Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the following financial ratios of the company based on the income statement and balance sheet attached below: 1) Debt Ratio 2) Return on sales

Calculate the following financial ratios of the company based on the income statement and balance sheet attached below:

1) Debt Ratio

2) Return on sales

3) Price to Earnings ratio

NOTE:

Interpret each ratios

Interpret each ratios

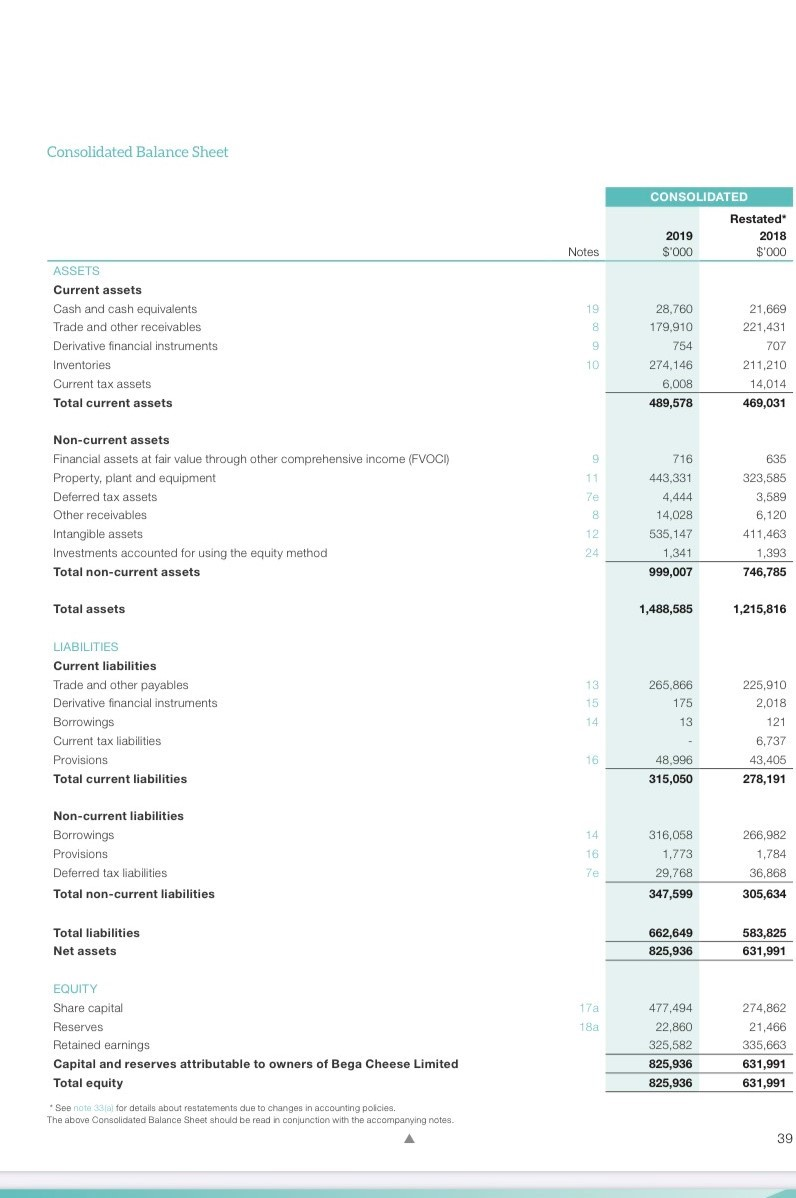

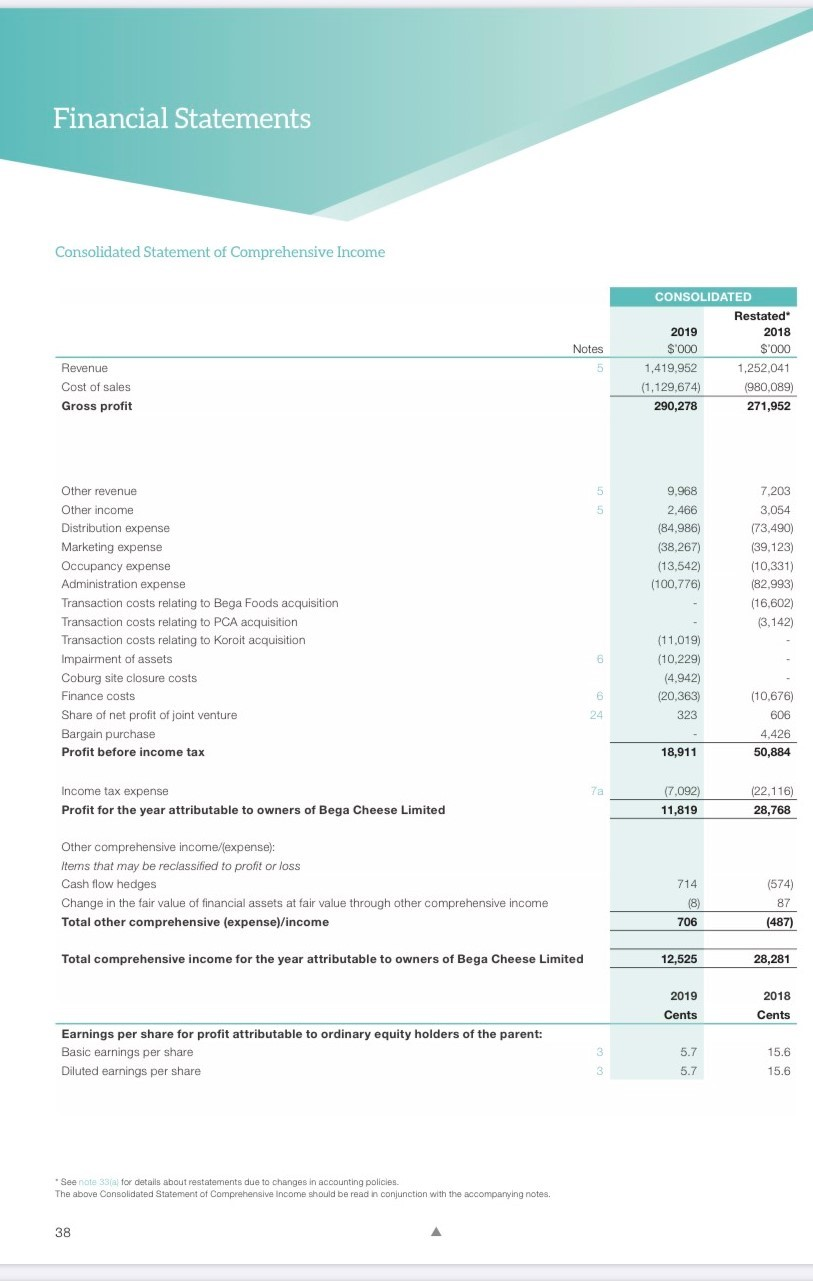

Consolidated Balance Sheet CONSOLIDATED 2019 S'000 Restated 2018 $'000 Notes ASSETS Current assets Cash and cash equivalents Trade and other receivables Derivative financial instruments Inventories Current tax assets Total current assets 19 8 9 28,760 179,910 754 274,146 6,008 489,578 21,669 221,431 707 211,210 14,014 469,031 10 9 11 Non-current assets Financial assets at fair value through other comprehensive income (FVOCI) Property, plant and equipment Deferred tax assets Other receivables Intangible assets Investments accounted for using the equity method Total non-current assets 8 716 443,331 4.444 14,028 535,147 1,341 999,007 635 323,585 3,589 6,120 411,463 1,393 746,785 12 24 Total assets 1,488,585 1,215,816 13 15 265,866 175 LIABILITIES Current liabilities Trade and other payables Derivative financial instruments Borrowings Current tax liabilities Provisions Total current liabilities 14 13 225,910 2,018 121 6,737 43,405 278,191 16 48,996 315,050 14 Non-current liabilities Borrowings Provisions Deferred tax liabilities Total non-current liabilities 16 316,058 1,773 29,768 266,982 1,784 36,868 305,634 347,599 Total liabilities Net assets 662,649 825,936 583,825 631,991 17a 18a EQUITY Share capital Reserves Retained earnings Capital and reserves attributable to owners of Bega Cheese Limited Total equity 477,494 22,860 325,582 825,936 825,936 274,862 21,466 335,663 631,991 631,991 * See note 33 al for details about restatements due to changes in accounting policies. The above Consolidated Balance Sheet should be read in conjunction with the accompanying notes. 39 Financial Statements Consolidated Statement of Comprehensive Income Notes CONSOLIDATED Restated 2019 2018 S'000 S'000 1,419,952 1,252,041 (1,129,674) (980,089) 290,278 271,952 5 Revenue Cost of sales Gross profit 5 5 9.968 2,466 (84,986) (38,267) (13,542) (100,776) Other revenue Other income Distribution expense Marketing expense Occupancy expense Administration expense Transaction costs relating to Bega Foods acquisition Transaction costs relating to PCA acquisition Transaction costs relating to Koroit acquisition Impairment of assets Coburg site closure costs Finance costs Share of net profit of joint venture Bargain purchase Profit before income tax 7,203 3,054 (73,490) (39,123) (10,331) (82.993) (16,602) (3,142) (11,019) (10,229) (4.942) (20,363) 6 24 323 (10,676) 606 4,426 50,884 18,911 7a Income tax expense Profit for the year attributable to owners of Bega Cheese Limited (7,092) 11,819 (22.116) 28,768 Other comprehensive income/expense): Items that may be reclassified to profit or loss Cash flow hedges Change in the fair value of financial assets at fair value through other comprehensive income Total other comprehensive (expense)/income (574) 714 (8) 87 706 (487) Total comprehensive income for the year attributable to owners of Bega Cheese Limited 12,525 28,281 2018 2019 Cents Cents Earnings per share for profit attributable to ordinary equity holders of the parent: Basic earnings per share Diluted earnings per share 3 3 5.7 5.7 15.6 15.6 * See note 3 al for details about restatements due to changes in accounting policies The above Consolidated Statement of Comprehensive Income should be read in conjunction with the accompanying notes. 38

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started