Answered step by step

Verified Expert Solution

Question

1 Approved Answer

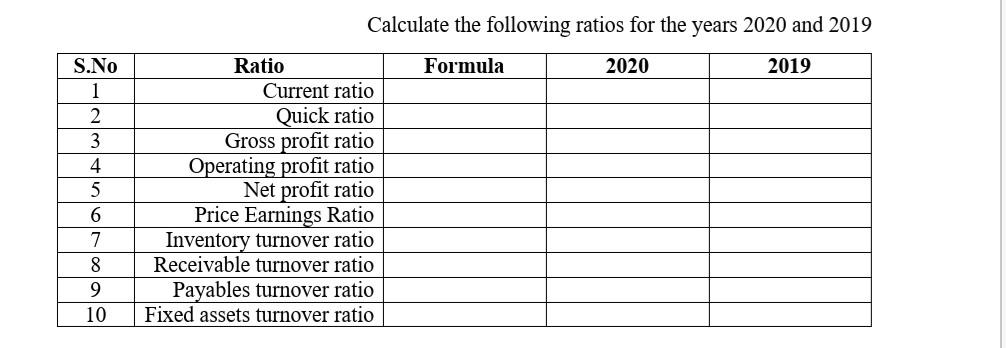

Calculate the following ratios for the years 2020 and 2019 Formula 2020 2019 S.NO 1 2 3 4 5 6 Ratio Current ratio Quick ratio

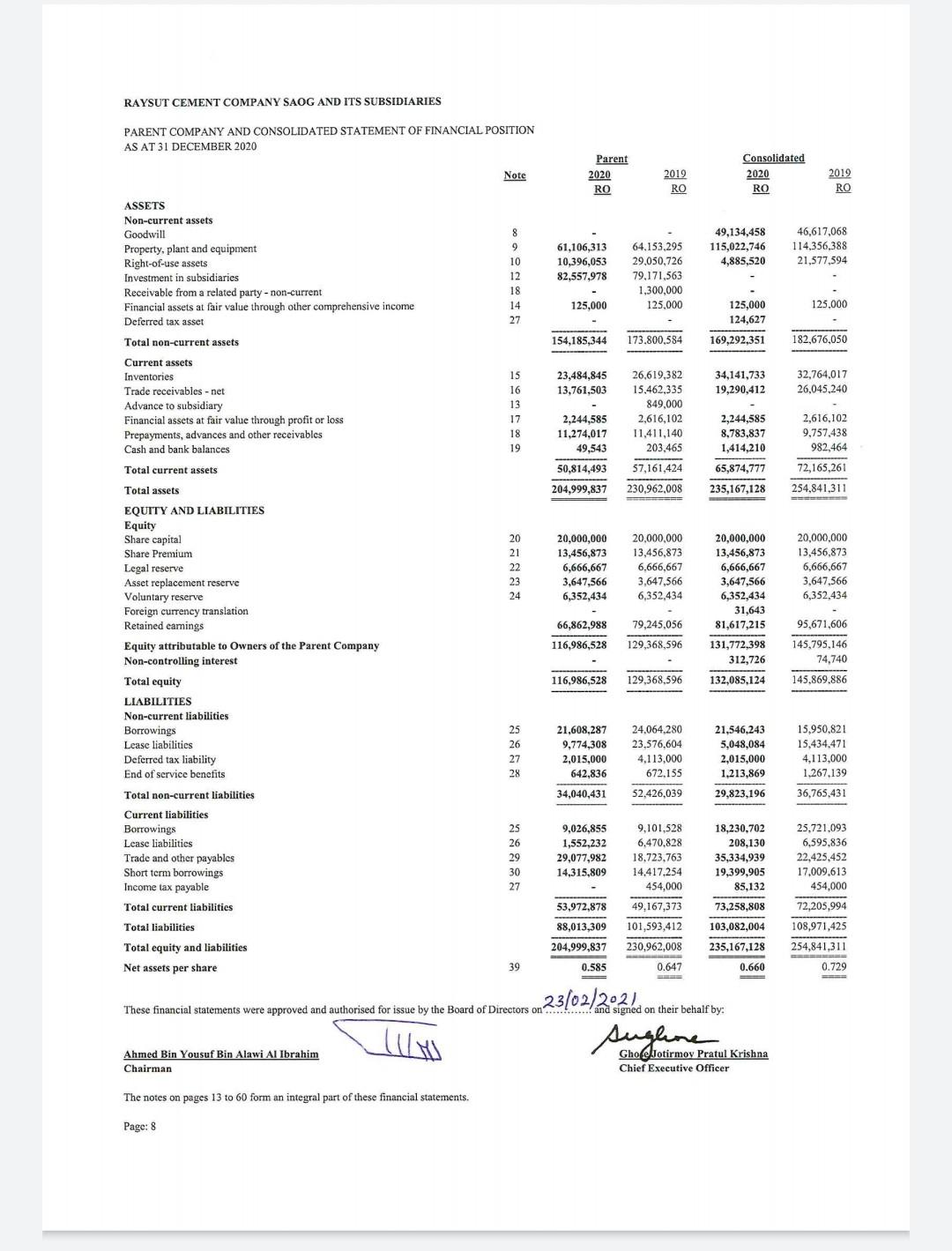

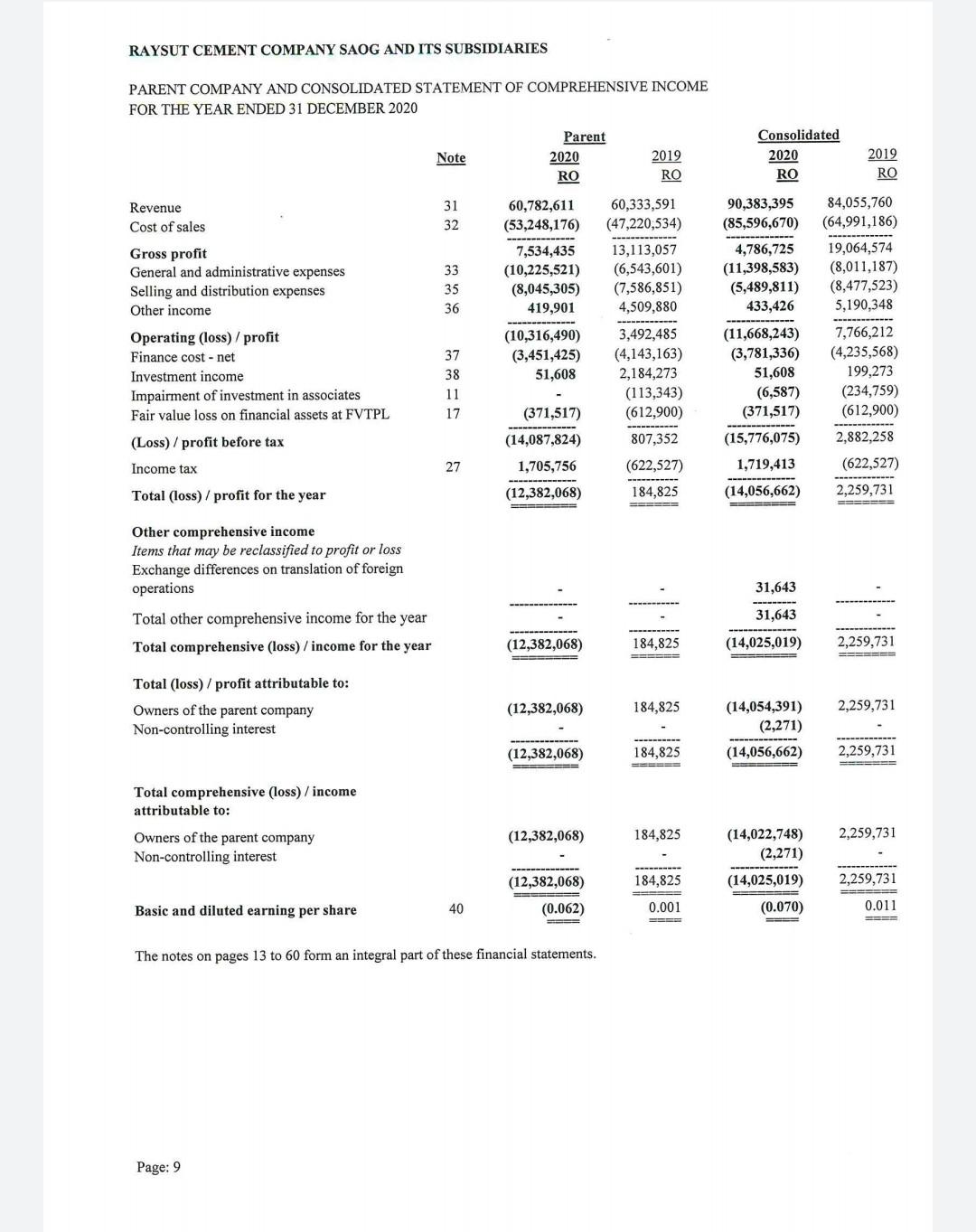

Calculate the following ratios for the years 2020 and 2019 Formula 2020 2019 S.NO 1 2 3 4 5 6 Ratio Current ratio Quick ratio Gross profit ratio Operating profit ratio Net profit ratio Price Earnings Ratio Inventory turnover ratio Receivable turnover ratio Payables turnover ratio Fixed assets turnover ratio 7 8 9 10 RAYSUT CEMENT COMPANY SAOG AND ITS SUBSIDIARIES PARENT COMPANY AND CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2020 Note Parent 2020 RO 2019 RO Consolidated 2020 RO 2012 RO ASSETS Non-current assets Goodwill Property, plant and equipment Right-of-use assets Investment in subsidiaries Receivable from a related party - non-current Financial assets at fair value through other comprehensive income Deferred tax asset 49,134,458 115,022,746 4,885,520 61,106,313 10,396,053 82,557,978 8 9 10 12 18 14 27 46,617,068 114,356,388 21,577,594 64.153,295 29,050,726 79,171,563 1,300,000 125,000 125,000 125.000 125.000 124,627 Total non-current assets 154,185,344 173.800,584 169.292,351 182,676,050 23,484,845 13,761,503 34,141,733 19,290,412 32,764,017 26,045,240 15 16 13 17 18 19 2,244,585 11,274,017 49,543 50,814,493 204,999,837 26,619,382 15,462,335 849,000 2,616,102 11,411,140 203,465 57,161,424 230,962.008 2,244,585 8,783,837 1,414,210 65,874,777 235,167,128 2,616,102 9,757,438 982,464 72,165,261 254,841,311 Current assets Inventories Trade receivables-net Advance to subsidiary Financial assets at fair value through profit or loss Prepayments, advances and other receivables Cash and bank balances Total current assets Total assets EQUITY AND LIABILITIES Equity Share capital Share Premium Legal reserve Asset replacement reserve Voluntary reserve Foreign currency translation Retained earnings Equity attributable to Owners of the Parent Company Non-controlling interest Total equity LIABILITIES Non-current liabilities Borrowings Lease liabilities Deferred tax liability End of service benefits 20 21 22 23 24 20,000,000 13,456,873 6,666,667 3,647,566 6,352,434 20,000,000 13,456,873 6,666,667 3,647,566 6,352,434 20,000,000 13,456,873 6,666,667 3,647,566 6,352.434 20,000,000 13,456,873 6,666,667 3,647,566 6,352,434 31,643 81,617,215 131,772,398 312,726 132,085,124 66,862,988 95,671,606 79,245,056 129,368,596 116,986,528 145,795,146 74,740 145.869.886 116,986,528 129,368.596 129,368,596 25 26 27 28 21,608,287 9,774,308 2,015,000 642,836 34,040,431 24.064.280 23,576,604 4,113,000 672.155 21,546,243 5,048,084 2,015,000 1,213,869 15,950.821 15,434,471 4,113,000 1,267,139 36.765.431 52,426,039 29,823,196 18,230,702 208.130 Total non-current liabilities Current liabilities Borrowings Lease liabilities Trade and other payables Short term borrowings Income tax payable Total current liabilities 25 26 29 30 27 9,026,855 1,552,232 29,077,982 14,315,809 9,101,528 6,470.828 18.723,763 14.417.254 454,000 25,721,093 6,595,836 22,425,452 17.009.613 454,000 53,972,878 49.167,373 72,205,994 35,334,939 19,399,905 85,132 73,258,808 103,082,004 235,167,128 0.660 108,971,425 Total liabilities Total equity and liabilities Net assets per share 88,013,309 204,999,837 101,593,412 230,962,008 254,841,311 39 0.585 0.647 0.729 These financial statements were approved and authorised for issue by the Board of Directors on ... and signed on their behalf by: 23/02/2021 suglione Ahmed Bin Yousuf Bin Alawi Al Ibrahim Chairman Gho.Jotirmov Pratul Krishna Chief Executive Officer The notes on pages 13 to 60 form an integral part of these financial statements. Page: 8 RAYSUT CEMENT COMPANY SAOG AND ITS SUBSIDIARIES PARENT COMPANY AND CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2020 Note Parent 2020 RO 2019 RO Consolidated 2020 RO 2012 RO Revenue Cost of sales 31 32 Gross profit General and administrative expenses Selling and distribution expenses Other income 60,782,611 (53,248,176) 7,534,435 (10,225,521) (8,045,305) 419,901 33 35 36 90,383,395 (85,596,670) 4,786,725 (11,398,583) (5,489,811) 433,426 (11,668,243) (3,781,336) 51,608 (6,587) (371,517) (15,776,075) 84,055,760 (64,991,186) 19,064,574 (8,011,187) (8,477,523) 5,190,348 7,766,212 (4,235,568) 199,273 (234,759) (612,900) 2,882,258 Operating (loss) / profit Finance cost - net Investment income Impairment of investment in associates Fair value loss on financial assets at FVTPL 60,333,591 (47,220,534) 13,113,057 (6,543,601) (7,586,851) 4,509,880 3,492,485 (4,143,163) 2,184,273 (113,343) (612,900) 807,352 (622,527) 184,825 (10,316,490) (3,451,425) 51,608 37 38 11 17 (Loss) / profit before tax (371,517) (14,087,824) 1,705,756 Income tax 27 1,719,413 (622,527) Total (loss) / profit for the year (12,382,068) (14,056,662) 2,259,731 ===== Other comprehensive income Items that may be reclassified to profit or loss Exchange differences on translation of foreign operations Total other comprehensive income for the year Total comprehensive (loss) / income for the year 31,643 31,643 (12,382,068) 184,825 (14,025,019) 2,259,731 Total (loss) / profit attributable to: Owners of the parent company Non-controlling interest (12,382,068) 184,825 2,259,731 (14,054,391) (2,271) (14,056,662) (12,382,068) 184,825 2,259,731 Total comprehensive (loss) /income attributable to: Owners of the parent company Non-controlling interest (12,382,068) 184,825 2,259,731 (14,022,748) (2,271) (14,025,019) (12,382,068) 2,259,731 184,825 0.001 Basic and diluted earning per share 40 (0.062) (0.070) 0.011 SEE Ee The notes on pages 13 to 60 form an integral part of these financial statements. Page: 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started