Answered step by step

Verified Expert Solution

Question

1 Approved Answer

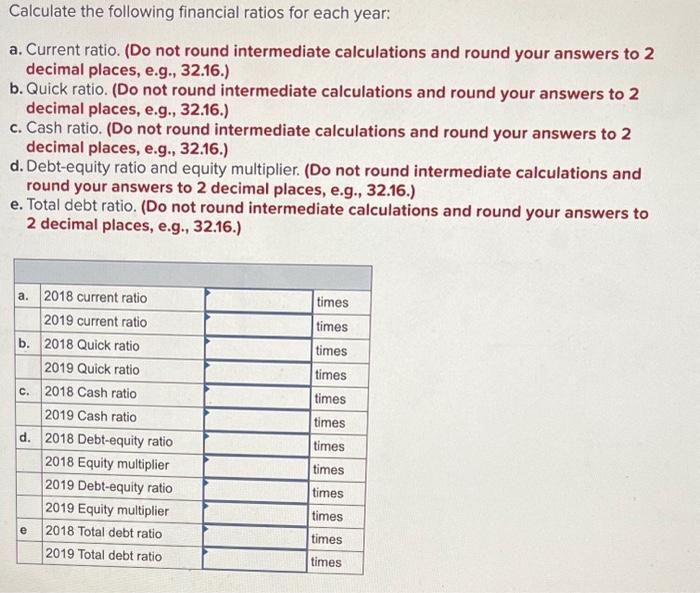

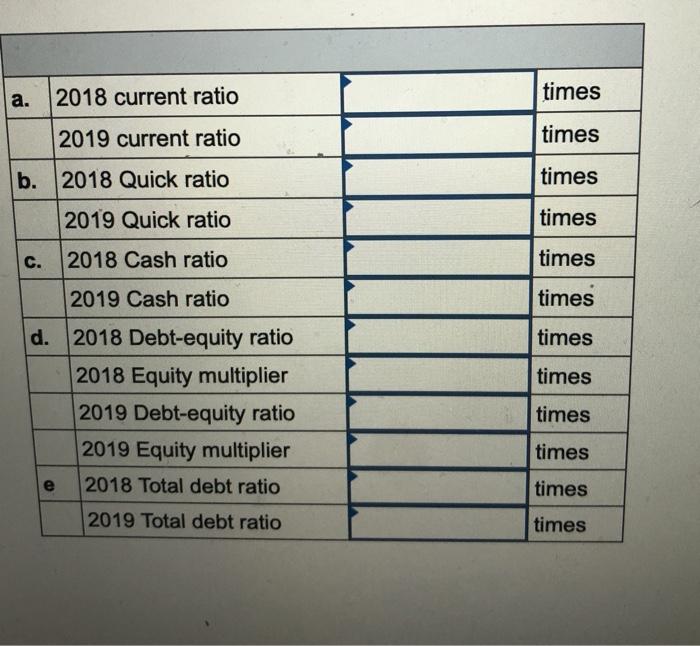

Calculate the following financial ratios for each year: a. Current ratio. (Do not round intermediate calculations and round your answers to 2 decimal places,

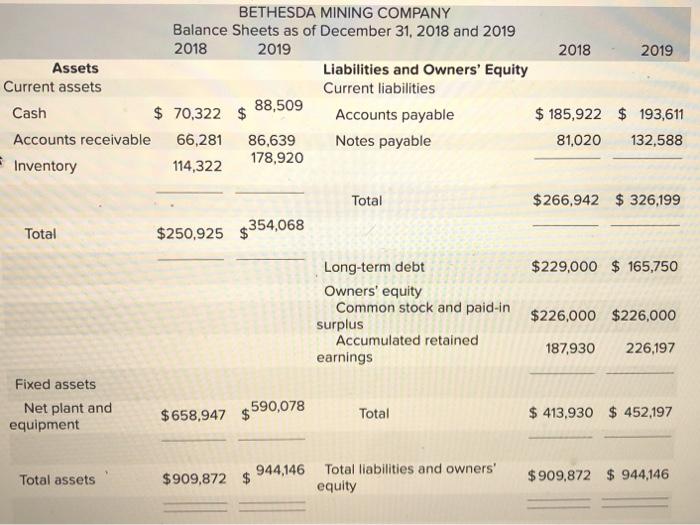

Calculate the following financial ratios for each year: a. Current ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Quick ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Cash ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. Debt-equity ratio and equity multiplier. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) e. Total debt ratio. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. 2018 current ratio 2019 current ratio b. 2018 Quick ratio 2019 Quick ratio c. 2018 Cash ratio 2019 Cash ratio d. 2018 Debt-equity ratio 2018 Equity multiplier 2019 Debt-equity ratio e 2019 Equity multiplier 2018 Total debt ratio 2019 Total debt ratio times times times times times times times times times times times times Assets Current assets Cash 88,509 $70,322 $ Accounts receivable 66,281 86,639 178,920 Inventory 114,322 Total Fixed assets Net plant and equipment BETHESDA MINING COMPANY Balance Sheets as of December 31, 2018 and 2019 2018 2019 Total assets $250,925 $354,068 $658,947 $909,872 590,078 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock and paid-in Accumulated retained surplus earnings Total 944,146 Total liabilities and owners' equity 2018 2019 $185,922 $ 193,611 81,020 132,588 $266,942 $326,199 $229,000 $ 165,750 $226,000 $226,000 187,930 226,197 $413,930 $ 452,197 $909,872 $ 944,146 2018 current ratio 2019 current ratio b. 2018 Quick ratio 2019 Quick ratio 2018 Cash ratio 2019 Cash ratio d. 2018 Debt-equity ratio 2018 Equity multiplier 2019 Debt-equity ratio 2019 Equity multiplier 2018 Total debt ratio 2019 Total debt ratio a. C. e times times times times times times times times times times times times

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Lets go through each of the financial ratios requested and calculate them using the information provided in the balance sheets for the years 2018 and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started