Question

Calculate the expected return and standard deviation of for single stocks and portfolio You have estimated the following probability distributions of expected future returns from

Calculate the expected return and standard deviation of for single stocks and portfolio

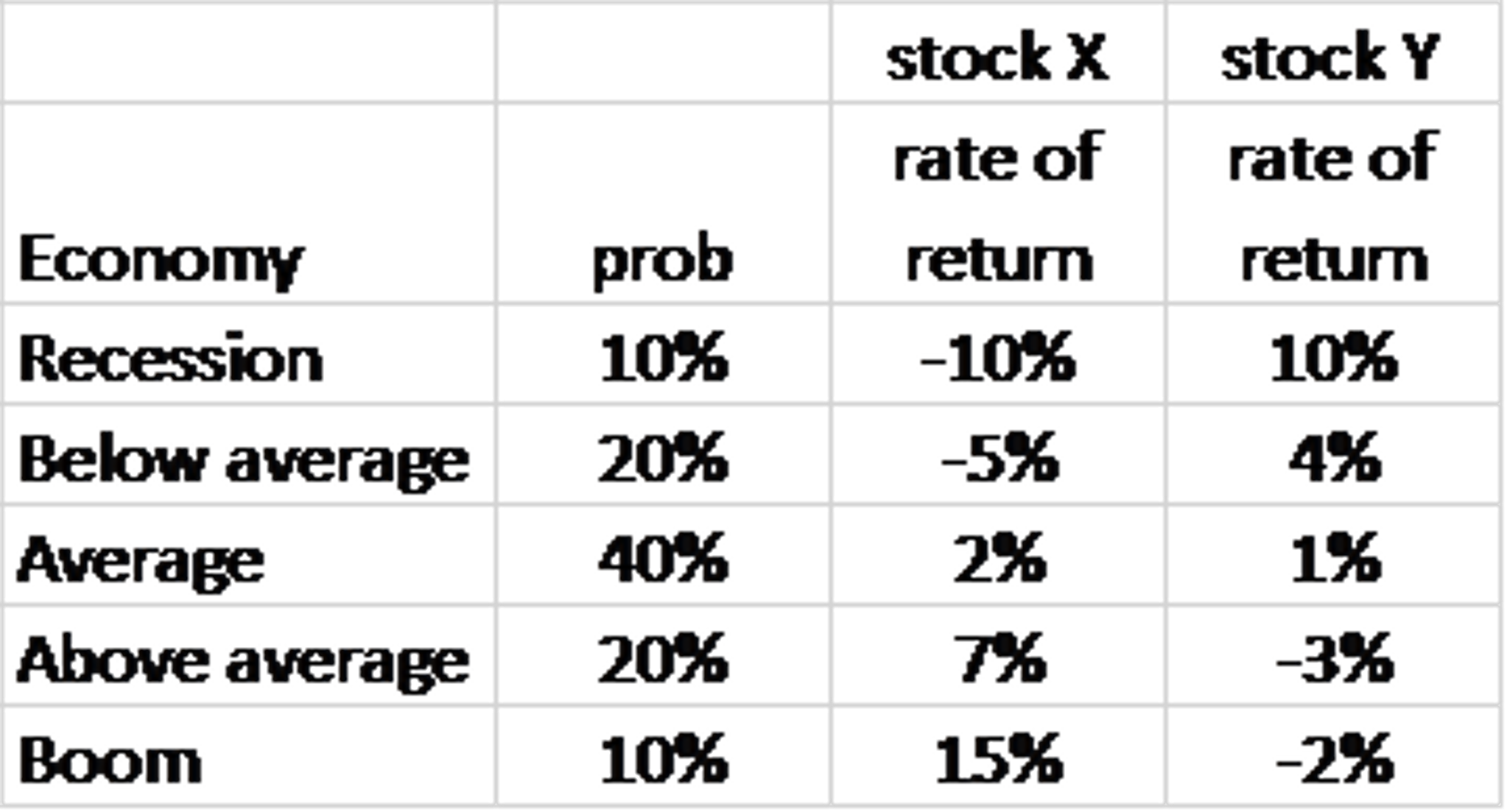

You have estimated the following probability distributions of expected future returns from stocks X and Y:

What is the expected return for stock X and Y?

Expected return of X = ??

Expected return of Y = ??

What is the standard deviation of expected returns for stock X and Y?

Standard deviation of X = ??

Standard deviation of Y = ??

Calculate the expected return and standard deviation of the mix of 50% X and 50% Y.

Expected return of the mix of 50% X + 50% Y = ??

Which stock would you consider to be riskier, X, Y, or 50% X + 50% Y? Why? (hint: calculate the coefficient of variation (COV) = standard deviation / expected return and compare.) Hints: please study the slides for the explanation of calculations.

Cov of X = ??

Cov of Y = ??

Cov of ( 50% X + 50% Y) = ??

Which do you pick? ---- ??

stock Xstock Y rate of rate of return Economy Recession Below average Average Above Boom prob 10% 20% 40% 20% 10% returm -10% -5% 2% 7% 15% 10% 4% 1% -3% -2% averageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started