Answered step by step

Verified Expert Solution

Question

1 Approved Answer

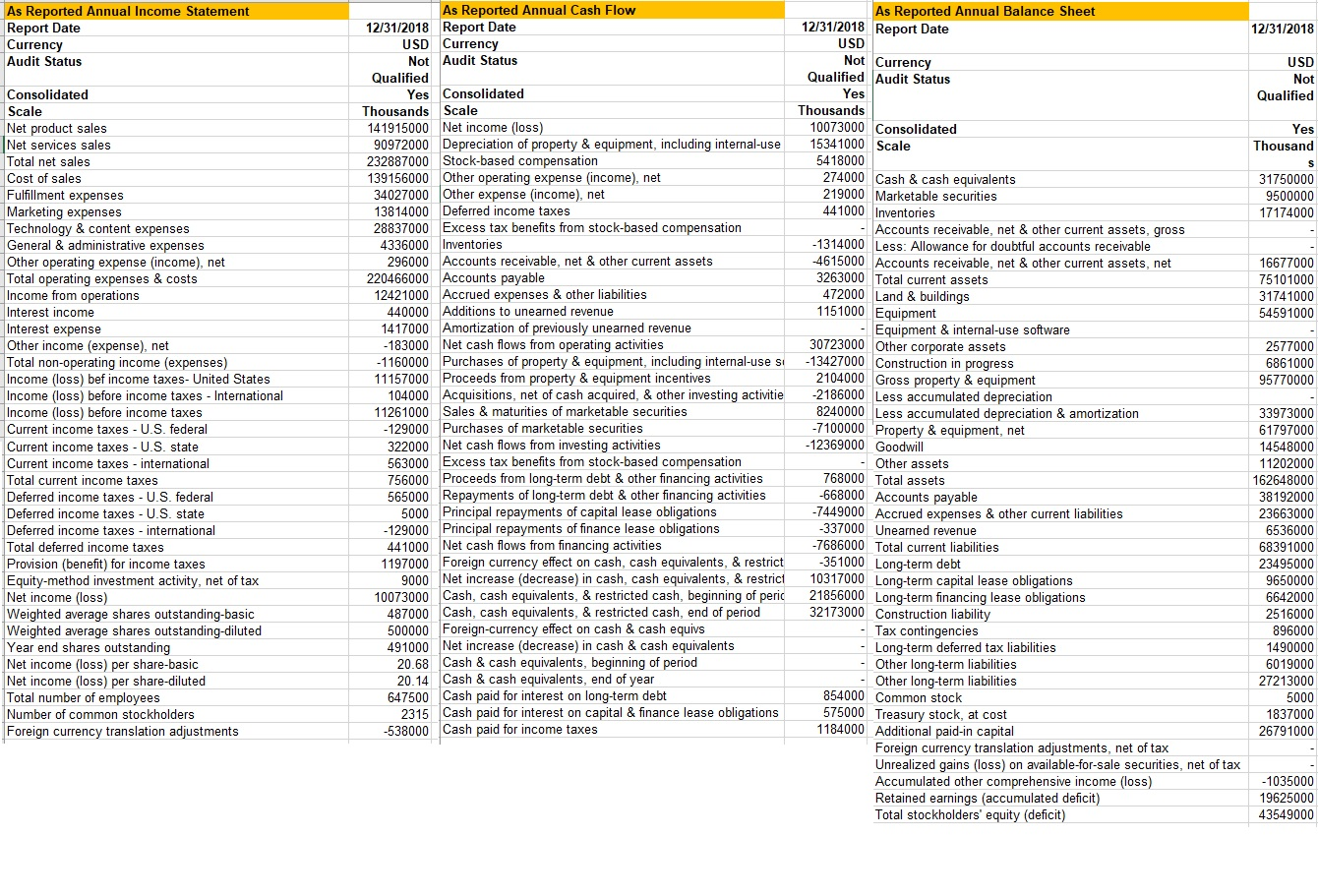

calculate the following financial indicators Current Ratio Debt/Equity Ratio Free Cash Flow Earnings per Share Price/Earnings Ratio Return on Equity Net Profit Margin As Reported

calculate the following financial indicators

Current Ratio Debt/Equity Ratio Free Cash Flow Earnings per Share Price/Earnings Ratio Return on Equity Net Profit Margin

As Reported Annual Income Statement Report Date Currency Audit Status Consolidated Scale Net product sales Net services sales Total net sales Cost of sales Fulfillment expenses Marketing expenses Technology & content expenses General & administrative expenses Other operating expense (income), net Total operating expenses & costs Income from operations Interest income Interest expense Other income (expense), net Total non-operating income (expenses) Income (loss) bef income taxes- United States Income (loss) before income taxes - International Income (loss) before income taxes Current income taxes - U.S. federal Current income taxes - U.S. state Current income taxes - international Total current income taxes Deferred income taxes - U.S. federal Deferred income taxes - U.S. state Deferred income taxes - international Total deferred income taxes Provision (benefit) for income taxes Equity-method investment activity, net of tax Net income (loss) Weighted average shares outstanding-basic Weighted average shares outstanding-diluted Year end shares outstanding Net income (loss) per share-basic Net income (loss) per share-diluted Total number of employees Number of common stockholders Foreign currency translation adjustments As Reported Annual Cash Flow 12/31/2018 Report Date USD Currency Not Audit Status Qualified Yes Consolidated Thousands Scale 141915000 Net income (loss) 90972000 Depreciation of property & equipment, including internal-use 232887000 Stock-based compensation 139156000 Other operating expense (income), net 34027000 Other expense (income), net 13814000 Deferred income taxes 28837000 Excess tax benefits from stock-based compensation 4336000 Inventories 296000 Accounts receivable, net & other current assets 220466000 Accounts payable 12421000 Accrued expenses & other liabilities 440000 Additions to unearned revenue 1417000 Amortization of previously unearned revenue -183000 Net cash flows from operating activities - 1160000 Purchases of property & equipment, including internal-use si 11157000 Proceeds from property & equipment incentives 104000 Acquisitions, net of cash acquired, & other investing activitie 11261000 Sales & maturities of marketable securities - 129000 Purchases of marketable securities 322000 Net cash flows from investing activities 563000 Excess tax benefits from stock-based compensation 756000 Proceeds from long-term debt & other financing activities 565000 Repayments of long-term debt & other financing activities 5000 Principal repayments of capital lease obligations -129000 Principal repayments of finance lease obligations 441000 Net cash flows from financing activities 1197000 Foreign currency effect on cash, cash equivalents, & restrict 9000 Net increase (decrease) in cash, cash equivalents, & restrict 10073000 Cash, cash equivalents, & restricted cash, beginning of peric 487000 Cash, cash equivalents, & restricted cash, end of period 500000 Foreign-currency effect on cash & cash equivs 491000 Net increase (decrease) in cash & cash equivalents 20.68 Cash & cash equivalents, beginning of period 20.14 Cash & cash equivalents, end of year 647500 Cash paid for interest on long-term debt 2315 Cash paid for interest on capital & finance lease obligations -538000 Cash paid for income taxes As Reported Annual Balance Sheet 12/31/2018 Report Date 12/31/2018 USD Not Currency USD Qualified Audit Status Not Yes Qualified Thousands 10073000 Consolidated Yes 15341000 Scale Thousand 5418000 S 274000 Cash & cash equivalents 31750000 219000 Marketable securities 9500000 441000 Inventories 17174000 - Accounts receivable, net & other current assets, gross -1314000 Less: Allowance for doubtful accounts receivable -4615000 Accounts receivable, net & other current assets, net 16677000 3263000 Total current assets 75101000 472000 Land & buildings 31741000 1151000 Equipment 54591000 Equipment & internal-use software 30723000 Other corporate assets 2577000 -13427000 Construction in progress 6861000 2104000 Gross property & equipment 95770000 -2186000 Less accumulated depreciation 8240000 Less accumulated depreciation & amortization 33973000 -7100000 Property & equipment, net 61797000 -12369000 Goodwill 14548000 - Other assets 11202000 768000 Total assets 162648000 -668000 Accounts payable 38192000 -7449000 Accrued expenses & other current liabilities 23663000 -337000 Unearned revenue 6536000 -7686000 Total current liabilities 68391000 -351000 Long-term debt 23495000 10317000 Long-term capital lease obligations 9650000 2 1856000 Long-term financing lease obligations 6642000 32173000 Construction liability 2516000 - Tax contingencies 896000 - Long-term deferred tax liabilities 1490000 - Other long-term liabilities 6019000 - Other long-term liabilities 27213000 854000 Common stock 5000 575000 Treasury stock, at cost 1837000 1184000 Additional paid-in capital 26791000 Foreign currency translation adjustments, net of tax Unrealized gains (loss) on available-for-sale securities, net of tax Accumulated other comprehensive income (loss) -1035000 Retained earnings (accumulated deficit) 19625000 Total stockholders' equity (deficit) 43549000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started