Calculate the following ratios for a company (year 2020): 1. Quarterly Revenue Growth; 2. Quarterly Earnings Growth, 3. Profit Margin 4. Debts/Assets Ratio, 5. Return

Calculate the following ratios for a company (year 2020):

1. Quarterly Revenue Growth;

2. Quarterly Earnings Growth,

3. Profit Margin

4. Debts/Assets Ratio,

5. Return on Equity (ROE)

6. Earnings per Share (EPS) and

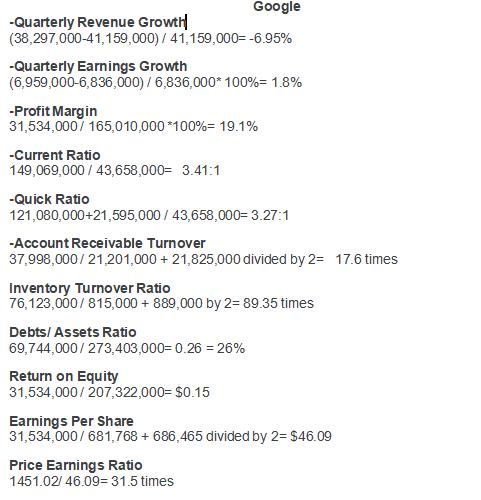

7. Price Earnings Ratio (P/E) for any public listed company of your own choice. Example is in the picture down below.

Google -Quarterly Revenue Growth (38,297,000-41,159,000) / 41,159,000= -6.95% -Quarterly Earnings Growth (6,959,000-6,836,000) / 6,836,000* 100%= 1.8% -Profit Margin 31,534,000/ 165,010,000 *100%= 19.1% -Current Ratio 149,069,000 / 43,658,000= 3.41:1 -Quick Ratio 121,080,000+21,595,000 / 43,658,000= 3.27:1 -Account Receivable Turnover 37,998,000/21,201,000 + 21,825,000 divided by 2= 17.6 times Inventory Turnover Ratio 76,123,000/ 815,000 + 889,000 by 2= 89.35 times Debts/ Assets Ratio 69,744,000/ 273,403,000= 0.26 = 26% Return on Equity 31,534,000/ 207,322,000= $0.15 Earnings Per Share 31,534,000/ 681,768 + 686,465 divided by 2= $46.09 Price Earnings Ratio 1451.02/ 46.09= 31.5 times

Step by Step Solution

3.27 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

WALMART Quarterly Revenue growth 137742000134622000 134622000 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started