Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the expected returns for the individual stocks and Ethan's portfolio as well as the expected rate of return of the entire portfolio over the

Calculate the expected returns for the individual stocks and Ethan's portfolio as well as the expected rate of return of the entire portfolio over the three possible market conditions next year. How do I solve for the expected rate of return on Ethans portfolio?

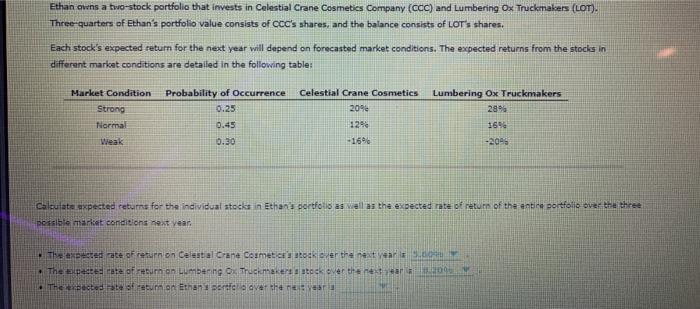

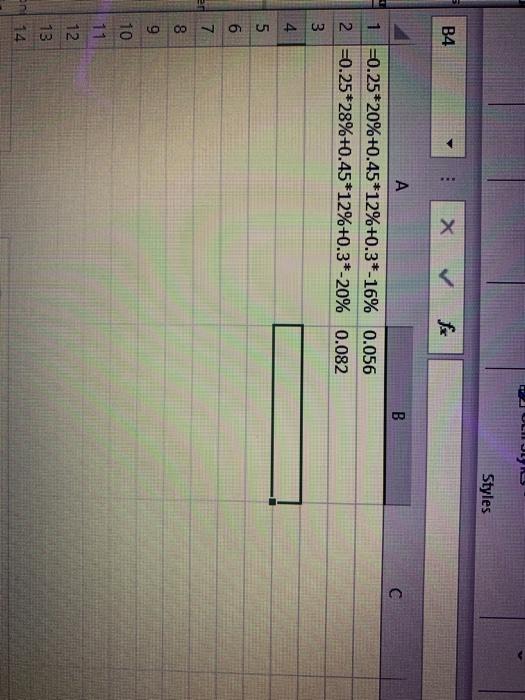

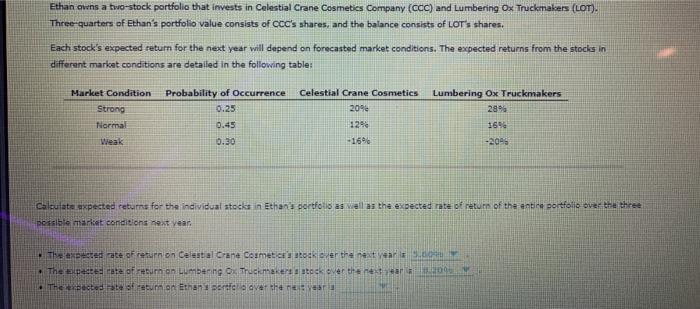

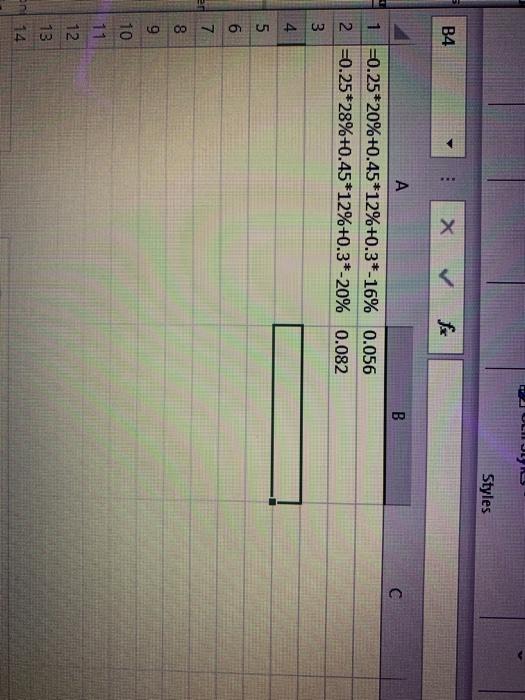

Ethan ovens a two-stock portfolic that invests in Celestial Crane Cosmetics Company (CCC) and Lumbering Ox Truckmakers (LOT). Three-quarters of Ethan's portfolio value consists of coc's shares, and the balance consists of LOT's shares, Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Market Condition Strong Normal Weak Probability of Occurrence 0.25 0.45 0.30 Celestial Crane Cosmetics 2094 129 -1696 Lumbering Ox Truckmakers 289 1696 -20 Calculate expected returns for the individual stocks in Ethan portfolio as well as the expected rate of return of the entire portfolio ove the three possible market conditions next year. The expected rate of return on Celestial Crane Cosmetics tocker the next year. The per te of return on Lumbang o Trockmaker stock over the next . The expected to secum on Ethan porta aver the res vara JULIULUI Styles B4 X B C A 1 =0.25*20%+0.45*12%+0.3*-16% 0.056 2 =0.25*28%+0.45*12%+0.3*-20% 0.082 3 4 5 6 7 8 9 10 11 12 13 14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started