Question

Calculate the following ratios and analyze your results for the years 2018 (replacing net sales with net interest income if desired) Liquidity Ratios 1. Account

Calculate the following ratios and analyze your results for the years 2018 (replacing net sales with net interest income if desired)

Liquidity Ratios

1. Account Receivable Turnover

2. Working Capital

3. Current Ratio

4. Acid-Test Ratio

5. Cash Ratio

6. Interest Revenue to Working Capital

Profitability Ratios

1. Return on Assets

2. Return on Equity

3. Return on Investment

4. Return on Common Equity

Investor and Market Ratios

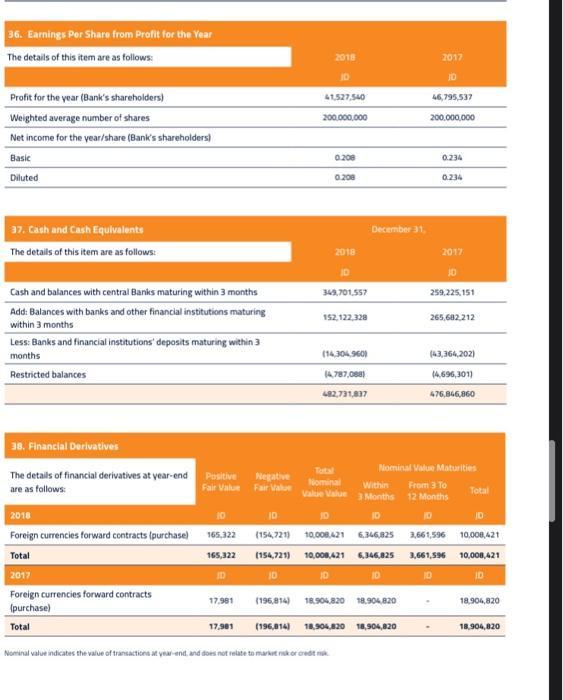

1. Earnings Per Share

2. Book Value per Share

3. Earning Yield (EPS/MARKETVALUE)

4. Price-to-Book Ratio (Price value/Book value Per Share)

Activity Ratios

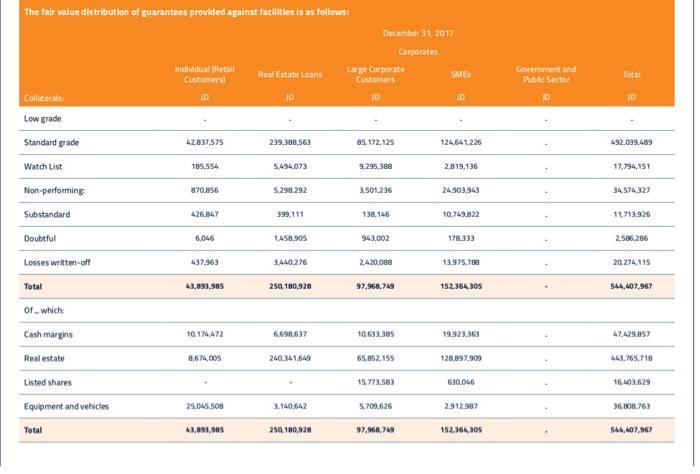

1. Investment to deposit ratio. (INVESTMENTS/DEPOSITS)

2. Resource Utilization ratio. (INVESTMENTS/(DEPOSITS + OWNERS EQUITY)

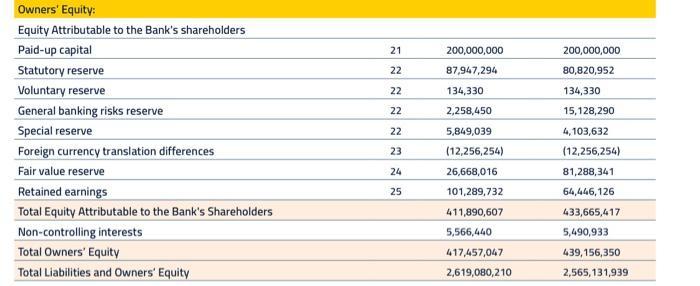

Owners' Equity: Equity Attributable to the Bank's shareholders Paid-up capital 21 200,000,000 200,000,000 Statutory reserve 22 87,947,294 80,820,952 Voluntary reserve 22 134,330 134,330 General banking risks reserve 22 2,258,450 15,128,290 Special reserve 22 5,849,039 4,103,632 Foreign currency translation differences Fair value reserve 23 (12,256,254) (12,256,254) 24 26,668,016 81,288,341 Retained earnings 64,446,126 25 101,289,732 Total Equity Attributable to the Bank's Shareholders 411,890,607 433,665,417 Non-controlling interests 5,566,440 5,490,933 Total Owners' Equity 417,457,047 439,156,350 Total Liabilities and Owners' Equity 2,619,080,210 2,565,131,939

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started