Question

Given the information in the projected income statements, and assuming the projected improvements in working capital (that is, Ideko's working capital requirements though 2010 will

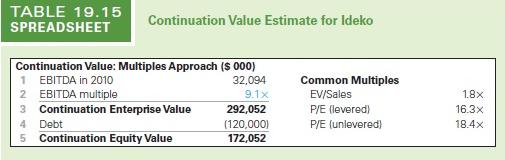

Given the information in the projected income statements, and assuming the projected improvements in working capital (that is, Ideko's working capital requirements though 2010 will be as shown here), use EBITDA as a multiple to estimate the continuation value in 2010 (reproduce Table 19.15), assuming the EBITDA multiple for Ideko remains at 9.1× Infer the EV/sales and the unlevered and levered P/E ratios implied by the continuation value you calculated. Also assume that Ideko's production plant will require an expansion in 2010, and that the cost of this expansion, $15.3 million, will be added to Ideko's debt in 2010. Ideko's balance sheet for 2005 is shown here. Ideko's free cash flows through 2010 are shown here

Income Statement ($ 000) | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

Sales | 74,600 | 85,148 | 96,453 | 108,901 | 122,594 | 137,644 |

Cost of Goods Sold | ||||||

Raw Materials | -16,000 | -17,667 | -19,815 | -22,153 | -24,694 | -27,454 |

Direct Labor Costs | -18,000 | -21,092 | -24,408 | -28,154 | -32,378 | -37,139 |

Gross Profit | 40,600 | 46,389 | 52,230 | 58,594 | 65,522 | 73,051 |

Sales and Marketing | -11,250 | -14,024 | -17,284 | -21,094 | -24,298 | -27,281 |

Administrative | -13,500 | -12,925 | -14,642 | -15,442 | -16,158 | -18,141 |

EBITDA | 15,850 | 19,440 | 20,304 | 22,058 | 25,066 | 27,629 |

Depreciation | -5,500 | -5,950 | -5,850 | -5,760 | -5,679 | -7,136 |

EBIT | 10,350 | 13,490 | 14,454 | 16,298 | 19,387 | 20,493 |

Interest Expense (net) | -75 | -6,680 | -6,680 | -6,680 | -6,680 | -6,680 |

Pretax Income | 10,275 | 6,810 | 7,774 | 9,618 | 12,707 | 13,813 |

Income Tax | -3,596 | -2,384 | -2,721 | -3,366 | -4,447 | -4,835 |

Net Income | 6,679 | 4,426 | 5,053 | 6,252 | 8,260 | 8,978 |

Working Capital Days | 2005 | > 2005 | |

Assets | Based on: | Days | Days |

Accounts Receivable | Sales Revenue | 90 | 90 |

Raw Materials | Raw Materials Costs | 45 | 45 |

Finished Goods | Raw Materials+Labor Costs | 45 | 45 |

Minimum Cash Balance | Sales Revenue | 30 | 30 |

Liabilities | |||

Wages Payable | Direct Labor+Admin Costs | 15 | 15 |

Other Accounts Payable | Raw Materials+Sales and Marketing | 45 | 45 |

Working Capital ($ 000) | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

Assets | ||||||

Accounts Receivable | 54,550 | 20,995 | 23,783 | 26,852 | 30,229 | 33,940 |

Raw Materials | 1,973 | 2,178 | 2,443 | 2,731 | 3,044 | 3,385 |

Finished Goods | 4,192 | 4,779 | 5,452 | 6,202 | 7,036 | 7,964 |

Minimum Cash Balance | 6,132 | 6,998 | 7,928 | 8,951 | 10,076 | 11,313 |

Total Current Assets | 66,847 | 34,950 | 39,606 | 44,736 | 50,385 | 56,602 |

Labilities | ||||||

Wages Payable | 1,295 | 1,398 | 1,605 | 1,792 | 1,995 | 2,272 |

Other Accounts Payable | 3,360 | 3,907 | 4,574 | 5,332 | 6,040 | 6,748 |

Total Current Liabilities | 4,655 | 5,305 | 6,179 | 7,124 | 8,035 | 9,020 |

Net Working Capital | 62,192 | 29,645 | 33,427 | 37,612 | 42,350 | 47,582 |

Increase in Net Working Capital | -32,547 | 3,782 | 4,185 | 4,738 | 5,232 |

Estimated 2005 Balance Sheet Data for | ||

Balance Sheet ($ 000) | ||

Assets | ||

Cash and Equivalents | 6164 | |

Accounts Receivable | 54550 | |

Inventories | 6165 | |

Total Current Assets | 66879 | |

Property, Plant, and Equipment | 54550 | |

Goodwill | 72332 | |

Total Assets | 193761 | |

Liabilities and Stockholders' Equity | ||

Accounts Payable | 4654 | |

Debt | 100000 | |

Total Liabilities | 104654 | |

Stockholders' Equity | 89107 | |

Total Liabilities and Equity | 193761 |

Free Cash Flow ($ 000) | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

Net Income | 4,426 | 5,053 | 6,252 | 8,260 | 8,978 | |

Plus: After-tax Interest Expense | 4,342 | 4,342 | 4,342 | 4,342 | 4,342 | |

Unlevered Net Income | 8,768 | 9,395 | 10,594 | 12,602 | 13,320 | |

Plus: Depreciation | 5,950 | 5,850 | 5,760 | 5,679 | 7,136 | |

Less: Increase in NWC | 32,547 | -3,782 | -4,185 | -4,738 | -5,232 | |

Less: Capital Expenditures | -4,950 | -4,950 | -4,950 | -4,950 | -20,250 | |

Free Cash Flow of Firm | 42,315 | 6,513 | 7,219 | 8,593 | -5,026 | |

Plus: Net Borrowing | 15,300 | |||||

Less: After-tax Interest Expense | -4,342 | -4,342 |

TABLE 19.15 SPREADSHEET Continuation Value: Multiples Approach ($ 000) EBITDA in 2010 32,094 EBITDA multiple Continuation Enterprise Value Continuation Equity Value 1 2 3 4 5 Continuation Value Estimate for Ideko Debt 9.1x 292,052 (120,000) 172,052 Common Multiples EV/Sales P/E (levered) P/E (unlevered) 18x 16.3x 18.4x

Step by Step Solution

3.26 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the continuation value in 2010 using the EBITDA multiple we need the EBITDA for 2010 and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started