Calculate the expected initialcost of development for all three options using weighted values. (25 points)i. Include your calculations (i.e., a screenshot of the part of the Excel spreadsheet that shows your work or copy and right click/paste - picture) in your submission.ii. Explain (for DBVac) what these values are and how they should be useful to the company in terms of evaluating the three options.

In the pictures is the information needed to answer the question.

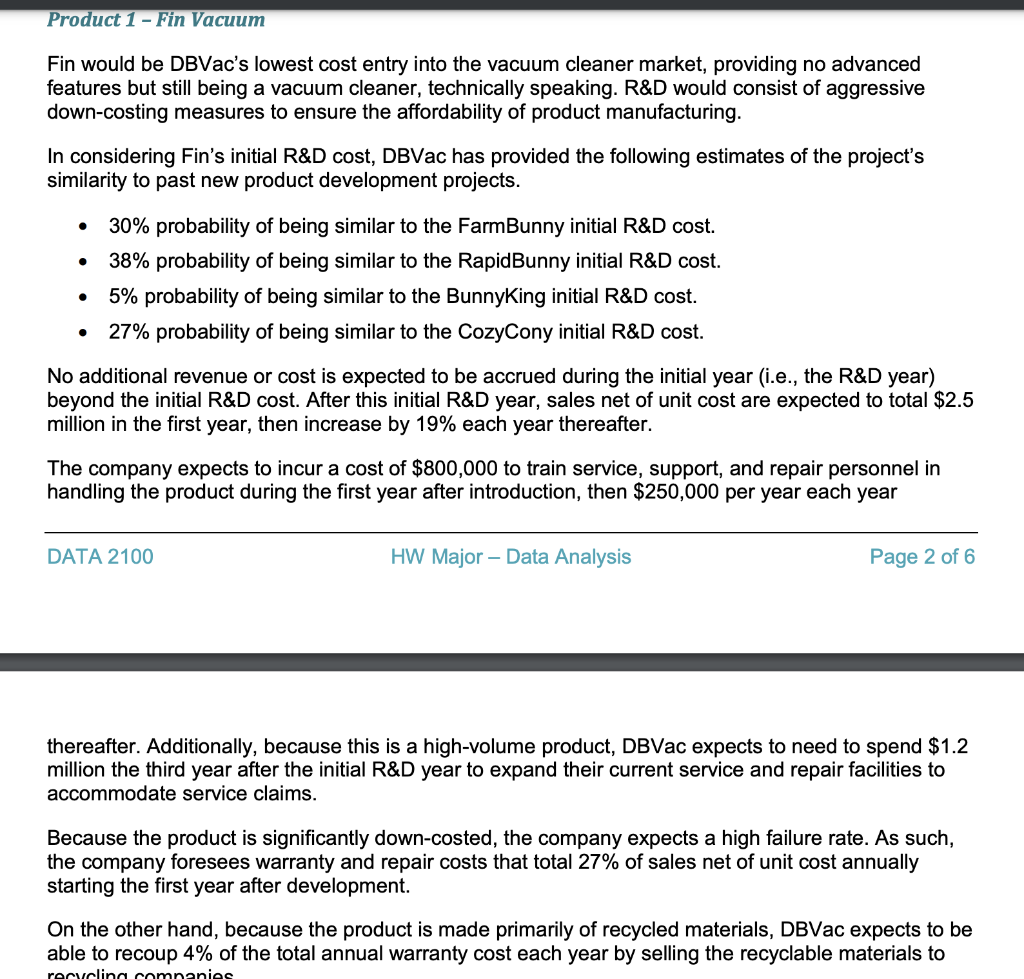

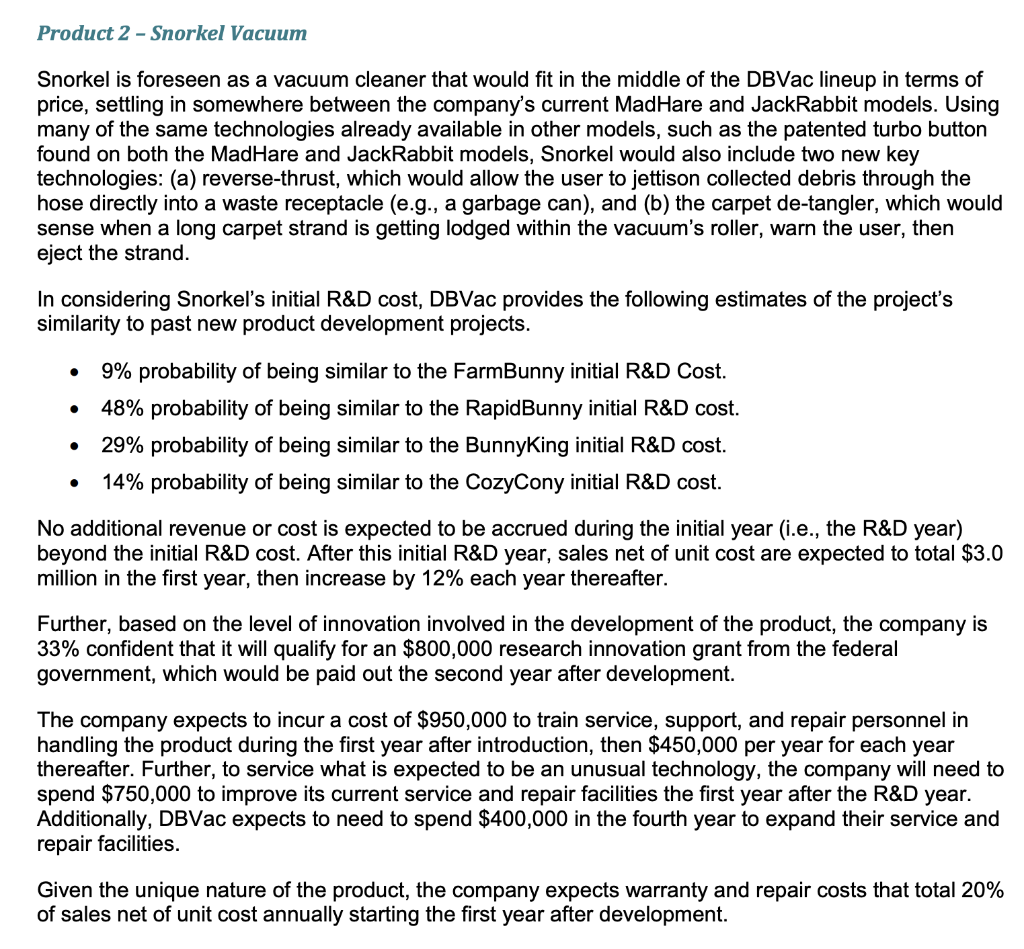

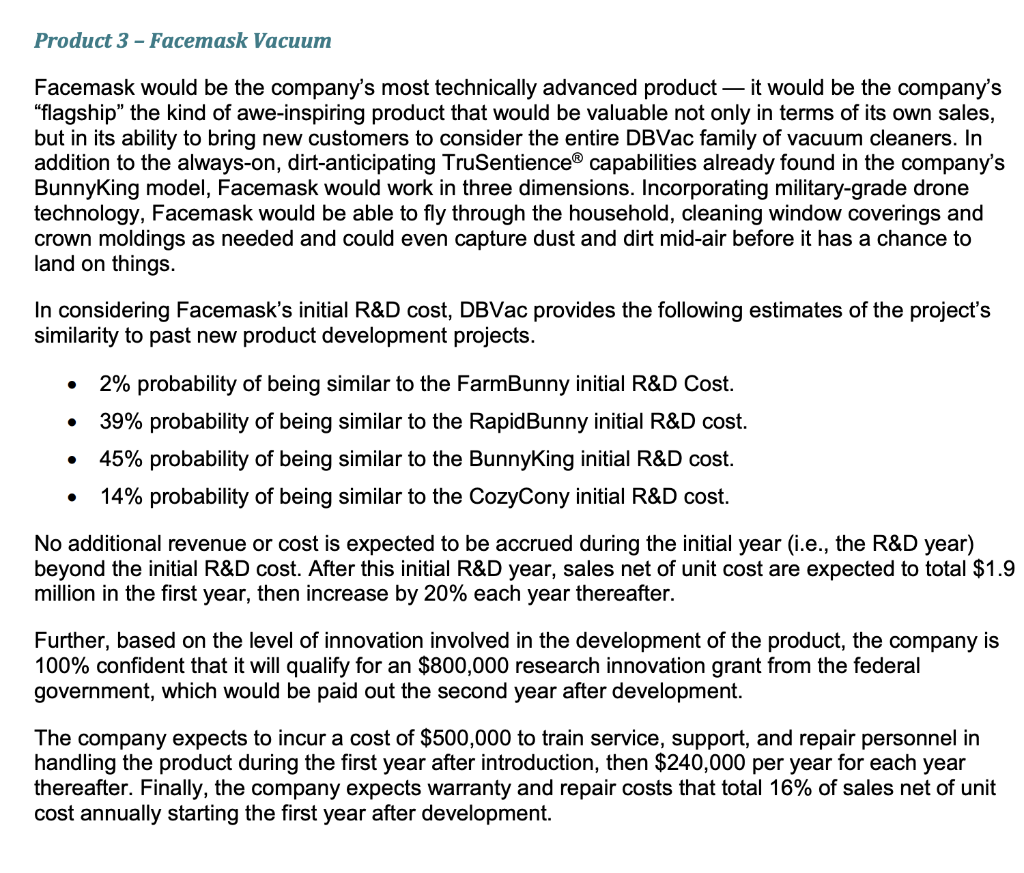

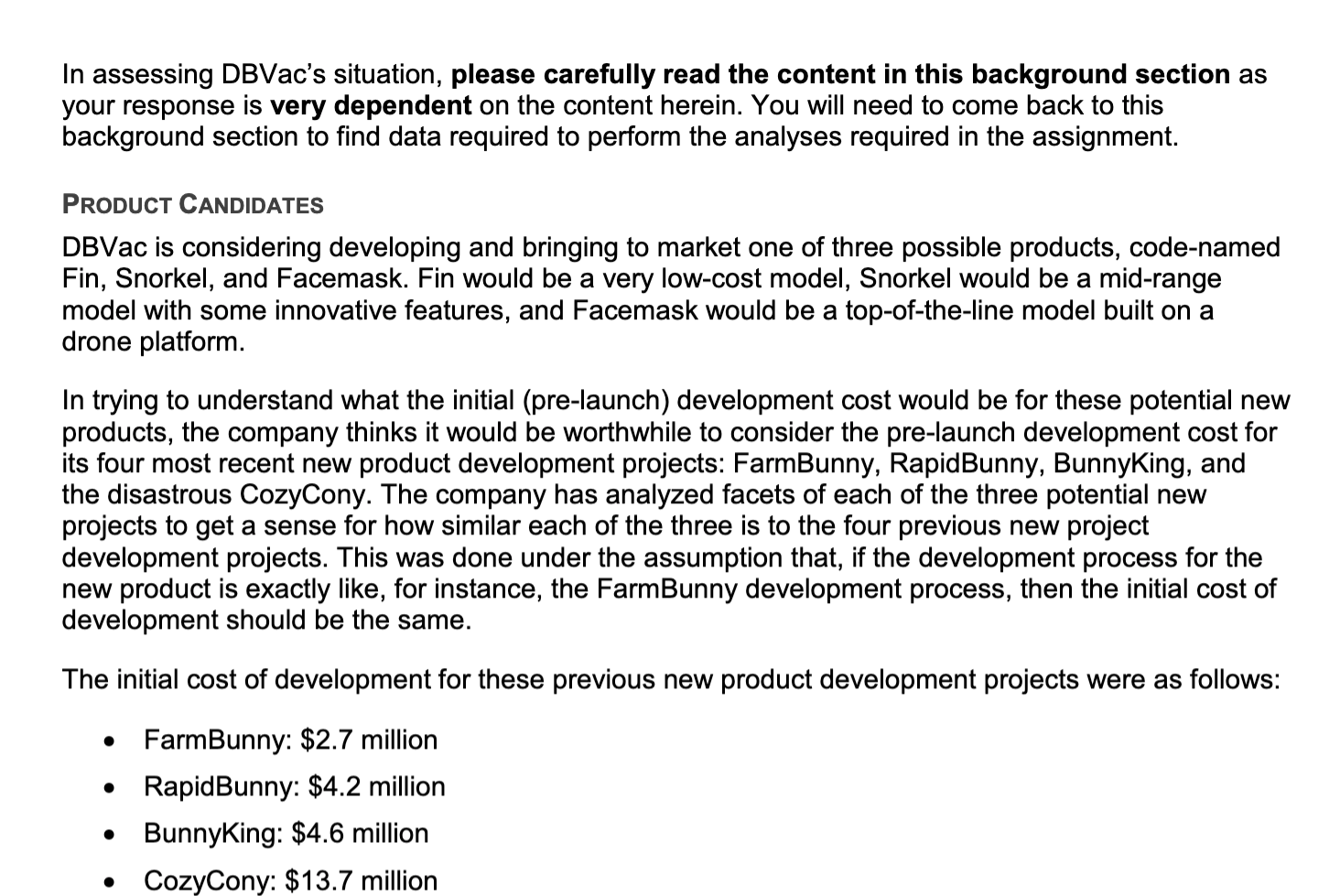

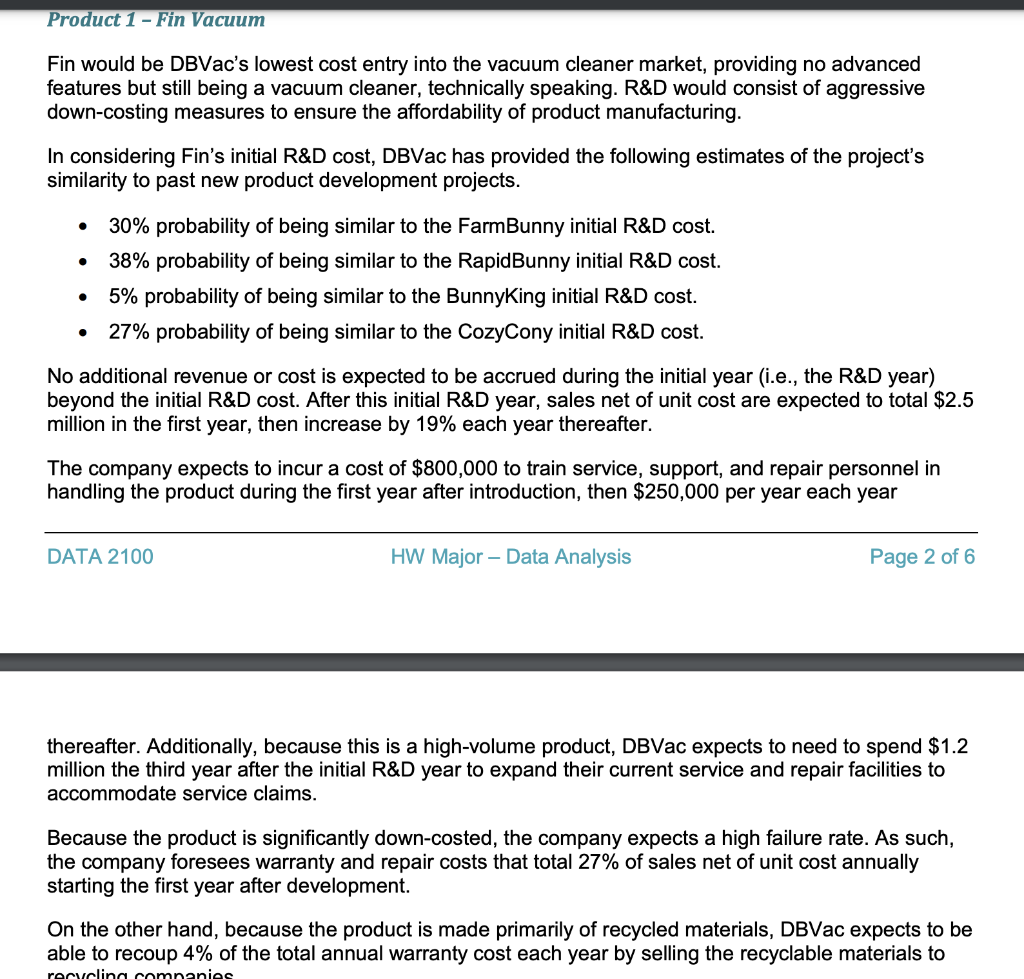

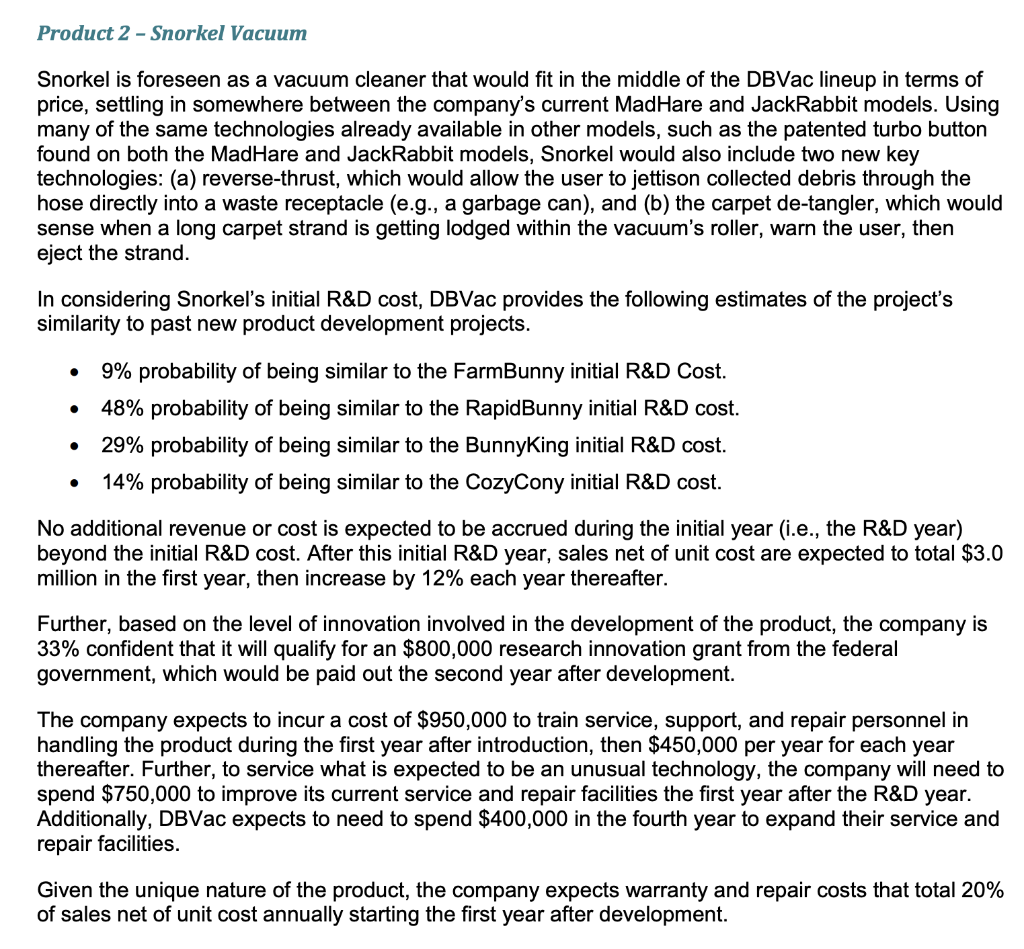

In assessing DBVac's situation, please carefully read the content in this background section as your response is very dependent on the content herein. You will need to come back to this background section to find data required to perform the analyses required in the assignment. PRODUCT CANDIDATES DBVac is considering developing and bringing to market one of three possible products, code-named Fin, Snorkel, and Facemask. Fin would be a very low-cost model, Snorkel would be a mid-range model with some innovative features, and Facemask would be a top-of-the-line model built on a drone platform. In trying to understand what the initial (pre-launch) development cost would be for these potential new products, the company thinks it would be worthwhile to consider the pre-launch development cost for its four most recent new product development projects: FarmBunny, RapidBunny, BunnyKing, and the disastrous CozyCony. The company has analyzed facets of each of the three potential new projects to get a sense for how similar each of the three is to the four previous new project development projects. This was done under the assumption that, if the development process for the new product is exactly like, for instance, the FarmBunny development process, then the initial cost of development should be the same. The initial cost of development for these previous new product development projects were as follows: FarmBunny: $2.7 million RapidBunny: $4.2 million BunnyKing: $4.6 million CozyCony: $13.7 million . Product 1 - Fin Vacuum Fin would be DBVac's lowest cost entry into the vacuum cleaner market, providing no advanced features but still being a vacuum cleaner, technically speaking. R&D would consist of aggressive down-costing measures to ensure the affordability of product manufacturing. In considering Fin's initial R&D cost, DBVac has provided the following estimates of the project's similarity to past new product development projects. 30% probability of being similar to the FarmBunny initial R&D cost. 38% probability of being similar to the RapidBunny initial R&D cost. 5% probability of being similar to the BunnyKing initial R&D cost. 27% probability of being similar to the CozyCony initial R&D cost. . No additional revenue or cost is expected to be accrued during the initial year (i.e., the R&D year) beyond the initial R&D cost. After this initial R&D year, sales net of unit cost are expected to total $2.5 million in the first year, then increase by 19% each year thereafter. The company expects to incur a cost of $800,000 to train service, support, and repair personnel in handling the product during the first year after introduction, then $250,000 per year each year DATA 2100 HW Major - Data Analysis Page 2 of 6 thereafter. Additionally, because this is a high-volume product, DBVac expects to need to spend $1.2 million the third year after the initial R&D year to expand their current service and repair facilities to accommodate service claims. Because the product is significantly down-costed, the company expects a high failure rate. As such, the company foresees warranty and repair costs that total 27% of sales net of unit cost annually starting the first year after development. On the other hand, because the product is made primarily of recycled materials, DBVac expects to be able to recoup 4% of the total annual warranty cost each year by selling the recyclable materials to recycling companies Product 2 - Snorkel Vacuum Snorkel is foreseen as a vacuum cleaner that would fit in the middle of the DBVac lineup in terms of price, settling in somewhere between the company's current MadHare and JackRabbit models. Using many of the same technologies already available in other models, such as the patented turbo button found on both the MadHare and JackRabbit models, Snorkel would also include two new key technologies: (a) reverse-thrust, which would allow the user to jettison collected debris through the hose directly into a waste receptacle (e.g., a garbage can), and (b) the carpet de-tangler, which would sense when a long carpet strand is getting lodged within the vacuum's roller, warn the user, then eject the strand. In considering Snorkel's initial R&D cost, DBVac provides the following estimates of the project's similarity to past new product development projects. 9% probability of being similar to the FarmBunny initial R&D Cost. 48% probability of being similar to the RapidBunny initial R&D cost. 29% probability of being similar to the BunnyKing initial R&D cost. 14% probability of being similar to the CozyCony initial R&D cost. . . No additional revenue or cost is expected to be accrued during the initial year (i.e., the R&D year) beyond the initial R&D cost. After this initial R&D year, sales net of unit cost are expected to total $3.0 million in the first year, then increase by 12% each year thereafter. Further, based on the level of innovation involved in the development of the product, the company is 33% confident that it will qualify for an $800,000 research innovation grant from the federal government, which would be paid out the second year after development. The company expects to incur a cost of $950,000 to train service, support, and repair personnel in handling the product during the first year after introduction, then $450,000 per year for each year thereafter. Further, to service what is expected to be an unusual technology, the company will need to spend $750,000 to improve its current service and repair facilities the first year after the R&D year. Additionally, DBVac expects to need to spend $400,000 in the fourth year to expand their service and repair facilities. Given the unique nature of the product, the company expects warranty and repair costs that total 20% of sales net of unit cost annually starting the first year after development. Product 3 - Facemask Vacuum Facemask would be the company's most technically advanced product it would be the company's "flagship the kind of awe-inspiring product that would be valuable not only in terms of its own sales, but in its ability to bring new customers to consider the entire DBVac family of vacuum cleaners. In addition to the always-on, dirt-anticipating TruSentience capabilities already found in the company's BunnyKing model, Facemask would work in three dimensions. Incorporating military-grade drone technology, Facemask would be able to fly through the household, cleaning window coverings and crown moldings as needed and could even capture dust and dirt mid-air before it has a chance to land on things. In considering Facemask's initial R&D cost, DBVac provides the following estimates of the project's similarity to past new product development projects. 2% probability of being similar to the FarmBunny initial R&D Cost. 39% probability of being similar to the RapidBunny initial R&D cost. 45% probability of being similar to the BunnyKing initial R&D cost. 14% probability of being similar to the CozyCony initial R&D cost. No additional revenue or cost is expected to be accrued during the initial year (i.e., the R&D year) beyond the initial R&D cost. After this initial R&D year, sales net of unit cost are expected to total $1.9 million in the first year, then increase by 20% each year thereafter. Further, based on the level of innovation involved in the development of the product, the company is 100% confident that it will qualify for an $800,000 research innovation grant from the federal government, which would be paid out the second year after development. The company expects to incur a cost of $500,000 to train service, support, and repair personnel in handling the product during the first year after introduction, then $240,000 per year for each year thereafter. Finally, the company expects warranty and repair costs that total 16% of sales net of unit cost annually starting the first year after development. In assessing DBVac's situation, please carefully read the content in this background section as your response is very dependent on the content herein. You will need to come back to this background section to find data required to perform the analyses required in the assignment. PRODUCT CANDIDATES DBVac is considering developing and bringing to market one of three possible products, code-named Fin, Snorkel, and Facemask. Fin would be a very low-cost model, Snorkel would be a mid-range model with some innovative features, and Facemask would be a top-of-the-line model built on a drone platform. In trying to understand what the initial (pre-launch) development cost would be for these potential new products, the company thinks it would be worthwhile to consider the pre-launch development cost for its four most recent new product development projects: FarmBunny, RapidBunny, BunnyKing, and the disastrous CozyCony. The company has analyzed facets of each of the three potential new projects to get a sense for how similar each of the three is to the four previous new project development projects. This was done under the assumption that, if the development process for the new product is exactly like, for instance, the FarmBunny development process, then the initial cost of development should be the same. The initial cost of development for these previous new product development projects were as follows: FarmBunny: $2.7 million RapidBunny: $4.2 million BunnyKing: $4.6 million CozyCony: $13.7 million . Product 1 - Fin Vacuum Fin would be DBVac's lowest cost entry into the vacuum cleaner market, providing no advanced features but still being a vacuum cleaner, technically speaking. R&D would consist of aggressive down-costing measures to ensure the affordability of product manufacturing. In considering Fin's initial R&D cost, DBVac has provided the following estimates of the project's similarity to past new product development projects. 30% probability of being similar to the FarmBunny initial R&D cost. 38% probability of being similar to the RapidBunny initial R&D cost. 5% probability of being similar to the BunnyKing initial R&D cost. 27% probability of being similar to the CozyCony initial R&D cost. . No additional revenue or cost is expected to be accrued during the initial year (i.e., the R&D year) beyond the initial R&D cost. After this initial R&D year, sales net of unit cost are expected to total $2.5 million in the first year, then increase by 19% each year thereafter. The company expects to incur a cost of $800,000 to train service, support, and repair personnel in handling the product during the first year after introduction, then $250,000 per year each year DATA 2100 HW Major - Data Analysis Page 2 of 6 thereafter. Additionally, because this is a high-volume product, DBVac expects to need to spend $1.2 million the third year after the initial R&D year to expand their current service and repair facilities to accommodate service claims. Because the product is significantly down-costed, the company expects a high failure rate. As such, the company foresees warranty and repair costs that total 27% of sales net of unit cost annually starting the first year after development. On the other hand, because the product is made primarily of recycled materials, DBVac expects to be able to recoup 4% of the total annual warranty cost each year by selling the recyclable materials to recycling companies Product 2 - Snorkel Vacuum Snorkel is foreseen as a vacuum cleaner that would fit in the middle of the DBVac lineup in terms of price, settling in somewhere between the company's current MadHare and JackRabbit models. Using many of the same technologies already available in other models, such as the patented turbo button found on both the MadHare and JackRabbit models, Snorkel would also include two new key technologies: (a) reverse-thrust, which would allow the user to jettison collected debris through the hose directly into a waste receptacle (e.g., a garbage can), and (b) the carpet de-tangler, which would sense when a long carpet strand is getting lodged within the vacuum's roller, warn the user, then eject the strand. In considering Snorkel's initial R&D cost, DBVac provides the following estimates of the project's similarity to past new product development projects. 9% probability of being similar to the FarmBunny initial R&D Cost. 48% probability of being similar to the RapidBunny initial R&D cost. 29% probability of being similar to the BunnyKing initial R&D cost. 14% probability of being similar to the CozyCony initial R&D cost. . . No additional revenue or cost is expected to be accrued during the initial year (i.e., the R&D year) beyond the initial R&D cost. After this initial R&D year, sales net of unit cost are expected to total $3.0 million in the first year, then increase by 12% each year thereafter. Further, based on the level of innovation involved in the development of the product, the company is 33% confident that it will qualify for an $800,000 research innovation grant from the federal government, which would be paid out the second year after development. The company expects to incur a cost of $950,000 to train service, support, and repair personnel in handling the product during the first year after introduction, then $450,000 per year for each year thereafter. Further, to service what is expected to be an unusual technology, the company will need to spend $750,000 to improve its current service and repair facilities the first year after the R&D year. Additionally, DBVac expects to need to spend $400,000 in the fourth year to expand their service and repair facilities. Given the unique nature of the product, the company expects warranty and repair costs that total 20% of sales net of unit cost annually starting the first year after development. Product 3 - Facemask Vacuum Facemask would be the company's most technically advanced product it would be the company's "flagship the kind of awe-inspiring product that would be valuable not only in terms of its own sales, but in its ability to bring new customers to consider the entire DBVac family of vacuum cleaners. In addition to the always-on, dirt-anticipating TruSentience capabilities already found in the company's BunnyKing model, Facemask would work in three dimensions. Incorporating military-grade drone technology, Facemask would be able to fly through the household, cleaning window coverings and crown moldings as needed and could even capture dust and dirt mid-air before it has a chance to land on things. In considering Facemask's initial R&D cost, DBVac provides the following estimates of the project's similarity to past new product development projects. 2% probability of being similar to the FarmBunny initial R&D Cost. 39% probability of being similar to the RapidBunny initial R&D cost. 45% probability of being similar to the BunnyKing initial R&D cost. 14% probability of being similar to the CozyCony initial R&D cost. No additional revenue or cost is expected to be accrued during the initial year (i.e., the R&D year) beyond the initial R&D cost. After this initial R&D year, sales net of unit cost are expected to total $1.9 million in the first year, then increase by 20% each year thereafter. Further, based on the level of innovation involved in the development of the product, the company is 100% confident that it will qualify for an $800,000 research innovation grant from the federal government, which would be paid out the second year after development. The company expects to incur a cost of $500,000 to train service, support, and repair personnel in handling the product during the first year after introduction, then $240,000 per year for each year thereafter. Finally, the company expects warranty and repair costs that total 16% of sales net of unit cost annually starting the first year after development