Answered step by step

Verified Expert Solution

Question

1 Approved Answer

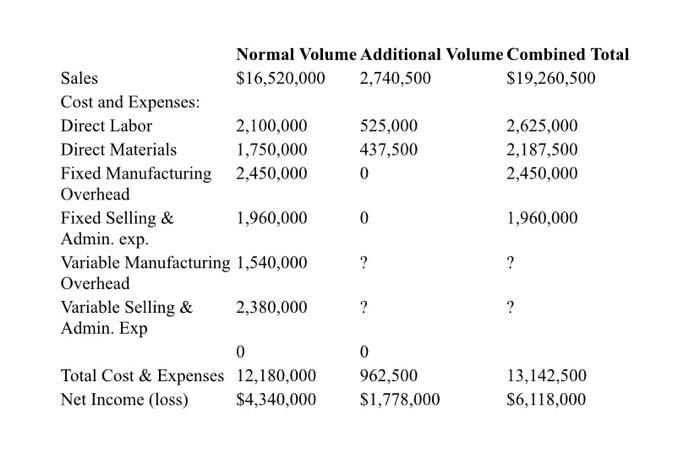

Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $78.30 per unit. The

Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $78.30 per unit.

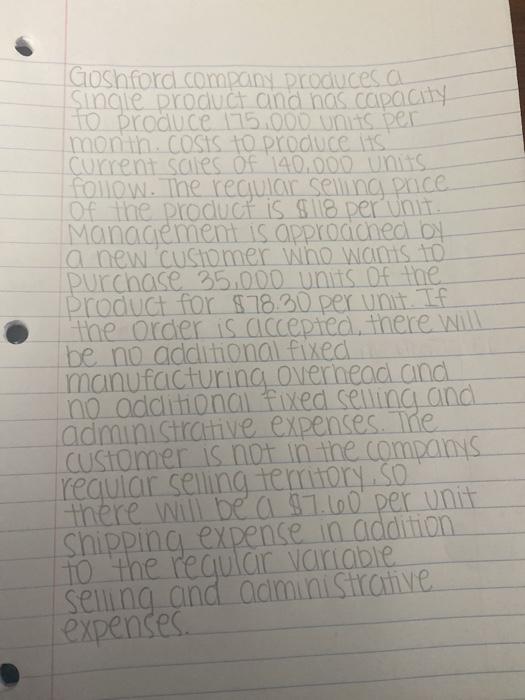

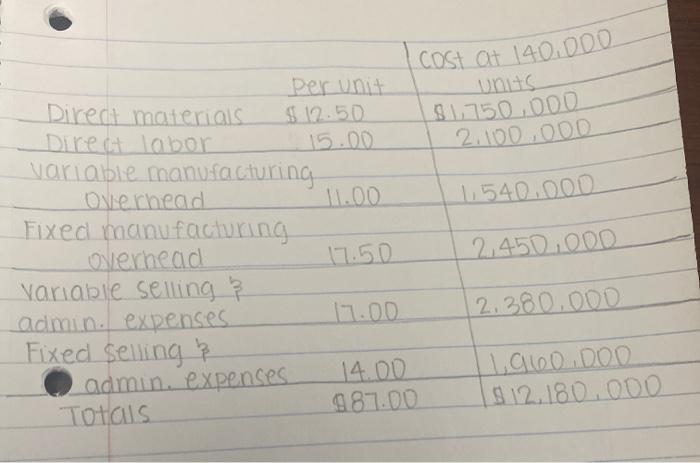

Goshford company produces a single product and nas capacity to produce 175.000 unts per month. COSIS to produce its Coxrent sales Of 40.000 units follow. The regular selling price Of the product is $118 per unit. Management is approached by a new customer who wanS 10 Purchase 35.000 units of the Product for $78.30 per unit. If the order is accepted, there will be no additional fixed manufacturing overhead and no additional fixed selling and administrative expenses. The Customer is not in the companys regular selling temory so there will be a $7.60 per unit Shipping expense in addition To the regular variable selling and administrative expenses. costat 140.000 US $1,750,000 2.400,000 1,540.000 Per unit Direct materials $12.50 Direct labor 15.00 variable manufacturing Olerhead 11.00 Fixed manufacturing oserhead 17.50 Variable selling admin. expenses 17.00 Fixed selling? admin. expenses 14.00 Totals 987.00 2.450.000 2.380.000 11,960. DOO $12.180.000 Normal Volume Additional Volume Combined Total Sales $16,520,000 2,740,500 $19,260,500 Cost and Expenses: Direct Labor 2,100,000 525,000 2,625,000 Direct Materials 1,750,000 437,500 2,187,500 Fixed Manufacturing 2,450,000 0 2,450,000 Overhead Fixed Selling & 1,960,000 0 1,960,000 Admin. exp. Variable Manufacturing 1,540,000 ? ? Overhead Variable Selling & 2,380,000 ? ? Admin. Exp 0 0 Total Cost & Expenses 12,180,000 962,500 13,142,500 Net Income (loss) $4,340,000 $1,778,000 $6,118,000 The first 2 pictures are the information needed. I already answered the majority of the question. I just need help with 4 questions marks you see on the 3rd picture. Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started