Answered step by step

Verified Expert Solution

Question

1 Approved Answer

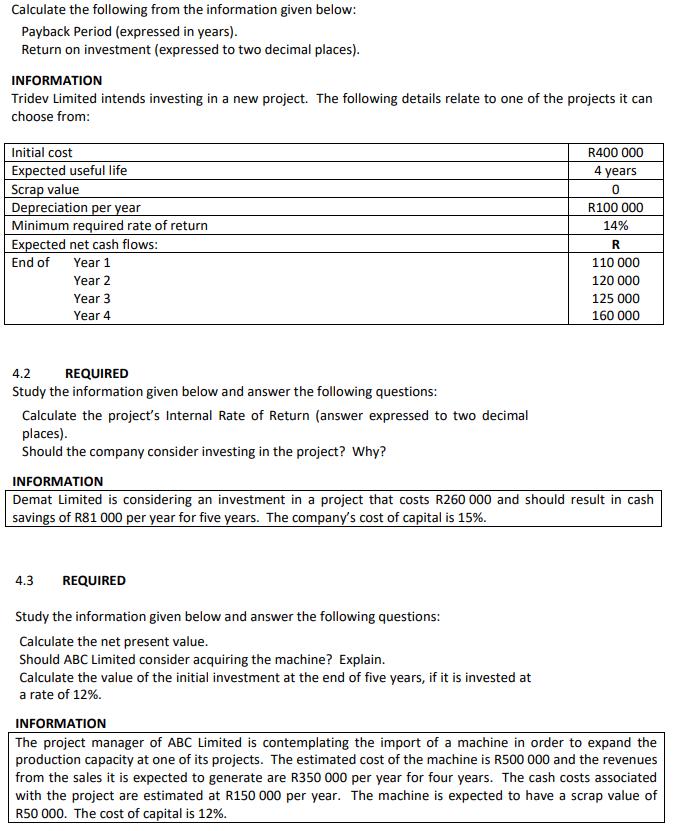

Calculate the following from the information given below: Payback Period (expressed in years). Return on investment (expressed to two decimal places). INFORMATION Tridev Limited

Calculate the following from the information given below: Payback Period (expressed in years). Return on investment (expressed to two decimal places). INFORMATION Tridev Limited intends investing in a new project. The following details relate to one of the projects it can choose from: R400 000 4 years Initial cost Expected useful life Scrap value Depreciation per year Minimum required rate of return Expected net cash flows: R100 000 14% R End of Year 1 110 000 Year 2 120 000 Year 3 125 000 Year 4 160 000 4.2 REQUIRED Study the information given below and answer the following questions: Calculate the project's Internal Rate of Return (answer expressed to two decimal places). Should the company consider investing in the project? Why? INFORMATION Demat Limited is considering an investment in a project that costs R260 000 and should result in cash savings of R81 000 per year for five years. The company's cost of capital is 15%. 4.3 REQUIRED Study the information given below and answer the following questions: Calculate the net present value. Should ABC Limited consider acquiring the machine? Explain. Calculate the value of the initial investment at the end of five years, if it is invested at a rate of 12%. INFORMATION The project manager of ABC Limited is contemplating the import of a machine in order to expand the production capacity at one of its projects. The estimated cost of the machine is RS00 000 and the revenues from the sales it is expected to generate are R350 000 per year for four years. The cash costs associated with the project are estimated at R150 000 per year. The machine is expected to have a scrap value of R50 000. The cost of capital is 12%.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Computation of NPV and IRR and payaback period Cumulative PVF PV of cash Year Cash Flows PV...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started