Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the cost of capital: Debt: XYZ issues 100 10-year bonds selling at $970 with a par of $1000. They have a coupon of

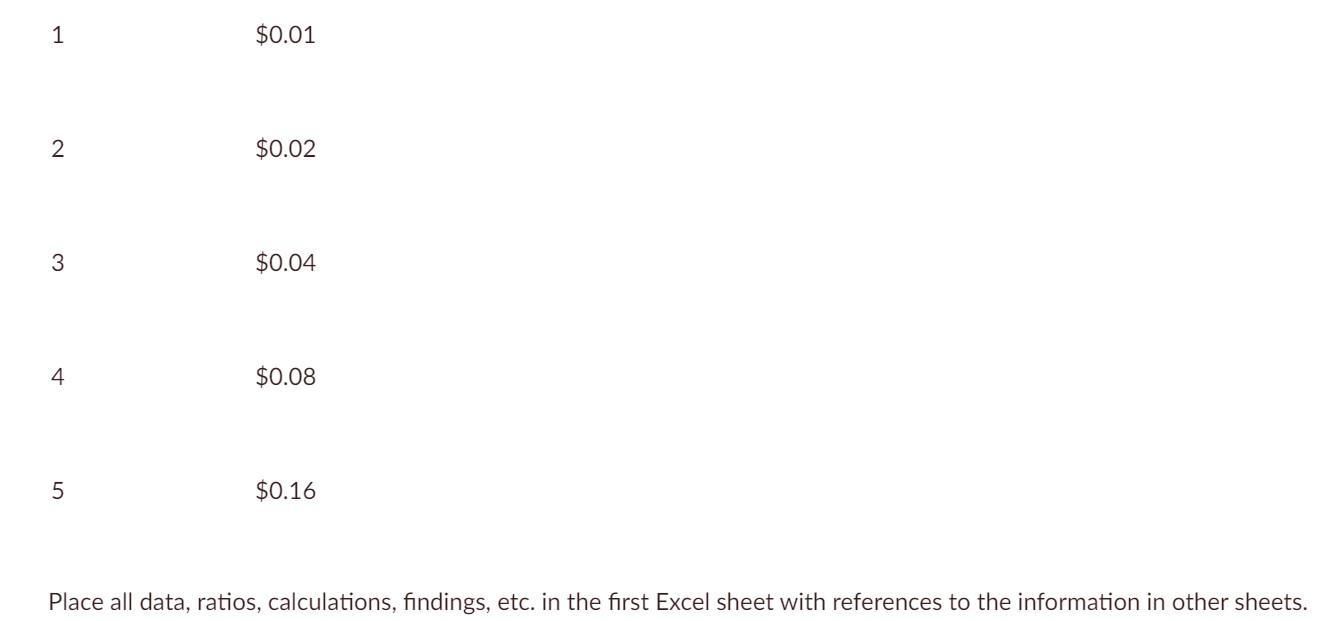

Calculate the cost of capital: Debt: XYZ issues 100 10-year bonds selling at $970 with a par of $1000. They have a coupon of 10% paid semiannually. Preferred Stock: XYZ issues 1000 shares of preferred stock selling at $50 with an annual dividend of 5% based on $100 par. Common Stock: XYZ issues 10000 common shares at $7. XYZ just paid a dividend of $0.25. Investors require a 200% return. Other possible relevant information: Taxes are at 20%. Assume no flotation costs. Dividends have been paid over the past 5 years: 1 $0.01 2 $0.02 3 $0.04 $0.08 4 5 $0.16 Place all data, ratios, calculations, findings, etc. in the first Excel sheet with references to the information in other sheets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Cost of Capital for XYZ Company This sheet calculates the Weighted Average Cost of Capital WACC for XYZ Company Data Source of Capital Description Value Reference Debt Bond Issue 100 bonds Debt Coupon ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started