Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the estimated taxes on sale, as if you were selling after 5 years [Value5=$15,416,349]? The answer is $15, 416, 349 for taxes on sale.

Calculate the estimated taxes on sale, as if you were selling after 5 years [Value5=$15,416,349]? The answer is $15, 416, 349 for taxes on sale. Please show how you get this answer.

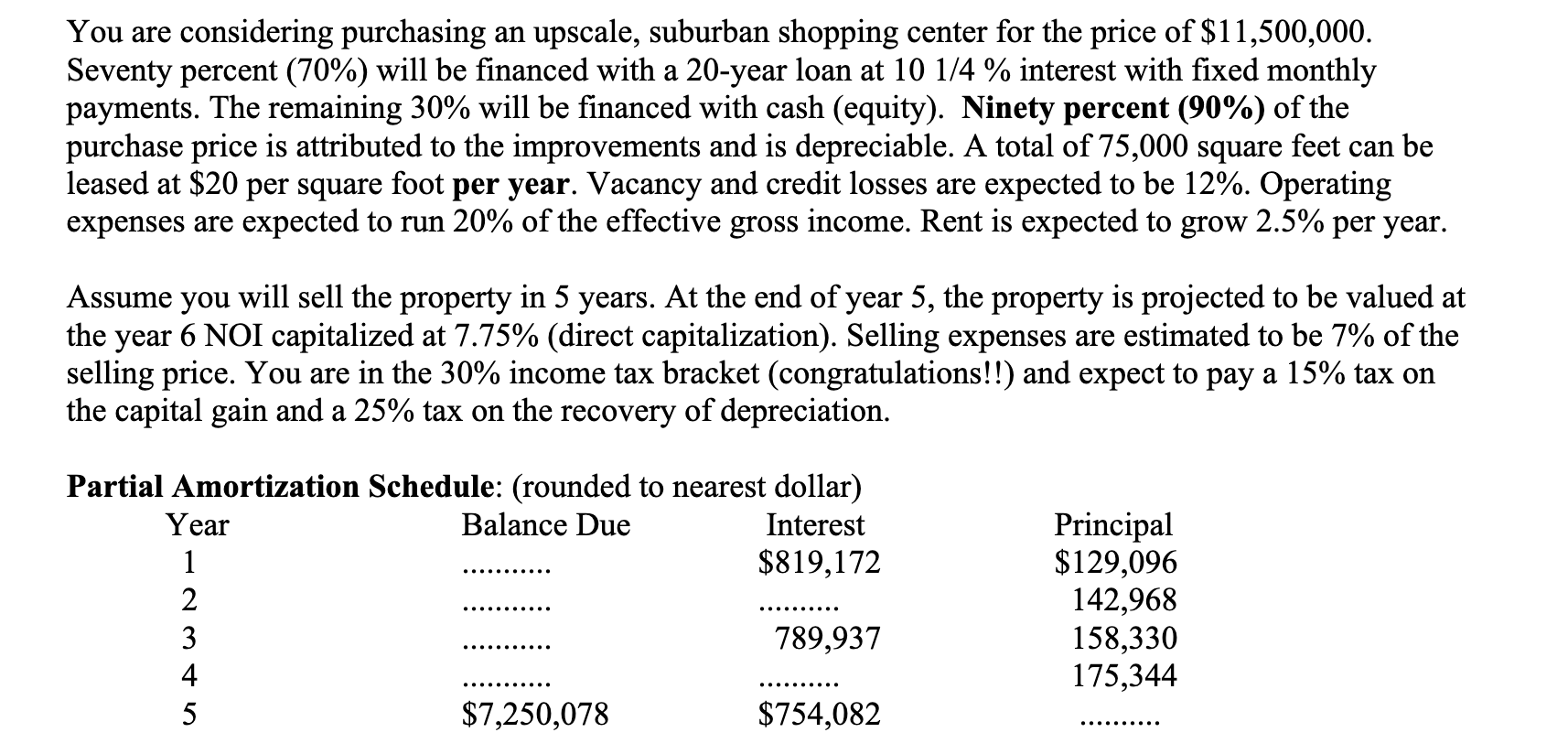

You are considering purchasing an upscale, suburban shopping center for the price of $11,500,000. Seventy percent (70%) will be financed with a 20-year loan at 10 1/4 % interest with fixed monthly payments. The remaining 30% will be financed with cash (equity). Ninety percent (90%) of the purchase price is attributed to the improvements and is depreciable. A total of 75,000 square feet can be leased at $20 per square foot per year. Vacancy and credit losses are expected to be 12%. Operating expenses are expected to run 20% of the effective gross income. Rent is expected to grow 2.5% per year. Assume you will sell the property in 5 years. At the end of year 5, the property is projected to be valued at the year 6 NOI capitalized at 7.75% (direct capitalization). Selling expenses are estimated to be 7% of the selling price. You are in the 30% income tax bracket (congratulations!!) and expect to pay a 15% tax on the capital gain and a 25% tax on the recovery of depreciation. Partial Amortization Schedule: (rounded to nearest dollar) Year Balance Due Interest $819,172 2 3 789,937 4 5 $7,250,078 $754,082 Fmtn Principal $129,096 142,968 158,330 175,344 You are considering purchasing an upscale, suburban shopping center for the price of $11,500,000. Seventy percent (70%) will be financed with a 20-year loan at 10 1/4 % interest with fixed monthly payments. The remaining 30% will be financed with cash (equity). Ninety percent (90%) of the purchase price is attributed to the improvements and is depreciable. A total of 75,000 square feet can be leased at $20 per square foot per year. Vacancy and credit losses are expected to be 12%. Operating expenses are expected to run 20% of the effective gross income. Rent is expected to grow 2.5% per year. Assume you will sell the property in 5 years. At the end of year 5, the property is projected to be valued at the year 6 NOI capitalized at 7.75% (direct capitalization). Selling expenses are estimated to be 7% of the selling price. You are in the 30% income tax bracket (congratulations!!) and expect to pay a 15% tax on the capital gain and a 25% tax on the recovery of depreciation. Partial Amortization Schedule: (rounded to nearest dollar) Year Balance Due Interest $819,172 2 3 789,937 4 5 $7,250,078 $754,082 Fmtn Principal $129,096 142,968 158,330 175,344Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started