Answered step by step

Verified Expert Solution

Question

1 Approved Answer

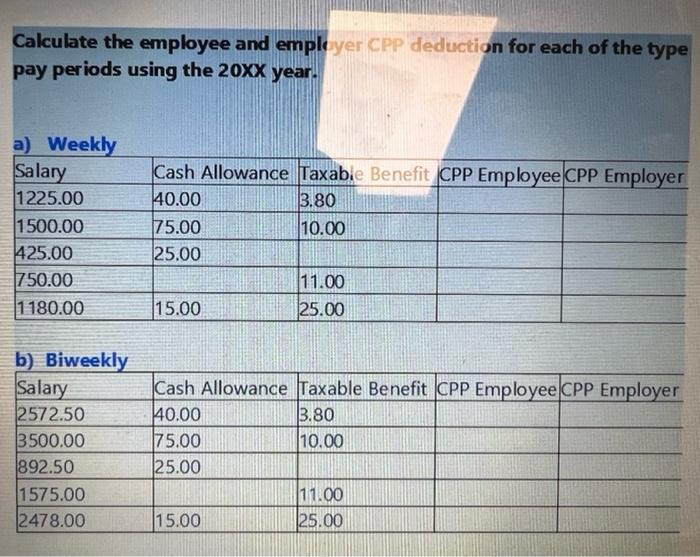

Calculate the employee and employer CPP deduction for each of the type pay periods using the 20XX year. a) Weekly Salary Cash Allowance Taxable

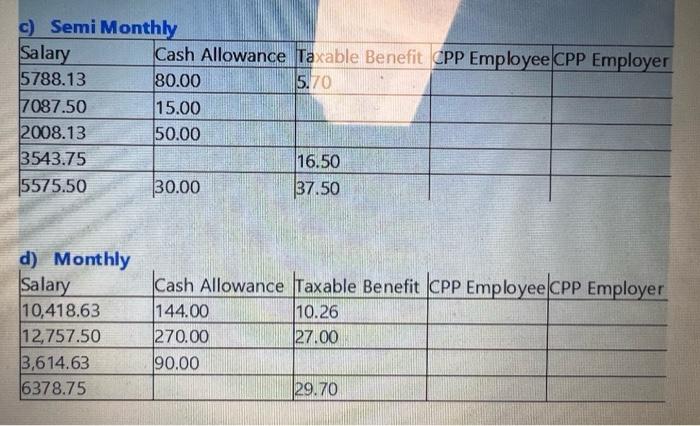

Calculate the employee and employer CPP deduction for each of the type pay periods using the 20XX year. a) Weekly Salary Cash Allowance Taxable Benefit CPP Employee CPP Employer 1225.00 40.00 3.80 1500.00 75.00 10.00 425.00 25.00 750.00 11.00 1180.00 15.00 25.00 b) Biweekly Salary Cash Allowance Taxable Benefit CPP Employee CPP Employer 2572.50 40.00 3.80 3500.00 75.00 10.00 892.50 25.00 1575.00 11.00 2478.00 15.00 25.00 c) Semi Monthly Salary 5788.13 7087.50 2008.13 3543.75 5575.50 d) Monthly Salary 10,418.63 12,757.50 3,614.63 6378.75 Cash Allowance Taxable Benefit CPP Employee CPP Employer 80.00 5.70 15.00 50.00 16.50 30.00 37.50 Cash Allowance Taxable Benefit CPP Employee CPP Employer 144.00 10.26 270.00 27.00 90.00 29.70

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

CPP Contribution by employer CPP contribution by employee ee 570 of Income by employes 570 of Incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started