Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the continuation value in 2010. Given the information in the projected income statements use EBITDA as a multiple to estimate the continuation value in

Calculate the continuation value in 2010.

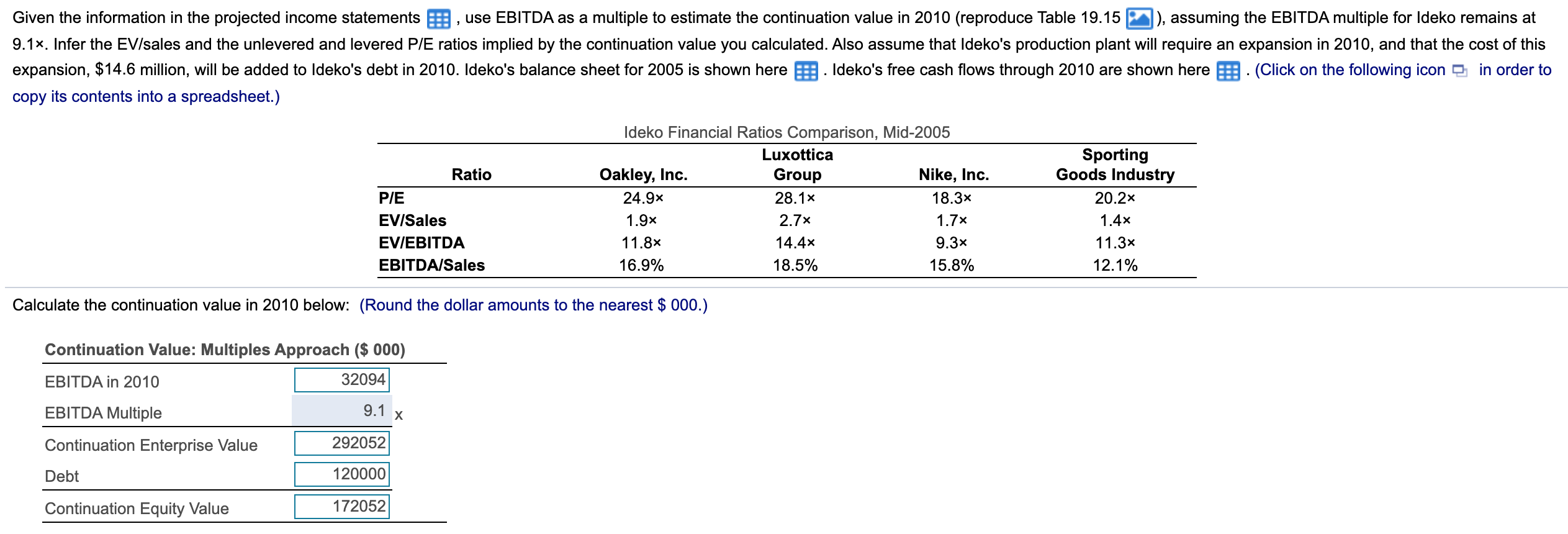

Given the information in the projected income statements use EBITDA as a multiple to estimate the continuation value in 2010 (reproduce Table 19.15 ), assuming the EBITDA multiple for Ideko remains at 9.1x. Infer the EV/sales and the unlevered and levered P/E ratios implied by the continuation value you calculated. Also assume that Ideko's production plant will require an expansion in 2010, and that the cost of this expansion, $14.6 million, will be added to Ideko's debt in 2010. Ideko's balance sheet for 2005 is shown here. Ideko's free cash flows through 2010 are shown here. (Click on the following icon in order to copy its contents into a spreadsheet.) EBITDA in 2010 EBITDA Multiple Continuation Enterprise Value Debt Continuation Equity Value " P/E EV/Sales EV/EBITDA EBITDA/Sales Calculate the continuation value in 2010 below: (Round the dollar amounts to the nearest $ 000.) Continuation Value: Multiples Approach ($ 000) 32094 9.1 x Ratio 292052 120000 172052 Ideko Financial Ratios Comparison, Mid-2005 Oakley, Inc. 24.9x 1.9x 11.8x 16.9% Luxottica Group 28.1x 2.7x 14.4x 18.5% Nike, Inc. 18.3x 1.7x 9.3x 15.8% Sporting Goods Industry 20.2x 1.4x 11.3x 12.1%

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Continuation Value in 2010 Given Free Cash Flow FC...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started