Calculate the company:

1. Cost of preferred equity

2. Cost of common equity

3. cost of debt

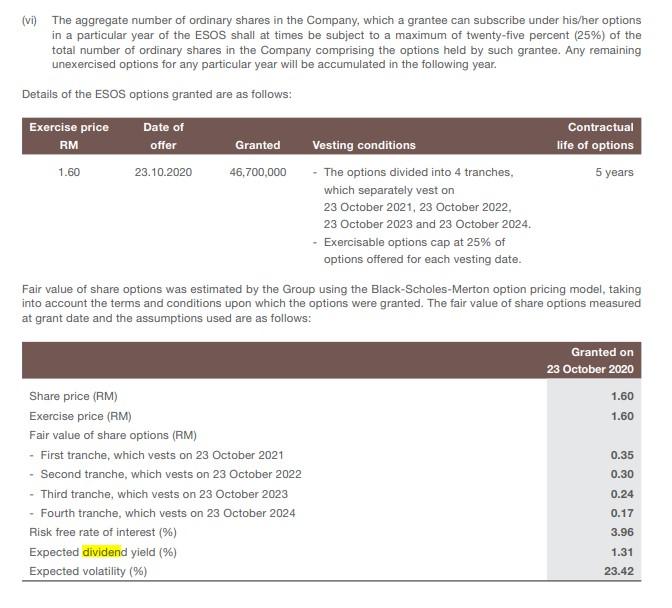

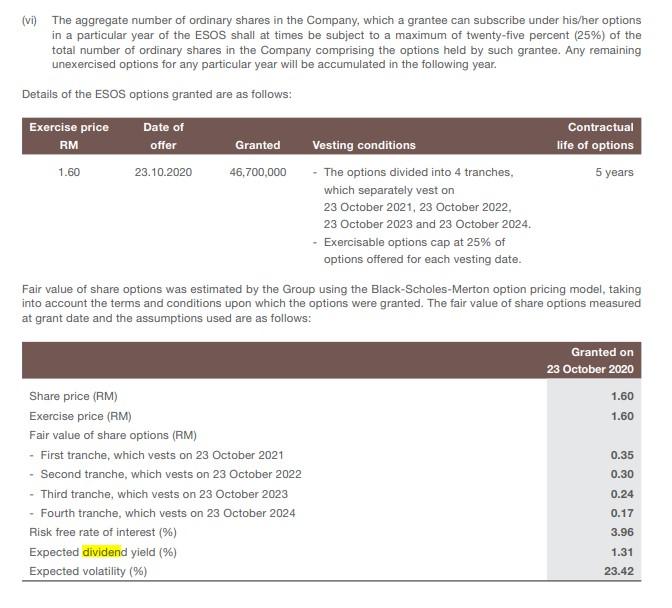

(vi) The aggregate number of ordinary shares in the Company, which a grantee can subscribe under his/her options in a particular year of the ESOS shall at times be subject to a maximum of twenty-five percent (25%) of the total number of ordinary shares in the Company comprising the options held by such grantee. Any remaining unexercised options for any particular year will be accumulated in the following year. Details of the ESOS options granted are as follows: Exercise price Date of Contractual RM offer Granted Vesting conditions life of options 1.60 23.10.2020 46,700,000 - The options divided into 4 tranches, 5 years which separately vest on 23 October 2021, 23 October 2022, 23 October 2023 and 23 October 2024. - Exercisable options cap at 25% of options offered for each vesting date. Fair value of share options was estimated by the Group using the Black-Scholes-Merton option pricing model, taking into account the terms and conditions upon which the options were granted. The fair value of share options measured at grant date and the assumptions used are as follows: Granted on 23 October 2020 1.60 1.60 0.35 0.30 Share price (RM) Exercise price (RM) Fair value of share options (RM) - First tranche, which vests on 23 October 2021 - Second tranche, which vests on 23 October 2022 - Third tranche, which vests on 23 October 2023 - Fourth tranche, which vests on 23 October 2024 Risk free rate of interest (%) Expected dividend yield (%) Expected volatility (%) 0.24 0.17 3.96 1.31 23.42 (vi) The aggregate number of ordinary shares in the Company, which a grantee can subscribe under his/her options in a particular year of the ESOS shall at times be subject to a maximum of twenty-five percent (25%) of the total number of ordinary shares in the Company comprising the options held by such grantee. Any remaining unexercised options for any particular year will be accumulated in the following year. Details of the ESOS options granted are as follows: Exercise price Date of Contractual RM offer Granted Vesting conditions life of options 1.60 23.10.2020 46,700,000 - The options divided into 4 tranches, 5 years which separately vest on 23 October 2021, 23 October 2022, 23 October 2023 and 23 October 2024. - Exercisable options cap at 25% of options offered for each vesting date. Fair value of share options was estimated by the Group using the Black-Scholes-Merton option pricing model, taking into account the terms and conditions upon which the options were granted. The fair value of share options measured at grant date and the assumptions used are as follows: Granted on 23 October 2020 1.60 1.60 0.35 0.30 Share price (RM) Exercise price (RM) Fair value of share options (RM) - First tranche, which vests on 23 October 2021 - Second tranche, which vests on 23 October 2022 - Third tranche, which vests on 23 October 2023 - Fourth tranche, which vests on 23 October 2024 Risk free rate of interest (%) Expected dividend yield (%) Expected volatility (%) 0.24 0.17 3.96 1.31 23.42