Question

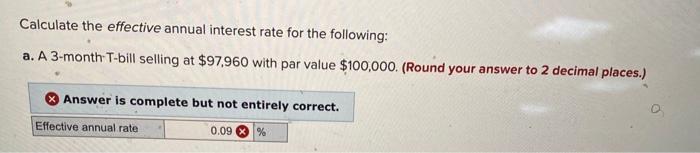

Calculate the effective annual interest rate for the following: a. A 3-month-T-bill selling at $97,960 with par value $100,000. (Round your answer to 2

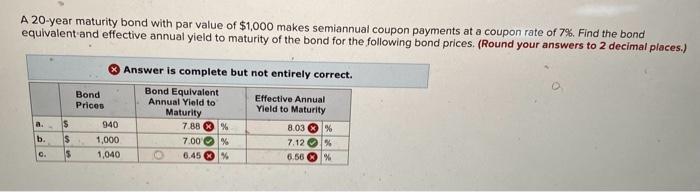

Calculate the effective annual interest rate for the following: a. A 3-month-T-bill selling at $97,960 with par value $100,000. (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Effective annual rate 0.09% A 20-year maturity bond with par value of $1,000 makes semiannual coupon payments at a coupon rate of 7%. Find the bond equivalent and effective annual yield to maturity of the bond for the following bond prices. (Round your answers to 2 decimal places.) a. b. 0. $ $ S Bond Prices 940 1,000 1,040 Answer is complete but not entirely correct. Bond Equivalent Annual Yield to Maturity O 7.88% 7.00 % 6.45% Effective Annual Yield to Maturity 8.03% 7.12 % 6.56%

Step by Step Solution

3.21 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Brigham, Daves

10th Edition

978-1439051764, 1111783659, 9780324594690, 1439051763, 9781111783655, 324594690, 978-1111021573

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App