Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the closing balance of Share Capital Class A as it would appear in the Statement of Changes in Equity of TMJ Ltd for

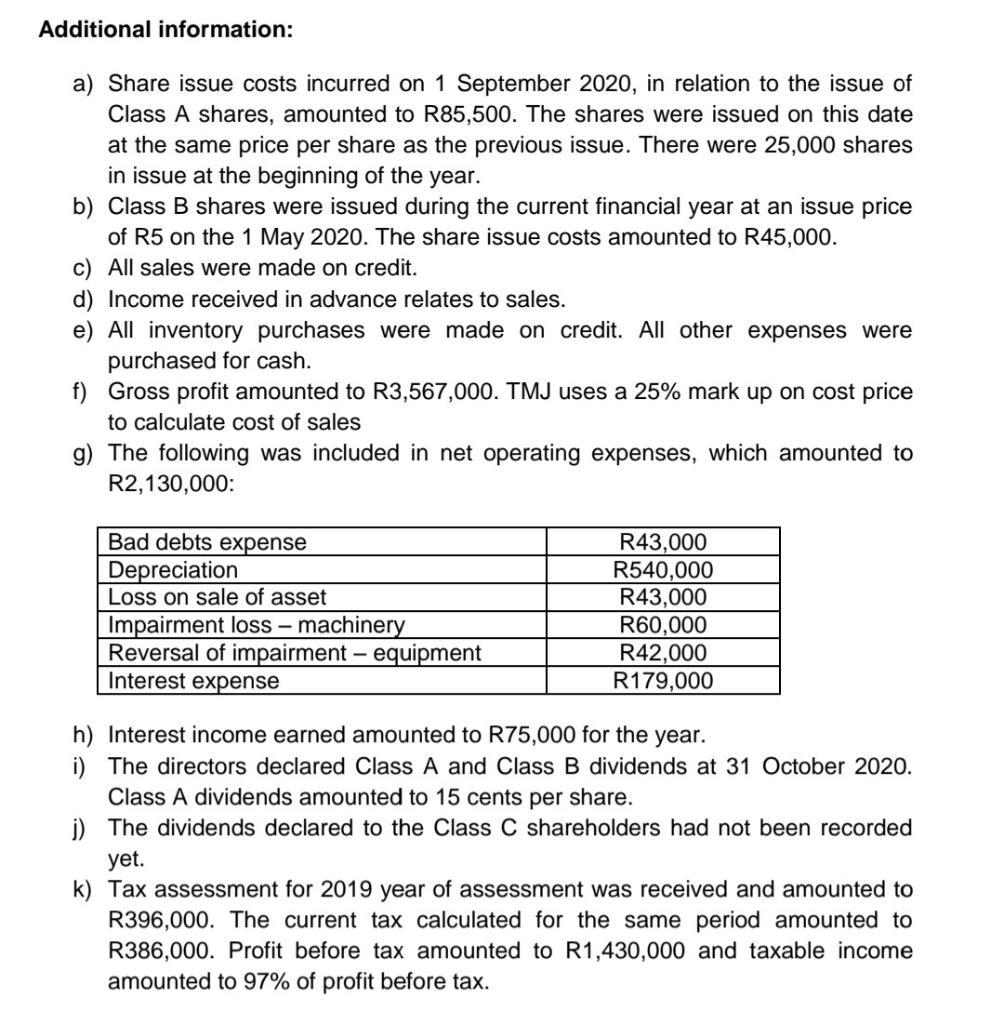

Calculate the closing balance of Share Capital – Class A as it would appear in the Statement of Changes in Equity of TMJ Ltd for the year ended 31 October 2020. 2. Calculate the closing balance of Share Capital – Class B as it would appear in the Statement of Changes in Equity of TMJ Ltd for the year ended 31 October 2020. 3. Prepare the Retained Earnings column as it would appear in the Statement of Changes in Equity of TMJ Ltd for the year ended 31 October 2020.

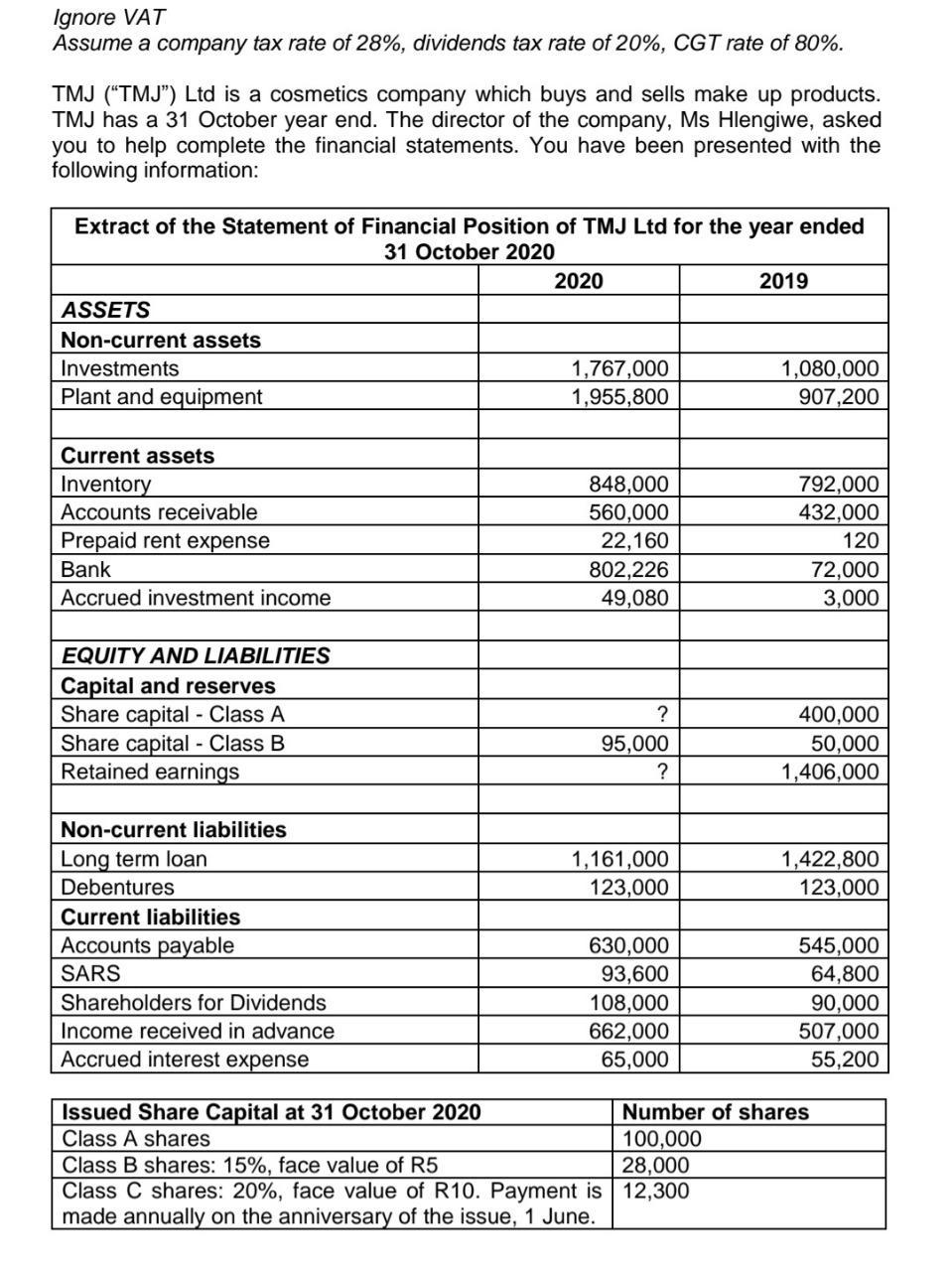

Ignore VAT Assume a company tax rate of 28%, dividends tax rate of 20%, CGT rate of 80%. TMJ ("TMJ") Ltd is a cosmetics company which buys and sells make up products. TMJ has a 31 October year end. The director of the company, Ms Hlengiwe, asked you to help complete the financial statements. You have been presented with the following information: Extract of the Statement of Financial Position of TMJ Ltd for the year ended 31 October 2020 ASSETS Non-current assets Investments Plant and equipment Current assets Inventory Accounts receivable Prepaid rent expense Bank Accrued investment income EQUITY AND LIABILITIES Capital and reserves Share capital - Class A Share capital - Class B Retained earnings Non-current liabilities Long term loan Debentures Current liabilities Accounts payable SARS Shareholders for Dividends Income received in advance Accrued interest expense Issued Share Capital at 31 October 2020 Class A shares 2020 1,767,000 1,955,800 848,000 560,000 22,160 802,226 49,080 ? 95,000 ? 1,161,000 123,000 630,000 93,600 108,000 662,000 65,000 Class B shares: 15%, face value of R5 Class C shares: 20%, face value of R10. Payment is made annually on the anniversary of the issue, 1 June. 2019 1,080,000 907,200 792,000 432,000 120 72,000 3,000 400,000 50,000 1,406,000 1,422,800 123,000 545,000 64,800 90,000 507,000 55,200 Number of shares 100,000 28,000 12,300

Step by Step Solution

★★★★★

3.61 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Share Capital Class A Opening Balance 800000 Add Issue of Class A shares 2500010085 21250 Less Divid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started