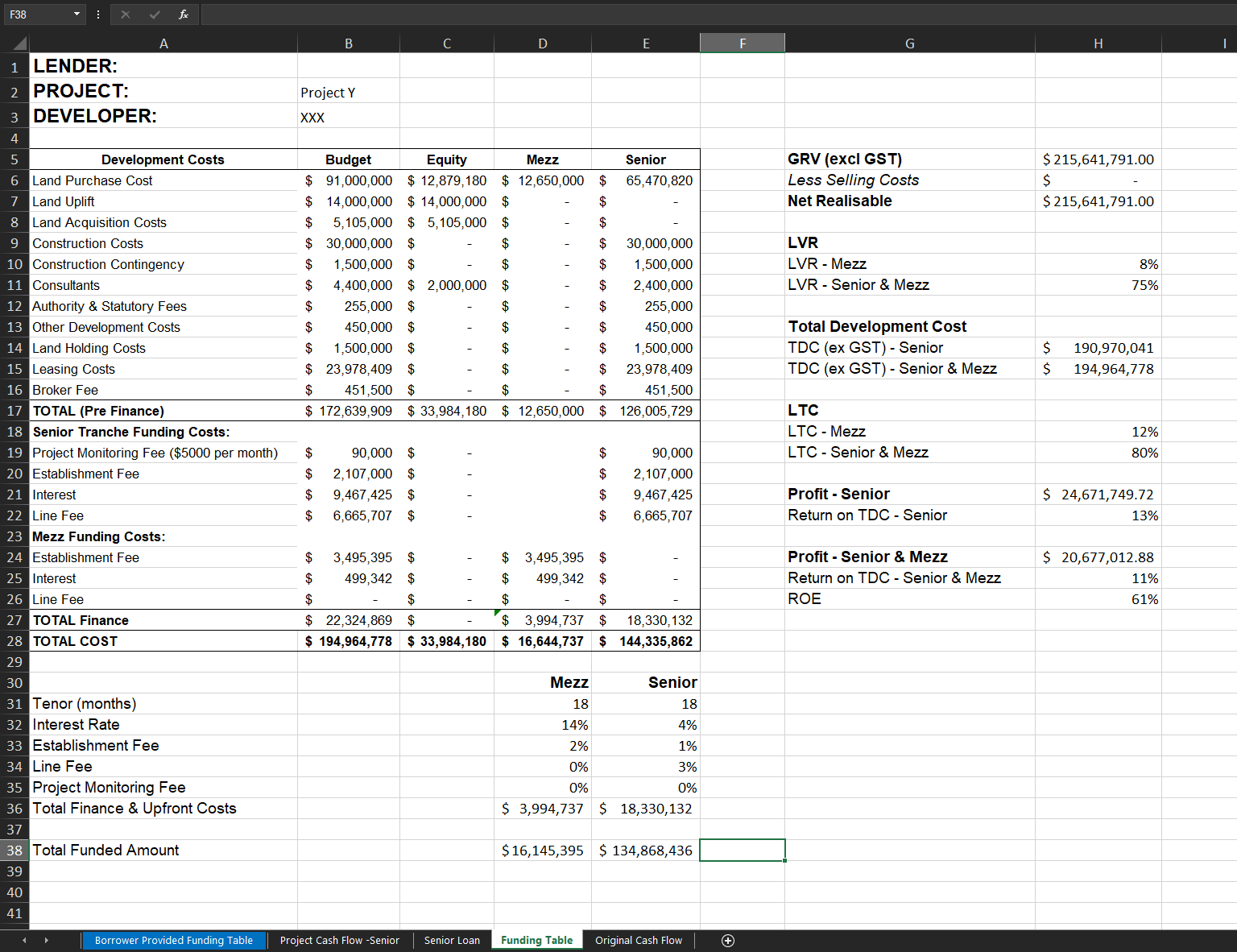

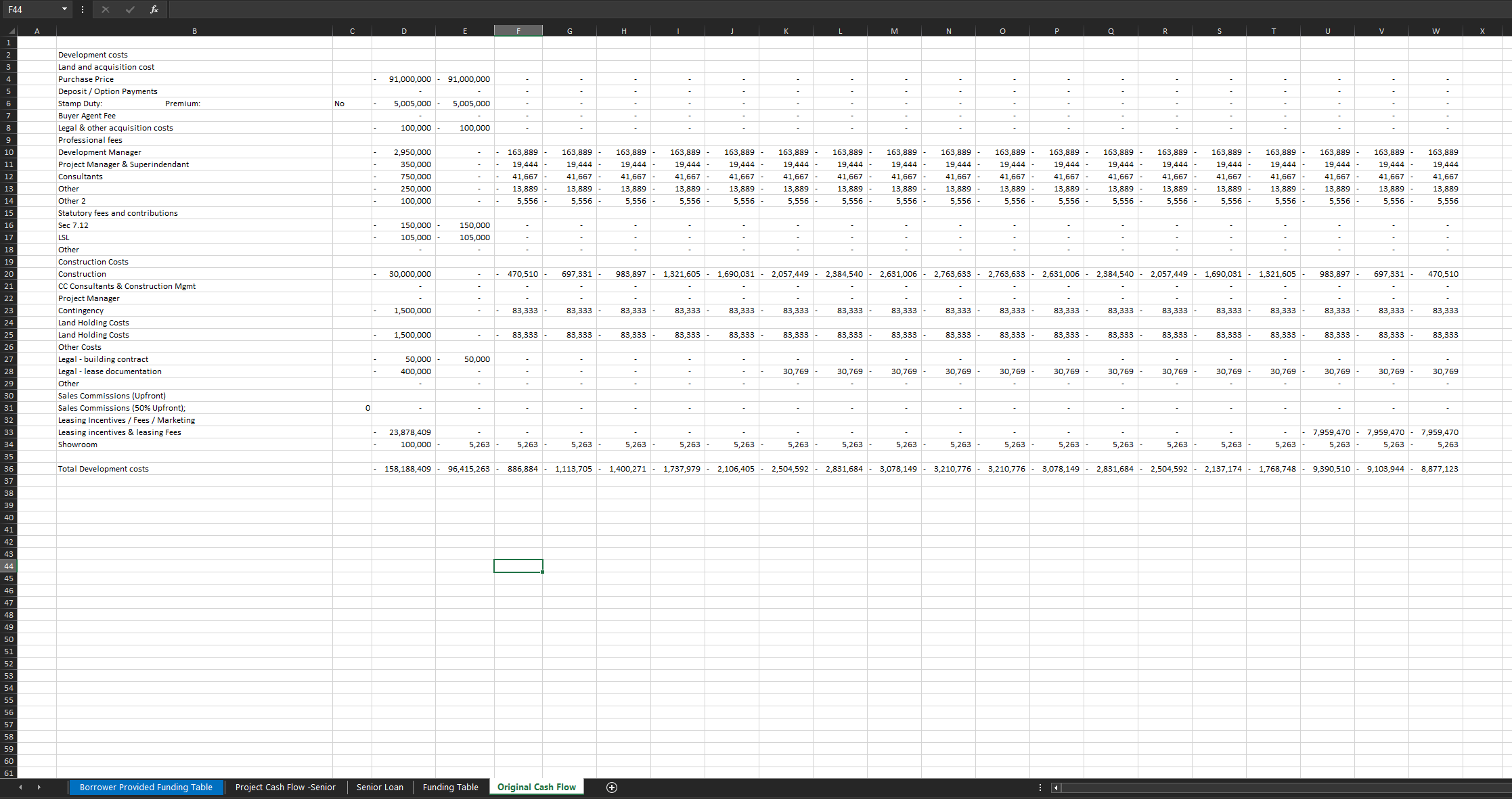

required to conduct a funding exercise on Project Y with the following information. ? We are considering a Mezz Loan Facility for Project Y, with Senior Loan Facility being offered by another lender. Our terms for the Mezz Facility are as below. o Interest Rate: 14% p.a o Establishment Fee: 2% o Loan Term: 18 months o Total LVR Covenant: 75% o Total LTC Covenant: 80% ? The attached Project Y worksheet (Project Y Mezz Funding Exercise.xlsx) is prepared by the borrower which includes the funding table and cash flow proposed by the borrower. ? Please build up a model for Project Y to apply our terms with the following assumptions. o The data in the "Cash Flow" tab is accurate and can be used in the project cash flow in your model. o As the funding table provided in the current worksheet is the borrower's proposal, you will need to update it based on our pricing and financial covenants. The results derived from the project cash flow shall be reflected in the funding table. LVR, LTC, etc. need to be calculated based on these figures. o As the Senior Loan Facility has been provided by another lender, you can rely on those figures for the Senior portion in the current funding table. However, we would like to know the pricing details for the senior facility. This could be derived by running the cash flow for the Senior portion. Since you have the total figures of the Establishment Fee, Interest, and Line Fee, you can work backward and find out what the rates are for the respective finance costs. Example - Project X (for reference only) Project X is a development with three ground-floor retail tenancies, nine levels of office space (including a rooftop terrace), two levels of basement car parking and onsite amenities. To facilitate the commercial development funding of this project, the Senior and Junior lenders have provided the Construction Loan Facility. The model for Project X (Project X - Model.xlsx) is enclosed for your reference, which contains the Funding Table and cash flow for both Senior and Junior (Mezz) Loan. below is project x which is for reference only:

3 LENDER: 4 PROJECT: Project X G M N R 5 DEVELOPER: XXX 6 7 Total Development Cost: Amount Equity/Paid Pref Equity Junior Tranche Senior Tranche GRV (excl GST) $238,400,000 8 Land & Acquisition Costs (Inc. Bank Loan) $ 26,882,211 $ 9 Repayment of Current Lender Loan $ 8,550,000 $ 5,532,211 $ $ $ 11,880,000 $ $ $ 9,470,000 8,550,000 Less Selling Costs Net Realisable $0 $238,400,000 10 Construction (Exc. Current Lender Loan, Inc. Bank funded cont. co: $ 82,040,871 $ 6,457,172 $ $ $ 75,583,699 **Treating Borrower Land equity as Construction Equity (Funded by Bank). CTC is $75.6m 11 Contingency $ 4.257,000 $ $ $ $ 4,257,000 12 Marketing $ 250,000 $ 169,186 $ $ $ 80,814 13 Professional Fees (Inc. Bank funded prof costs) $ 7,961,407 $ 6,805,693 $ $ $ 1,155,714 LVR 14 Statutory Costs $ 1,990,000 $ 1,175,132 $ $ $ 814,868 Senior Debt Limit $149,213,629 15 Tenants Incentives $ 32,563,000 $ $ $ $ 32,563,000 Junior Loan Limit $17,680,000 16 Leasing Fees $ 1,322,884 $ $ $ $ 1,322,884 LVR - Senior 17 Finance Costs to-date $ $ $ LVR - Senior & Junior 62.590% 70.006% 18 Legal $ 425,000 $ 285.339 $ $ $ 139,661 19 CHECK 20 Total: $ 166,242,374 $ 20,424,733 $ $ 11,880,000 $ 133,937,640 21 Senior Tranche Funding Costs: Total Development Cost TDC (ex GST) - Senior 22 Up-front Fee $ 2,248,950 $ $ $ $ 2,248,950 TDC (ex GST) - Senior & Junior $182,257,538 $188,059,817 Borrower Provided Funding Table Junior + Senior $ $145,817,639 145,817,640 23 LM Fee $ $ $ $ $ 24 Line Fee $ 6,640,461 $ $ $ $ 6,640,461 LTC - Senior 81.9% 25 Interest Capitalised $ 7,125,753 $ $ $ 7,125,753 LTC - Senior & Junior 88.7% 26 27 Junior Tranche Funding Costs 28 Up-front Fee $ 353,600 $ $ $ 353,600 $ LTC - Senior (Land at 'as-is' Val) Valuation: $40.0 m 76.4% 29 Line Fee $ 530,884 $ $ 530,884 $ 30 Introducer Fee $ 670,720 $ 670,720 Profit - Senior 31 Interest Capitalised $ 4,247,075 $ $ $ 4,247,075 Return on TDC - Senior $56,142,462 30.8% 32 33 Profit - Senior & Junior $50,340,183 34 35 Total Development Costs (exc GST) $ 188,059,817 $ 20,424,733 $ $ 17,682,279 $ 149,952,805 Return on TDC - Senior & Junior ROE 26.8% 246.47% 36 37 $ 167,635,084 38 39 40 41 Tenor (months) 42 Start 43 End 44 Upfront Fee (Inc. Broker Fee) 45 Interest Rate 46 Line Fee 47 Loan Management Fee 48 Total Finance & Upfront Costs 49 50 Total Funded Amount Junior 18 Senior 18 15-Jun-20 15-Dec-21 2.00% 15-Jun-20 15-Dec-21 1.50% 16.00% 6.25% 2.00% 2.95% 0.00% 0.00% $ 5,802,279 $ 16,015,164 $ 12,764,484 $ 142,827,052 51 52 53 54 55 56 57 58 59 60 Funding Table Feaso - Senior only Senior Loan Junior Loan Project Cash Flows Borrower Provided Funding Table Estate Master Output Estate Master CashFlow +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started