Calculate the following debt and asset management ratios for 2020: a) total asset turnover, b) debt to equity ratio.

Calculate the following debt and asset management ratios for 2020: a) total asset turnover, b) debt to equity ratio.

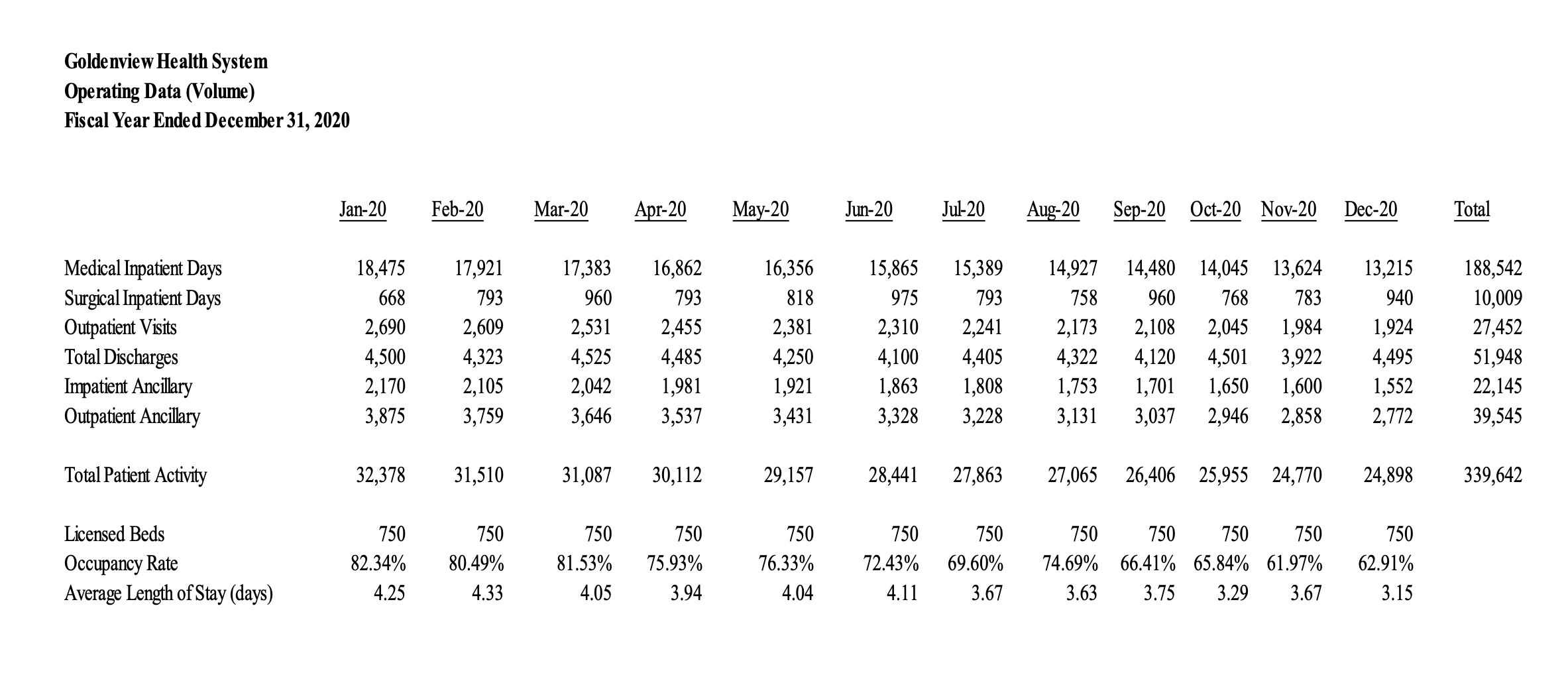

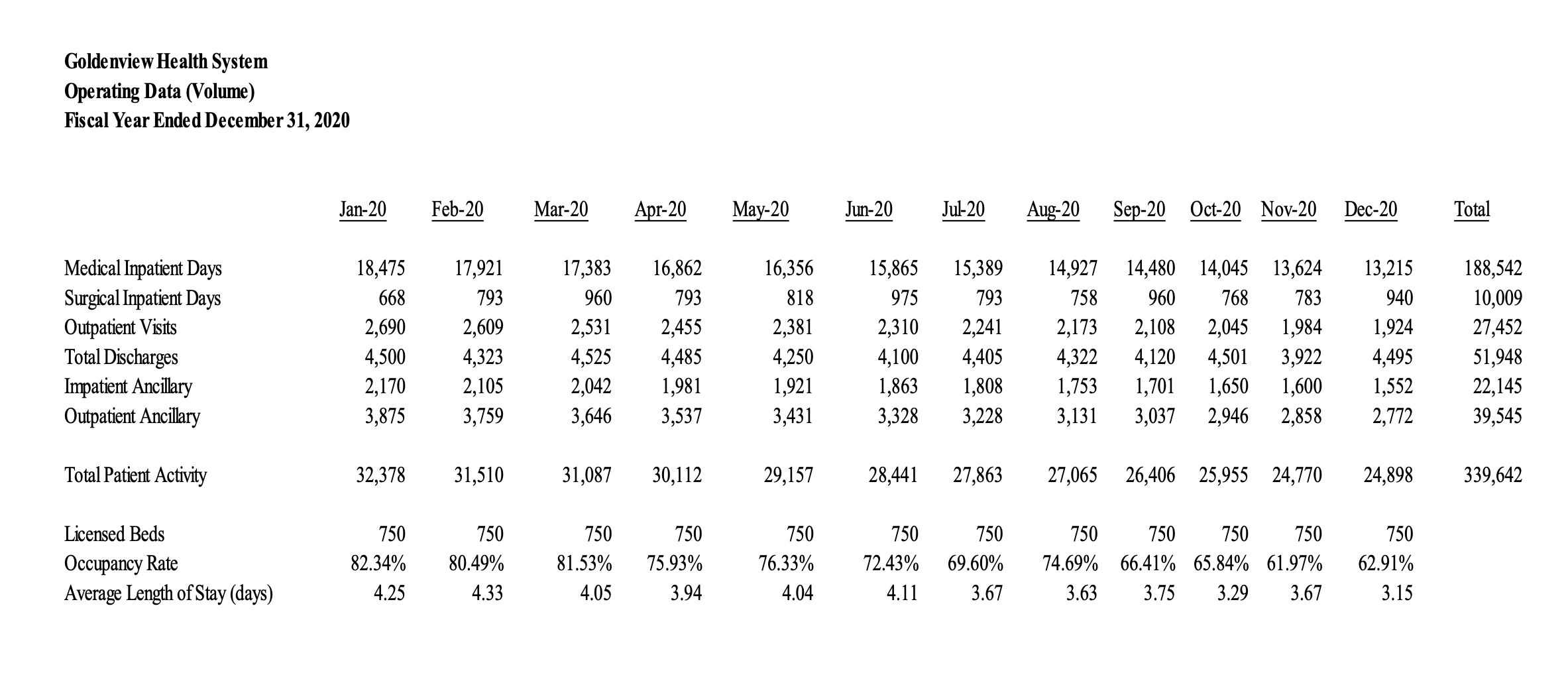

Goldenview Health System Operating Data (Volume) Fiscal Year Ended December 31, 2020 Medical Inpatient Days Surgical Inpatient Days Outpatient Visits Total Discharges Impatient Ancillary Outpatient Ancillary Total Patient Activity Licensed Beds Occupancy Rate Average Length of Stay (days) Jan-20 18,475 668 2,690 4,500 2,170 3,875 32,378 750 82.34% 4.25 Feb-20 17,921 793 2,609 4,323 2,105 3,759 31,510 750 80.49% 4.33 Mar-20 17,383 960 2,531 4,525 2,042 3,646 Apr-20 May-20 750 81.53% 4.05 16,862 793 2,455 4,485 1,981 3,537 31,087 30,112 750 75.93% 3.94 16,356 818 2,381 4,250 1,921 3,431 29,157 750 76.33% 4.04 Jun-20 15,865 975 2,310 4,100 1,863 3,328 Jul-20 15,389 793 2,241 4,405 1,808 3,228 28,441 27,863 750 750 72.43% 69.60% 4.11 3.67 Aug-20 Sep-20 Oct-20 Nov-20 14,927 14,480 14,045 13,624 13,215 783 758 960 768 940 2,173 2,108 2,045 1,984 1,924 4,322 4,120 4,501 3,922 4,495 1,753 1,701 1,650 1,600 1,552 3,131 3,037 2,946 2,858 2,772 27,065 26,406 25,955 24,770 Dec-20 750 750 750 750 74.69% 66.41% 65.84% 61.97% 3.63 3.75 3.29 3.67 24,898 750 62.91% 3.15 Total 188,542 10,009 27,452 51,948 22,145 39,545 339,642 Goldenview Health System Operating Data (Volume) Fiscal Year Ended December 31, 2020 Medical Inpatient Days Surgical Inpatient Days Outpatient Visits Total Discharges Impatient Ancillary Outpatient Ancillary Total Patient Activity Licensed Beds Occupancy Rate Average Length of Stay (days) Jan-20 18,475 668 2,690 4,500 2,170 3,875 32,378 750 82.34% 4.25 Feb-20 17,921 793 2,609 4,323 2,105 3,759 31,510 750 80.49% 4.33 Mar-20 17,383 960 2,531 4,525 2,042 3,646 Apr-20 May-20 750 81.53% 4.05 16,862 793 2,455 4,485 1,981 3,537 31,087 30,112 750 75.93% 3.94 16,356 818 2,381 4,250 1,921 3,431 29,157 750 76.33% 4.04 Jun-20 15,865 975 2,310 4,100 1,863 3,328 Jul-20 15,389 793 2,241 4,405 1,808 3,228 28,441 27,863 750 750 72.43% 69.60% 4.11 3.67 Aug-20 Sep-20 Oct-20 Nov-20 14,927 14,480 14,045 13,624 13,215 783 758 960 768 940 2,173 2,108 2,045 1,984 1,924 4,322 4,120 4,501 3,922 4,495 1,753 1,701 1,650 1,600 1,552 3,131 3,037 2,946 2,858 2,772 27,065 26,406 25,955 24,770 Dec-20 750 750 750 750 74.69% 66.41% 65.84% 61.97% 3.63 3.75 3.29 3.67 24,898 750 62.91% 3.15 Total 188,542 10,009 27,452 51,948 22,145 39,545 339,642

Calculate the following debt and asset management ratios for 2020: a) total asset turnover, b) debt to equity ratio.

Calculate the following debt and asset management ratios for 2020: a) total asset turnover, b) debt to equity ratio.