Answered step by step

Verified Expert Solution

Question

1 Approved Answer

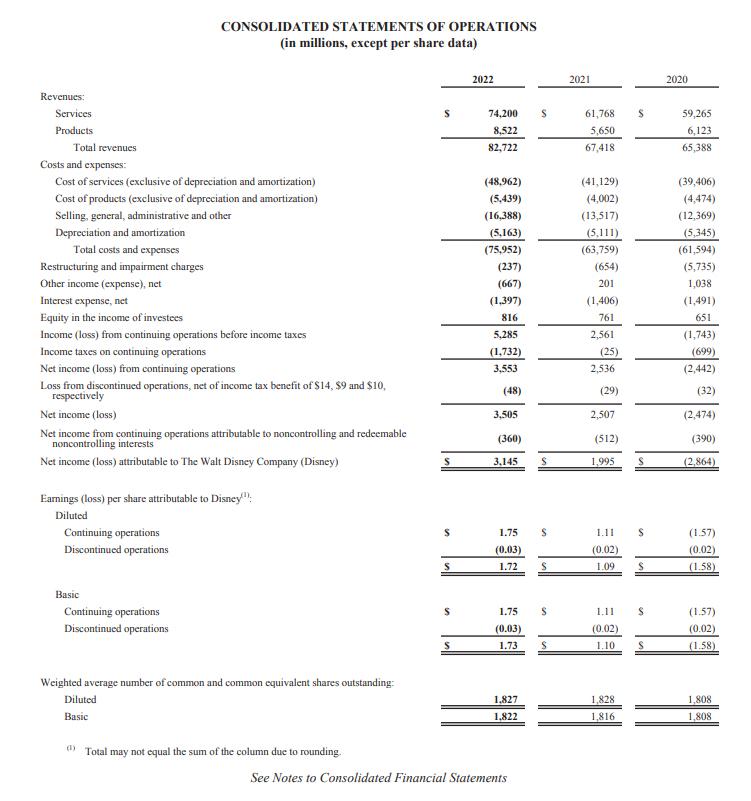

Calculate the following ratios for two fiscal years. a. Working Capital b. Current ratio c. Quick ratio d. Accounts Receivable turnover e. Days sales in

Calculate the following ratios for two fiscal years.

a. Working Capital

b. Current ratio

c. Quick ratio

d. Accounts Receivable turnover

e. Days sales in receivables

f. Inventory turnover

g. Days sales in inventory

h. Ratio of liabilities to stockholders’ equity

i. Asset turnover

j. Return on total assets

k. Return on common stockholders’ equity

l. Price earnings ratio

m. Percentage relationship of net income to sales.

Revenues: Services Products Total revenues Costs and expenses: Cost of services (exclusive of depreciation and amortization) Cost of products (exclusive of depreciation and amortization) Selling, general, administrative and other Depreciation and amortization Total costs and expenses Restructuring and impairment charges Other income (expense), net Interest expense, net Equity in the income of investees Income (loss) from continuing operations before income taxes Income taxes on continuing operations Net income (loss) from continuing operations Loss from discontinued operations, net of income tax benefit of $14, $9 and $10, respectively Net income (loss) CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) Net income from continuing operations attributable to noncontrolling and redeemable noncontrolling interests Net income (loss) attributable to The Walt Disney Company (Disney) Earnings (loss) per share attributable to Disney"). Diluted Continuing operations Discontinued operations Basic Continuing operations Discontinued operations Weighted average number of common and common equivalent shares outstanding: Diluted Basic () Total may not equal the sum of the column due to rounding. S S S S 2022 74,200 8,522 82,722 (48,962) (5,439) (16,388) (5,163) (75,952) (237) (667) (1,397) 816 5,285 (1,732) 3,553 (48) 3,505 (360) 3,145 1.75 (0.03) 1.72 1,827 1,822 S See Notes to Consolidated Financial Statements S S 1.75 S (0.03) 1.73 S S 2021 61,768 5,650 67,418 (41,129) (4,002) (13,517) (5,111) (63,759) (654) 201 (1,406) 761 2,561 (25) 2,536 (29) 2,507 (512) 1,995 1.11 (0.02) 1.09 $ 1,828 1,816 S S S 1.11 (0.02) 1.10 S $ 2020 59,265 6,123 65,388 (39,406) (4,474) (12,369) (5,345) (61,594) (5,735) 1,038 (1,491) 651 (1,743) (699) (2,442) (32) (2,474) (390) (2,864) (1.57) (0.02) (1.58) (1.57) (0.02) (1.58) 1,808 1,808

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started