Question

Consider the Income Statement and Note 18 (Supplemental information) for General Mills below and answer the following questions. Assume revenue is presented gross of bad

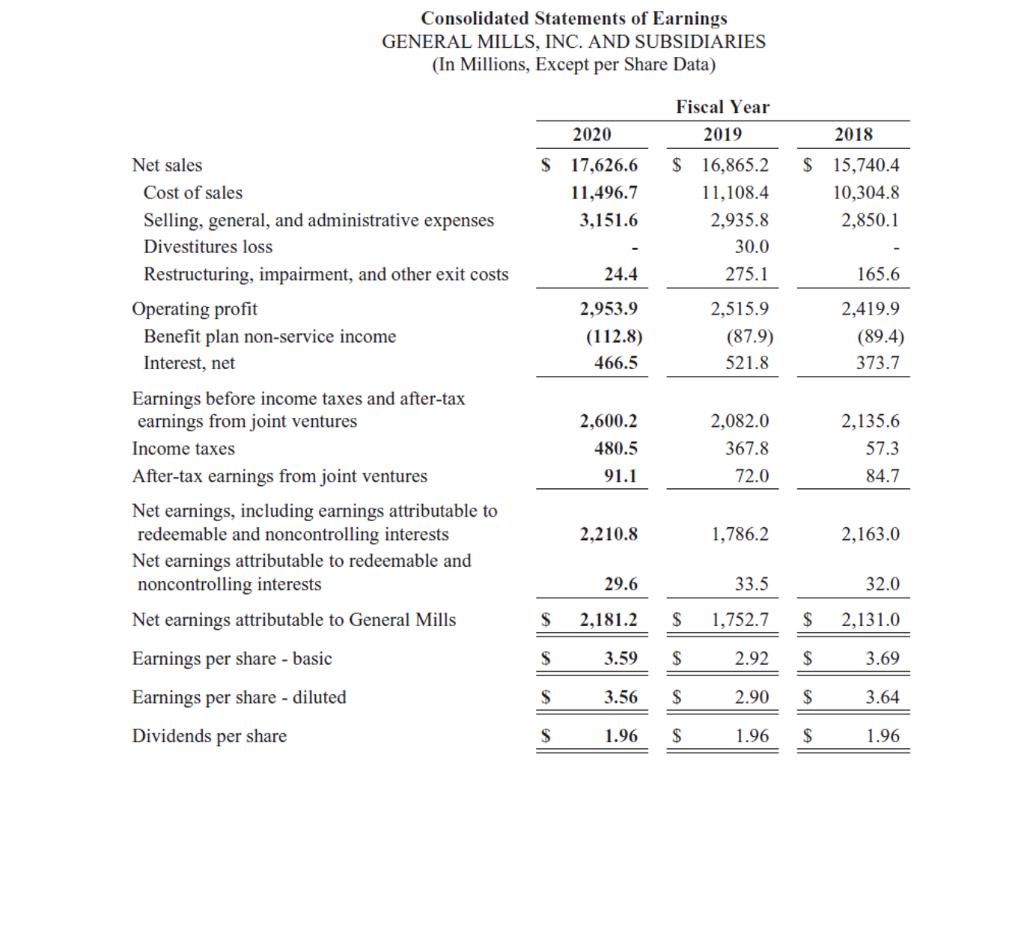

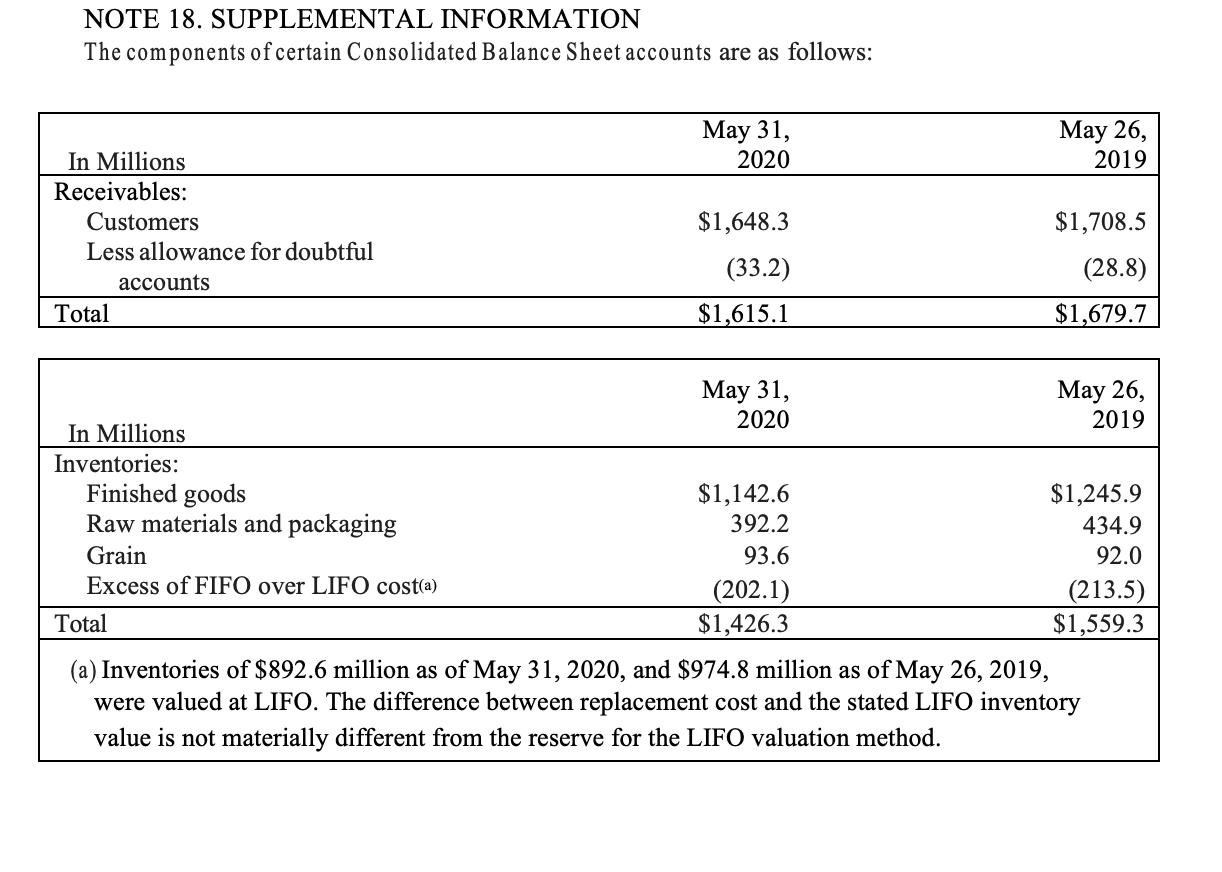

Consider the Income Statement and Note 18 (Supplemental information) for General Mills below and answer the following questions. Assume revenue is presented gross of bad debt expense.

a. Assume that the Company charged $16 million as bad debt expense in 2020. Compute the number of bad debts written off in 2020.

b. Compute the amount of cash collected from customers during the year ended May 31, 2020.

c. What cost flow assumption(s) for inventories does General Mills use?

d. Suppose that General Mills had in all periods used FIFO as their cost flow assumption for all their inventories. What would have been General Mills’ book value of inventories at the end of the fiscal year 2020 under this alternative cost flow assumption?

e. What is the amount of inventory purchases in the fiscal year 2020?

f. If General Mills had used FIFO as a cost flow assumption for all of their inventories, recalculate the value of COGS on a FIFO basis in the fiscal year 2020.

Net sales Consolidated Statements of Earnings GENERAL MILLS, INC. AND SUBSIDIARIES (In Millions, Except per Share Data) Cost of sales Selling, general, and administrative expenses Divestitures loss Restructuring, impairment, and other exit costs Operating profit Benefit plan non-service income Interest, net Earnings before income taxes and after-tax earnings from joint ventures Income taxes After-tax earnings from joint ventures Net earnings, including earnings attributable to redeemable and noncontrolling interests Net earnings attributable to redeemable and noncontrolling interests Net earnings attributable to General Mills Earnings per share - basic Earnings per share - diluted Dividends per share 2020 S 17,626.6 11,496.7 3,151.6 24.4 S 2,953.9 (112.8) 466.5 2,600.2 480.5 91.1 2,210.8 29.6 $ 2,181.2 $ S Fiscal Year 2019 $ 16,865.2 11,108.4 2,935.8 30.0 275.1 $ 3.59 $ 3.56 $ 1.96 $ 2,515.9 (87.9) 521.8 2,082.0 367.8 72.0 1,786.2 33.5 1,752.7 $ $ 2.90 $ $ 2.92 2018 $ 15,740.4 10,304.8 2,850.1 1.96 165.6 2,419.9 (89.4) 373.7 2,135.6 57.3 84.7 2,163.0 32.0 2,131.0 3.69 3.64 1.96

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a 16 million 17085 million 00094 bad debts written off in 2020 Bad debt expense is an estimate of the amount of receivables that will not be collected The company uses the allowance method to account ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started