Calculate the dollar and duration gap and interpret the results.

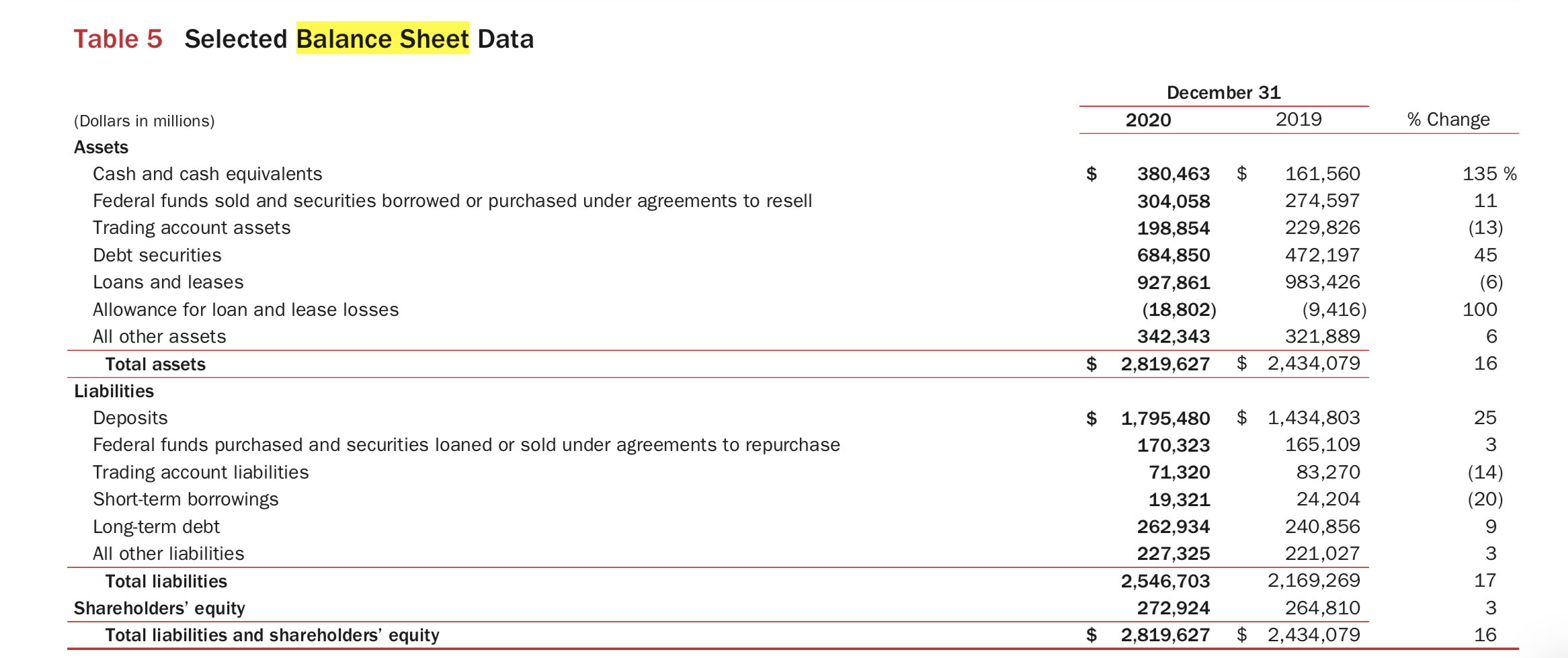

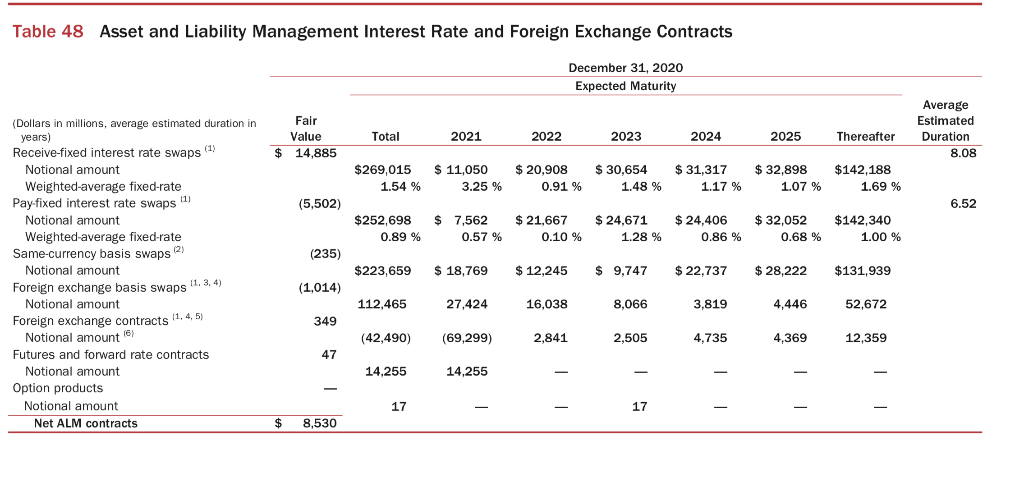

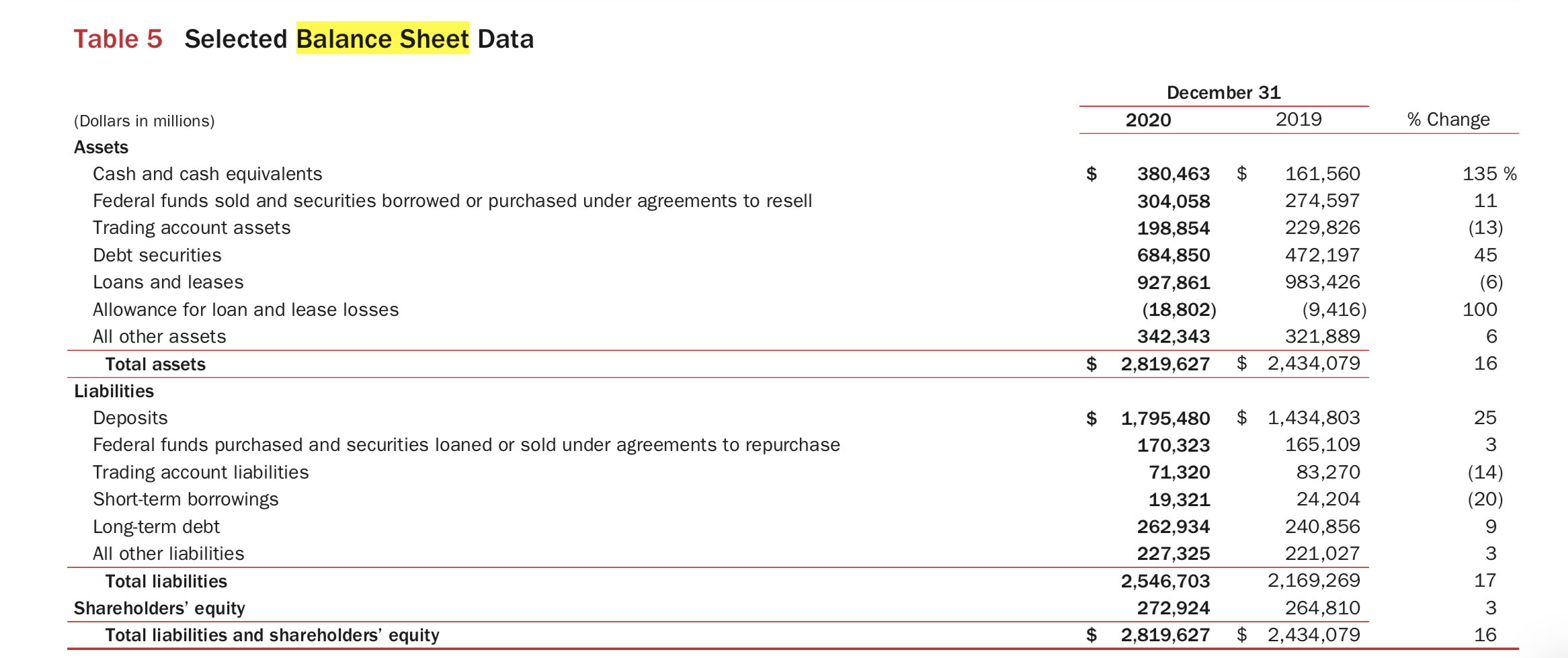

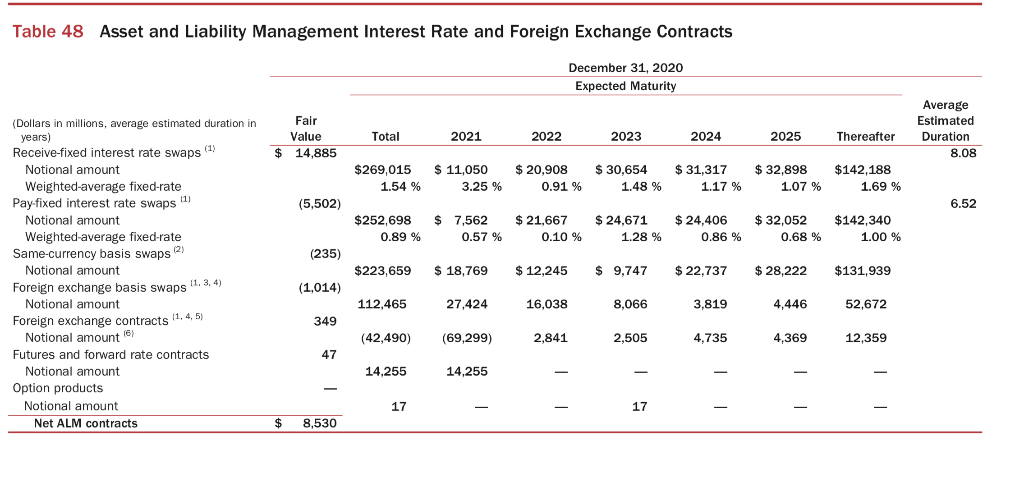

Table 5 Selected Balance Sheet Data December 31 2020 2019 % Change $ 380,463 304,058 198,854 684,850 927,861 (18,802) 342,343 $ 2,819,627 $ 161,560 274,597 229,826 472,197 983,426 (9,4 321,889 $ 2,434,079 135 % 11 (13) 45 (6) 100 6 16 (Dollars in millions) Assets Cash and cash equivalents Federal funds sold and securities borrowed or purchased under agreements to resell Trading account assets Debt securities Loans and leases Allowance for loan and lease losses All other assets Total assets Liabilities Deposits Federal funds purchased and securities loaned or sold under agreements to repurchase Trading account liabilities Short-term borrowings Long-term debt All other liabilities Total liabilities Shareholders' equity Total liabilities and shareholders' equity 25 3 (14) (20) $ 1,795,480 170,323 71,320 19,321 262,934 227,325 2,546,703 272,924 $ 2,819,627 $ 1,434,803 165,109 83,270 24,204 240,856 221,027 2,169,269 264,810 $ 2,434,079 17 5 6 3 16 Table 48 Asset and Liability Management Interest Rate and Foreign Exchange Contracts December 31, 2020 Expected Maturity Fair Value $ 14,885 Total 2021 2022 Average Estimated Duration 8.08 2023 2024 2025 Thereafter $269,015 1.54 % $ 11,050 3.25 % $ 20,908 0.91 % $ 30,654 1.48 % $ 31,317 1.17 % $ 32,898 1.07 % $142,188 1.69 % 11 (5,502) 6.52 $252,698 0.89 % $ 7,562 0.57 % $ 21,667 0.10 % $ 24.671 1.28 % $ 24,406 0.86 % $ 32,052 0.68 % $142,340 1.00 % 2 (235) (Dollars in millions, average estimated duration in years) Receive-fixed interest rate swaps (1) Notional amount Weighted average fixed-rate Pay-fixed interest rate swaps (1) Notional amount Weighted average fixed-rate Same-currency basis swaps (2) Notional amount Foreign exchange basis swaps Notional amount Foreign exchange contracts (1,4,5) Notional amount (6) Futures and forward rate contracts Notional amount Option products Notional amount Net ALM contracts $223,659 $ 18,769 $ 12,245 $ 9.747 $ 22.737 $ 28,222 $131,939 (1,014) 112,465 27,424 16,038 8,066 3.819 4,446 52,672 349 (42,490) (69,299) 2,841 2,505 4,735 4,369 12,359 47 14.255 14,255 17 17 $ $ 8,530 Table 5 Selected Balance Sheet Data December 31 2020 2019 % Change $ 380,463 304,058 198,854 684,850 927,861 (18,802) 342,343 $ 2,819,627 $ 161,560 274,597 229,826 472,197 983,426 (9,4 321,889 $ 2,434,079 135 % 11 (13) 45 (6) 100 6 16 (Dollars in millions) Assets Cash and cash equivalents Federal funds sold and securities borrowed or purchased under agreements to resell Trading account assets Debt securities Loans and leases Allowance for loan and lease losses All other assets Total assets Liabilities Deposits Federal funds purchased and securities loaned or sold under agreements to repurchase Trading account liabilities Short-term borrowings Long-term debt All other liabilities Total liabilities Shareholders' equity Total liabilities and shareholders' equity 25 3 (14) (20) $ 1,795,480 170,323 71,320 19,321 262,934 227,325 2,546,703 272,924 $ 2,819,627 $ 1,434,803 165,109 83,270 24,204 240,856 221,027 2,169,269 264,810 $ 2,434,079 17 5 6 3 16 Table 48 Asset and Liability Management Interest Rate and Foreign Exchange Contracts December 31, 2020 Expected Maturity Fair Value $ 14,885 Total 2021 2022 Average Estimated Duration 8.08 2023 2024 2025 Thereafter $269,015 1.54 % $ 11,050 3.25 % $ 20,908 0.91 % $ 30,654 1.48 % $ 31,317 1.17 % $ 32,898 1.07 % $142,188 1.69 % 11 (5,502) 6.52 $252,698 0.89 % $ 7,562 0.57 % $ 21,667 0.10 % $ 24.671 1.28 % $ 24,406 0.86 % $ 32,052 0.68 % $142,340 1.00 % 2 (235) (Dollars in millions, average estimated duration in years) Receive-fixed interest rate swaps (1) Notional amount Weighted average fixed-rate Pay-fixed interest rate swaps (1) Notional amount Weighted average fixed-rate Same-currency basis swaps (2) Notional amount Foreign exchange basis swaps Notional amount Foreign exchange contracts (1,4,5) Notional amount (6) Futures and forward rate contracts Notional amount Option products Notional amount Net ALM contracts $223,659 $ 18,769 $ 12,245 $ 9.747 $ 22.737 $ 28,222 $131,939 (1,014) 112,465 27,424 16,038 8,066 3.819 4,446 52,672 349 (42,490) (69,299) 2,841 2,505 4,735 4,369 12,359 47 14.255 14,255 17 17 $ $ 8,530