Question

Calculate the current ratio, the acid test and the debt ratios for Pamplin for both 2014 and 2015. Did you get the data you needed

Calculate the current ratio, the acid test and the debt ratios for Pamplin for both 2014 and 2015.

Did you get the data you needed in order to calculate these 3 ratios from a) the income statement, b) the balance sheet or a c) combination of the two? No explanation needed just indicate the source of your data.

None of these ratios measure profitability. Tell me what each of them measure. A sentence or two for each is what I have in mind.

For each ratio, comment on:

a) How Pamplin compares to the industry norm and

b) The trend in each ratio from 2014 to 2015

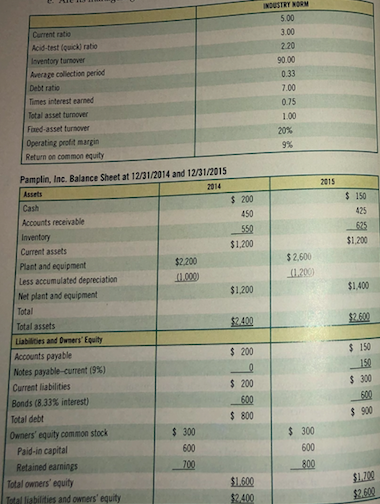

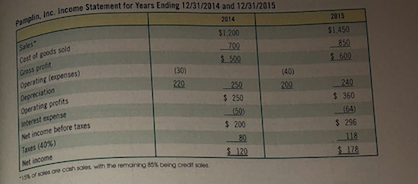

INDUSTRY NDAN 5.00 3.00 2.20 Current ratio Acid-test (quick) ratio loventory turnover Average collection period Debt ratio Times interest earned Total asset turnover Faed-assed turnover Operating profit margin Return on common equity 90.00 0.33 7.00 0.75 1.00 20% 9% Pamplin, Inc. Balance Sheet at 12/31/2014 and 12/31/2015 2015 $ 150 $25 $ 200 450 550 $1,200 625 $1.200 Cash Accounts receivable Inventory Current assets Plant and equipment Less accumulated depreciation Net plant and equipment $2,200 $2.600 11.2001 $1,200 $1,400 $2400 $2.600 $ 200 $ 150 $ 300 Total assets Liabilities and Owners' Equity Accounts payable Notes payable current 19%) Current liabilities Bonds (8.33% interest Total debt Owners' equity common stock Paid-in capital Retained earnings Total owners' equity Total liabilities and owners' equity $ 200 600 $ 800 $ 900 $ 300 600 700 600 800 $120 $1.600 $2.400 $2.600 come Statement for Years Ending 12/31/2014 and 1201015 Pamplit, Inc. Income 2015 $1.450 51 200 Cast of goods sold $6.00 (30) expenses per 240 $ 360 $ 250 income before taxes $ 200 80 $ 120 $ 296 118 178 Net income recoshow the remor being treat INDUSTRY NDAN 5.00 3.00 2.20 Current ratio Acid-test (quick) ratio loventory turnover Average collection period Debt ratio Times interest earned Total asset turnover Faed-assed turnover Operating profit margin Return on common equity 90.00 0.33 7.00 0.75 1.00 20% 9% Pamplin, Inc. Balance Sheet at 12/31/2014 and 12/31/2015 2015 $ 150 $25 $ 200 450 550 $1,200 625 $1.200 Cash Accounts receivable Inventory Current assets Plant and equipment Less accumulated depreciation Net plant and equipment $2,200 $2.600 11.2001 $1,200 $1,400 $2400 $2.600 $ 200 $ 150 $ 300 Total assets Liabilities and Owners' Equity Accounts payable Notes payable current 19%) Current liabilities Bonds (8.33% interest Total debt Owners' equity common stock Paid-in capital Retained earnings Total owners' equity Total liabilities and owners' equity $ 200 600 $ 800 $ 900 $ 300 600 700 600 800 $120 $1.600 $2.400 $2.600 come Statement for Years Ending 12/31/2014 and 1201015 Pamplit, Inc. Income 2015 $1.450 51 200 Cast of goods sold $6.00 (30) expenses per 240 $ 360 $ 250 income before taxes $ 200 80 $ 120 $ 296 118 178 Net income recoshow the remor being treatStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started