Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the current price of a $ 1 , 0 0 0 par value bond that has a coupon rate of 9 percent, pays coupon

Calculate the current price of a $ par value bond that has a coupon rate of percent, pays coupon interest annually, has years remaining to maturity, and has a current yield to maturity discount rate of percent. Round your answer to decimal places

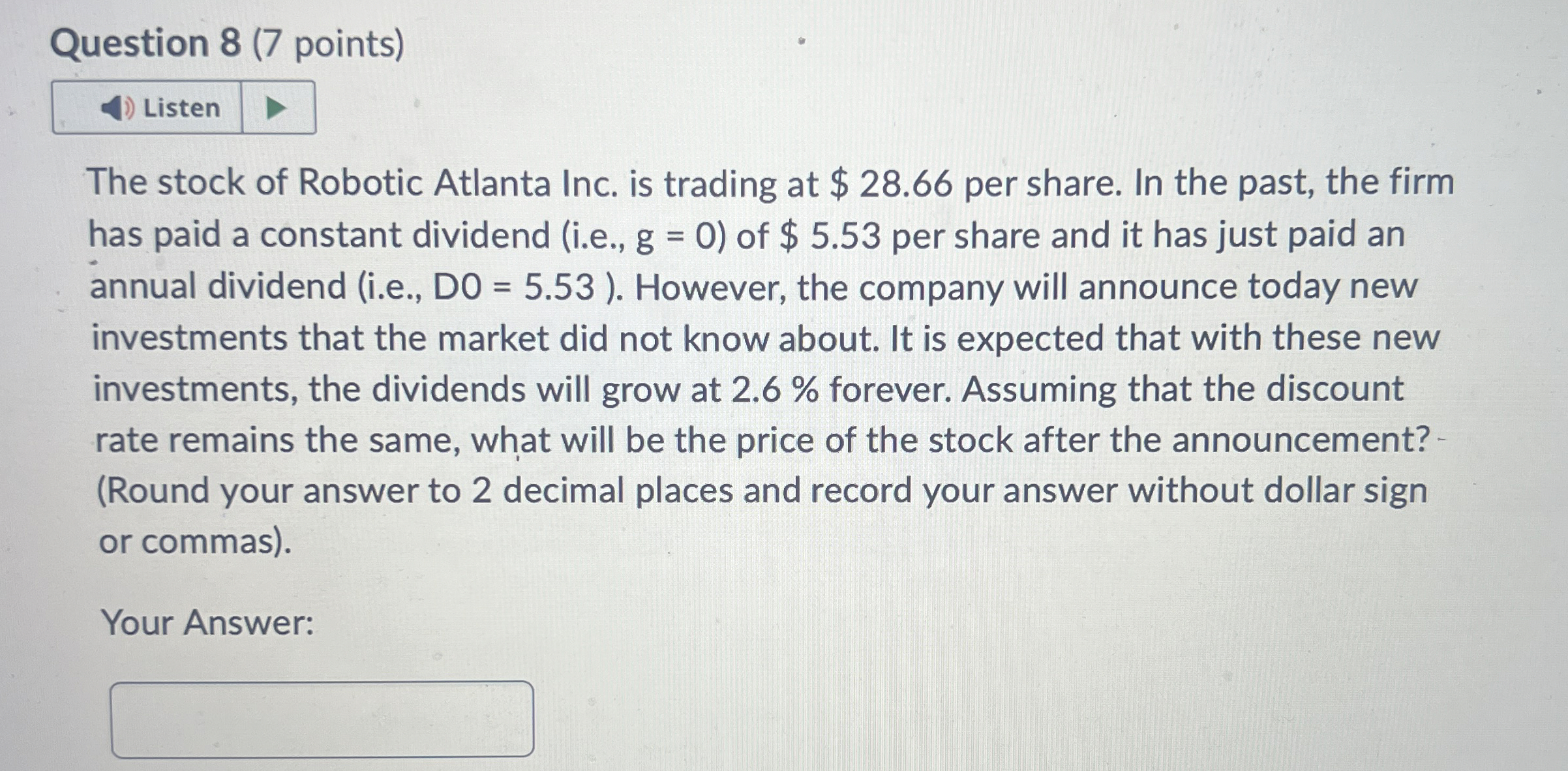

Question points

Listen

The stock of Robotic Atlanta Inc. is trading at $ per share. In the past, the firm has paid a constant dividend ie of $ per share and it has just paid an annual dividend ie However, the company will announce today new investments that the market did not know about. It is expected that with these new investments, the dividends will grow at forever. Assuming that the discount rate remains the same, what will be the price of the stock after the announcement? Round your answer to decimal places and record your answer without dollar sign or commas

Your Answer:and record without dollar sign or commas

Your Answer:

Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started