Answered step by step

Verified Expert Solution

Question

1 Approved Answer

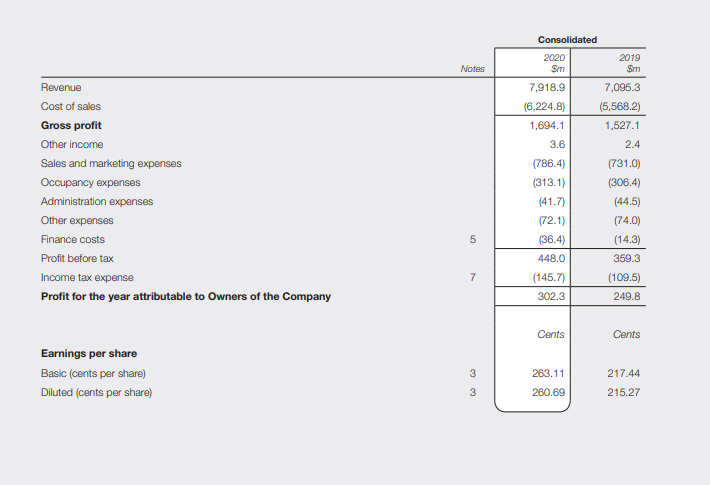

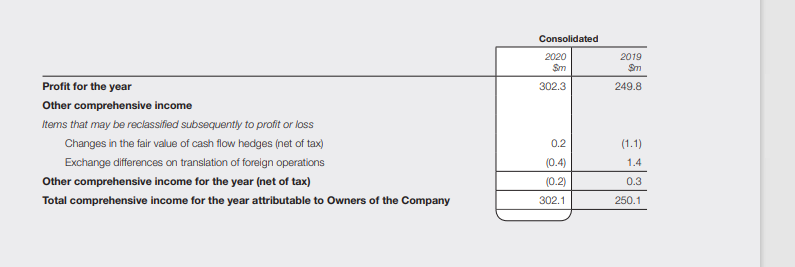

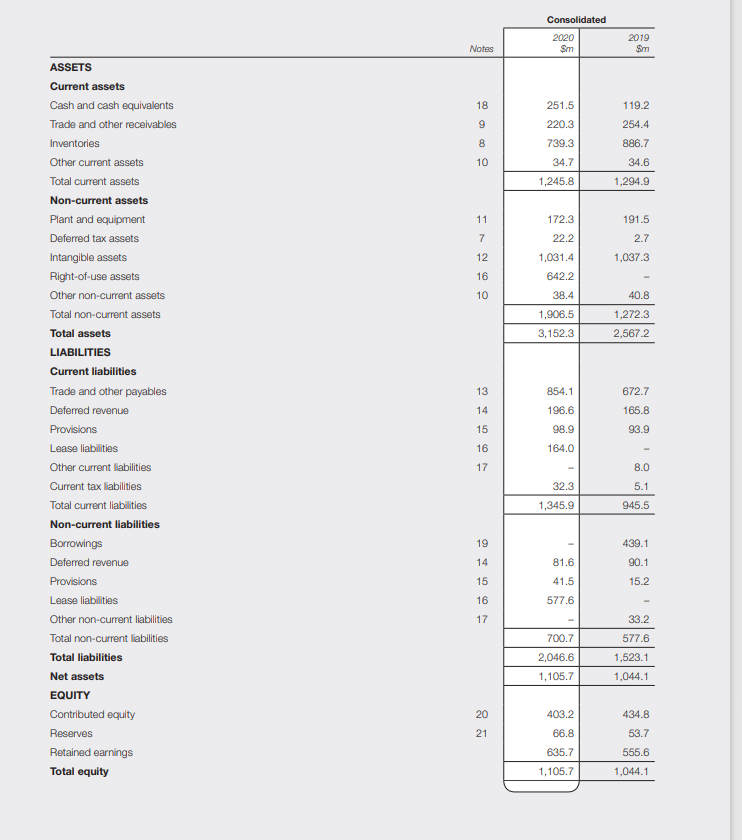

Calculate the following ratios for JB Hi-Fi for the year ended 30 June 2020 based on the annual financial statements. Convert your figures to a

Calculate the following ratios for JB Hi-Fi for the year ended 30 June 2020 based on the annual financial statements. Convert your figures to a percentage (%) where specified. Round your answers to one decimal place (1 d.p.). You will need to record your numerator and denominator for each ratio in addition to your answer

Gross profit margin (%)

Operating profit margin (%)

Return on shareholders funds (%)

Inventory turnover in days

*Accounts receivable turnover in days

Current ratio

Acid test ratio

Interest cover ratio

Gearing ratio (%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started