Answered step by step

Verified Expert Solution

Question

1 Approved Answer

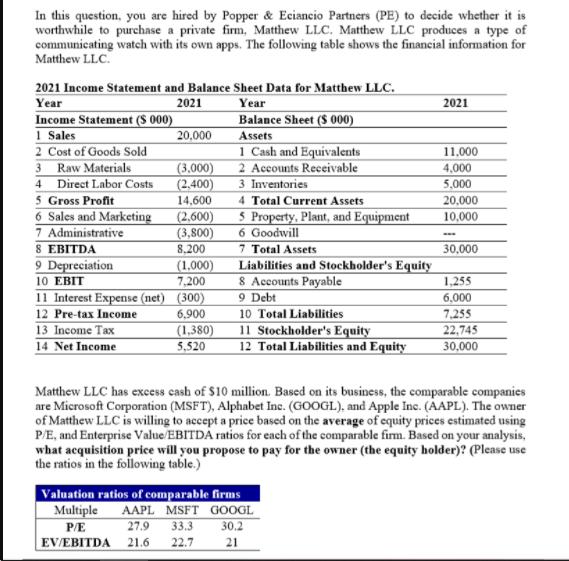

In this question, you are hired by Popper & Eciancio Partners (PE) to decide whether it is worthwhile to purchase a private firm, Matthew

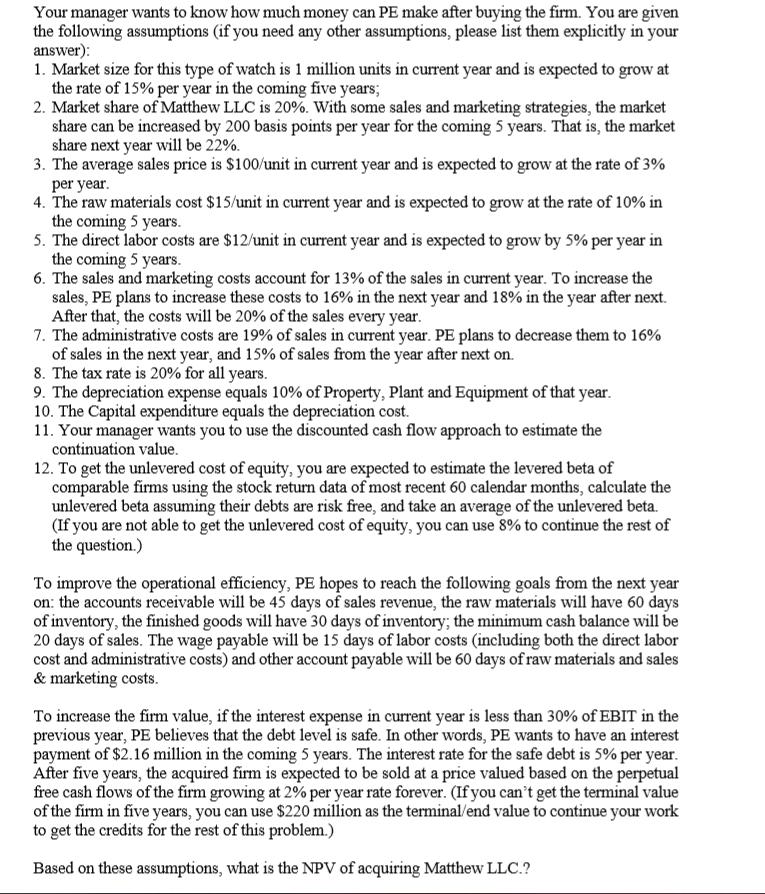

In this question, you are hired by Popper & Eciancio Partners (PE) to decide whether it is worthwhile to purchase a private firm, Matthew LLC. Matthew LLC produces a type of communicating watch with its own apps. The following table shows the financial information for Matthew LLC. 2021 Income Statement and Balance Sheet Data for Matthew LLC. Year 2021 Year 2021 Balance Sheet (S 000) Income Statement (S 000) 1 Sales 2 Cost of Goods Sold Raw Materials 20,000 Assets 1 Cash and Equivalents 2 Accounts Receivable 3 Inventories 11.000 (3,000) (2.400) 4,000 Direct Labor Costs 5,000 4 5 Gross Profit 6 Sales and Marketing 7 Administrative 8 EBITDA 9 Depreciation 10 EBIT 11 Interest Expense (net) (300) 12 Pre-tax Income 13 Income Tax 14 Net Income 14,600 4 Total Current Assets 20,000 5 Property, Plant, and Equipment 6 Goodwill 7 Total Assets Liabilities and Stockholder's Equity 8 Accounts Payable 9 Debt 10 Total Liabilities 11 Stockholder's Equity 12 Total Liabilities and Equity 10,000 (2,600) (3,800) 8.200 30,000 (1.000) 7,200 1,255 6,000 6,900 7,255 (1,380) 5,520 22,745 30,000 Matthew LLC has excess cash of $10 million. Based on its business, the comparable companies are Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), and Apple Inc. (AAPL). The owner of Matthew LLC is willing to accept a price based on the average of equity prices estimated using PE, and Enterprise Value/EBITDA ratios for each of the comparable firm. Based on your analysis, what acquisition price will you propose to pay for the owner (the equity holder)? (Please use the ratios in the following table.) Valuation ratios of comparable firms Multiple AAPL MSFT GOOGL 27.9 33,3 30.2 EVEBITDA 21.6 22.7 21 Your manager wants to know how much money can PE make after buying the firm. You are given the following assumptions (if you need any other assumptions, please list them explicitly in your answer): 1. Market size for this type of watch is 1 million units in current year and is expected to grow at the rate of 15% per year in the coming five years; 2. Market share of Matthew LLC is 20%. With some sales and marketing strategies, the market share can be increased by 200 basis points per year for the coming 5 years. That is, the market share next year will be 22%. 3. The average sales price is $100/unit in current year and is expected to grow at the rate of 3% per year. 4. The raw materials cost $15/unit in current year and is expected to grow at the rate of 10% in the coming 5 years. 5. The direct labor costs are $12/unit in current year and is expected to grow by 5% per year in the coming 5 years. 6. The sales and marketing costs account for 13% of the sales in current year. To increase the sales, PE plans to increase these costs to 16% in the next year and 18% in the year after next. After that, the costs will be 20% of the sales every year. 7. The administrative costs are 19% of sales in current year. PE plans to decrease them to 16% of sales in the next year, and 15% of sales from the year after next on. 8. The tax rate is 20% for all years. 9. The depreciation expense equals 10% of Property, Plant and Equipment of that year. 10. The Capital expenditure equals the depreciation cost. 11. Your manager wants you to use the discounted cash flow approach to estimate the continuation value. 12. To get the unlevered cost of equity, you are expected to estimate the levered beta of comparable firms using the stock return data of most recent 60 calendar months, calculate the unlevered beta assuming their debts are risk free, and take an average of the unlevered beta. (If you are not able to get the unlevered cost of equity, you can use 8% to continue the rest of the question.) To improve the operational efficiency, PE hopes to reach the following goals from the next year on: the accounts receivable will be 45 days of sales revenue, the raw materials will have 60 days of inventory, the finished goods will have 30 days of inventory; the minimum cash balance will be 20 days of sales. The wage payable will be 15 days of labor costs (including both the direct labor cost and administrative costs) and other account payable will be 60 days of raw materials and sales & marketing costs. To increase the firm value, if the interest expense in current year is less than 30% of EBIT in the previous year, PE believes that the debt level is safe. In other words, PE wants to have an interest payment of $2.16 million in the coming 5 years. The interest rate for the safe debt is 5% per year. After five years, the acquired firm is expected to be sold at a price valued based on the perpetual free cash flows of the firm growing at 2% per year rate forever. (If you can't get the terminal value of the firm in five years, you can use $220 million as the terminal/end value to continue your work to get the credits for the rest of this problem.) Based on these assumptions, what is the NPV of acquiring Matthew LLC.? In this question, you are hired by Popper & Eciancio Partners (PE) to decide whether it is worthwhile to purchase a private firm, Matthew LLC. Matthew LLC produces a type of communicating watch with its own apps. The following table shows the financial information for Matthew LLC. 2021 Income Statement and Balance Sheet Data for Matthew LLC. Year 2021 Year 2021 Balance Sheet (S 000) Income Statement (S 000) 1 Sales 2 Cost of Goods Sold Raw Materials 20,000 Assets 1 Cash and Equivalents 2 Accounts Receivable 3 Inventories 11.000 (3,000) (2.400) 4,000 Direct Labor Costs 5,000 4 5 Gross Profit 6 Sales and Marketing 7 Administrative 8 EBITDA 9 Depreciation 10 EBIT 11 Interest Expense (net) (300) 12 Pre-tax Income 13 Income Tax 14 Net Income 14,600 4 Total Current Assets 20,000 5 Property, Plant, and Equipment 6 Goodwill 7 Total Assets Liabilities and Stockholder's Equity 8 Accounts Payable 9 Debt 10 Total Liabilities 11 Stockholder's Equity 12 Total Liabilities and Equity 10,000 (2,600) (3,800) 8.200 30,000 (1.000) 7,200 1,255 6,000 6,900 7,255 (1,380) 5,520 22,745 30,000 Matthew LLC has excess cash of $10 million. Based on its business, the comparable companies are Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), and Apple Inc. (AAPL). The owner of Matthew LLC is willing to accept a price based on the average of equity prices estimated using PE, and Enterprise Value/EBITDA ratios for each of the comparable firm. Based on your analysis, what acquisition price will you propose to pay for the owner (the equity holder)? (Please use the ratios in the following table.) Valuation ratios of comparable firms Multiple AAPL MSFT GOOGL 27.9 33,3 30.2 EVEBITDA 21.6 22.7 21 Your manager wants to know how much money can PE make after buying the firm. You are given the following assumptions (if you need any other assumptions, please list them explicitly in your answer): 1. Market size for this type of watch is 1 million units in current year and is expected to grow at the rate of 15% per year in the coming five years; 2. Market share of Matthew LLC is 20%. With some sales and marketing strategies, the market share can be increased by 200 basis points per year for the coming 5 years. That is, the market share next year will be 22%. 3. The average sales price is $100/unit in current year and is expected to grow at the rate of 3% per year. 4. The raw materials cost $15/unit in current year and is expected to grow at the rate of 10% in the coming 5 years. 5. The direct labor costs are $12/unit in current year and is expected to grow by 5% per year in the coming 5 years. 6. The sales and marketing costs account for 13% of the sales in current year. To increase the sales, PE plans to increase these costs to 16% in the next year and 18% in the year after next. After that, the costs will be 20% of the sales every year. 7. The administrative costs are 19% of sales in current year. PE plans to decrease them to 16% of sales in the next year, and 15% of sales from the year after next on. 8. The tax rate is 20% for all years. 9. The depreciation expense equals 10% of Property, Plant and Equipment of that year. 10. The Capital expenditure equals the depreciation cost. 11. Your manager wants you to use the discounted cash flow approach to estimate the continuation value. 12. To get the unlevered cost of equity, you are expected to estimate the levered beta of comparable firms using the stock return data of most recent 60 calendar months, calculate the unlevered beta assuming their debts are risk free, and take an average of the unlevered beta. (If you are not able to get the unlevered cost of equity, you can use 8% to continue the rest of the question.) To improve the operational efficiency, PE hopes to reach the following goals from the next year on: the accounts receivable will be 45 days of sales revenue, the raw materials will have 60 days of inventory, the finished goods will have 30 days of inventory; the minimum cash balance will be 20 days of sales. The wage payable will be 15 days of labor costs (including both the direct labor cost and administrative costs) and other account payable will be 60 days of raw materials and sales & marketing costs. To increase the firm value, if the interest expense in current year is less than 30% of EBIT in the previous year, PE believes that the debt level is safe. In other words, PE wants to have an interest payment of $2.16 million in the coming 5 years. The interest rate for the safe debt is 5% per year. After five years, the acquired firm is expected to be sold at a price valued based on the perpetual free cash flows of the firm growing at 2% per year rate forever. (If you can't get the terminal value of the firm in five years, you can use $220 million as the terminal/end value to continue your work to get the credits for the rest of this problem.) Based on these assumptions, what is the NPV of acquiring Matthew LLC.? In this question, you are hired by Popper & Eciancio Partners (PE) to decide whether it is worthwhile to purchase a private firm, Matthew LLC. Matthew LLC produces a type of communicating watch with its own apps. The following table shows the financial information for Matthew LLC. 2021 Income Statement and Balance Sheet Data for Matthew LLC. Year 2021 Year 2021 Balance Sheet (S 000) Income Statement (S 000) 1 Sales 2 Cost of Goods Sold Raw Materials 20,000 Assets 1 Cash and Equivalents 2 Accounts Receivable 3 Inventories 11.000 (3,000) (2.400) 4,000 Direct Labor Costs 5,000 4 5 Gross Profit 6 Sales and Marketing 7 Administrative 8 EBITDA 9 Depreciation 10 EBIT 11 Interest Expense (net) (300) 12 Pre-tax Income 13 Income Tax 14 Net Income 14,600 4 Total Current Assets 20,000 5 Property, Plant, and Equipment 6 Goodwill 7 Total Assets Liabilities and Stockholder's Equity 8 Accounts Payable 9 Debt 10 Total Liabilities 11 Stockholder's Equity 12 Total Liabilities and Equity 10,000 (2,600) (3,800) 8.200 30,000 (1.000) 7,200 1,255 6,000 6,900 7,255 (1,380) 5,520 22,745 30,000 Matthew LLC has excess cash of $10 million. Based on its business, the comparable companies are Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), and Apple Inc. (AAPL). The owner of Matthew LLC is willing to accept a price based on the average of equity prices estimated using PE, and Enterprise Value/EBITDA ratios for each of the comparable firm. Based on your analysis, what acquisition price will you propose to pay for the owner (the equity holder)? (Please use the ratios in the following table.) Valuation ratios of comparable firms Multiple AAPL MSFT GOOGL 27.9 33,3 30.2 EVEBITDA 21.6 22.7 21 Your manager wants to know how much money can PE make after buying the firm. You are given the following assumptions (if you need any other assumptions, please list them explicitly in your answer): 1. Market size for this type of watch is 1 million units in current year and is expected to grow at the rate of 15% per year in the coming five years; 2. Market share of Matthew LLC is 20%. With some sales and marketing strategies, the market share can be increased by 200 basis points per year for the coming 5 years. That is, the market share next year will be 22%. 3. The average sales price is $100/unit in current year and is expected to grow at the rate of 3% per year. 4. The raw materials cost $15/unit in current year and is expected to grow at the rate of 10% in the coming 5 years. 5. The direct labor costs are $12/unit in current year and is expected to grow by 5% per year in the coming 5 years. 6. The sales and marketing costs account for 13% of the sales in current year. To increase the sales, PE plans to increase these costs to 16% in the next year and 18% in the year after next. After that, the costs will be 20% of the sales every year. 7. The administrative costs are 19% of sales in current year. PE plans to decrease them to 16% of sales in the next year, and 15% of sales from the year after next on. 8. The tax rate is 20% for all years. 9. The depreciation expense equals 10% of Property, Plant and Equipment of that year. 10. The Capital expenditure equals the depreciation cost. 11. Your manager wants you to use the discounted cash flow approach to estimate the continuation value. 12. To get the unlevered cost of equity, you are expected to estimate the levered beta of comparable firms using the stock return data of most recent 60 calendar months, calculate the unlevered beta assuming their debts are risk free, and take an average of the unlevered beta. (If you are not able to get the unlevered cost of equity, you can use 8% to continue the rest of the question.) To improve the operational efficiency, PE hopes to reach the following goals from the next year on: the accounts receivable will be 45 days of sales revenue, the raw materials will have 60 days of inventory, the finished goods will have 30 days of inventory; the minimum cash balance will be 20 days of sales. The wage payable will be 15 days of labor costs (including both the direct labor cost and administrative costs) and other account payable will be 60 days of raw materials and sales & marketing costs. To increase the firm value, if the interest expense in current year is less than 30% of EBIT in the previous year, PE believes that the debt level is safe. In other words, PE wants to have an interest payment of $2.16 million in the coming 5 years. The interest rate for the safe debt is 5% per year. After five years, the acquired firm is expected to be sold at a price valued based on the perpetual free cash flows of the firm growing at 2% per year rate forever. (If you can't get the terminal value of the firm in five years, you can use $220 million as the terminal/end value to continue your work to get the credits for the rest of this problem.) Based on these assumptions, what is the NPV of acquiring Matthew LLC.? In this question, you are hired by Popper & Eciancio Partners (PE) to decide whether it is worthwhile to purchase a private firm, Matthew LLC. Matthew LLC produces a type of communicating watch with its own apps. The following table shows the financial information for Matthew LLC. 2021 Income Statement and Balance Sheet Data for Matthew LLC. Year 2021 Year 2021 Balance Sheet (S 000) Income Statement (S 000) 1 Sales 2 Cost of Goods Sold Raw Materials 20,000 Assets 1 Cash and Equivalents 2 Accounts Receivable 3 Inventories 11.000 (3,000) (2.400) 4,000 Direct Labor Costs 5,000 4 5 Gross Profit 6 Sales and Marketing 7 Administrative 8 EBITDA 9 Depreciation 10 EBIT 11 Interest Expense (net) (300) 12 Pre-tax Income 13 Income Tax 14 Net Income 14,600 4 Total Current Assets 20,000 5 Property, Plant, and Equipment 6 Goodwill 7 Total Assets Liabilities and Stockholder's Equity 8 Accounts Payable 9 Debt 10 Total Liabilities 11 Stockholder's Equity 12 Total Liabilities and Equity 10,000 (2,600) (3,800) 8.200 30,000 (1.000) 7,200 1,255 6,000 6,900 7,255 (1,380) 5,520 22,745 30,000 Matthew LLC has excess cash of $10 million. Based on its business, the comparable companies are Microsoft Corporation (MSFT), Alphabet Inc. (GOOGL), and Apple Inc. (AAPL). The owner of Matthew LLC is willing to accept a price based on the average of equity prices estimated using PE, and Enterprise Value/EBITDA ratios for each of the comparable firm. Based on your analysis, what acquisition price will you propose to pay for the owner (the equity holder)? (Please use the ratios in the following table.) Valuation ratios of comparable firms Multiple AAPL MSFT GOOGL 27.9 33,3 30.2 EVEBITDA 21.6 22.7 21 Your manager wants to know how much money can PE make after buying the firm. You are given the following assumptions (if you need any other assumptions, please list them explicitly in your answer): 1. Market size for this type of watch is 1 million units in current year and is expected to grow at the rate of 15% per year in the coming five years; 2. Market share of Matthew LLC is 20%. With some sales and marketing strategies, the market share can be increased by 200 basis points per year for the coming 5 years. That is, the market share next year will be 22%. 3. The average sales price is $100/unit in current year and is expected to grow at the rate of 3% per year. 4. The raw materials cost $15/unit in current year and is expected to grow at the rate of 10% in the coming 5 years. 5. The direct labor costs are $12/unit in current year and is expected to grow by 5% per year in the coming 5 years. 6. The sales and marketing costs account for 13% of the sales in current year. To increase the sales, PE plans to increase these costs to 16% in the next year and 18% in the year after next. After that, the costs will be 20% of the sales every year. 7. The administrative costs are 19% of sales in current year. PE plans to decrease them to 16% of sales in the next year, and 15% of sales from the year after next on. 8. The tax rate is 20% for all years. 9. The depreciation expense equals 10% of Property, Plant and Equipment of that year. 10. The Capital expenditure equals the depreciation cost. 11. Your manager wants you to use the discounted cash flow approach to estimate the continuation value. 12. To get the unlevered cost of equity, you are expected to estimate the levered beta of comparable firms using the stock return data of most recent 60 calendar months, calculate the unlevered beta assuming their debts are risk free, and take an average of the unlevered beta. (If you are not able to get the unlevered cost of equity, you can use 8% to continue the rest of the question.) To improve the operational efficiency, PE hopes to reach the following goals from the next year on: the accounts receivable will be 45 days of sales revenue, the raw materials will have 60 days of inventory, the finished goods will have 30 days of inventory; the minimum cash balance will be 20 days of sales. The wage payable will be 15 days of labor costs (including both the direct labor cost and administrative costs) and other account payable will be 60 days of raw materials and sales & marketing costs. To increase the firm value, if the interest expense in current year is less than 30% of EBIT in the previous year, PE believes that the debt level is safe. In other words, PE wants to have an interest payment of $2.16 million in the coming 5 years. The interest rate for the safe debt is 5% per year. After five years, the acquired firm is expected to be sold at a price valued based on the perpetual free cash flows of the firm growing at 2% per year rate forever. (If you can't get the terminal value of the firm in five years, you can use $220 million as the terminal/end value to continue your work to get the credits for the rest of this problem.) Based on these assumptions, what is the NPV of acquiring Matthew LLC.?

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To find out the acquisition price first we need to do the equity valuation in the preacquisition and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started