Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Calculate the following ratios and submit in Word document to Brightspace Assignments: - Quick ratio - Earnings per share (assume 10 million shares outstanding)

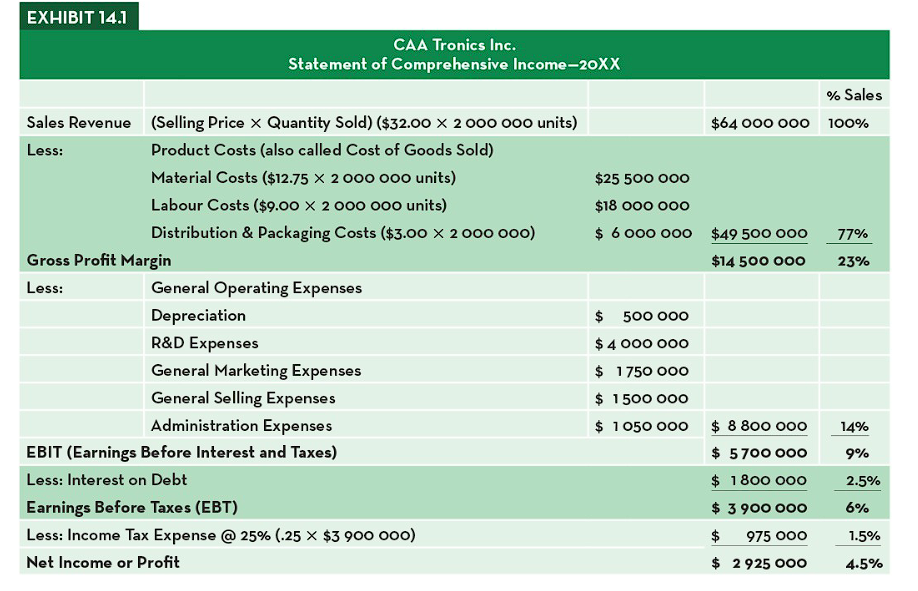

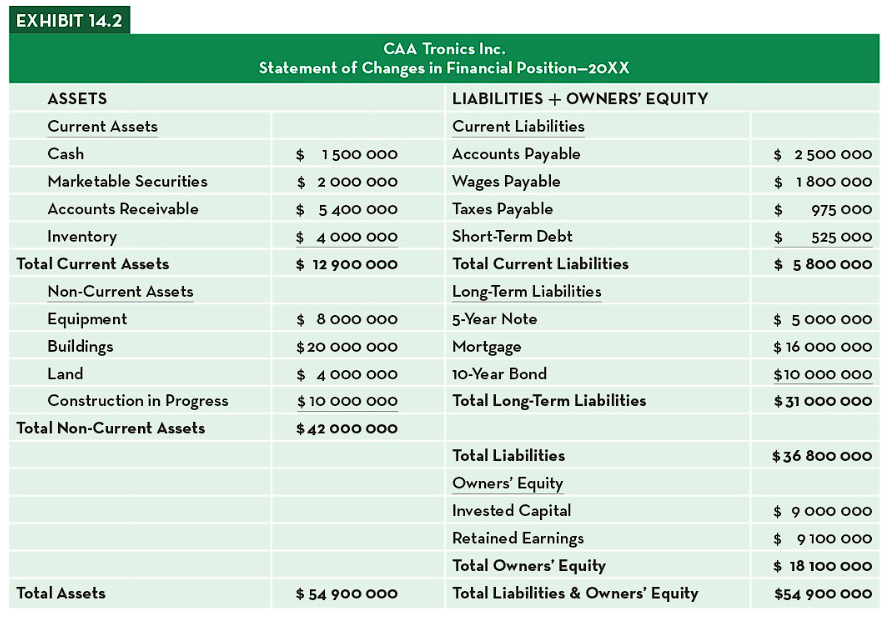

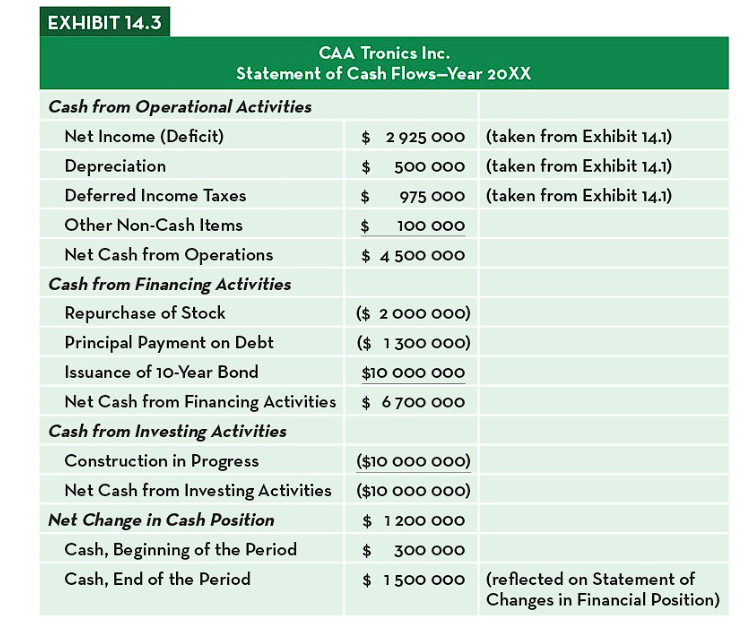

- Calculate the following ratios and submit in Word document to Brightspace Assignments: - Quick ratio - Earnings per share (assume 10 million shares outstanding) - Debt-to-asset ratio - Current ratio EXHIBIT 14.1 CAA Tronics Inc. Statement of Comprehensive Income-20XX EXHIBIT 14.2 CAA Tronics Inc. Statement of Changes in Financial Position-20XX EXHIBIT 14.3 CAA Tronics Inc. Statement of Cash Flows-Year 20XX Cash from Operational Activities Net Income (Deficit) Depreciation Deferred Income Taxes Other Non-Cash Items Net Cash from Operations Cash from Financing Activities Repurchase of Stock Principal Payment on Debt Issuance of 10-Year Bond Net Cash from Financing Activities Cash from Investing Activities Construction in Progress Net Cash from Investing Activities Net Change in Cash Position Cash, Beginning of the Period Cash, End of the Period $2925000 $500000 $975000 $100000 $4500000 (\$2 000 000) (\$ 1300000 ) $10000000 $6700000 (\$10 000 000) (\$10 000 000) $1200000 $300000 $1500000 (taken from Exhibit 14.1) (taken from Exhibit 14.1) (taken from Exhibit 14.1) ) - Calculate the following ratios and submit in Word document to Brightspace Assignments: - Quick ratio - Earnings per share (assume 10 million shares outstanding) - Debt-to-asset ratio - Current ratio EXHIBIT 14.1 CAA Tronics Inc. Statement of Comprehensive Income-20XX EXHIBIT 14.2 CAA Tronics Inc. Statement of Changes in Financial Position-20XX EXHIBIT 14.3 CAA Tronics Inc. Statement of Cash Flows-Year 20XX Cash from Operational Activities Net Income (Deficit) Depreciation Deferred Income Taxes Other Non-Cash Items Net Cash from Operations Cash from Financing Activities Repurchase of Stock Principal Payment on Debt Issuance of 10-Year Bond Net Cash from Financing Activities Cash from Investing Activities Construction in Progress Net Cash from Investing Activities Net Change in Cash Position Cash, Beginning of the Period Cash, End of the Period $2925000 $500000 $975000 $100000 $4500000 (\$2 000 000) (\$ 1300000 ) $10000000 $6700000 (\$10 000 000) (\$10 000 000) $1200000 $300000 $1500000 (taken from Exhibit 14.1) (taken from Exhibit 14.1) (taken from Exhibit 14.1) )

- Calculate the following ratios and submit in Word document to Brightspace Assignments: - Quick ratio - Earnings per share (assume 10 million shares outstanding) - Debt-to-asset ratio - Current ratio EXHIBIT 14.1 CAA Tronics Inc. Statement of Comprehensive Income-20XX EXHIBIT 14.2 CAA Tronics Inc. Statement of Changes in Financial Position-20XX EXHIBIT 14.3 CAA Tronics Inc. Statement of Cash Flows-Year 20XX Cash from Operational Activities Net Income (Deficit) Depreciation Deferred Income Taxes Other Non-Cash Items Net Cash from Operations Cash from Financing Activities Repurchase of Stock Principal Payment on Debt Issuance of 10-Year Bond Net Cash from Financing Activities Cash from Investing Activities Construction in Progress Net Cash from Investing Activities Net Change in Cash Position Cash, Beginning of the Period Cash, End of the Period $2925000 $500000 $975000 $100000 $4500000 (\$2 000 000) (\$ 1300000 ) $10000000 $6700000 (\$10 000 000) (\$10 000 000) $1200000 $300000 $1500000 (taken from Exhibit 14.1) (taken from Exhibit 14.1) (taken from Exhibit 14.1) ) - Calculate the following ratios and submit in Word document to Brightspace Assignments: - Quick ratio - Earnings per share (assume 10 million shares outstanding) - Debt-to-asset ratio - Current ratio EXHIBIT 14.1 CAA Tronics Inc. Statement of Comprehensive Income-20XX EXHIBIT 14.2 CAA Tronics Inc. Statement of Changes in Financial Position-20XX EXHIBIT 14.3 CAA Tronics Inc. Statement of Cash Flows-Year 20XX Cash from Operational Activities Net Income (Deficit) Depreciation Deferred Income Taxes Other Non-Cash Items Net Cash from Operations Cash from Financing Activities Repurchase of Stock Principal Payment on Debt Issuance of 10-Year Bond Net Cash from Financing Activities Cash from Investing Activities Construction in Progress Net Cash from Investing Activities Net Change in Cash Position Cash, Beginning of the Period Cash, End of the Period $2925000 $500000 $975000 $100000 $4500000 (\$2 000 000) (\$ 1300000 ) $10000000 $6700000 (\$10 000 000) (\$10 000 000) $1200000 $300000 $1500000 (taken from Exhibit 14.1) (taken from Exhibit 14.1) (taken from Exhibit 14.1) ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started