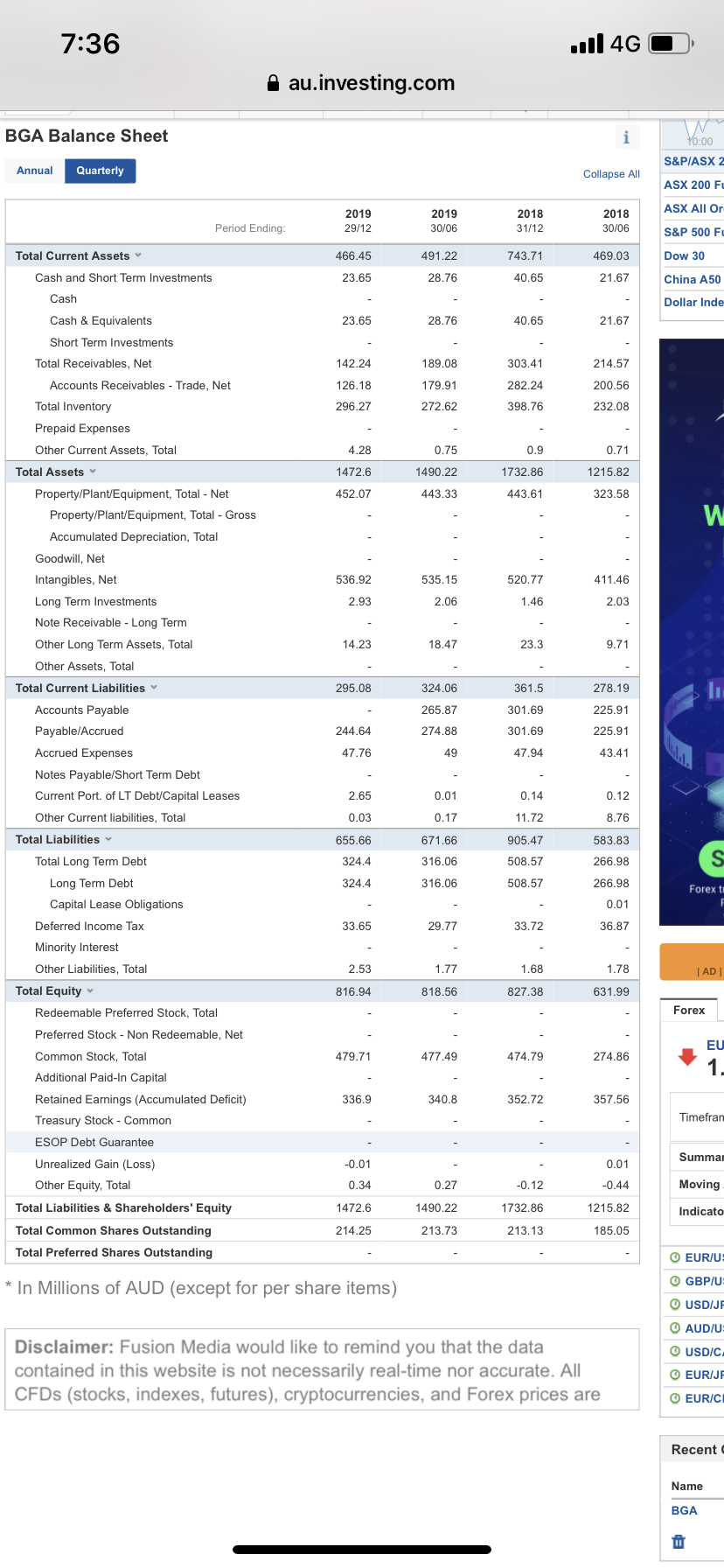

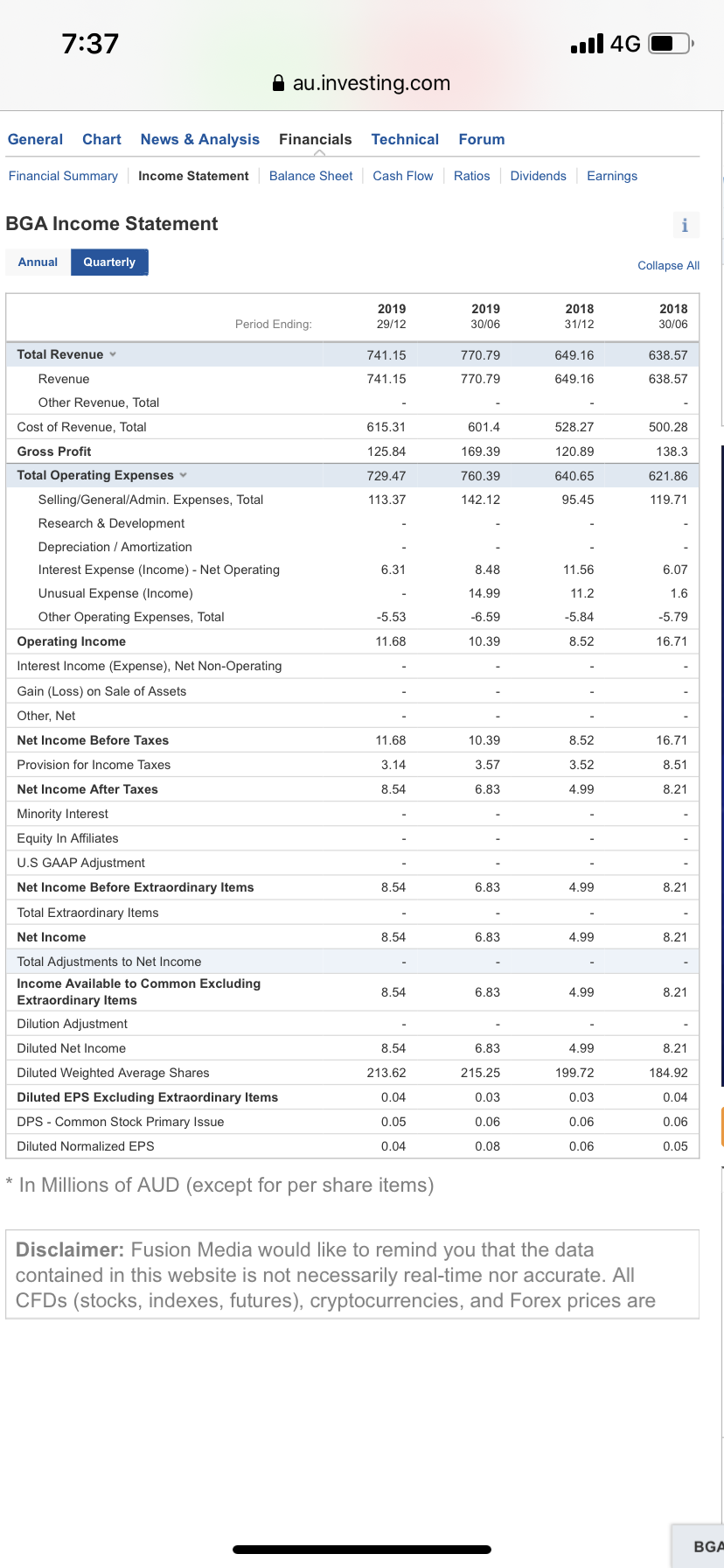

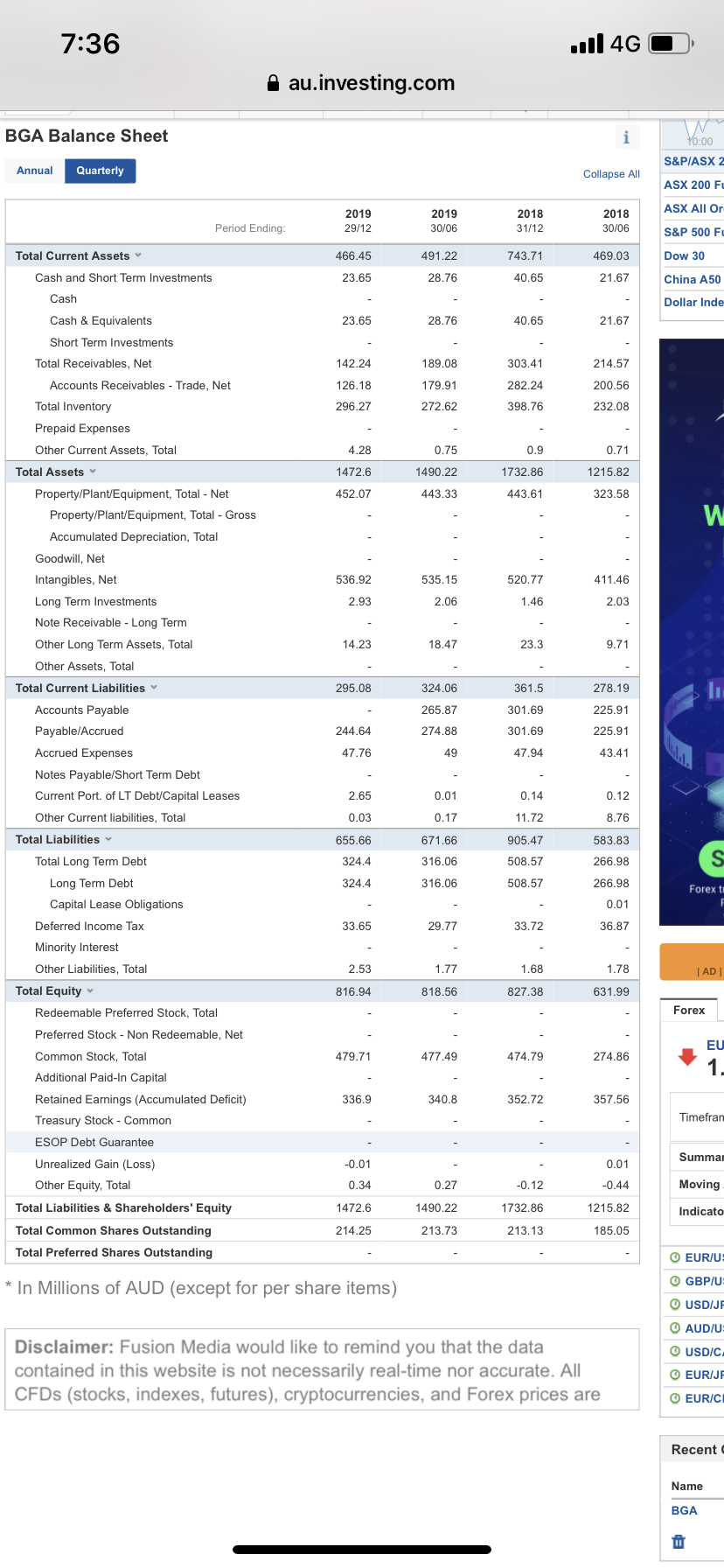

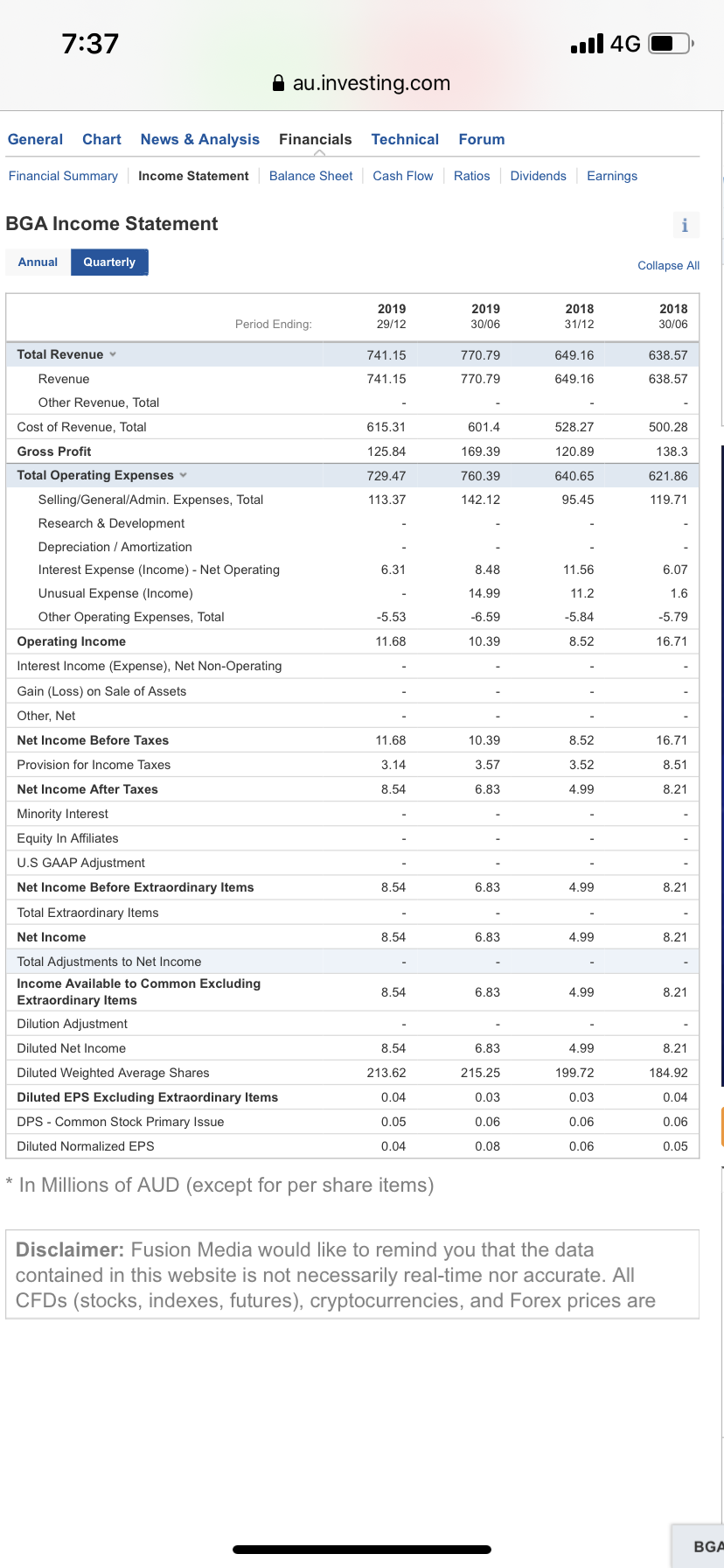

Calculate the following financial ratio from the given balance sheet and income statement for 2018 and 2019 :

1) Net Profit %

2) Inventory turnover (days)

3) Age of account receivable

4) Return on equity %

5) Current Ratio

6) Liquid Ratio

7) Return on assets %

8) Equity Ratio

7:36 100 4G O A au.investing.com BGA Balance Sheet Annual Quarterly Collapse All 10:00 S&PASX 2 ASX 200 Ft ASX All Or S&P 500 Ft 2019 29/12 2019 30/06 2018 31/12 2018 30/06 Period Ending: 466.45 23.65 491.22 28.76 743.71 40.65 469.03 21.67 Dow 30 China A50 Dollar Inde 23.65 28.76 40.65 21.67 142.24 189.08 303.41 126.18 296.27 179.91 272.62 282.24 398.76 214.57 200.56 232.08 4.28 0.75 0.9 1472.6 1490.22 1732.86 443.61 0.71 1215.82 323.58 452.07 443.33 536.92 2.93 535.15 2.06 520.77 1.46 411.46 2.03 Total Current Assets Cash and Short Term Investments Cash Cash & Equivalents Short Term Investments Total Receivables, Net Accounts Receivables - Trade, Net Total Inventory Prepaid Expenses Other Current Assets, Total Total Assets Property/Plant/Equipment, Total - Net Property/Plant/Equipment, Total - Gross Accumulated Depreciation, Total Goodwill, Net Intangibles, Net Long Term Investments Note Receivable - Long Term Other Long Term Assets, Total Other Assets, Total Total Current Liabilities Accounts Payable Payable/Accrued Accrued Expenses Notes Payable/Short Term Debt Current Port of LT Debt/Capital Leases Other Current liabilities, Total Total Liabilities Total Long Term Debt Long Term Debt Capital Lease Obligations Deferred Income Tax Minority Interest Other Liabilities, Total 14.23 18.47 23.3 9.71 295.08 324.06 265.87 274.88 361.5 301.69 301.69 278.19 225.91 225.91 244.64 47.76 47.94 43.41 2.65 0.03 0.01 0.17 0.14 11.72 0.12 8.76 671.66 905.47 583.83 655.66 324.4 324.4 266.98 316.06 316.06 508.57 508.57 Forex ti 266.98 0.01 36.87 33.65 29.77 33.72 I AD 2.53 816.94 1.77 818.56 1.68 827.38 1.78 631.99 Forex EU 479.71 477.49 474.79 274.86 336.9 340.8 352.72 357.56 Total Equity Redeemable Preferred Stock, Total Preferred Stock - Non Redeemable, Net Common Stock, Total Additional Paid-In Capital Retained Earnings (Accumulated Deficit) Treasury Stock - Common ESOP Debt Guarantee Unrealized Gain (Loss) Other Equity, Total Total Liabilities & Shareholders' Equity Total Common Shares Outstanding Total Preferred Shares Outstanding Timefran 0.01 Summar -0.01 0.34 Moving 0.27 1490.22 213.73 1472.6 214.25 -0.12 1732.86 213.13 -0.44 1215.82 185.05 Indicato * In Millions of AUD (except for per share items) O EUR/U: O GBP/U USD/JF AUD/U USDIC EUR/JE O EUR/CI Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures), cryptocurrencies, and Forex prices are Recent Name BGA 7:37 4G O au.investing.com General Chart News & Analysis Financials Technical Forum Financial Summary Income Statement Balance Sheet Cash Flow Ratios Dividends Earnings BGA Income Statement Annual Quarterly Collapse All 2019 29/12 2019 30/06 2018 31/12 2018 30/06 Period Ending: Total Revenue 770.79 638.57 741.15 741.15 649.16 649.16 770.79 638.57 601.4 528.27 500.28 615.31 125.84 729.47 113.37 169.39 760.39 142.12 120.89 640.65 95.45 138.3 621.86 119.71 6.31 8.48 6.07 11.56 11.2 14.99 -6.59 10.39 1.6 -5.79 -5.53 11.68 -5.84 8.52 16.71 8.52 16.71 Revenue Other Revenue, Total Cost of Revenue, Total Gross Profit Total Operating Expenses Selling/General/Admin. Expenses, Total Research & Development Depreciation / Amortization Interest Expense (Income) - Net Operating Unusual Expense (Income) Other Operating Expenses, Total Operating Income Interest Income (Expense), Net Non-Operating Gain (Loss) on Sale of Assets Other, Net Net Income Before Taxes Provision for Income Taxes Net Income After Taxes Minority Interest Equity In Affiliates U.S GAAP Adjustment Net Income Before Extraordinary Items Total Extraordinary Items Net Income Total Adjustments to Net Income Income Available to Common Excluding Extraordinary Items Dilution Adjustment Diluted Net Income Diluted Weighted Average Shares Diluted EPS Excluding Extraordinary Items DPS - Common Stock Primary Issue Diluted Normalized EPS 11.68 3.14 8.54 10.39 3.57 6.83 3.52 8.51 4.99 8.21 8.54 6.83 4.99 8.21 8.54 6.83 4.99 8.21 8.54 6.83 4.99 8.21 4.99 8.21 8.54 213.62 6.83 215.25 199.72 184.92 0.04 0.05 0.04 0.03 0.06 0.08 0.03 0.06 0.06 0.04 0.06 0.05 * In Millions of AUD (except for per share items) Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures), cryptocurrencies, and Forex prices are BGA