Answered step by step

Verified Expert Solution

Question

1 Approved Answer

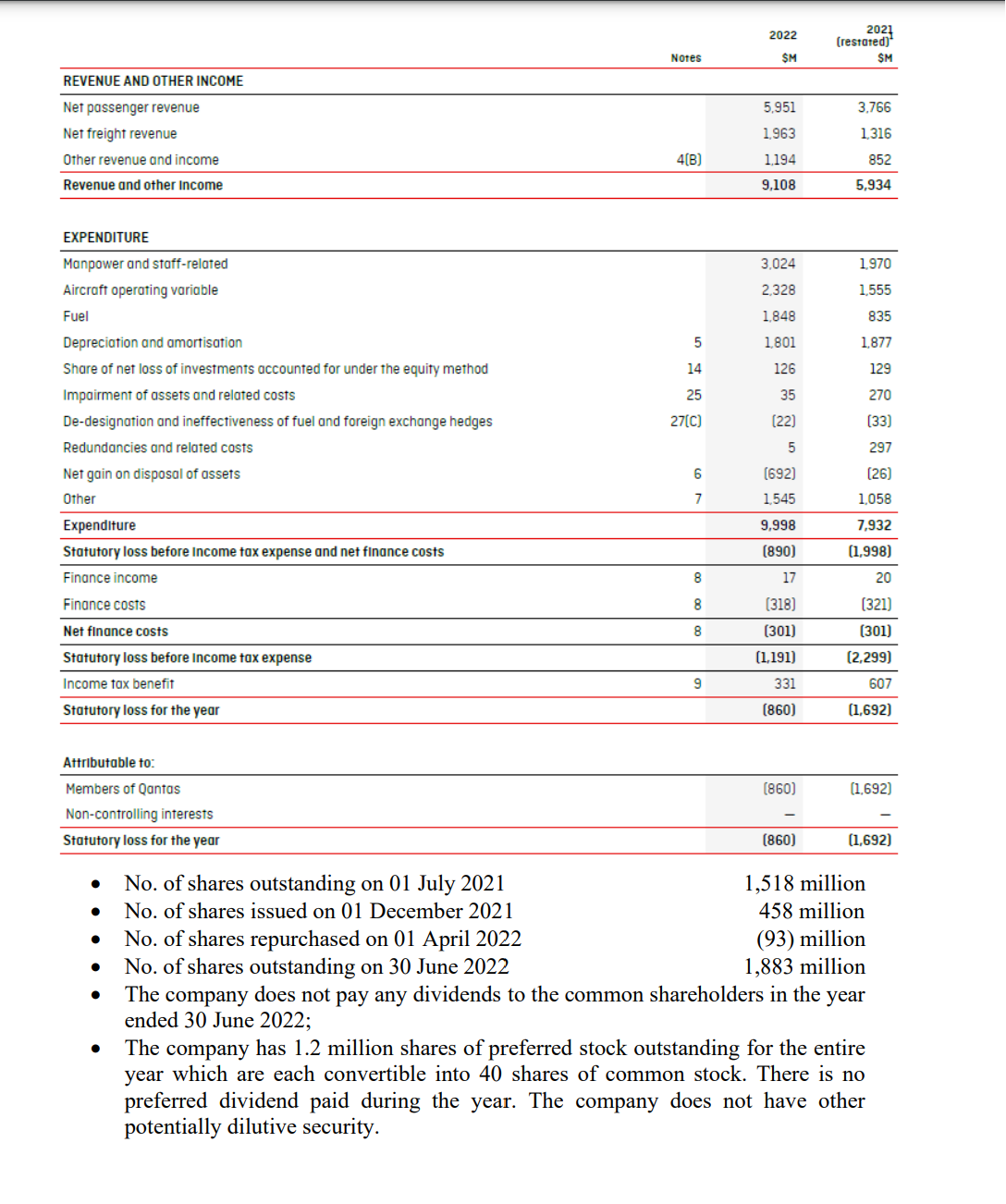

Calculate the companys basic and diluted EPS for the year ended 30 June 2022 using the information below. begin{tabular}{|c|c|c|c|} hline & & 2022 & 202(restated)1

Calculate the companys basic and diluted EPS for the year ended 30 June 2022 using the information below.

\begin{tabular}{|c|c|c|c|} \hline & & 2022 & 202(restated)1 \\ \hline & Notes & \$M & \$M \\ \hline \multicolumn{4}{|l|}{ REVENUE AND OTHER INCOME } \\ \hline Net passenger revenue & & 5,951 & 3.766 \\ \hline Net freight revenue & & 1.963 & 1,316 \\ \hline Other revenue and income & 4(B) & 1,194 & 852 \\ \hline Revenue and other Income & & 9,108 & 5,934 \\ \hline \multicolumn{4}{|l|}{ EXPENDITURE } \\ \hline Manpower and staff-related & & 3.024 & 1,970 \\ \hline Aircraft operating variable & & 2,328 & 1,555 \\ \hline Fuel & & 1.848 & 835 \\ \hline Depreciation and amortisation & 5 & 1.801 & 1.877 \\ \hline Share of net loss of investments accounted for under the equity method & 14 & 126 & 129 \\ \hline Impairment of assets and related costs & 25 & 35 & 270 \\ \hline De-designation and ineffectiveness of fuel and foreign exchange hedges & 27(C) & [22] & [33) \\ \hline Redundancies and related costs & & 5 & 297 \\ \hline Net gain on disposal of assets & 6 & [692] & [26) \\ \hline Other & 7 & 1.545 & 1,058 \\ \hline Expendlture & & 9,998 & 7,932 \\ \hline Statutory loss before Income tax expense and net finance costs & & {[890]} & {[1,998)} \\ \hline Finance income & 8 & 17 & 20 \\ \hline Finance costs & 8 & [318) & [321] \\ \hline Net finance costs & 8 & [301) & (301) \\ \hline Statutory loss before Income tax expense & & {1,191) & {[2,299)} \\ \hline Income tax benefit & 9 & 331 & 607 \\ \hline Statutory loss for the year & & {[860]} & {[1,692)} \\ \hline \end{tabular} \begin{tabular}{lrr} Attrlbutable to: & {[860]} & {[1,692]} \\ \hline Members of Qantas & - & - \\ Non-controlling interests & {[860]} & {[1,692)} \\ \hline Statutory loss for the year & \end{tabular} - No. of shares outstanding on 01 July 2021 - No. of shares issued on 01 December 2021 - No. of shares repurchased on 01 April 2022 - No. of shares outstanding on 30 June 2022 1,518 million 458 million (93) million 1,883 million - The company does not pay any dividends to the common shareholders in the year ended 30 June 2022; - The company has 1.2 million shares of preferred stock outstanding for the entire year which are each convertible into 40 shares of common stock. There is no preferred dividend paid during the year. The company does not have other potentially dilutive securityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started