Calculate the cost of equity using CAPM and then WACC

Compute the required rate of return on common equity capital and the weighted average cost of capital for Diamond at the start of fiscal year 2012

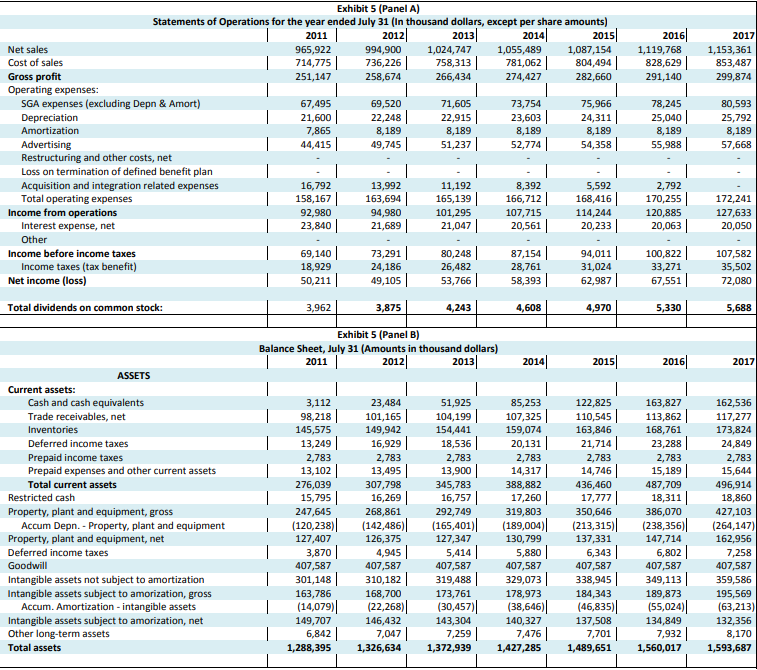

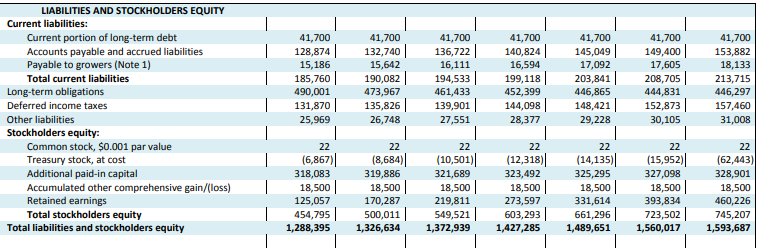

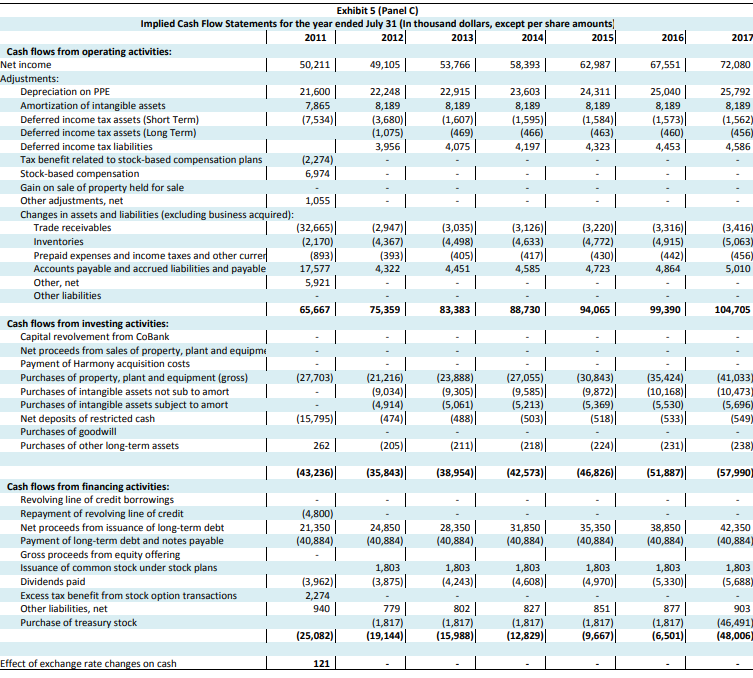

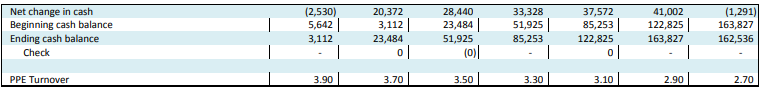

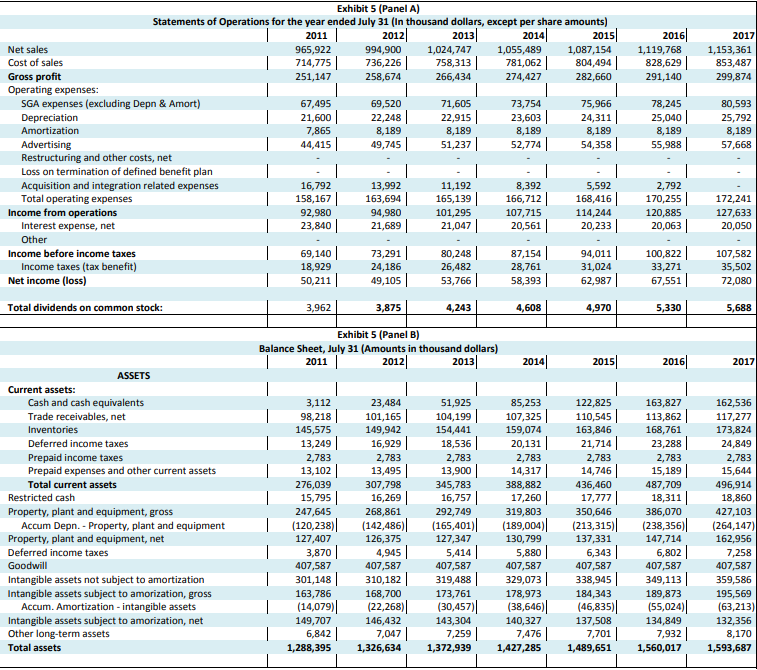

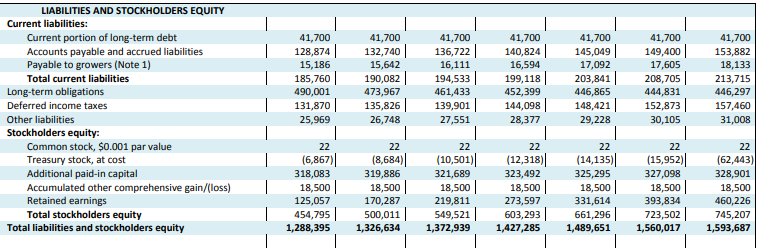

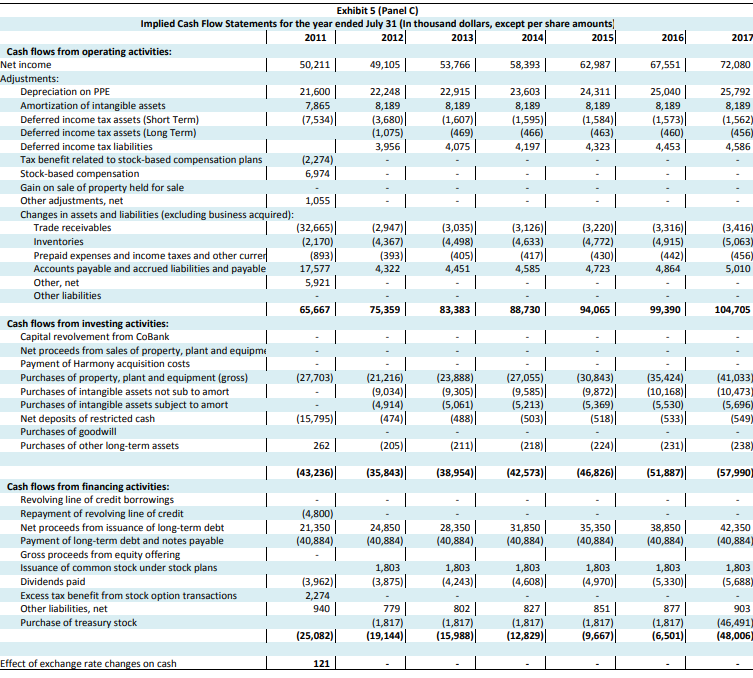

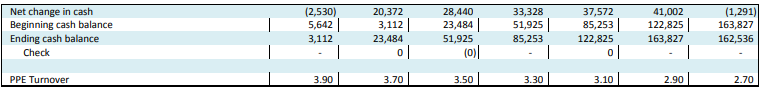

2016 1,119,768 828,629 291,140 2017 1,153,361 853,487 299,874 Exhibit 5 (Panel A) Statements of Operations for the year ended July 31 (In thousand dollars, except per share amounts) 2011 2012 2013 2014 2015 Net sales 965,922 994,900 1,024,747 1,055,489 1,087,154 Cost of sales 714,775 736,226 758,313 781,062 804,494 Gross profit 251,147 258,674 266,434 274,427 282,660 Operating expenses: SGA expenses (excluding Depn & Amort) 67,495 69,520 71,605 73,754 75,966 Depreciation 21,600 22,248 22,915 23,603 24,311 | Amortization 7,865 8,189 8,189 8,189 8,189 Advertising 44,415 49,745 51,237 52,774 54,358 Restructuring and other costs, net Loss on termination of defined benefit plan Acquisition and integration related expenses 16,792 13,992 11,192 8,392 5,592 Total operating expenses 158,167 163,694 165,139 166,712 168,416 Income from operations 92,980 94,980 101,295 107,715 114,244 Interest expense, net 23,840 21,689 21,047 20,561 20,233 Other Income before income taxes 69,140 73,291 80,248 87,154 94,011 Income taxes (tax benefit) 18,929 24,186 26,482 28,761 31,024 Net income (loss) 50,211 | 49,105 53,766 58,393 62,987 78,245 25,040 8,189 55,988 80,593 25,792 8,189 57,668 2,792 170,255 120,885 20,063| 172,241 127,633 20,050 100,822 33,271 67,551 107,582 35,502 72,080 Total dividends on common stock: 3,962 3,875 4,243 4,608 4,970 5,330 5,688 Exhibit 5 (Panel B) Balance Sheet, July 31 (Amounts in thousand dollars) 2011 2012 2013 2014 2015 2016 2017 ASSETS Current assets: Cash and cash equivalents Trade receivables, net Inventories Deferred income taxes Prepaid income taxes Prepaid expenses and other current assets Total current assets Restricted cash Property, plant and equipment, gross Accum Depn. - Property, plant and equipment Property, plant and equipment, net Deferred income taxes Goodwill Intangible assets not subject to amortization Intangible assets subject to amorization, gross Accum. Amortization - intangible assets Intangible assets subject to amorization, net Other long-term assets Total assets 3,112 98,218 145,575 13,249 2,783 13,102 276,039 15,795 247,645 (120,238) 127,407 3,870 407,587 301,148 163,786 (14,079) 149,707 6,842 | 1,288,395 23,484 101,165 149,942 16,929 2.783 13,495 307,798 16,269 268,861 (142,486) 126,375 4,945 407,587 310,182 168,700 (22,268) 146,432 7,047 1,326,634 51,925 104,199 154,441 18,536 2,783 13,900 345,783 16,757 292,749 (165,401) 127,347 5,414 407,587 319,488 173,761 (30,457) 143.304 7,259 1,372,939 85,253 107,325 159,074 20,131 2,783 14,317 | 388,882 17,260 319,803 (189,004) 130,799 5,880 407,587 329,073 178,973 (38,646) 140,327 7,476 1,427,285 122,825 110,545 163,846 21,714 2,783 14,746 436,460 17,777 350,646 (213,315) 137,331 6,343 407,587 338,945 184,343 (46,835) 137,508 7,701 1,489,651 163,827 113,862 168,761 23,288 2,783 15,189 487,709 18,311 386,070 (238,356) 147,714 6,802 407,587 349,113 189,873 (55,024) 134,849 7,932 1,560,017 162,536 117,277 173,824 24,849 2,783 15,644 496,914 18,860 427,103 (264,147) 162,956 7,258 407,587 359,586 195,569 (63,213) 1 32,356 8,170 1,593,687 41,700 128,874 15,186 185,760 490,001 131,870 LIABILITIES AND STOCKHOLDERS EQUITY Current liabilities: Current portion of long-term debt Accounts payable and accrued liabilities Payable to growers (Note 1) Total current liabilities Long-term obligations Deferred income taxes Other liabilities Stockholders equity: Common stock, $0.001 par value Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive gain/(loss) Retained earnings Total stockholders equity Total liabilities and stockholders equity 41,700 132,740 15,642 190,082 473,967 135,826 26,748 41,700 136,722 16,111 194,533 461,433 139,901 27,551 41,700 140,824 16,594 199,118 452,399 144,098 28,377 41,700 145,049 17,092 203,841 446,865 148,421 29,228 41,700 149,400 17,605 208,705 444,831 152,873 30,105 41,700 153,882 18,133 213,715 446,297 157,460 31,008 25,969 22 22 22 22 (6,867) 318,083 18,500 125,057 454,795 1,288,395 (8,684) 319,886 18,500 170.287 500,011 | 1,326,634 (10,501) 321,689 18,500 219,811 549,521 1,372,939 (12,318) 323,492 18,500 273,597 603,293 1,427,285 (14,135) 325,295 18,500 331,614 661,296 1,489,651 22 (15,952) 327,098 18,500 393,834 723,502 1,560,017 (62,443) 328,901 18,500 460,226 745,207 1,593,687 2016 2017 67,551 72,080 25,040 8,189 (1,573) (460) 4,453 25,792 8,189 (1,562) (456) 4,586 Exhibit 5 (Panel) Implied Cash Flow Statements for the year ended July 31 (In thousand dollars, except per share amounts 2011 2012 2013 2014 2015 Cash flows from operating activities: Net income 50,211 49,105 | 53,766 58,393 Adiustments: Depreciation on PPE 21,600 22,248 22,915 23,603 24,311 Amortization of intangible assets 7,865 8,189 8,189 8,189 8,189 Deferred income tax assets (Short Term) (7,534) (3,680) (1,607) (1,595) (1,584) Deferred income tax assets (Long Term) (1,075) (469) (466) (463) Deferred income tax liabilities 3,956 4,075 4,197 4,323 Tax benefit related to stock-based compensation plans (2,274) Stock-based compensation 6,974 | Gain on sale of property held for sale Other adjustments, net 1,055 Changes in assets and liabilities (excluding business acquired): Trade receivables (32,665) (2,947) (3,035) (3,126) (3,220) Inventories (2,170) (4,367) (4,498) (4,633) (4,772) Prepaid expenses and income taxes and other currer (893) (393) (405) (417) (430) Accounts payable and accrued liabilities and payable 17,577 4,322 4,451 4,585 4,723 Other, net 5,921 | Other liabilities 65,667 75,359 83,383 88,730 94,065 Cash flows from investing activities: Capital revolvement from CoBank | | Net proceeds from sales of property, plant and equipme Payment of Harmony acquisition costs Purchases of property, plant and equipment (gross) (27,703) (21,216) (23,888) (27,055) (30,843) Purchases of intangible assets not sub to amort (9,034) (9,305) (9,585) (9,872) Purchases of intangible assets subject to amort (4,914) (5,061) (5,213) (5,369) Net deposits of restricted cash 1 (15,795) (474) (488) (503) (518) Purchases of goodwill Purchases of other long-term assets 262 (205) (211) (218) (224) (3,316) (4,915) (442) 4,864 (3,416) (5,063) (456) 5,010 99,390 104,705 (35,424) (10,168) (5,530) (41,033 (10,473 (5,696) (549) (533) (238) (231) (51,887) (43,236) (43,236) (35,843)| (38,954) (42,573)| (46,826) (57,990) (4,800) 21,350 (40,884) 24,850 (40,884) 28,350 (40,884) 31,850 (40,884) 35,350 (40,884) 38,850 (40,884) 42,350 (40,884 Cash flows from financing activities: Revolving line of credit borrowings Repayment of revolving line of credit Net proceeds from issuance of long-term debt Payment of long-term debt and notes payable Gross proceeds from equity offering Issuance of common stock under stock plans Dividends paid Excess tax benefit from stock option transactions Other liabilities, net Purchase of treasury stock 1,803 (3,875) 1,803 (4,243) 1,803 (4,608) 1,803 (4,970)| 1,803 (5,330) 1,803 (5,688) (3,962) 2,274 940 779 (1,817) (19,144)| 802 (1,817) (15,988) 827 (1,817) (12,829) 851 (1,817) (9,667) 877 (1,817) (6,501) 903 (46,491 (48,006 1 (25,082) Effect of exchange rate changes on cash 121 | Net change in cash Beginning cash balance Ending cash balance Check (2,530) 5,642 3,112 20,372 3,112 23,484 ol 28,440 23,484 51,925 (0) 51,925 85,253 37,572 85,253 122,825 41,002 122,825 163,827 (1,291) 163,827 162,536 | PPE Turnover 1 3 .90 3.70 3.50 3.30 3.10 2.90 2.70 2016 1,119,768 828,629 291,140 2017 1,153,361 853,487 299,874 Exhibit 5 (Panel A) Statements of Operations for the year ended July 31 (In thousand dollars, except per share amounts) 2011 2012 2013 2014 2015 Net sales 965,922 994,900 1,024,747 1,055,489 1,087,154 Cost of sales 714,775 736,226 758,313 781,062 804,494 Gross profit 251,147 258,674 266,434 274,427 282,660 Operating expenses: SGA expenses (excluding Depn & Amort) 67,495 69,520 71,605 73,754 75,966 Depreciation 21,600 22,248 22,915 23,603 24,311 | Amortization 7,865 8,189 8,189 8,189 8,189 Advertising 44,415 49,745 51,237 52,774 54,358 Restructuring and other costs, net Loss on termination of defined benefit plan Acquisition and integration related expenses 16,792 13,992 11,192 8,392 5,592 Total operating expenses 158,167 163,694 165,139 166,712 168,416 Income from operations 92,980 94,980 101,295 107,715 114,244 Interest expense, net 23,840 21,689 21,047 20,561 20,233 Other Income before income taxes 69,140 73,291 80,248 87,154 94,011 Income taxes (tax benefit) 18,929 24,186 26,482 28,761 31,024 Net income (loss) 50,211 | 49,105 53,766 58,393 62,987 78,245 25,040 8,189 55,988 80,593 25,792 8,189 57,668 2,792 170,255 120,885 20,063| 172,241 127,633 20,050 100,822 33,271 67,551 107,582 35,502 72,080 Total dividends on common stock: 3,962 3,875 4,243 4,608 4,970 5,330 5,688 Exhibit 5 (Panel B) Balance Sheet, July 31 (Amounts in thousand dollars) 2011 2012 2013 2014 2015 2016 2017 ASSETS Current assets: Cash and cash equivalents Trade receivables, net Inventories Deferred income taxes Prepaid income taxes Prepaid expenses and other current assets Total current assets Restricted cash Property, plant and equipment, gross Accum Depn. - Property, plant and equipment Property, plant and equipment, net Deferred income taxes Goodwill Intangible assets not subject to amortization Intangible assets subject to amorization, gross Accum. Amortization - intangible assets Intangible assets subject to amorization, net Other long-term assets Total assets 3,112 98,218 145,575 13,249 2,783 13,102 276,039 15,795 247,645 (120,238) 127,407 3,870 407,587 301,148 163,786 (14,079) 149,707 6,842 | 1,288,395 23,484 101,165 149,942 16,929 2.783 13,495 307,798 16,269 268,861 (142,486) 126,375 4,945 407,587 310,182 168,700 (22,268) 146,432 7,047 1,326,634 51,925 104,199 154,441 18,536 2,783 13,900 345,783 16,757 292,749 (165,401) 127,347 5,414 407,587 319,488 173,761 (30,457) 143.304 7,259 1,372,939 85,253 107,325 159,074 20,131 2,783 14,317 | 388,882 17,260 319,803 (189,004) 130,799 5,880 407,587 329,073 178,973 (38,646) 140,327 7,476 1,427,285 122,825 110,545 163,846 21,714 2,783 14,746 436,460 17,777 350,646 (213,315) 137,331 6,343 407,587 338,945 184,343 (46,835) 137,508 7,701 1,489,651 163,827 113,862 168,761 23,288 2,783 15,189 487,709 18,311 386,070 (238,356) 147,714 6,802 407,587 349,113 189,873 (55,024) 134,849 7,932 1,560,017 162,536 117,277 173,824 24,849 2,783 15,644 496,914 18,860 427,103 (264,147) 162,956 7,258 407,587 359,586 195,569 (63,213) 1 32,356 8,170 1,593,687 41,700 128,874 15,186 185,760 490,001 131,870 LIABILITIES AND STOCKHOLDERS EQUITY Current liabilities: Current portion of long-term debt Accounts payable and accrued liabilities Payable to growers (Note 1) Total current liabilities Long-term obligations Deferred income taxes Other liabilities Stockholders equity: Common stock, $0.001 par value Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive gain/(loss) Retained earnings Total stockholders equity Total liabilities and stockholders equity 41,700 132,740 15,642 190,082 473,967 135,826 26,748 41,700 136,722 16,111 194,533 461,433 139,901 27,551 41,700 140,824 16,594 199,118 452,399 144,098 28,377 41,700 145,049 17,092 203,841 446,865 148,421 29,228 41,700 149,400 17,605 208,705 444,831 152,873 30,105 41,700 153,882 18,133 213,715 446,297 157,460 31,008 25,969 22 22 22 22 (6,867) 318,083 18,500 125,057 454,795 1,288,395 (8,684) 319,886 18,500 170.287 500,011 | 1,326,634 (10,501) 321,689 18,500 219,811 549,521 1,372,939 (12,318) 323,492 18,500 273,597 603,293 1,427,285 (14,135) 325,295 18,500 331,614 661,296 1,489,651 22 (15,952) 327,098 18,500 393,834 723,502 1,560,017 (62,443) 328,901 18,500 460,226 745,207 1,593,687 2016 2017 67,551 72,080 25,040 8,189 (1,573) (460) 4,453 25,792 8,189 (1,562) (456) 4,586 Exhibit 5 (Panel) Implied Cash Flow Statements for the year ended July 31 (In thousand dollars, except per share amounts 2011 2012 2013 2014 2015 Cash flows from operating activities: Net income 50,211 49,105 | 53,766 58,393 Adiustments: Depreciation on PPE 21,600 22,248 22,915 23,603 24,311 Amortization of intangible assets 7,865 8,189 8,189 8,189 8,189 Deferred income tax assets (Short Term) (7,534) (3,680) (1,607) (1,595) (1,584) Deferred income tax assets (Long Term) (1,075) (469) (466) (463) Deferred income tax liabilities 3,956 4,075 4,197 4,323 Tax benefit related to stock-based compensation plans (2,274) Stock-based compensation 6,974 | Gain on sale of property held for sale Other adjustments, net 1,055 Changes in assets and liabilities (excluding business acquired): Trade receivables (32,665) (2,947) (3,035) (3,126) (3,220) Inventories (2,170) (4,367) (4,498) (4,633) (4,772) Prepaid expenses and income taxes and other currer (893) (393) (405) (417) (430) Accounts payable and accrued liabilities and payable 17,577 4,322 4,451 4,585 4,723 Other, net 5,921 | Other liabilities 65,667 75,359 83,383 88,730 94,065 Cash flows from investing activities: Capital revolvement from CoBank | | Net proceeds from sales of property, plant and equipme Payment of Harmony acquisition costs Purchases of property, plant and equipment (gross) (27,703) (21,216) (23,888) (27,055) (30,843) Purchases of intangible assets not sub to amort (9,034) (9,305) (9,585) (9,872) Purchases of intangible assets subject to amort (4,914) (5,061) (5,213) (5,369) Net deposits of restricted cash 1 (15,795) (474) (488) (503) (518) Purchases of goodwill Purchases of other long-term assets 262 (205) (211) (218) (224) (3,316) (4,915) (442) 4,864 (3,416) (5,063) (456) 5,010 99,390 104,705 (35,424) (10,168) (5,530) (41,033 (10,473 (5,696) (549) (533) (238) (231) (51,887) (43,236) (43,236) (35,843)| (38,954) (42,573)| (46,826) (57,990) (4,800) 21,350 (40,884) 24,850 (40,884) 28,350 (40,884) 31,850 (40,884) 35,350 (40,884) 38,850 (40,884) 42,350 (40,884 Cash flows from financing activities: Revolving line of credit borrowings Repayment of revolving line of credit Net proceeds from issuance of long-term debt Payment of long-term debt and notes payable Gross proceeds from equity offering Issuance of common stock under stock plans Dividends paid Excess tax benefit from stock option transactions Other liabilities, net Purchase of treasury stock 1,803 (3,875) 1,803 (4,243) 1,803 (4,608) 1,803 (4,970)| 1,803 (5,330) 1,803 (5,688) (3,962) 2,274 940 779 (1,817) (19,144)| 802 (1,817) (15,988) 827 (1,817) (12,829) 851 (1,817) (9,667) 877 (1,817) (6,501) 903 (46,491 (48,006 1 (25,082) Effect of exchange rate changes on cash 121 | Net change in cash Beginning cash balance Ending cash balance Check (2,530) 5,642 3,112 20,372 3,112 23,484 ol 28,440 23,484 51,925 (0) 51,925 85,253 37,572 85,253 122,825 41,002 122,825 163,827 (1,291) 163,827 162,536 | PPE Turnover 1 3 .90 3.70 3.50 3.30 3.10 2.90 2.70