Answered step by step

Verified Expert Solution

Question

1 Approved Answer

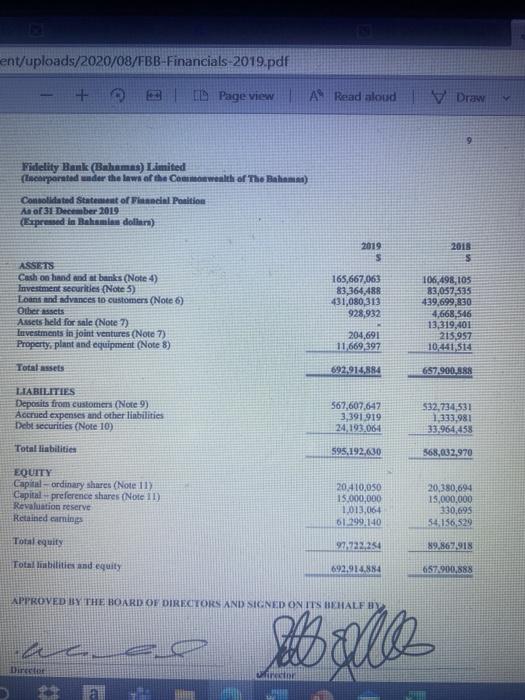

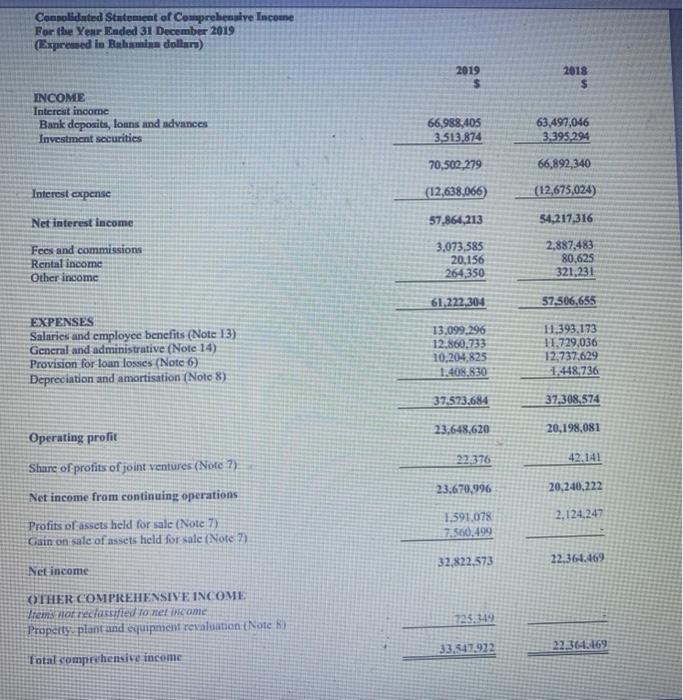

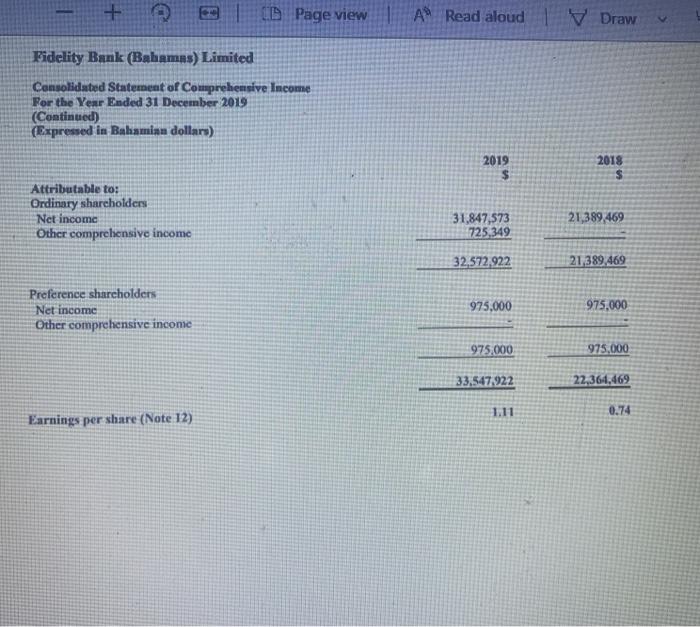

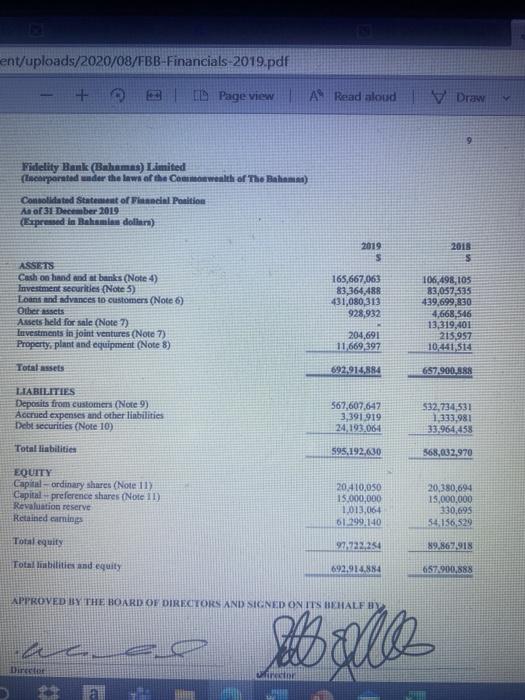

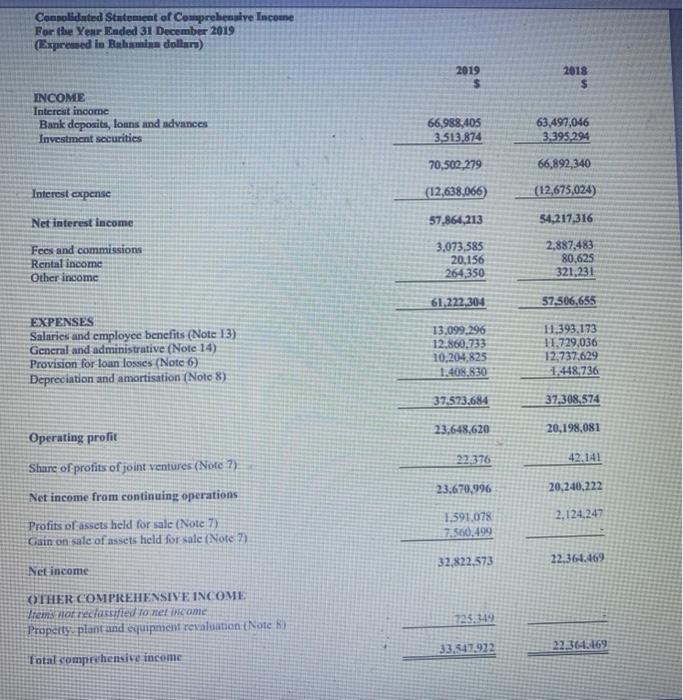

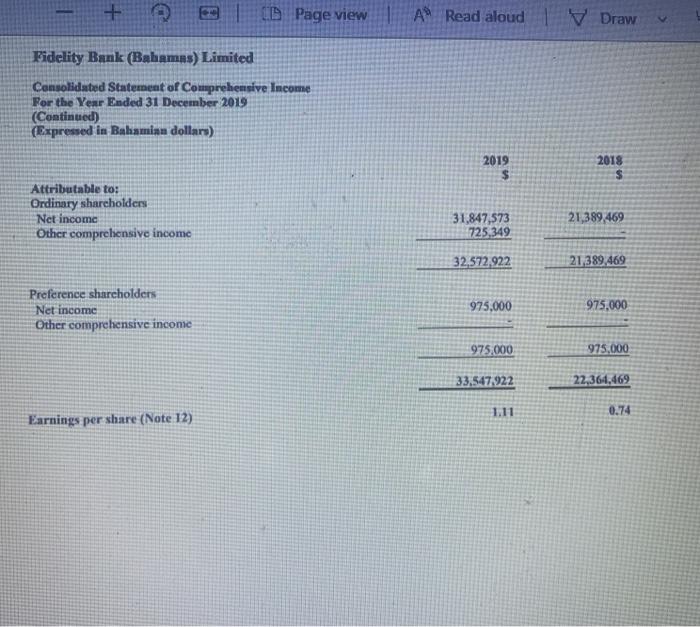

calculate the following and explain the banks' 1. quick ratio 2. inventory turn over 3.days sales outstanding 4.total asset turnover 5debt managment ent/uploads/2020/08/FBB-Financials 2019.pdf +

calculate the following and explain the banks'

ent/uploads/2020/08/FBB-Financials 2019.pdf + IL Page view A Read aloud Draw v 9 Fidelity Bank (Bahamas) Limited (Incorporated under the laws of the Commonwealth of The Bahamas) Consolidated Statement of Financial Position A of 31 December 2019 (Simpressed in Bahamiam dollars) 2019 $ 2015 s ASSETS Cash on hand and st banks (Note 4) Investment securities (Note 5) Loons and advances to customers (Note 6) Other Assets Assets held for sale (Note 7) Investments in joint ventures (Note 7) Property, plant and equipment (Note 8) 165,667,063 83,364,488 431,080,313 928 932 106,498,105 83,057,535 439,699,830 4,668,546 13,319,401 215,957 10,441,514 204,691 11669397 Total Assets 692.914,884 657.900. LIABILITIES Deposits from customers (Note 9) Accrued expenses and other liabilities Debt securities (Note 10) 567,607.647 3,391.919 24,193.060 $32,734,531 1.333,981 33,964,458 Total liabilities 595.192,630 568,032,970 EQUITY Capital - ordinary shares (Note 11) Capital preference shares (Note 11) Revaluation reserve Retained earning 20 410,050 15,000,000 1.013,064 61.299,140 20,380,694 15,000,000 330,695 54 156,529 Total equity 97,722,254 89.867,918 Total liabilities and equity 692,914884 657,900,888 APPROVED BY THE BOARD OF DIRECTORS AND SIGNED ON ITS BEHALF Abello Direct + CD Page view A Read aloud V Draw Fidelity Bank (Bahamas) Limited Consolidated Statement of Comprehensive Income For the Year Ended 31 December 2019 (Continued) (Expressed in Bahamian dollars) 2019 2018 $ Attributable to: Ordinary shareholders Net income Other comprehensive income 21,389,469 31,847,573 725,349 32,572,922 21 389,469 Preference sharcholders Net income Other comprehensive income 975,000 975,000 975.000 975,000 33,547.222 22,364,469 1.11 0.74 Earnings per share (Note 12) ent/uploads/2020/08/FBB-Financials 2019.pdf + IL Page view A Read aloud Draw v 9 Fidelity Bank (Bahamas) Limited (Incorporated under the laws of the Commonwealth of The Bahamas) Consolidated Statement of Financial Position A of 31 December 2019 (Simpressed in Bahamiam dollars) 2019 $ 2015 s ASSETS Cash on hand and st banks (Note 4) Investment securities (Note 5) Loons and advances to customers (Note 6) Other Assets Assets held for sale (Note 7) Investments in joint ventures (Note 7) Property, plant and equipment (Note 8) 165,667,063 83,364,488 431,080,313 928 932 106,498,105 83,057,535 439,699,830 4,668,546 13,319,401 215,957 10,441,514 204,691 11669397 Total Assets 692.914,884 657.900. LIABILITIES Deposits from customers (Note 9) Accrued expenses and other liabilities Debt securities (Note 10) 567,607.647 3,391.919 24,193.060 $32,734,531 1.333,981 33,964,458 Total liabilities 595.192,630 568,032,970 EQUITY Capital - ordinary shares (Note 11) Capital preference shares (Note 11) Revaluation reserve Retained earning 20 410,050 15,000,000 1.013,064 61.299,140 20,380,694 15,000,000 330,695 54 156,529 Total equity 97,722,254 89.867,918 Total liabilities and equity 692,914884 657,900,888 APPROVED BY THE BOARD OF DIRECTORS AND SIGNED ON ITS BEHALF Abello Direct + CD Page view A Read aloud V Draw Fidelity Bank (Bahamas) Limited Consolidated Statement of Comprehensive Income For the Year Ended 31 December 2019 (Continued) (Expressed in Bahamian dollars) 2019 2018 $ Attributable to: Ordinary shareholders Net income Other comprehensive income 21,389,469 31,847,573 725,349 32,572,922 21 389,469 Preference sharcholders Net income Other comprehensive income 975,000 975,000 975.000 975,000 33,547.222 22,364,469 1.11 0.74 Earnings per share (Note 12) 1. quick ratio

2. inventory turn over

3.days sales outstanding

4.total asset turnover

5debt managment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started