Answered step by step

Verified Expert Solution

Question

1 Approved Answer

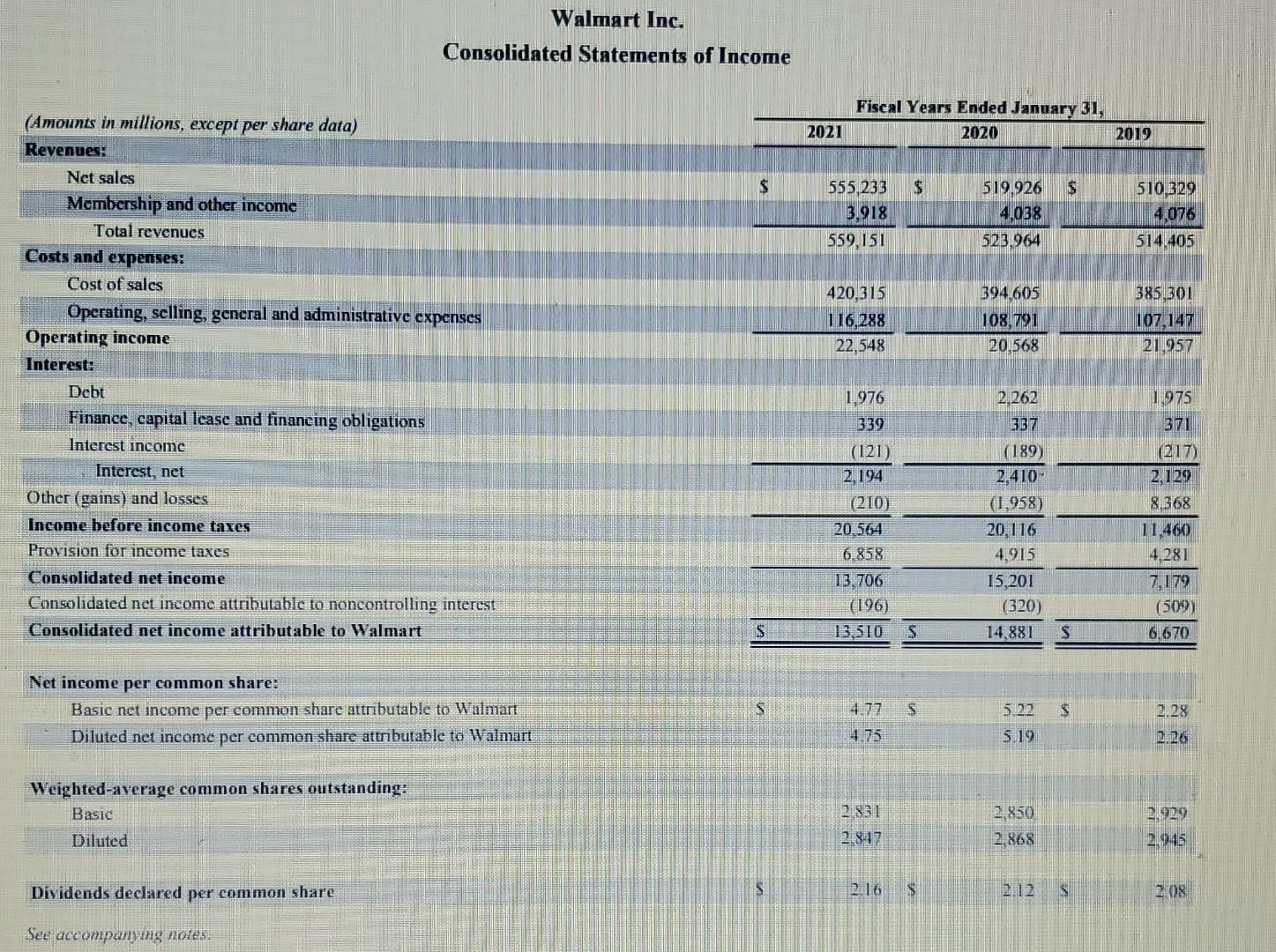

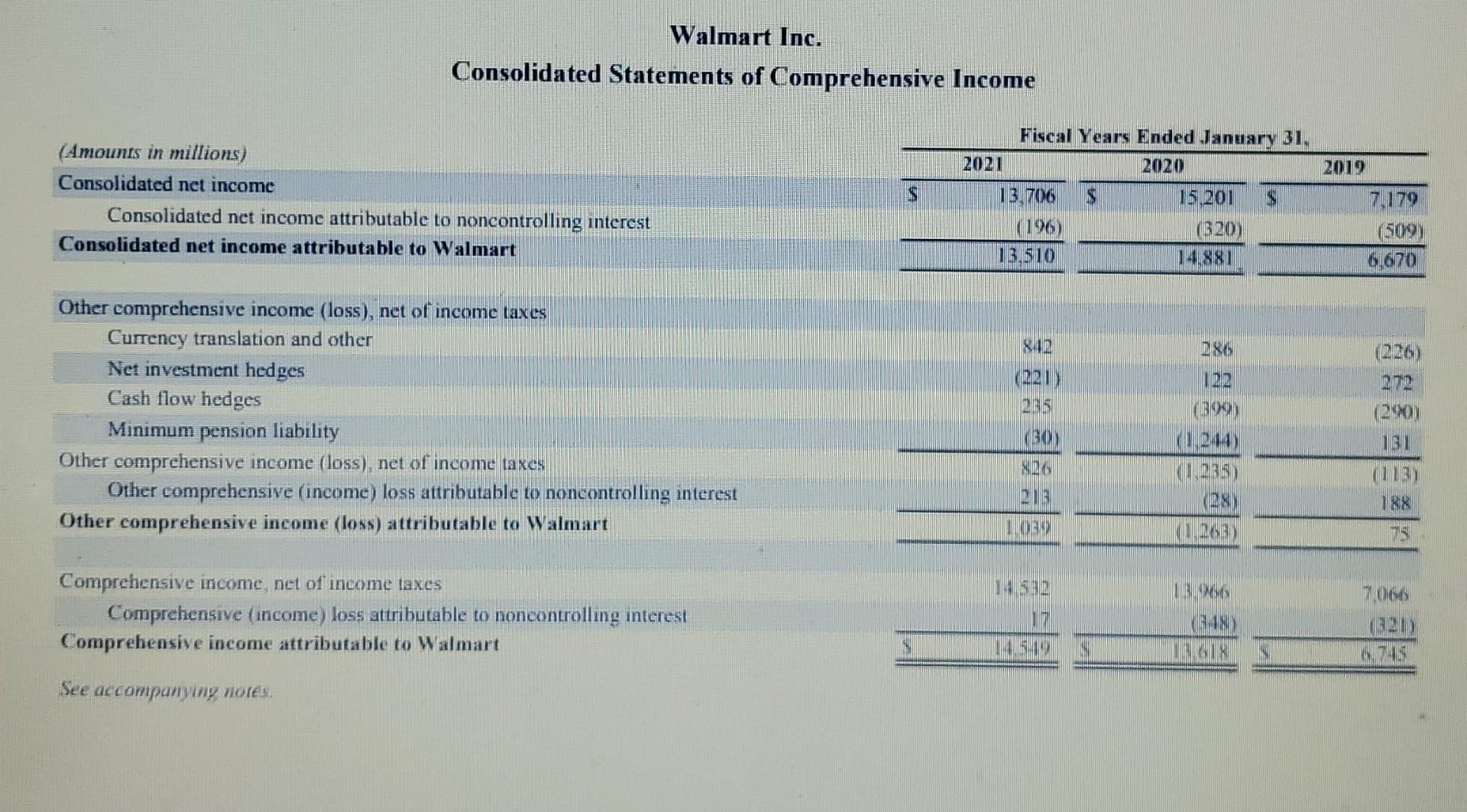

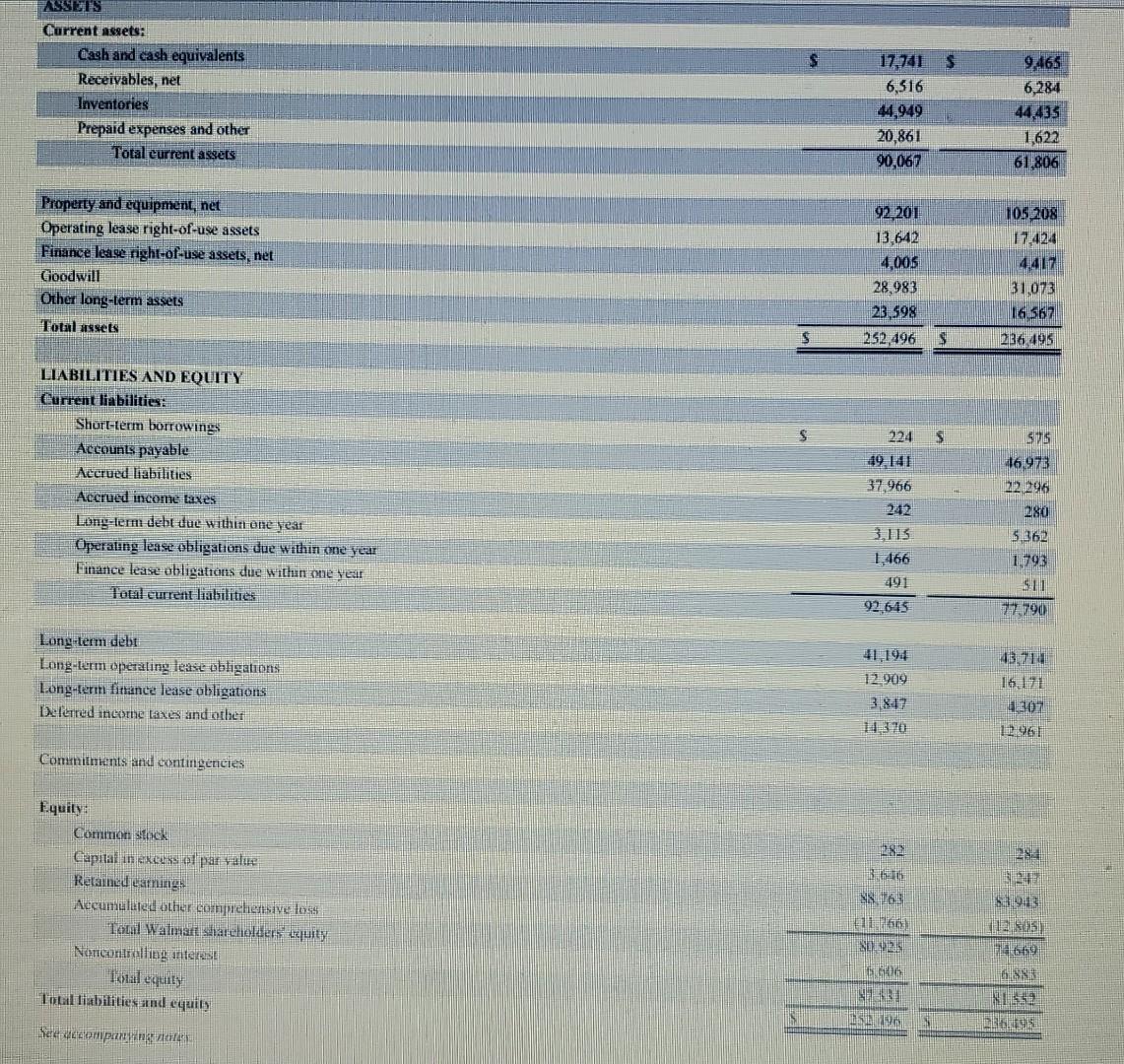

Calculate the followings 2020 and 20121 ratios from Walmart Annual report posted State and ratios and the formula and then calculations. A) Average Collection period

Calculate the followings 2020 and 20121 ratios from Walmart Annual report posted State and ratios and the formula and then calculations.

A) Average Collection period

Walmart Inc. Consolidated Statements of Income Fiscal Years Ended January 31, 2020 2021 2019 $ $ 555,233 3,918 559,151 519.926 4,038 523.964 510,329 4,076 514,405 420,315 116.288 22,548 394,605 108,791 20,568 385.301 107.147 21,957 (Amounts in millions, except per share data) Revenues: Net sales Membership and other income Total revenues Costs and expenses: Cost of sales Operating, selling, general and administrative expenses Operating income Interest: Debt Finance, capital lease and financing obligations Interest income Interest, net Other (gains) and losses Income before income taxes Provision for income taxes Consolidated net income Consolidated net income attributabic to noncontrolling interest Consolidated net income attributable to Walmart 1.976 339 1.975 371 (121) 2,194 (210) 20.564 6,858 13.706 (196) 13.510 2.262 337 (189) 2,410 (1.958) 20.116 4.915 (217) 2,129 8.368 11,460 4,281 7,179 (509) 6,670 15,201 (320) S s 14,881 Net income per common share: Basic net income per common share attributable to Walmart Diluted net income per common share attributable to Walmart S 4.77 S $ 2.28 5.22 5.19 2.26 Weighted average common shares outstanding: Basic Diluted 2.831 2.847 2,850 2.868 2.929 2,945 Dividends declared per common share 2016 $ 2.12 S 2.08 See accompanying notes: Walmart Inc. Consolidated Statements of Comprehensive Income 2019 (Amounts in millions) Consolidated net income Consolidated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart S Fiscal Years Ended January 31. 2021 2020 13,706 15,201 S (196) (320) 13.510 14881 7,179 (509) 6,670 2 286 Other comprehensive income (loss), net of income taxes Currency translation and other Net investment hedges Cash flow hedges Minimum pension liability Other comprehensive income (loss), net of income taxes Other comprehensive (income) loss attributable to noncontrolling interest Other comprehensive income (loss) attributable to Walmart 12:12 (299) (221 2015 (30) 826 23 (226 272 (290) 131 (113) 188 75 (26) (28) (263) 2 13.06 Comprehensive income net of income taxes Comprehensive (income) loss attributable to noncontrolling interest Comprehensive income attributable to Walmart 17 KAN TA 7060 KR 745 See accompanying nores. $ ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Prepaid expenses and other Total current assets 17,741 6,516 44,949 20,861 90,067 9,465 6,284 44.435 1622 61 806 Property and equipment, net Operating lease right-of-use assets Finance lease right-of-use assets, net Goodwill Other long-term assets Total assets 92 201 13.642 4,005 28.983 23,598 252,496 105 208 1024 40 31073 16567 236,495 5 224 $ LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Accounts payable Accrued liabilities Accrued income taxes Long-lem debt due within one year Operating lease obligations due within one year Finance lease obligations due withan one year Total current liabilities 1515 16.973 22.196 37,966 212 3.113 1,466 491 280 5 362 1793 SID 92.645 Long-term debt Long-term operating lease obligations Long-term finance lease obligations Deferred income taxes and other 41,194 12,909 387 14:30 2007 1961 Conuntinents and contingencies ENE 3,66 Equity Common SOCK Capital in excurs el par values Retained eaming Accumulated other comprehensive loss Total Walmart shareholders quity Noncontrolling inters! talquily Total liabilities and equity Ell 16 NO. LE SUE 669 16.806 BISNE SE 1961 95 See accompanying noen

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started