Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the costs and margins of the three different office visits using: (a) RCC method (b) TDABC method Question 1 On 1 July 2014 Paul

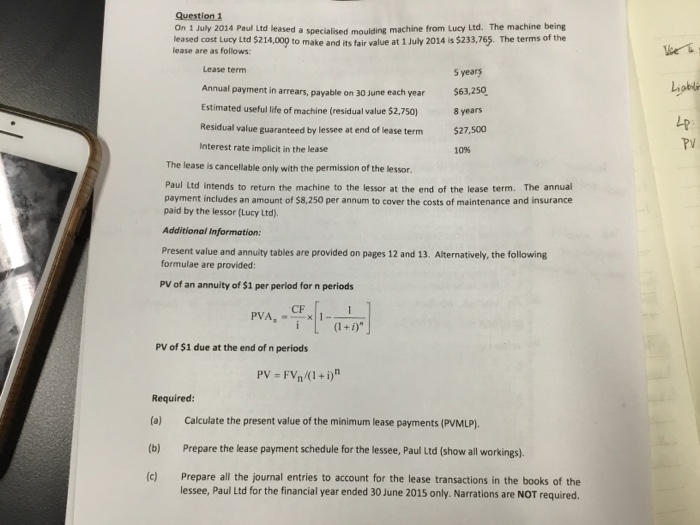

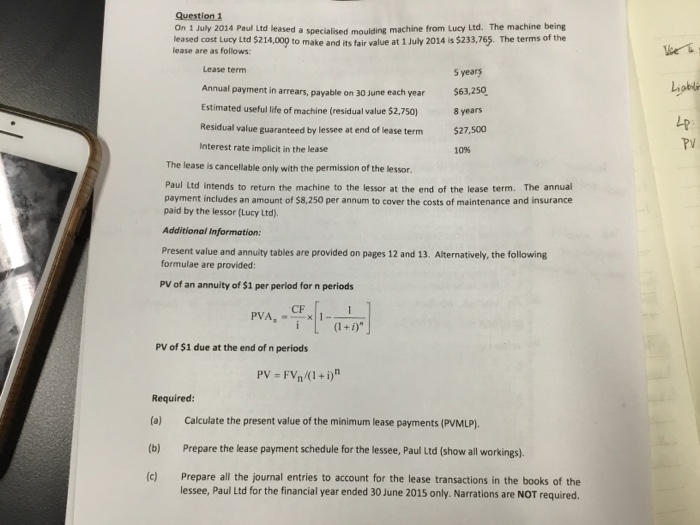

Calculate the costs and margins of the three different office visits using: (a) RCC method (b) TDABC method  Question 1 On 1 July 2014 Paul Ltd leased a specialised moulding machine from Lucy Ltd. The machine being leased cost Lucy Ltd $214,000 to make and its fair value at 1 July 2014 is $233,765. The terms of the lease are as follows Lease term Annual payment in arrears Estimated useful life of machine (residual value $2,750) 5 years 63,250 8 years $27,500 10% Liobli payable on 30 June each year Lp PV Residual value guaranteed by lessee at end of lease term Interest rate implicit in the lease The lease is cancellable only with the permission of the lessor Paul Ltd intends to return the machine to the lessor at the end of the lease term. The annual payment includes an amount of $8,250 per annum to cover the costs of maintenance and insurance paid by the lessor (Lucy Ltd) Additional Information: Present value and annuity tables are provided on pages 12 and 13. Alternatively, the following formulae are provided PV of an annuity of $1 per period for n periods CF PV of $1 due at the end of n periods Required a) Calculate the present value of the minimum lease payments (PVMLP). (b) Prepare the lease payment schedule for the lessee, Paul Ltd (show all workings). (c) Prepare all the journal entries to account for the lease transactions in the books of the lessee, Paul Ltd for the financial year ended 30 June 2015 only. Narrations are NOT required

Question 1 On 1 July 2014 Paul Ltd leased a specialised moulding machine from Lucy Ltd. The machine being leased cost Lucy Ltd $214,000 to make and its fair value at 1 July 2014 is $233,765. The terms of the lease are as follows Lease term Annual payment in arrears Estimated useful life of machine (residual value $2,750) 5 years 63,250 8 years $27,500 10% Liobli payable on 30 June each year Lp PV Residual value guaranteed by lessee at end of lease term Interest rate implicit in the lease The lease is cancellable only with the permission of the lessor Paul Ltd intends to return the machine to the lessor at the end of the lease term. The annual payment includes an amount of $8,250 per annum to cover the costs of maintenance and insurance paid by the lessor (Lucy Ltd) Additional Information: Present value and annuity tables are provided on pages 12 and 13. Alternatively, the following formulae are provided PV of an annuity of $1 per period for n periods CF PV of $1 due at the end of n periods Required a) Calculate the present value of the minimum lease payments (PVMLP). (b) Prepare the lease payment schedule for the lessee, Paul Ltd (show all workings). (c) Prepare all the journal entries to account for the lease transactions in the books of the lessee, Paul Ltd for the financial year ended 30 June 2015 only. Narrations are NOT required

Calculate the costs and margins of the three different office visits using: (a) RCC method (b) TDABC method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started