Answered step by step

Verified Expert Solution

Question

1 Approved Answer

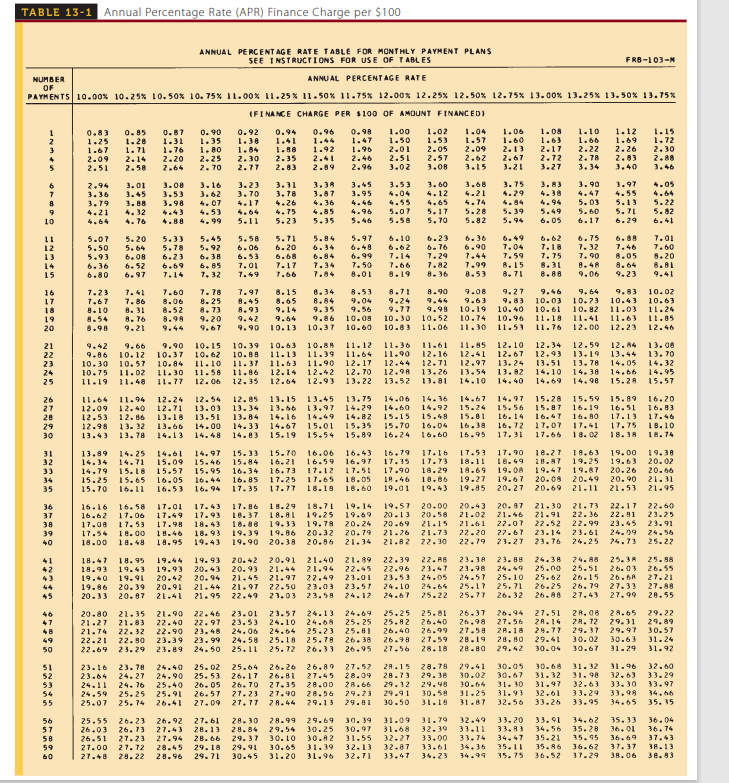

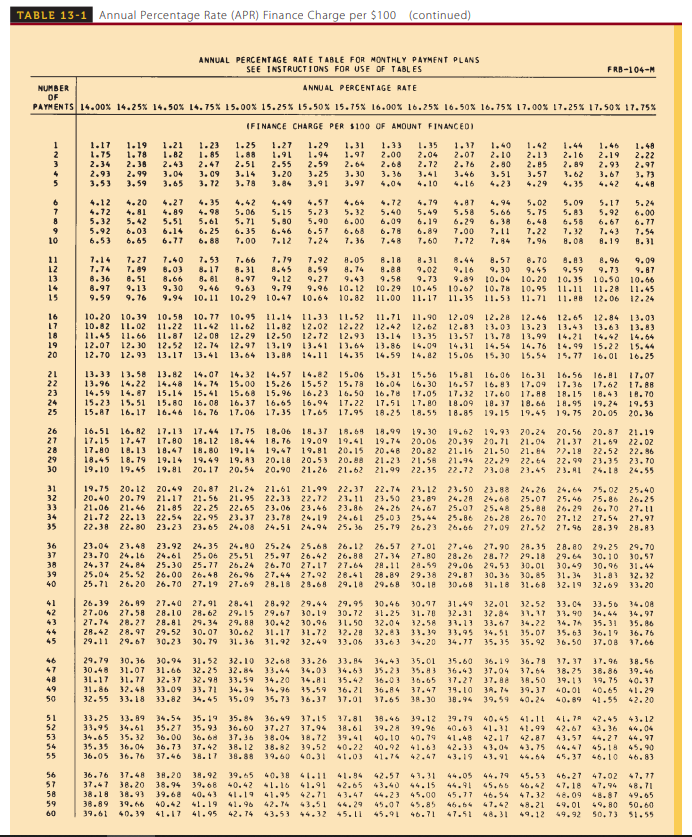

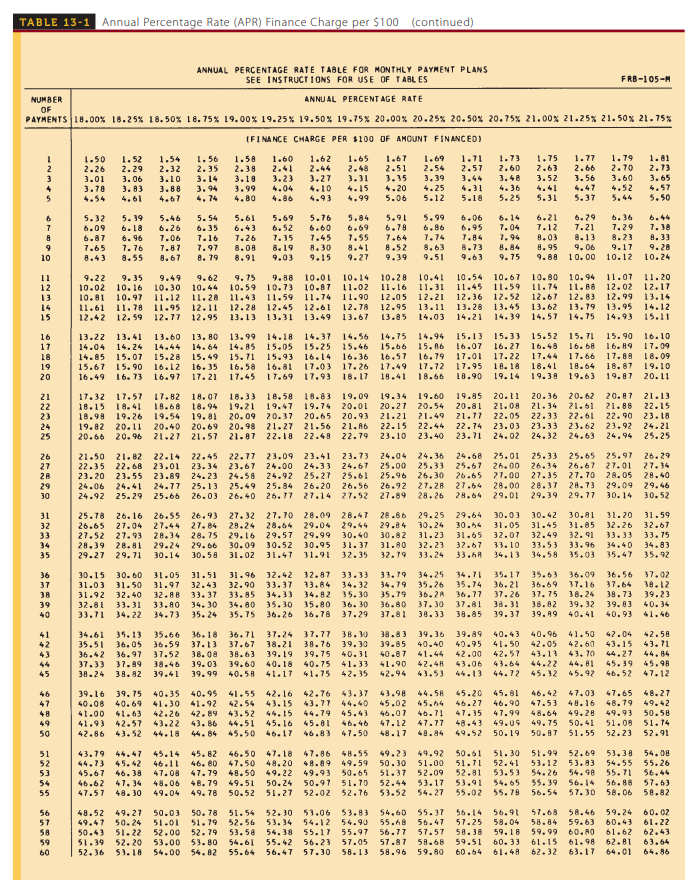

Calculate the finance charge (in $), the finance charge per $100 (in $), and the annual percentage rate for the installment loan by using the

|

|

Calculate the finance charge (in $), the finance charge per $100 (in $), and the annual percentage rate for the installment loan by using the APR table, Table 13-1. (Round dollar amounts to the nearest cent.)

| Amount Financed | Number of Payments | Monthly Payment | Finance Charge | Finance Charge per $100 | APR |

| $13,000 | 36 | $454.00 | $ | $ | % |

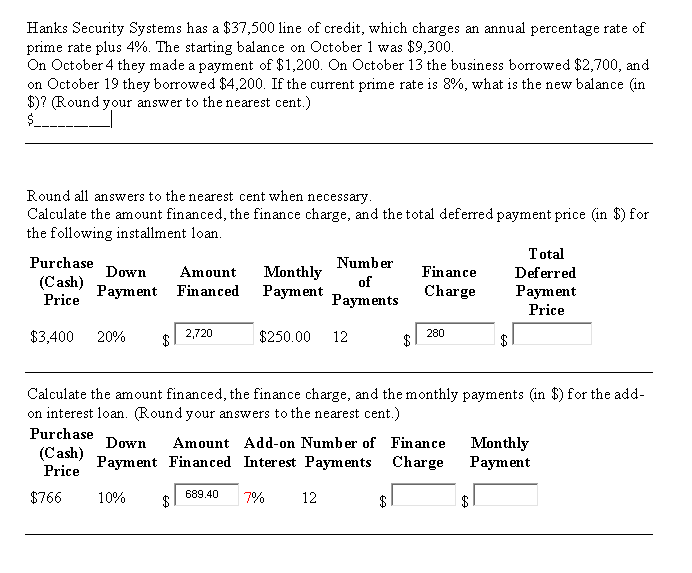

Hanks Security Systems has a $37,500 line of credit, which charges an annual percentage rate of prime rate plus 4%. The starting balance on October 1 was $9,300. On October 4 they made a payment of $1,200. On October 13 the business borrowed $2,700, and on October 19 they borrowed $4,200. If the current prime rate is 8%, what is the new balance (in $ )? (Round your answer to the nearest cent.) $ Round all answers to the nearest cent when necessary. Calculate the amount financed, the finance charge, and the total deferred payment price (in $ ) for the following installment loan. Calculate the amount financed, the finance charge, and the monthly payments (in $ ) for the addon interest loan. (Round your answers to the nearest cent.) Hanks Security Systems has a $37,500 line of credit, which charges an annual percentage rate of prime rate plus 4%. The starting balance on October 1 was $9,300. On October 4 they made a payment of $1,200. On October 13 the business borrowed $2,700, and on October 19 they borrowed $4,200. If the current prime rate is 8%, what is the new balance (in $ )? (Round your answer to the nearest cent.) $ Round all answers to the nearest cent when necessary. Calculate the amount financed, the finance charge, and the total deferred payment price (in $ ) for the following installment loan. Calculate the amount financed, the finance charge, and the monthly payments (in $ ) for the addon interest loan. (Round your answers to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started