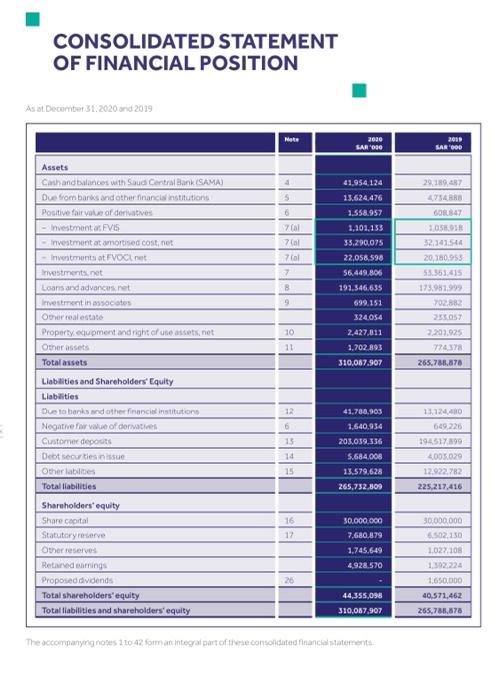

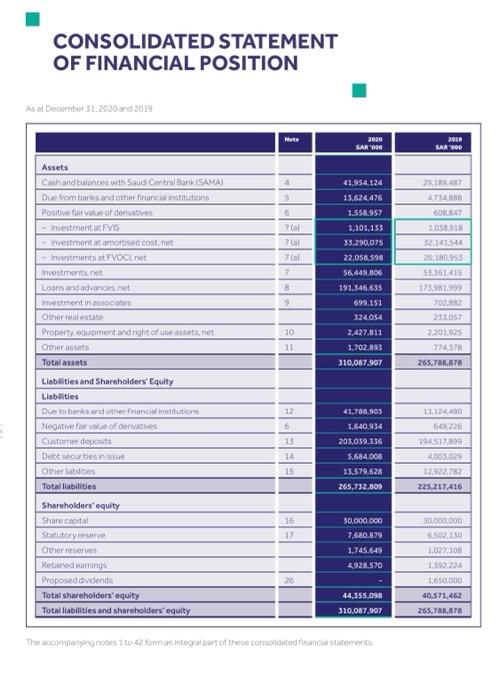

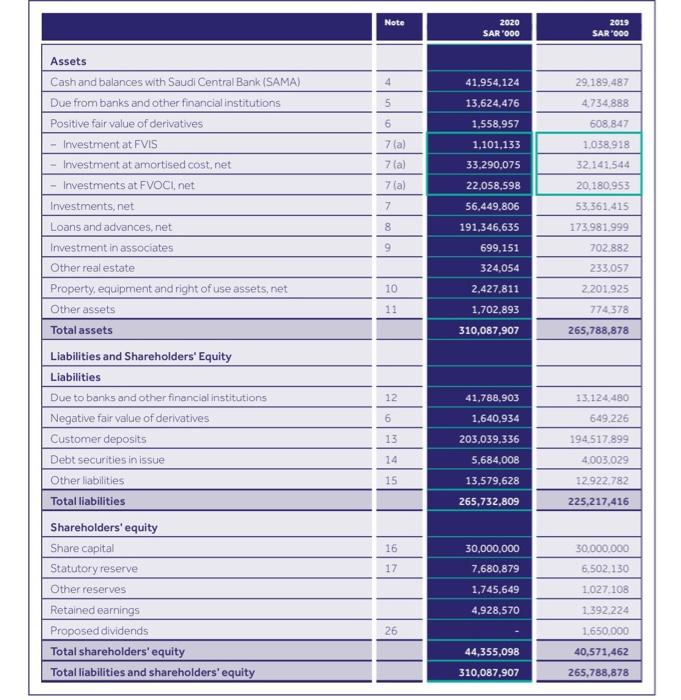

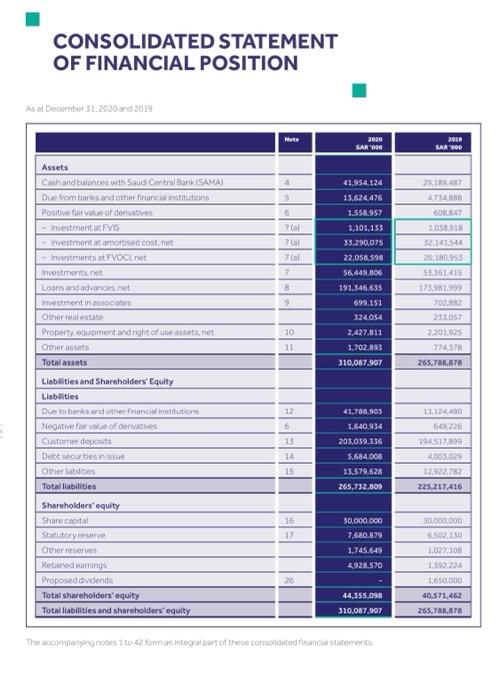

Calculate the CURRENT RATIO, QUICK RATIO, and CASH RATIO from this balance sheet. (EACH YEARS)

and if in the liability (BONDS) it considers current liability or long-term?

CONSOLIDATED STATEMENT OF FINANCIAL POSITION As bt December 31, 2020 ord 2019 2020 SAR"000 2009 SAR'000 Assets Cash and balances with Saud Central Bank (SAMA) 4 41.954.124 29,189.487 Due from banks and other financial institutions 5 13.624.476 1.558.957 608.847 Positive fair value of derivatives Investment at FVIS 1,201,133 1.05.08 7 al 33.290.075 52.341544 - Investment at amortised cost, net - Investments at EVOCE 7al 22,058, 598 20.180953 Investments.net 7 56,449,806 53.351415 Loans and advances et 8 191.546.635 173.981.999 9 699.151 702.882 Investment in assocates Other real estate 324.054 Property equipment and right crue assets.net 10 2.427,811 2.201.925 Other assets 11 1.702.893 7743 Total assets 310,087.907 265,788,878 Liabilities and Shareholders' Equity Liabilities Due to banks and other financial institutions 12 41,783.903 112 Negative for value of dorities 6 1,540,934 649.226 Customer depot 15 203.039.336 194517190 Debt Securities sue 5.684,008 400.029 Otherlabilities 15 13.579.628 12.922.782 Total liabilities 265.782.809 225.217.416 16 30.000.000 Shareholders equity Share capital Statutory reserve Other reserves 30.000.000 6.502. 130 7,680,879 1.745.649 1.027, 108 Retired earrings 4.928.570 1.592222 Proposed dividends 26 1650.000 Total shareholders'equity 44,355,096 40.571.462 Total liabilities and shareholders' equity 310,067.907 265,788,878 The accompanying notes 110 42 form an integral part of the consolidated financial statements CONSOLIDATED STATEMENT OF FINANCIAL POSITION As at December 31, 2020 and 2019 Note 2020 SARDO 2009 SAR'900 Assets Cashandbal with Saud Central Bank (SAMA) 41.954.124 29.189.487 Due from banks and other financial institutions 5 13.624.476 4754 Positive fair value of derivatives 1.558.957 Investment at FVS 1,202,133 105.95 za 7 33.290.075 - Investment at amortised cost het - Investments at EVOCE 7 al 22,058, 598 20,380953 Investments.net 7 56.449.806 53.561.415 Loans and advances.net 191,546,635 173.981999 Investment in associates 9 699.151 702882 324.054 Other real estate Property equpment and right cruits.net Other assets 10 2.427,811 22201.925 11 1.702.893 7745 Total assets 310,007 907 265,788,878 Liabilities and Shareholders' Equity Liabilities Due to banks and other financial institutions 12 41,780.903 13120 Negative for value of derties 6 1,540.934 649.226 Customer depots 15 203.059.336 194517.90 Debt Securtieste 14 5,684.008 0.020 Otherlabilities 15 13.579,628 12922.782 Total liabilities 265.732.800 225,217,416 Shareholders equity Share capital Statutory reserve 16 30.000.000 30.000.000 7.680,879 6502150 Other reserves 1,745.649 1,027. 108 4,928.570 1.592224 26 1.650.000 Retired earrings Proposed dividends Total shareholders'equity Total liabilities and shareholders' equity 44,355,098 40,571,462 310,067.907 265.78.8.878 The accompanying notes 110 42 forma integral part of the consolidated financial statements Note 2020 2019 SAR '000 SAR '000 Assets 41,954,124 29.189.487 5 13,624,476 4.734.888 Cash and balances with Saudi Central Bank (SAMA) Due from banks and other financial institutions Positive fair value of derivatives Investment at FVIS Investment at amortised cost, net 6 1,558,957 608,847 7(a) 1,101,133 1.038.918 7 al 33,290,075 32.141.544 Investments at FVOCI, net 7(a) 22,058,598 20.180.953 7 56.449,806 53.361.415 8 191,346,635 173.981.999 9 699.151 702.882 Investments.net Loans and advances, net Investment in associates Other real estate Property, equipment and right of use assets, net Other assets 324.054 233,057 10 2.427.811 2201925 11 1,702,893 774 378 Total assets 310,087,907 265,788,878 Liabilities and Shareholders' Equity Liabilities 12 41,788,903 13.124.480 Due to banks and other financial institutions Negative fair value of derivatives 6 1,640,934 649,226 Customer deposits 13 203,039,336 194 517.899 Debt securities in issue 5,684,008 4,003.029 15 13,579,628 12922.782 265,732,809 225,217,416 Other liabilities Total liabilities Shareholders' equity Share capital 16 30,000,000 30.000.000 Statutory reserve 17 7,680,879 6,502 130 1,745,649 1,027 108 Other reserves Retained earnings 4,928,570 1.392.224 Proposed dividends 26 1.650.000 44,355,098 40,571,462 Total shareholders' equity Total liabilities and shareholders' equity 310,087,907 265,788,878