Question

Calculate the current gift tax IRC 2503 Annual exclusion for a gift of $10,000 indexed ($11,000 in 2002-2005, $12,000 in 2006-2008, $13,000 in 2009-2012, S14,000

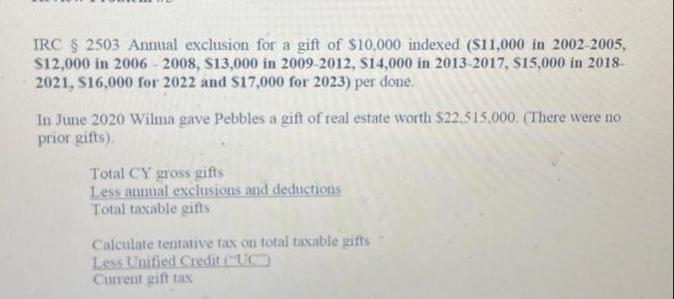

IRC 2503 Annual exclusion for a gift of $10,000 indexed ($11,000 in 2002-2005, $12,000 in 2006-2008, $13,000 in 2009-2012, S14,000 in 2013-2017, $15,000 in 2018- 2021, S16,000 for 2022 and $17,000 for 2023) per done. In June 2020 Wilma gave Pebbles a gift of real estate worth $22,515,000. (There were no prior gifts). Total CY gross gifts Less annual exclusions and deductions Total taxable gifts Calculate tentative tax on total taxable gifts Less Unified Credit (UC) Current gift tax

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Managerial Accounting Concepts

Authors: Thomas Edmonds, Christopher Edmonds, Bor Yi Tsay, Philip Olds

8th edition

978-1259569197

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App