Calculate the following ratios for this bank. (Show your computations) (5 Marks)

4. EM,

5. ROE,

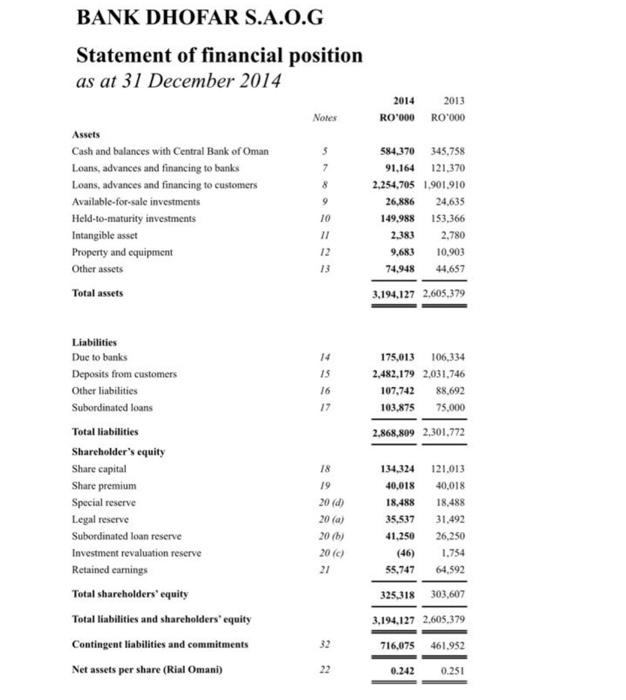

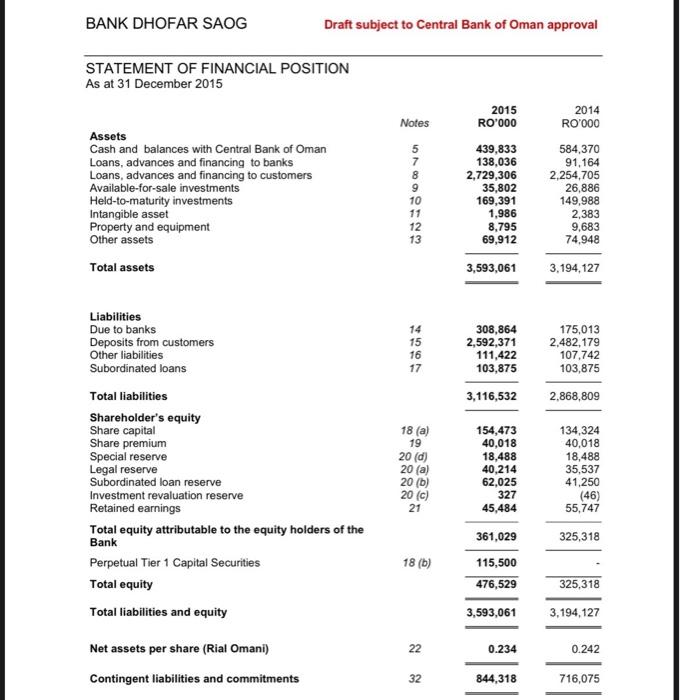

BANK DHOFAR S.A.O.G Statement of financial position as at 31 December 2014 2014 RO 000 2013 RO'000 Noles 5 7 8 9 Assets Cash and balances with Central Bank of Oman Loans, advances and financing to banks Loans, advances and financing to customers Available-for-sale investments Held-to-maturity investments Intangible asset Property and equipment Other assets Total assets 584.370 345,758 91,164 121,370 2,254,705 1.901.910 26,886 24,635 149.988 153,366 2.383 2.780 9,683 10.903 74,948 44,657 10 11 12 13 3,194,127 2,605,379 14 15 16 17 175,013 106,334 2,482,179 2,031,746 107,742 88,692 103.875 75,000 2,868,809 2,301.772 Liabilities Due to banks Deposits from customers Other liabilities Subordinated loans Total liabilities Shareholder's equity Share capital Share premium Special reserve Legal reserve Subordinated loan reserve Investment revaluation reserve Retained carnings Total shareholders' equity Total liabilities and shareholders' equity Contingent liabilities and commitments Net assets per share (Rial Omani) 18 19 20 (d) 20 (a) 20 (6) 20 (0) 21 134.324 40,018 18.488 35.537 41,250 (46) 55,747 121,013 40.018 18,488 31.492 26,250 1.754 64.592 325,318 303,607 3,194,127 2.605,379 32 716,075 461,952 22 0.242 0.251 BANK DHOFAR SAOG Draft subject to Central Bank of Oman approval STATEMENT OF FINANCIAL POSITION As at 31 December 2015 Notes Assets Cash and balances with Central Bank of Oman Loans, advances and financing to banks Loans, advances and financing to customers Available-for-sale investments Held-to-maturity investments Intangible asset Property and equipment Other assets Total assets 5 789 2015 RO'000 439,833 138,036 2,729,306 35,802 169,391 1,986 8,795 69,912 2014 RO 000 584,370 91,164 2,254,705 26,886 149,988 2,383 9,683 74,948 10 11 12 13 3,593,061 3,194,127 14 15 16 17 308,864 2,592,371 111,422 103,875 175,013 2,482,179 107.742 103,875 3,116,532 2.868,809 Liabilities Due to banks Deposits from customers Other liabilities Subordinated loans Total liabilities Shareholder's equity Share capital Share premium Special reserve Legal reserve Subordinated loan reserve Investment revaluation reserve Retained earnings Total equity attributable to the equity holders of the Bank Perpetual Tier 1 Capital Securities Total equity Total liabilities and equity 18 (a) 19 20 (d) 20 (a) 20 (b) 20 (c) 154,473 40,018 18,488 40,214 62,025 327 45,484 134,324 40,018 18,488 35,537 41.250 (46) 55,747 21 325,318 18 (b) 361,029 115,500 476,529 3,593,061 325,318 3,194,127 Net assets per share (Rial Omani) 22 0.234 0.242 Contingent liabilities and commitments 32 844,318 716,075