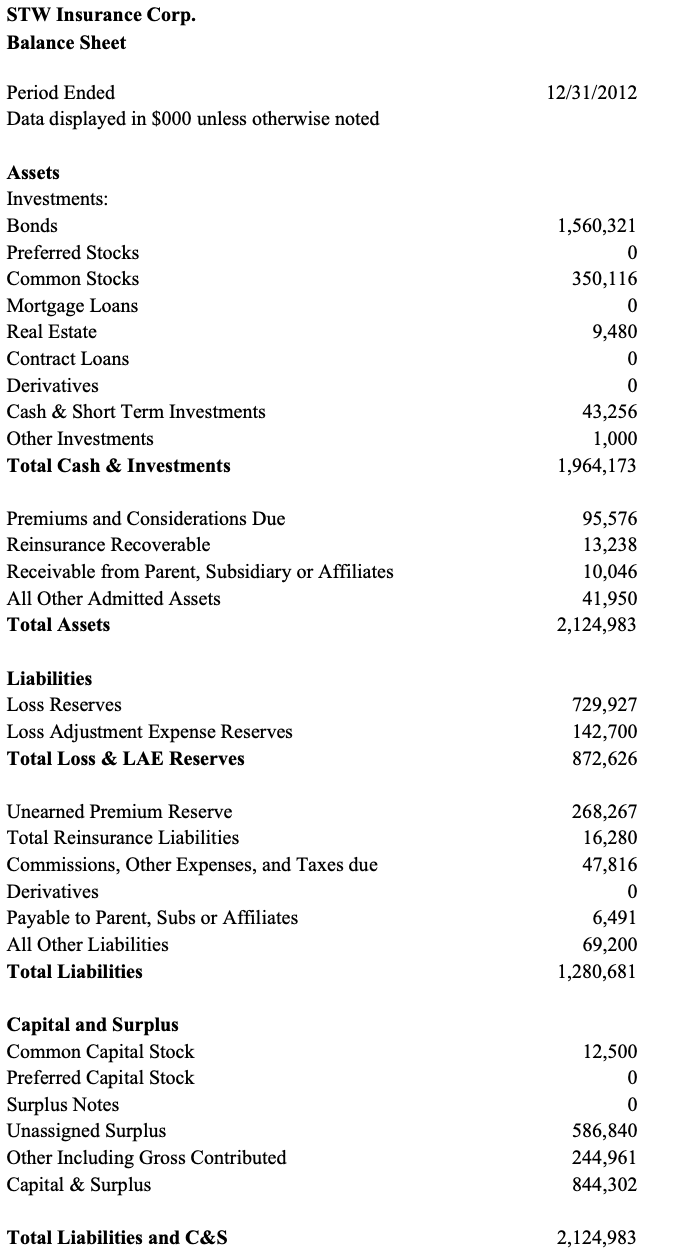

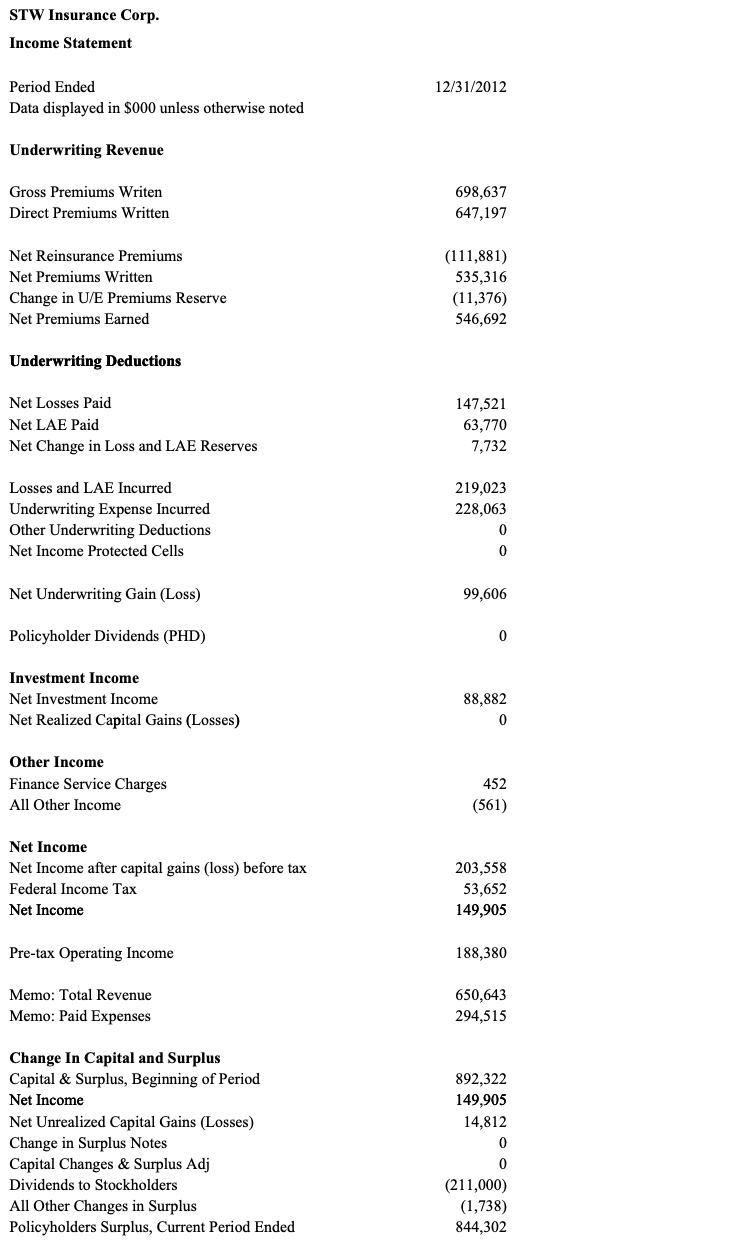

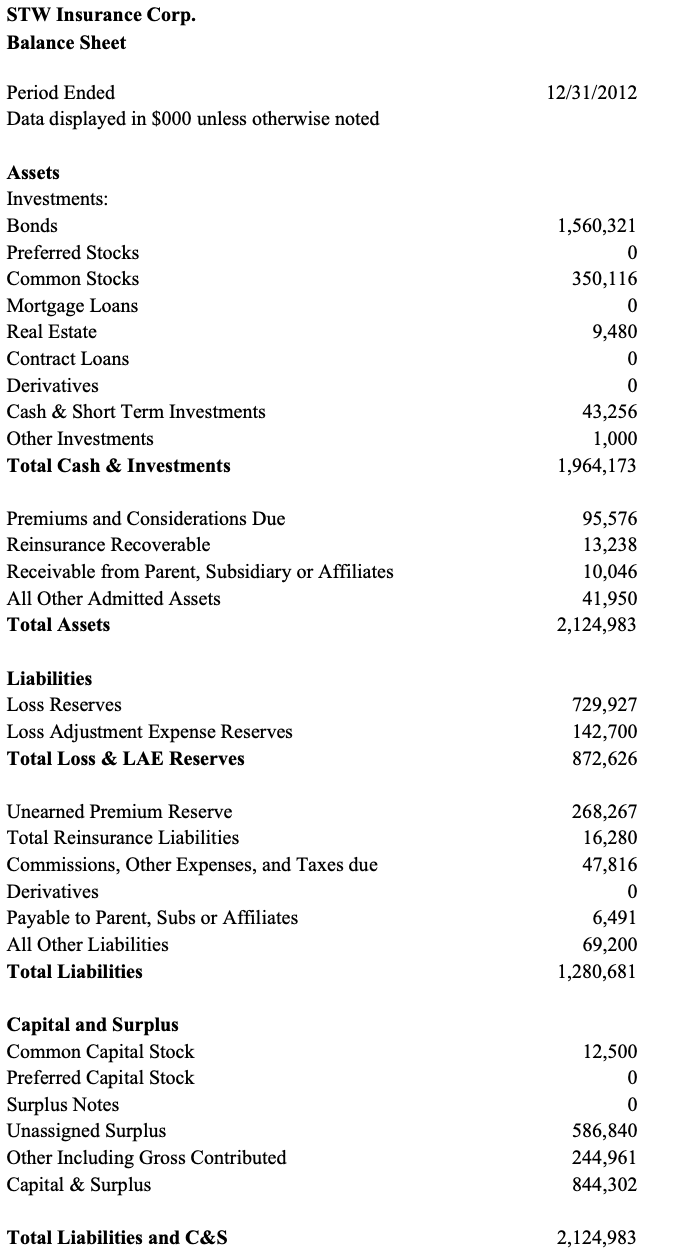

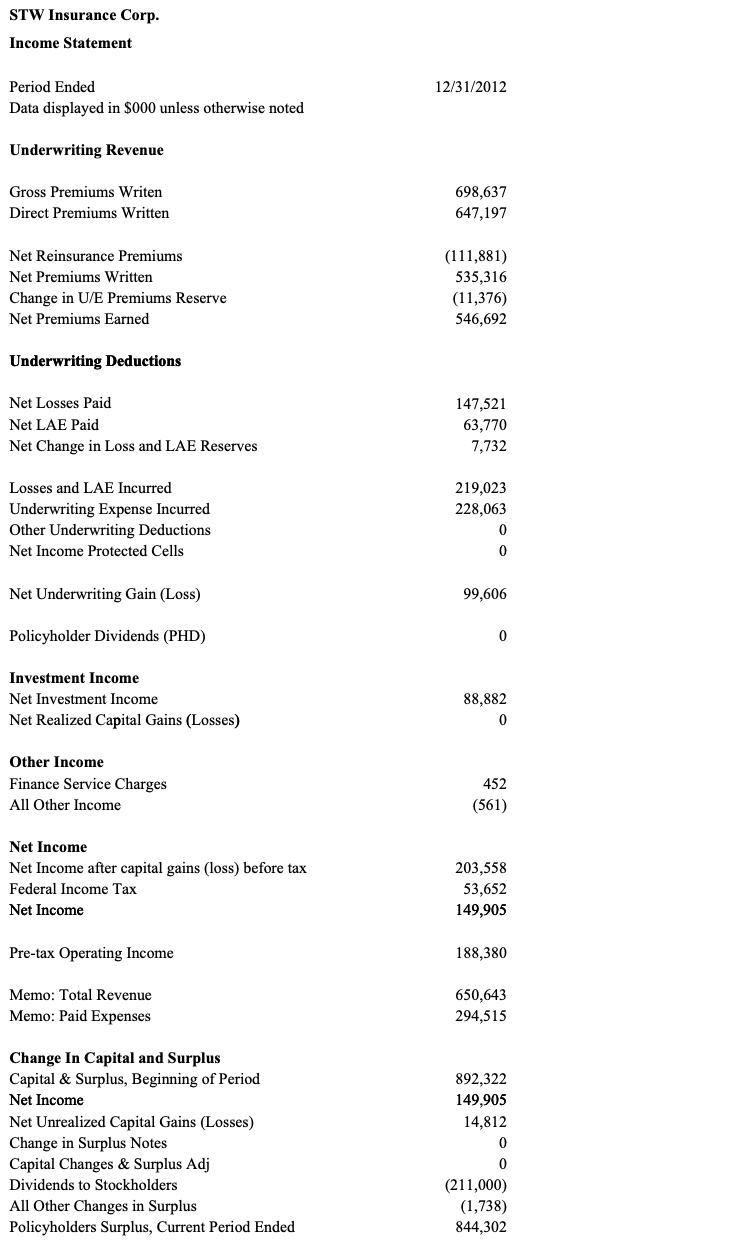

Calculate the following ratios. Round all calculations to two decimal places. Premium to surplus ratio Liquidity ratio Loss ratio Expense ratio Combined ratio Investment income ratio Invest yield ratio Operating ratio Return to equity Retention ratio STW Insurance Corp. Balance Sheet 12/31/2012 Period Ended Data displayed in $000 unless otherwise noted Assets Investments: Bonds Preferred Stocks Common Stocks Mortgage Loans Real Estate Contract Loans Derivatives Cash & Short Term Investments Other Investments Total Cash & Investments 1,560,321 0 350,116 0 9,480 0 0 43,256 1,000 1,964,173 Premiums and Considerations Due Reinsurance Recoverable Receivable from Parent, Subsidiary or Affiliates All Other Admitted Assets Total Assets 95,576 13,238 10,046 41,950 2,124,983 Liabilities Loss Reserves Loss Adjustment Expense Reserves Total Loss & LAE Reserves 729,927 142,700 872,626 Unearned Premium Reserve Total Reinsurance Liabilities Commissions, Other Expenses, and Taxes due Derivatives Payable to Parent, Subs or Affiliates All Other Liabilities Total Liabilities 268,267 16,280 47,816 0 6,491 69,200 1,280,681 Capital and Surplus Common Capital Stock Preferred Capital Stock Surplus Notes Unassigned Surplus Other Including Gross Contributed Capital & Surplus 12,500 0 0 586,840 244,961 844,302 Total Liabilities and C&S 2,124,983 STW Insurance Corp. Income Statement 12/31/2012 Period Ended Data displayed in $000 unless otherwise noted Underwriting Revenue Gross Premiums Writen Direct Premiums Written 698,637 647,197 Net Reinsurance Premiums Net Premiums Written Change in U/E Premiums Reserve Net Premiums Earned (111,881) 535,316 (11,376) 546,692 Underwriting Deductions Net Losses Paid Net LAE Paid Net Change in Loss and LAE Reserves 147,521 63,770 7,732 Losses and LAE Incurred Underwriting Expense Incurred Other Underwriting Deductions Net Income Protected Cells 219,023 228,063 0 0 Net Underwriting Gain (Loss) 99,606 Policyholder Dividends (PHD) 0 Investment Income Net Investment Income Net Realized Capital Gains (Losses) 88,882 0 Other Income Finance Service Charges All Other Income 452 (561) Net Income Net Income after capital gains (loss) before tax Federal Income Tax Net Income 203,558 53,652 149,905 Pre-tax Operating Income 188,380 Memo: Total Revenue Memo: Paid Expenses 650,643 294,515 Change In Capital and Surplus Capital & Surplus, Beginning of Period Net Income Net Unrealized Capital Gains (Losses) Change in Surplus Notes Capital Changes & Surplus Adj Dividends to Stockholders All Other Changes in Surplus Policyholders Surplus, Current Period Ended 892,322 149,905 14,812 0 0 0 (211,000) (1,738) 844,302 Calculate the following ratios. Round all calculations to two decimal places. Premium to surplus ratio Liquidity ratio Loss ratio Expense ratio Combined ratio Investment income ratio Invest yield ratio Operating ratio Return to equity Retention ratio STW Insurance Corp. Balance Sheet 12/31/2012 Period Ended Data displayed in $000 unless otherwise noted Assets Investments: Bonds Preferred Stocks Common Stocks Mortgage Loans Real Estate Contract Loans Derivatives Cash & Short Term Investments Other Investments Total Cash & Investments 1,560,321 0 350,116 0 9,480 0 0 43,256 1,000 1,964,173 Premiums and Considerations Due Reinsurance Recoverable Receivable from Parent, Subsidiary or Affiliates All Other Admitted Assets Total Assets 95,576 13,238 10,046 41,950 2,124,983 Liabilities Loss Reserves Loss Adjustment Expense Reserves Total Loss & LAE Reserves 729,927 142,700 872,626 Unearned Premium Reserve Total Reinsurance Liabilities Commissions, Other Expenses, and Taxes due Derivatives Payable to Parent, Subs or Affiliates All Other Liabilities Total Liabilities 268,267 16,280 47,816 0 6,491 69,200 1,280,681 Capital and Surplus Common Capital Stock Preferred Capital Stock Surplus Notes Unassigned Surplus Other Including Gross Contributed Capital & Surplus 12,500 0 0 586,840 244,961 844,302 Total Liabilities and C&S 2,124,983 STW Insurance Corp. Income Statement 12/31/2012 Period Ended Data displayed in $000 unless otherwise noted Underwriting Revenue Gross Premiums Writen Direct Premiums Written 698,637 647,197 Net Reinsurance Premiums Net Premiums Written Change in U/E Premiums Reserve Net Premiums Earned (111,881) 535,316 (11,376) 546,692 Underwriting Deductions Net Losses Paid Net LAE Paid Net Change in Loss and LAE Reserves 147,521 63,770 7,732 Losses and LAE Incurred Underwriting Expense Incurred Other Underwriting Deductions Net Income Protected Cells 219,023 228,063 0 0 Net Underwriting Gain (Loss) 99,606 Policyholder Dividends (PHD) 0 Investment Income Net Investment Income Net Realized Capital Gains (Losses) 88,882 0 Other Income Finance Service Charges All Other Income 452 (561) Net Income Net Income after capital gains (loss) before tax Federal Income Tax Net Income 203,558 53,652 149,905 Pre-tax Operating Income 188,380 Memo: Total Revenue Memo: Paid Expenses 650,643 294,515 Change In Capital and Surplus Capital & Surplus, Beginning of Period Net Income Net Unrealized Capital Gains (Losses) Change in Surplus Notes Capital Changes & Surplus Adj Dividends to Stockholders All Other Changes in Surplus Policyholders Surplus, Current Period Ended 892,322 149,905 14,812 0 0 0 (211,000) (1,738) 844,302