Answered step by step

Verified Expert Solution

Question

1 Approved Answer

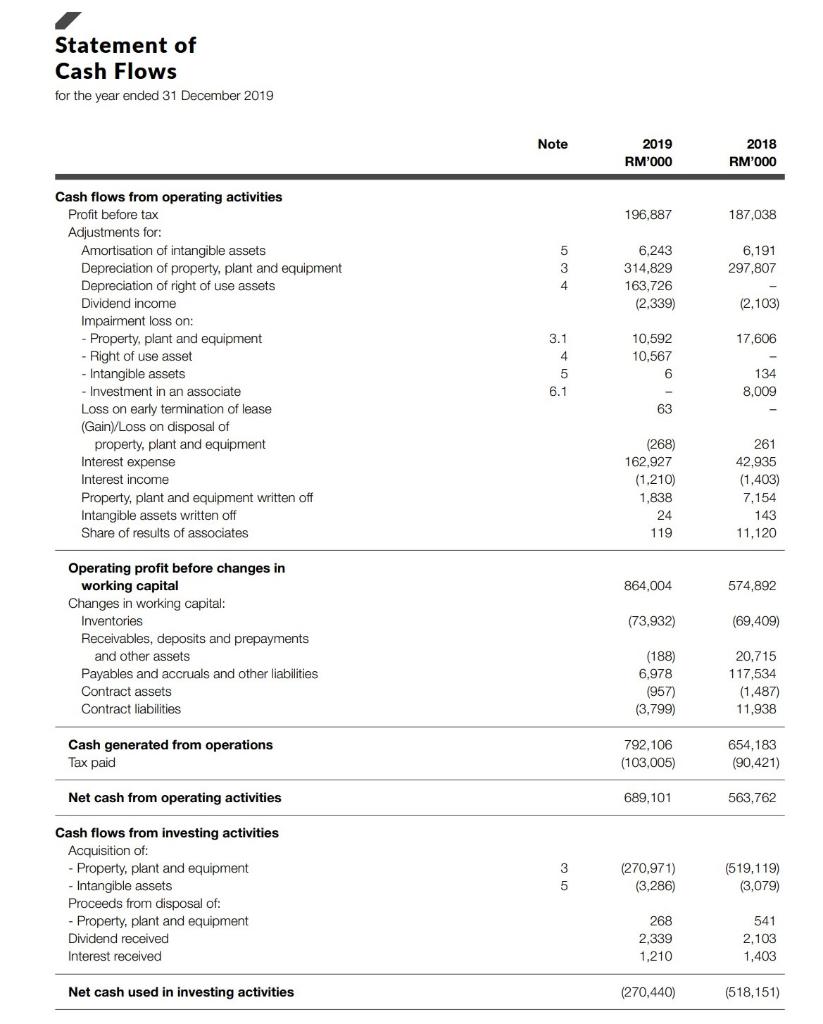

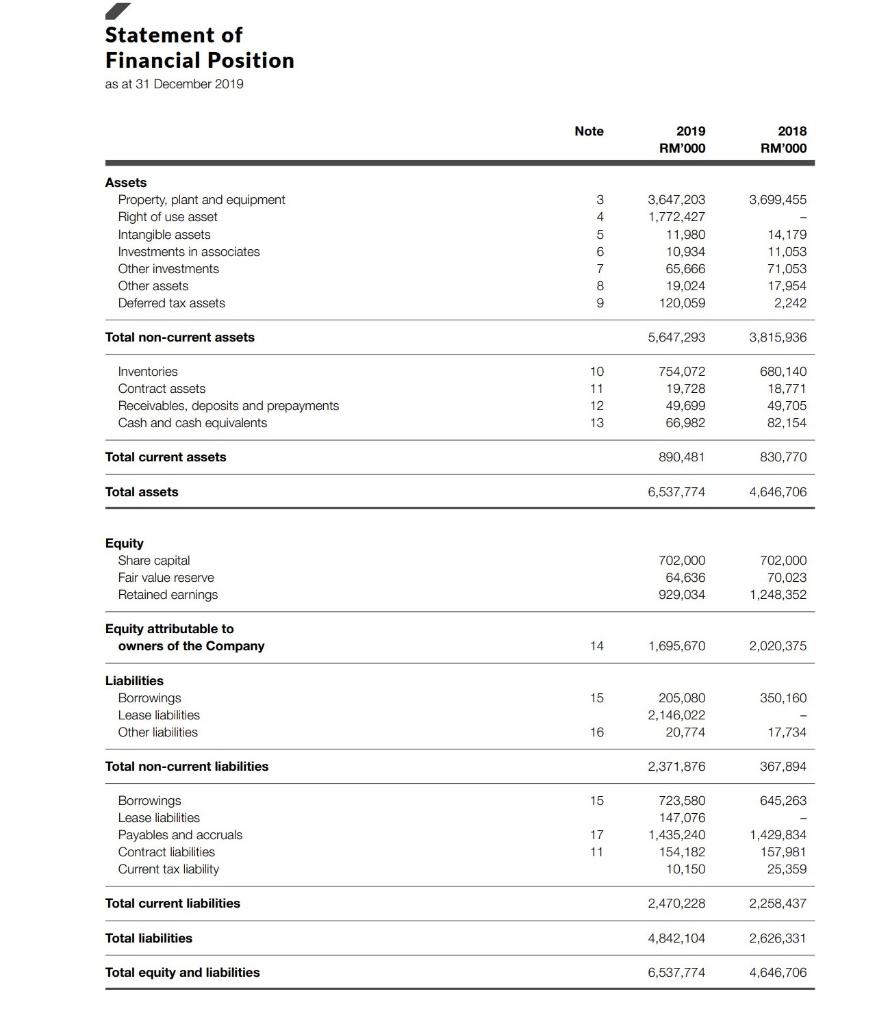

Calculate the Cash Flow Identity Operating Cash Flow NCS changes in NWC CFA CFC Statement of Cash Flows for the year ended 31 December 2019

Calculate the Cash Flow Identity

Operating Cash Flow

NCS

changes in NWC

CFA

CFC

Statement of Cash Flows for the year ended 31 December 2019 Note 2019 RM'000 2018 RM'000 196,887 187,038 5 3 4 6,191 297.807 6,243 314.829 163,726 (2,339) (2,103) 17,606 Cash flows from operating activities Profit before tax Adjustments for: Amortisation of intangible assets Depreciation of property, plant and equipment Depreciation of right of use assets Dividend income Impairment loss on: - Property, plant and equipment - Right of use asset - Intangible assets - Investment in an associate Loss on early termination of lease (Gain/Loss on disposal of property, plant and equipment Interest expense Interest income Property, plant and equipment written off Intangible assets written off Share of results of associates 3.1 4 5 6.1 10,592 10,567 6 134 8,009 63 (268) 162,927 (1.210) 1,838 24 119 261 42,935 (1.403) 7,154 143 11,120 864,004 574,892 (73,932) (69,409) Operating profit before changes in working capital Changes in working capital: Inventories Receivables, deposits and prepayments and other assets Payables and accruals and other liabilities Contract assets Contract liabilities (188) 6,978 (957) (3,799) 20,715 117,534 (1,487) 11,938 792.106 Cash generated from operations Tax paid 654,183 (90,421) (103,005) Net cash from operating activities 689.101 563,762 3 5 (270,971) (3,286) (519,119) (3,079) Cash flows from investing activities Acquisition of: Property, plant and equipment - Intangible assets Proceeds from disposal of: Property, plant and equipment Dividend received Interest received 268 2,339 1,210 541 2,103 1,403 Net cash used in investing activities (270,440) (518,151) Statement of Financial Position as at 31 December 2019 Note 2019 RM'000 2018 RM'000 3,699,455 Assets Property, plant and equipment Right of use asset Intangible assets Investments in associates Other investments Other assets Deferred tax assets 3 4 5 6 7 8 9 9 3.647,203 1,772,427 11.980 10,934 65,666 19,024 120,059 14,179 11,053 71,053 17,954 2,242 Total non-current assets 5.647,293 3,815,936 Inventories Contract assets Receivables, deposits and prepayments Cash and cash equivalents 10 11 12 13 754,072 19,728 49,699 66,982 680,140 18.771 49,705 82,154 Total current assets 890,481 830,770 Total assets 6,537,774 4,646,706 Equity Share capital Fair value reserve Retained earnings 702,000 64,636 929,034 702,000 70.023 1.248,352 Equity attributable to owners of the Company 14 1,695,670 2,020,375 15 350,160 Liabilities Borrowings Lease liabilities Other liabilities 205,080 2,146,022 20,774 16 17.734 Total non-current liabilities 2,371,876 367,894 15 645,263 Borrowings Lease liabilities Payables and accruals Contract liabilities Current tax liability 17 11 723,580 147,076 1,435,240 154,182 10,150 1,429,834 157,981 25,359 Total current liabilities 2,470,228 2,258,437 Total liabilities 4,842,104 2,626,331 Total equity and liabilities 6,537,774 4,646,706 Statement of Cash Flows for the year ended 31 December 2019 Note 2019 RM'000 2018 RM'000 196,887 187,038 5 3 4 6,191 297.807 6,243 314.829 163,726 (2,339) (2,103) 17,606 Cash flows from operating activities Profit before tax Adjustments for: Amortisation of intangible assets Depreciation of property, plant and equipment Depreciation of right of use assets Dividend income Impairment loss on: - Property, plant and equipment - Right of use asset - Intangible assets - Investment in an associate Loss on early termination of lease (Gain/Loss on disposal of property, plant and equipment Interest expense Interest income Property, plant and equipment written off Intangible assets written off Share of results of associates 3.1 4 5 6.1 10,592 10,567 6 134 8,009 63 (268) 162,927 (1.210) 1,838 24 119 261 42,935 (1.403) 7,154 143 11,120 864,004 574,892 (73,932) (69,409) Operating profit before changes in working capital Changes in working capital: Inventories Receivables, deposits and prepayments and other assets Payables and accruals and other liabilities Contract assets Contract liabilities (188) 6,978 (957) (3,799) 20,715 117,534 (1,487) 11,938 792.106 Cash generated from operations Tax paid 654,183 (90,421) (103,005) Net cash from operating activities 689.101 563,762 3 5 (270,971) (3,286) (519,119) (3,079) Cash flows from investing activities Acquisition of: Property, plant and equipment - Intangible assets Proceeds from disposal of: Property, plant and equipment Dividend received Interest received 268 2,339 1,210 541 2,103 1,403 Net cash used in investing activities (270,440) (518,151) Statement of Financial Position as at 31 December 2019 Note 2019 RM'000 2018 RM'000 3,699,455 Assets Property, plant and equipment Right of use asset Intangible assets Investments in associates Other investments Other assets Deferred tax assets 3 4 5 6 7 8 9 9 3.647,203 1,772,427 11.980 10,934 65,666 19,024 120,059 14,179 11,053 71,053 17,954 2,242 Total non-current assets 5.647,293 3,815,936 Inventories Contract assets Receivables, deposits and prepayments Cash and cash equivalents 10 11 12 13 754,072 19,728 49,699 66,982 680,140 18.771 49,705 82,154 Total current assets 890,481 830,770 Total assets 6,537,774 4,646,706 Equity Share capital Fair value reserve Retained earnings 702,000 64,636 929,034 702,000 70.023 1.248,352 Equity attributable to owners of the Company 14 1,695,670 2,020,375 15 350,160 Liabilities Borrowings Lease liabilities Other liabilities 205,080 2,146,022 20,774 16 17.734 Total non-current liabilities 2,371,876 367,894 15 645,263 Borrowings Lease liabilities Payables and accruals Contract liabilities Current tax liability 17 11 723,580 147,076 1,435,240 154,182 10,150 1,429,834 157,981 25,359 Total current liabilities 2,470,228 2,258,437 Total liabilities 4,842,104 2,626,331 Total equity and liabilities 6,537,774 4,646,706Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started