Answered step by step

Verified Expert Solution

Question

1 Approved Answer

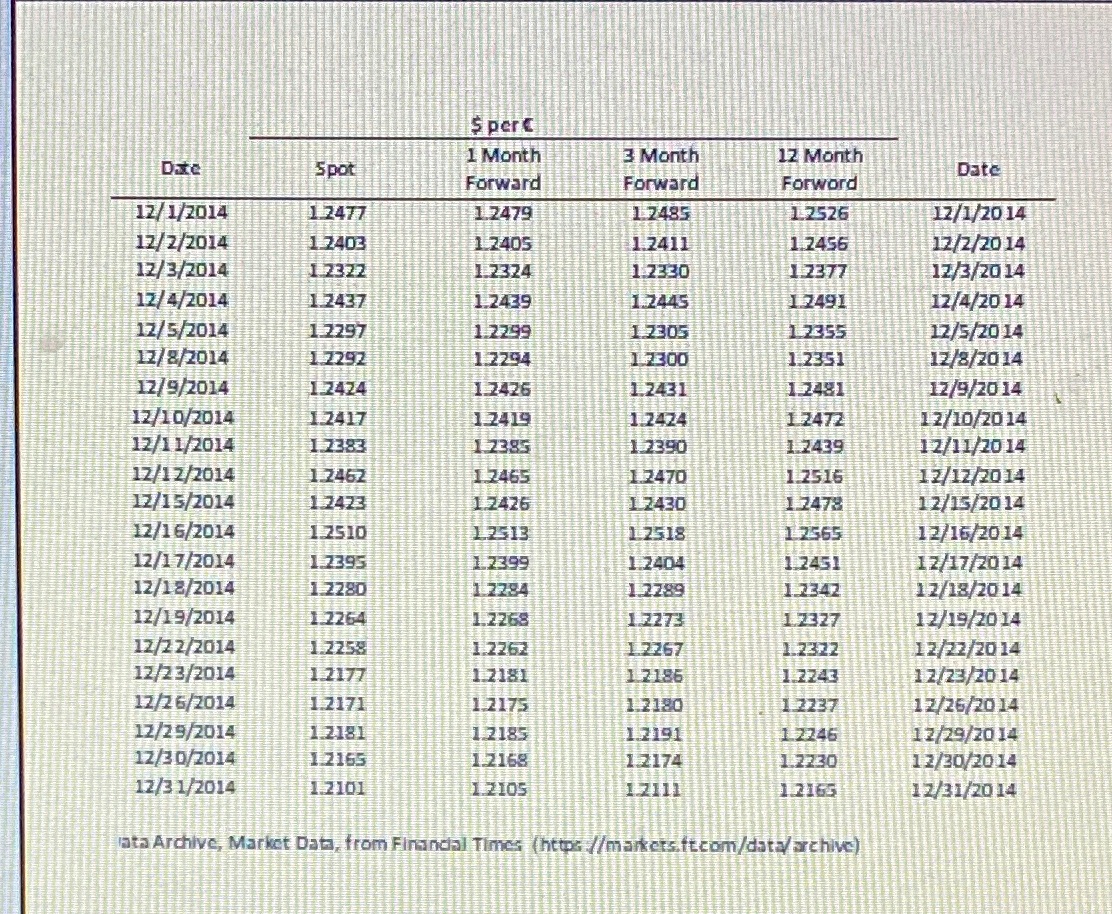

Calculate the forward premium or forward discount for $/yen and Yen/$ that shall include one month,3 month & 12 month forward premium/forward discount.use spreadsheet to

Calculate the forward premium or forward discount for $/yen and Yen/$ that shall include one month,3 month & 12 month forward premium/forward discount.use spreadsheet to complete the calculation.1,spot rate & forward rates2, the one month & 12 month forward premium/forward discount for $/yen and yen/$ 3,indicate which currency is at forward premium/discount against which currency.

Date 12/1/2014 12/2/2014 12/3/2014 12/4/2014 12/5/2014 12/8/2014 12/9/2014 12/10/2014 12/11/2014 12/12/2014 12/15/2014 12/16/2014 12/17/2014 12/18/2014 12/19/2014 12/22/2014 12/23/2014 12/26/2014 12/29/2014 12/30/2014 12/31/2014 Spot 12477 12403 1 2322 12437 12297 12292 12424 12417 1.2383 1.2462 1.2423 12510 1.2395 12280 1.2264 1.2258 12177 1.2171 12181 12165 1.2101 $ per 1 Month Forward 1.2479 1.2405 12324 1.2439 1.2299 1.2294 1.2426 12419 12385 1.2465 12426 12513 1.2399 1.2268 1.2262 1.2181 1.2175 1.2185 1.2168 1.2105 3 Month Forward 17485 1.2411 1.2330 1.2445 1.7305 17300 1.2431 1.2424 1.2390 1.2470 12430 1.2518 1.2404 12289 1.2273 12267 12186 1.2180 1.2191 1.2174 17111 12 Month Forword 12526 1.2456 12377 1 2491 12355 1.2351 12481 1 2472 1.2439 1.2516 1.2478 12565 1.2451 17342 1.2327 1.2322 1.2243 12237 1.2246 1.2730 1.2165 ata Archive, Market Data, from Financial Times (https://markets.ft.com/data/archive) Date 12/1/2014 12/2/2014 12/3/2014 12/4/2014 12/5/2014 12/8/2014 12/9/2014 12/10/2014 12/11/2014 12/12/2014 12/15/2014 12/16/2014 12/17/2014 12/18/2014 12/19/2014 12/22/2014 12/23/2014 12/26/2014 12/29/2014 12/30/2014 12/31/2014

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the forward premium or forward discount for yen and yen you will need the spot rate and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started