Answered step by step

Verified Expert Solution

Question

1 Approved Answer

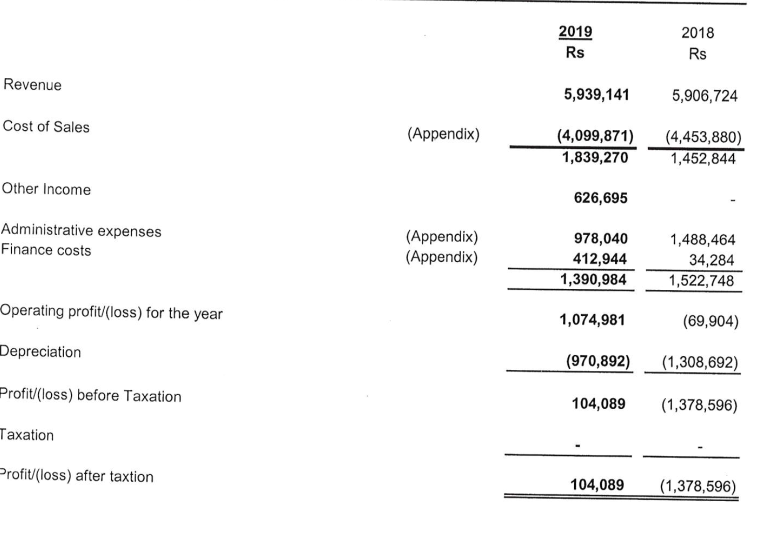

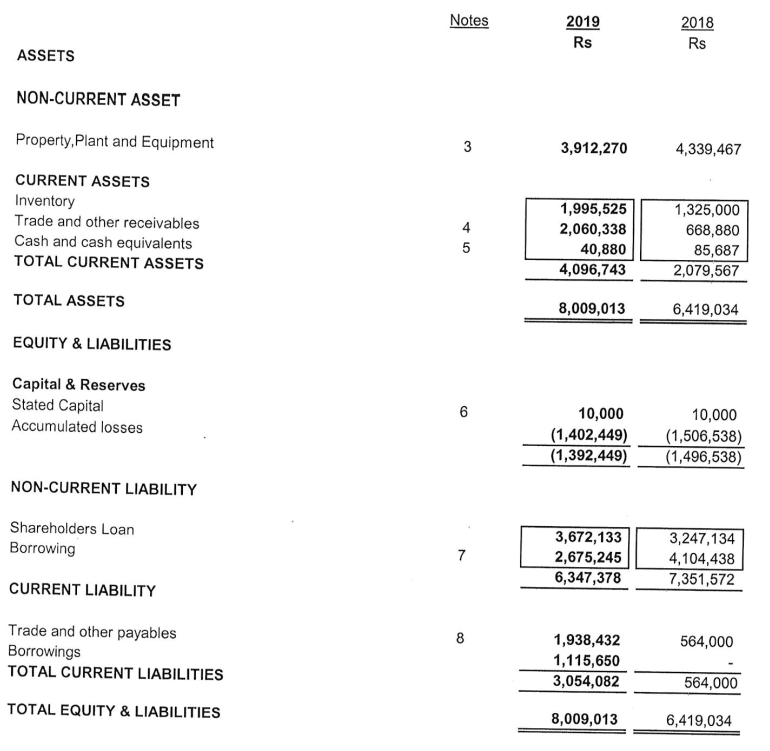

Calculate the following ratios for year 2018 and 2019 and comments on the performance of the firm: (i) Return on capital employed Formula: [Profit before

Calculate the following ratios for year 2018 and 2019 and comments on the performance of the firm:

(i) Return on capital employed

Formula: [Profit before interest and tax / (equity + long term debt)] x 100

(ii) Current ratio

Formula: Current assets / Current liabilities

(iii) financial gearing

Formula: [debt / (debt + equity)] x 100

YOU NEED TO SHOW YOUR CALCULATIONS.

2019 Rs 2018 Rs Revenue 5,939,141 5,906,724 Cost of Sales (Appendix) (4,099,871) 1,839,270 (4,453,880) 1,452,844 Other Income 626,695 Administrative expenses Finance costs (Appendix) (Appendix) 978,040 412,944 1,390,984 1,488,464 34,284 1,522,748 Operating profit/(loss) for the year 1,074,981 (69,904) Depreciation (970,892) (1,308,692) Profit/(loss) before Taxation 104,089 (1,378,596) Taxation Profit/(loss) after taxtion 104,089 (1,378,596) Notes 2019 Rs 2018 Rs ASSETS NON-CURRENT ASSET Property, plant and Equipment 3 3,912,270 4,339,467 CURRENT ASSETS Inventory Trade and other receivables Cash and cash equivalents TOTAL CURRENT ASSETS 4 5 1,995,525 2,060,338 40,880 4,096,743 1,325,000 668,880 85,687 2,079,567 TOTAL ASSETS 8,009,013 6,419,034 EQUITY & LIABILITIES Capital & Reserves Stated Capital Accumulated losses 6 10,000 (1,402,449) (1,392,449) 10,000 (1,506,538) (1,496,538) NON-CURRENT LIABILITY Shareholders Loan Borrowing 7 3,672,133 2,675,245 6,347,378 3,247,134 4,104,438 7,351,572 CURRENT LIABILITY 00 564,000 Trade and other payables Borrowings TOTAL CURRENT LIABILITIES 1,938,432 1,115,650 3,054,082 564,000 TOTAL EQUITY & LIABILITIES 8,009,013 6,419,034Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started